Wonderful Tips About Purpose Of Preparing Profit And Loss Account

Every company prepares a profit and loss account/statement at the end of the year generally, to get the visibility of the income, earning, expenses and loss incurred in a specific range of period.

Purpose of preparing profit and loss account. Trading and profit and loss account are prepared to determine the profit earned or loss sustained by the business enterprise during the accounting period. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Profit and loss accounts explained.

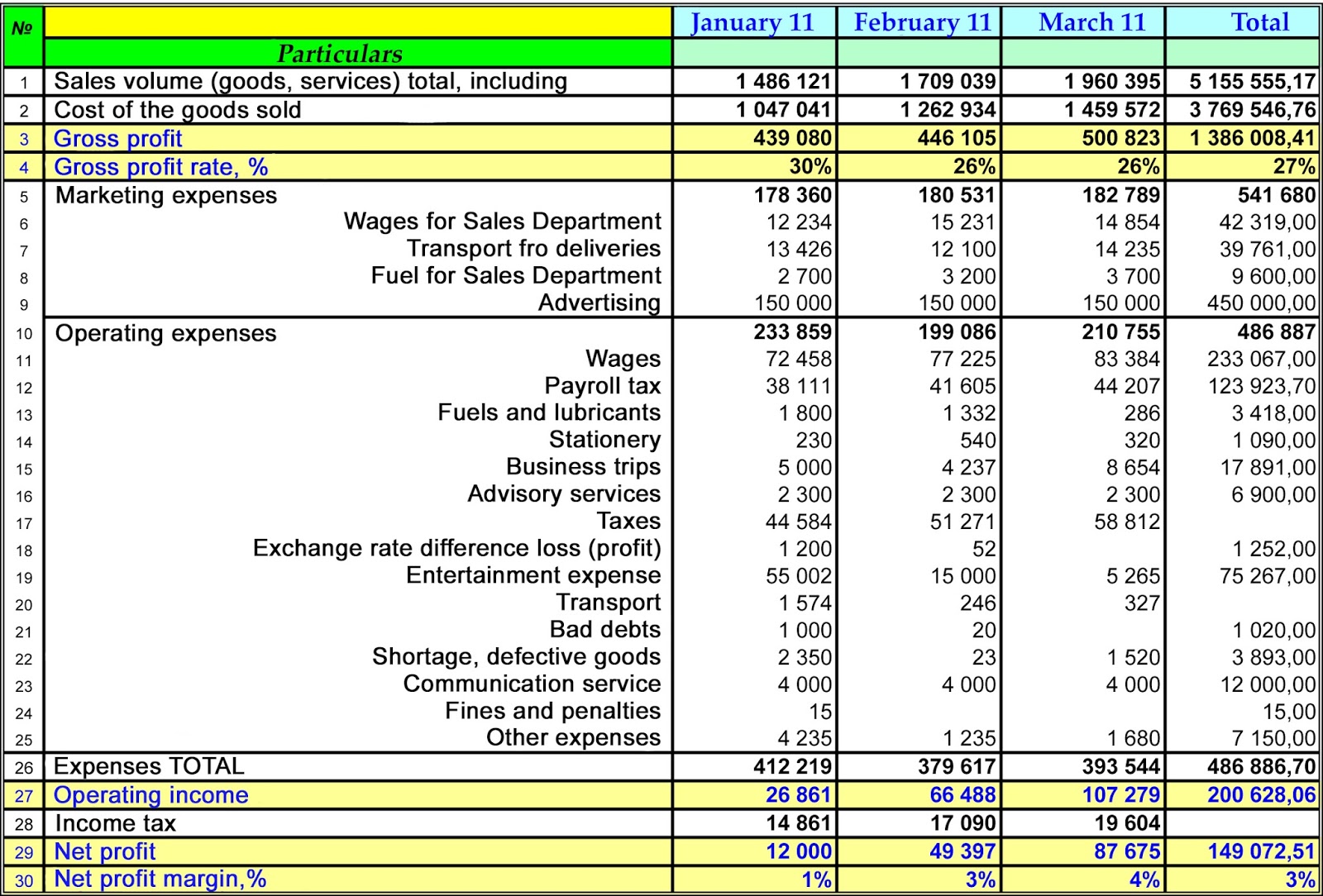

The trading and profit and loss account are two different accounts that are formed within the general ledger. The profit and loss statement, abbreviated as p&l, is a financial statement that summarises revenues, expenditures, and expenses incurred during a specific time period, generally a fiscal year. The object of studying the profit and loss account of a company for a particular year are 1.

You can obtain current account balances from your. A special purpose acquisition company, or spac, spiked 15% on the major milestone. Ai boom drove nvidia profits up 580% last year.

The p&l statement corresponds to the income statement. Add up all revenue earned over the accounting period. To prepare a profit and loss statement, you’ll essentially be solving the basic equation for calculating profit:

How to prepare a profit and loss statement. A profit and loss (or income) statement lists your sales and expenses. Show whether a business has made a profit or loss over a financial year.

A profit and loss (p&l) statement summarizes the revenues. Profit and loss appropriation account is necessary for businesses, especially partnerships because they help to allocate the net of expenditures and incomes among the various partners. Let us understand the trading account and profit and loss account in detail.

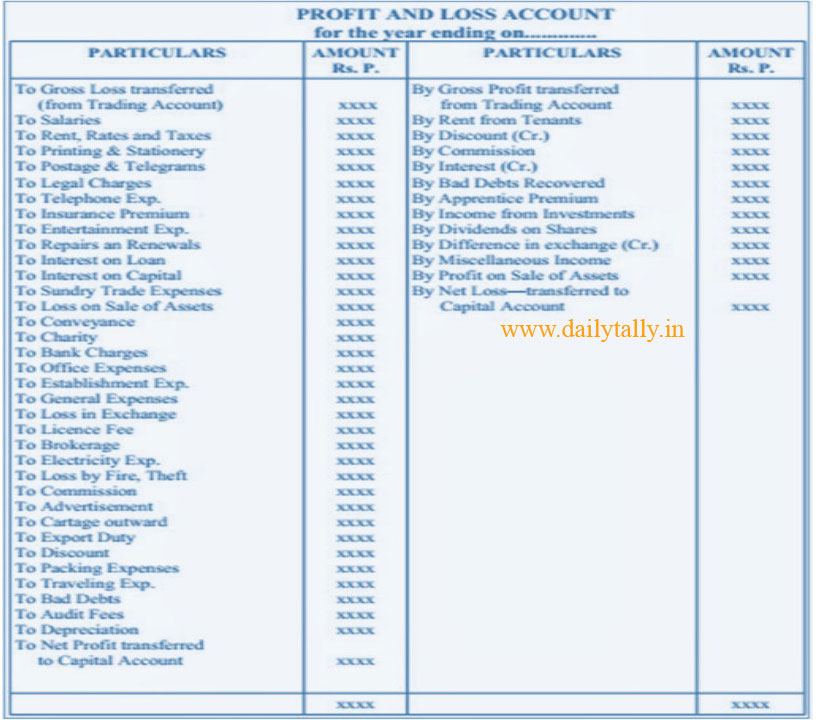

Structure of the profit and loss statement Hence, calculation of profit and loss account would be: The purposes of preparing profit and loss account are:

A balance sheet provides both investors and creditors with a snapshot as to how effectively a company's management uses its resources. The two parts of the account are: The ability to make informed decisions;

Categorising costs between cost of sales and operating costs. A profit and loss account (also referred to as p&l or a profit and loss statement) provides you with an overview of your company’s revenue and expenses over a given period of time. Proof of success helps with taxes;

The main objective of a profit and loss statement is to identify whether a company made a profit or lost money during a specified time, usually a month, quarter, or year. This account is prepared to arrive at the figure of revenue earned or loss incurred during a period. Profit and loss accounting is when companies prepare the profit and loss statements to figure out their financial performance for a fiscal quarter or year.