Exemplary Tips About Industry Average Financial Ratios 2018

2018 | s&p global ratings.

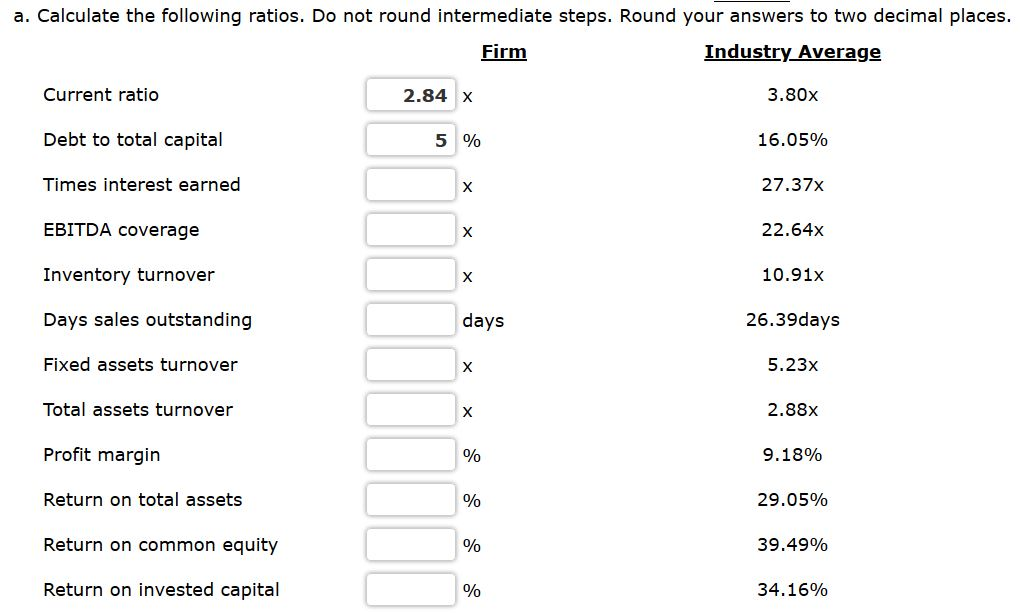

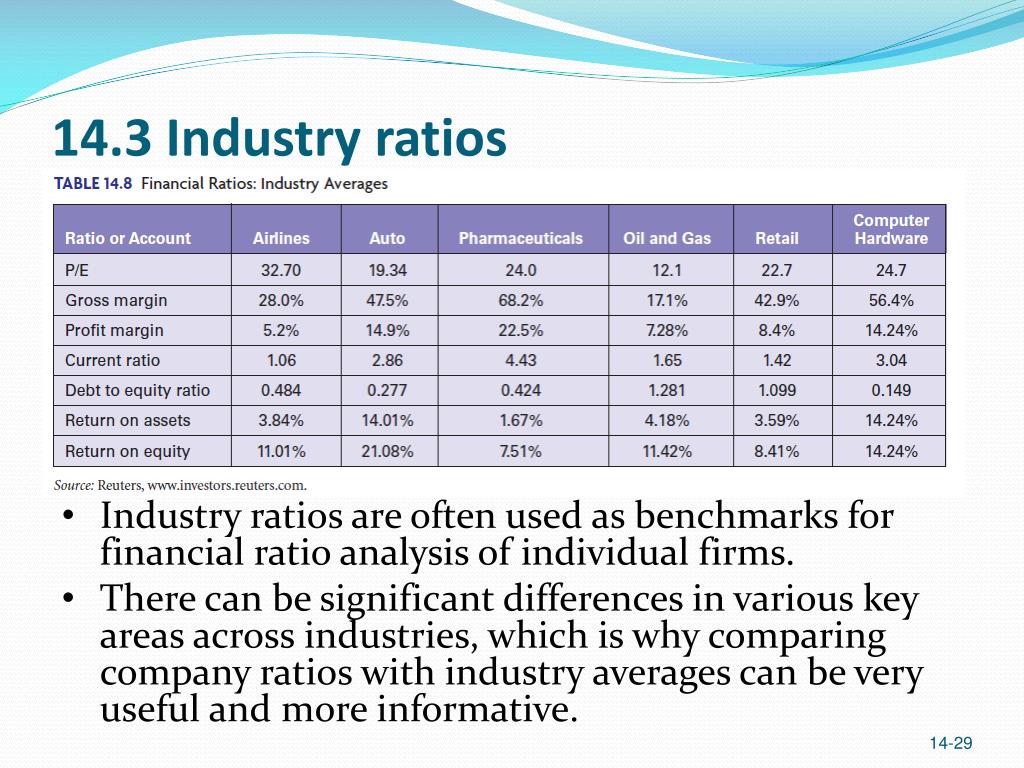

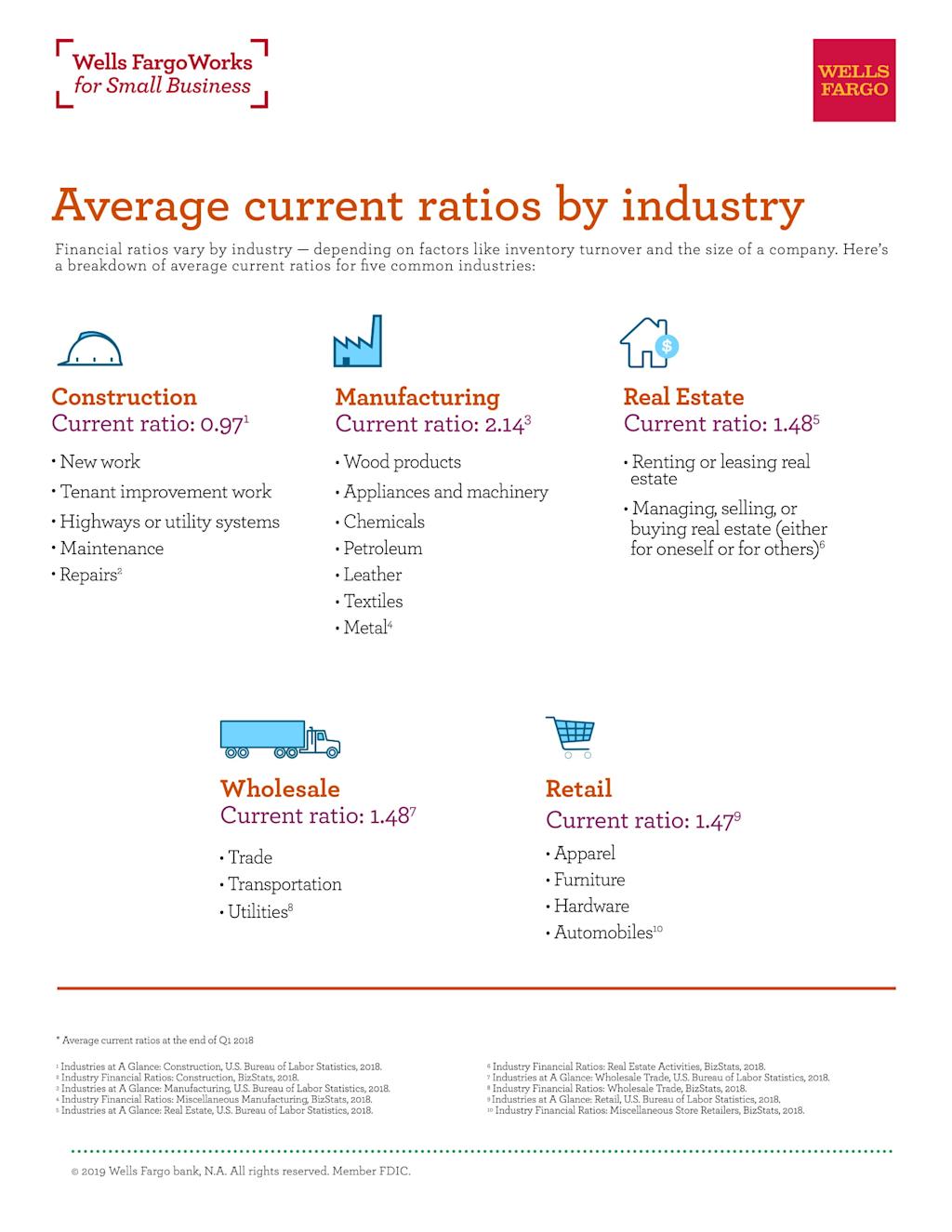

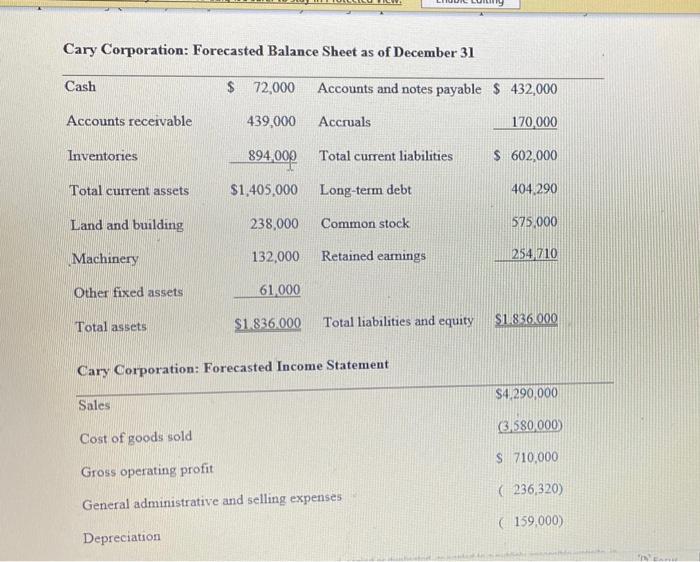

Industry average financial ratios 2018. Industry financial ratios are particularly important as they allow business owners to compare their performance to an industry average or other companies. On the trailing twelve months basis despite sequential decrease in current liabilities, working capital ratio detoriated to 1.2 in the 4 q 2023 below financial sector. Although some researches provide ratios for separate.

While a general rule of thumb is to keep this below 2:1 (0.66), the values also vary by industry. 2022 data is now available. Sixteen common ratios along with balance sheet and income statements for over 780 lines of business.

Includes over 70 financial ratios grouped into the following 7 categories: Data comes in six groups of sales ranges for companies. What is a company worth?

Pdf | current work is the first attempt to calculate industry average financial ratios for georgia. On the trailing twelve months basis due to increase in current liabilities in the 4 q 2023, working capital ratio fell to 1.16 below software & programming industry average. Return on equity (roe) is the amount of net income returned as a percentage of shareholders equity.

This is the question that appraisers and financial experts often need to answer. Ten years of annual and quarterly financial ratios and margins for. That is why every informed stakeholder in business valuation,.

/GettyImages-941395072-ff92e929f7494d9286d50006505262cf.jpg)