Can’t-Miss Takeaways Of Tips About Income Statement Of A Merchandising Business

This lets the reader know that the company generates its revenue from the sale of products rather than the delivery of services.

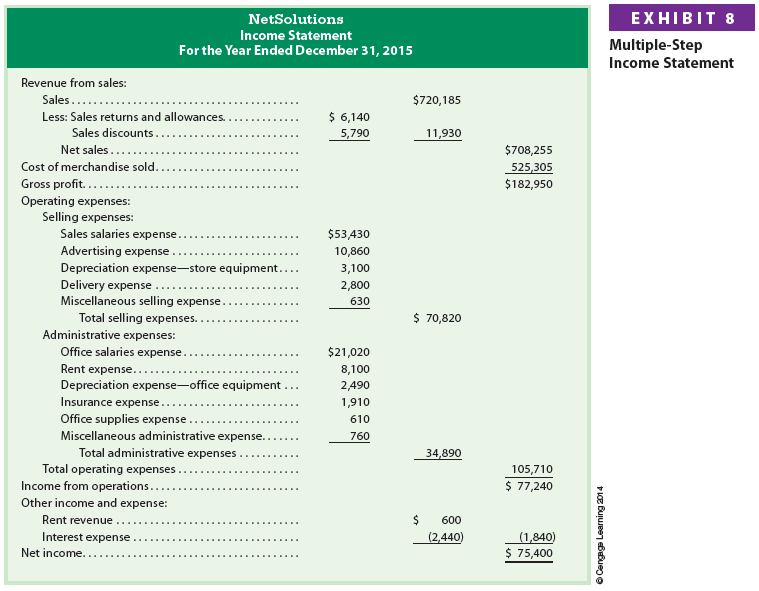

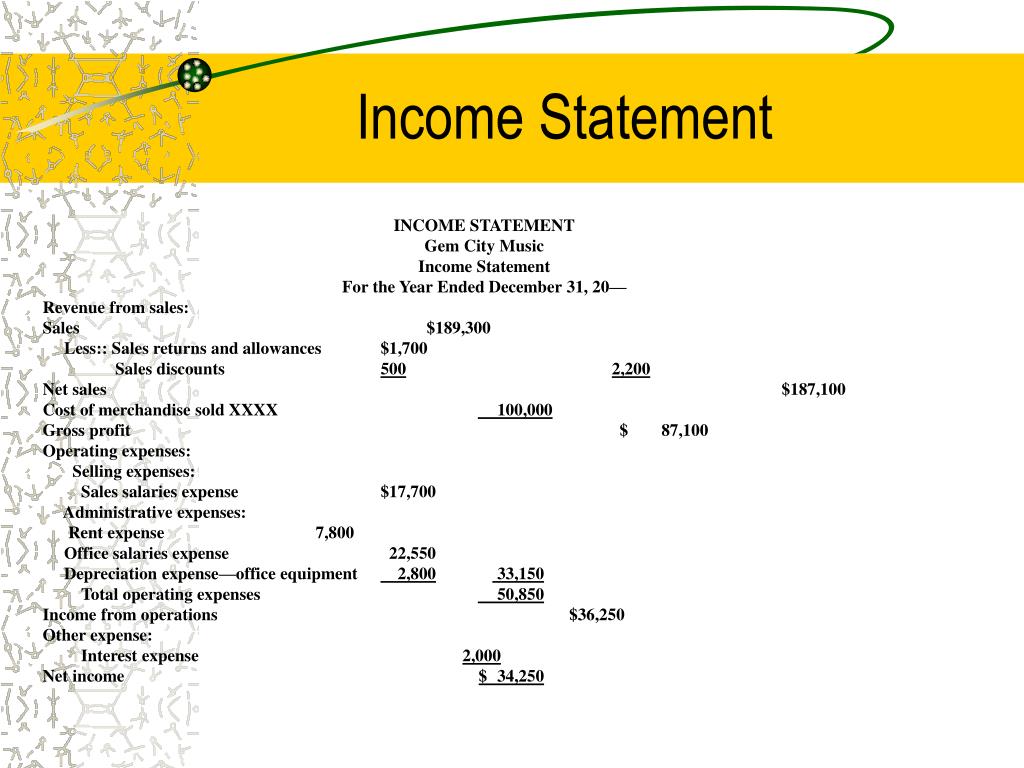

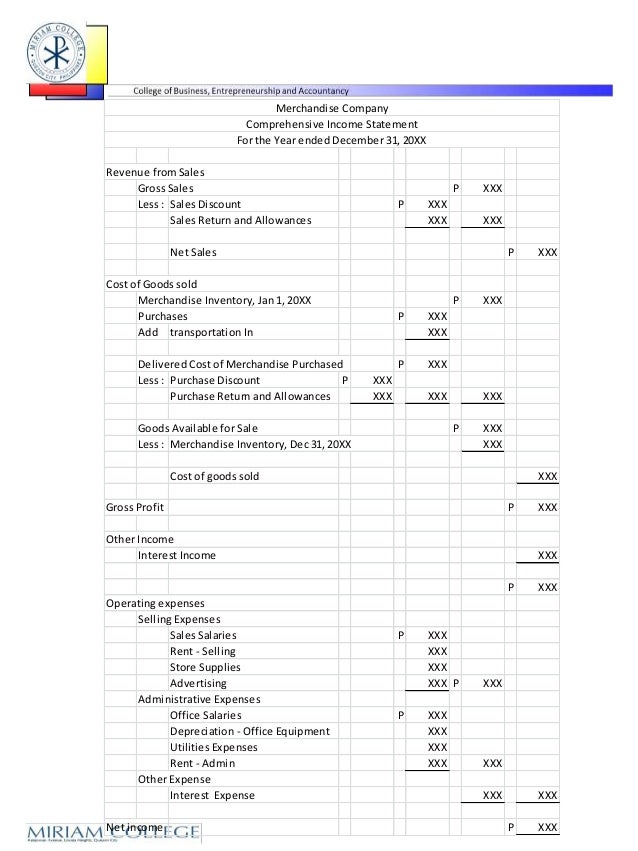

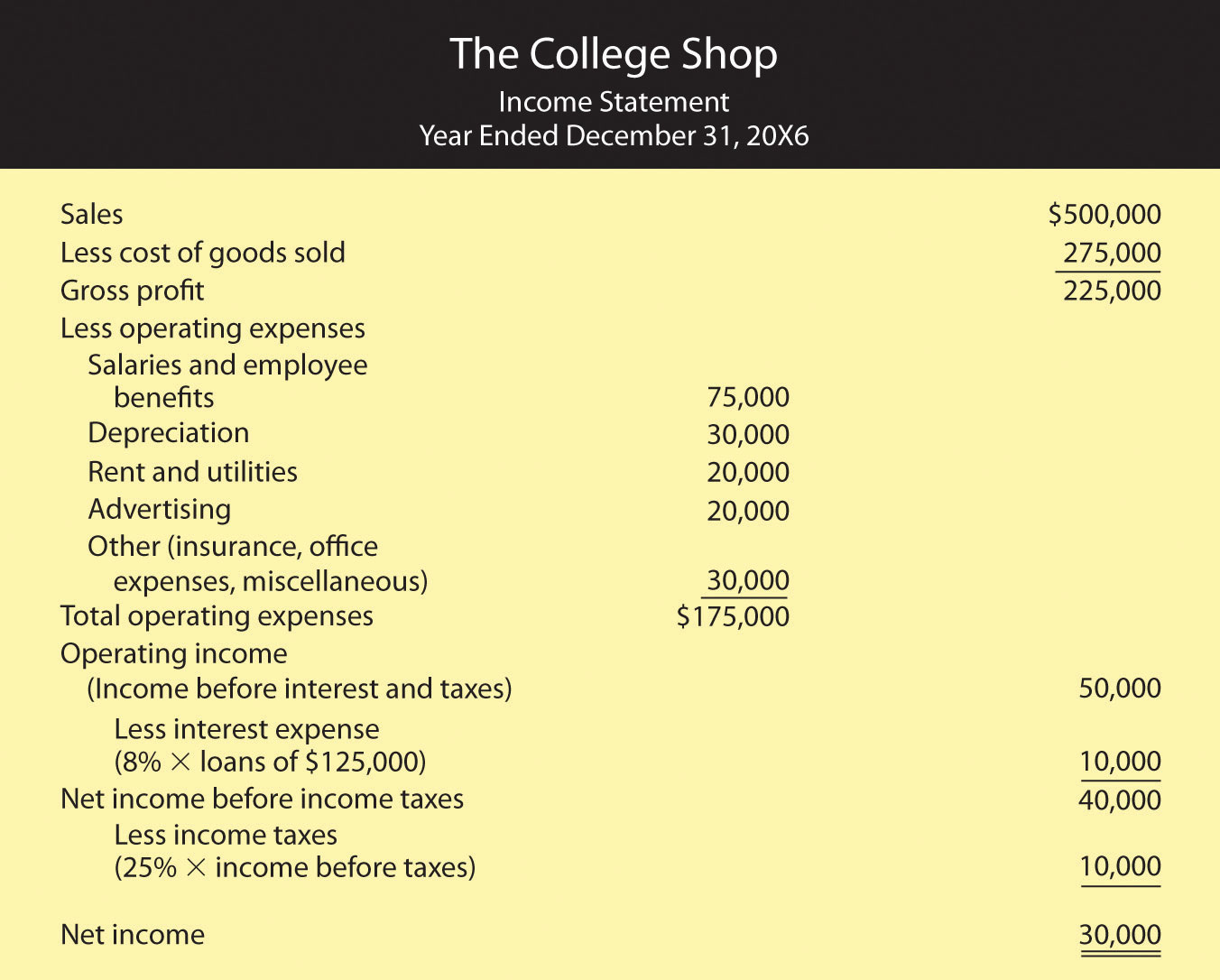

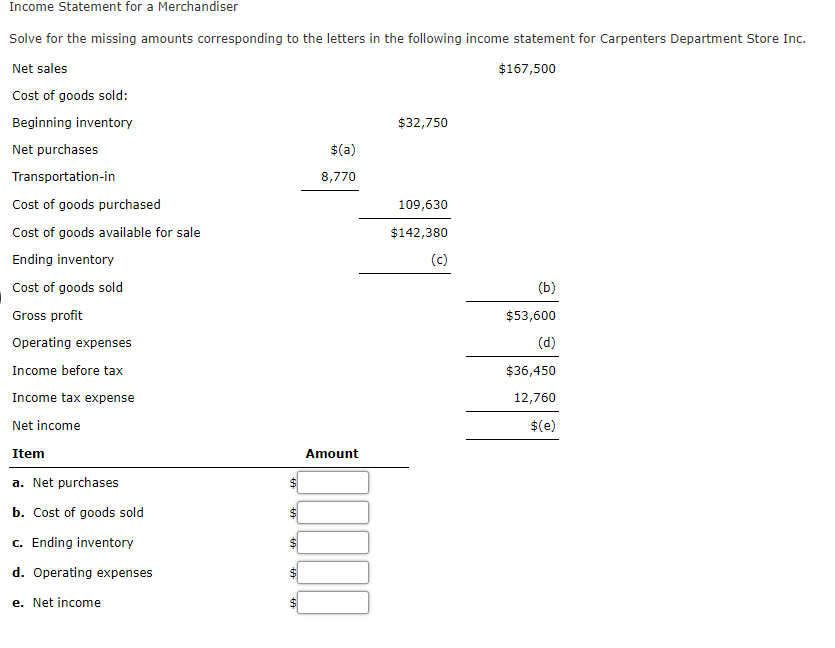

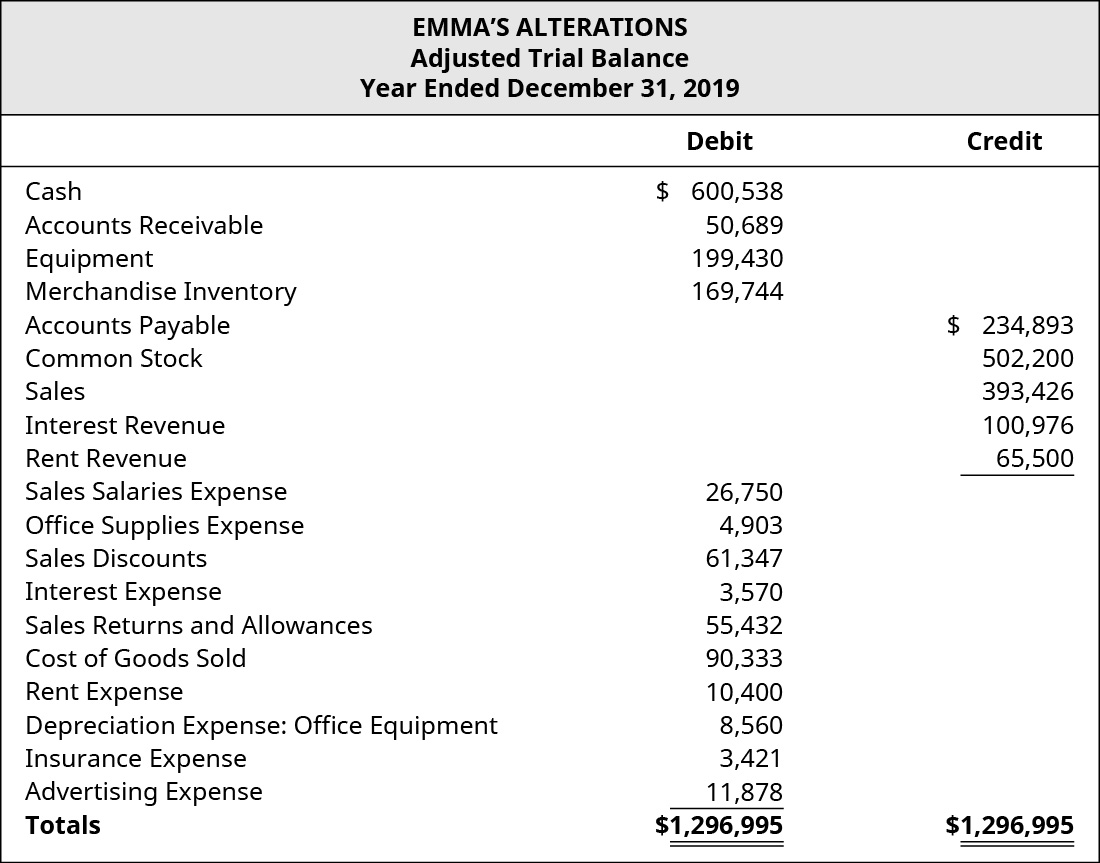

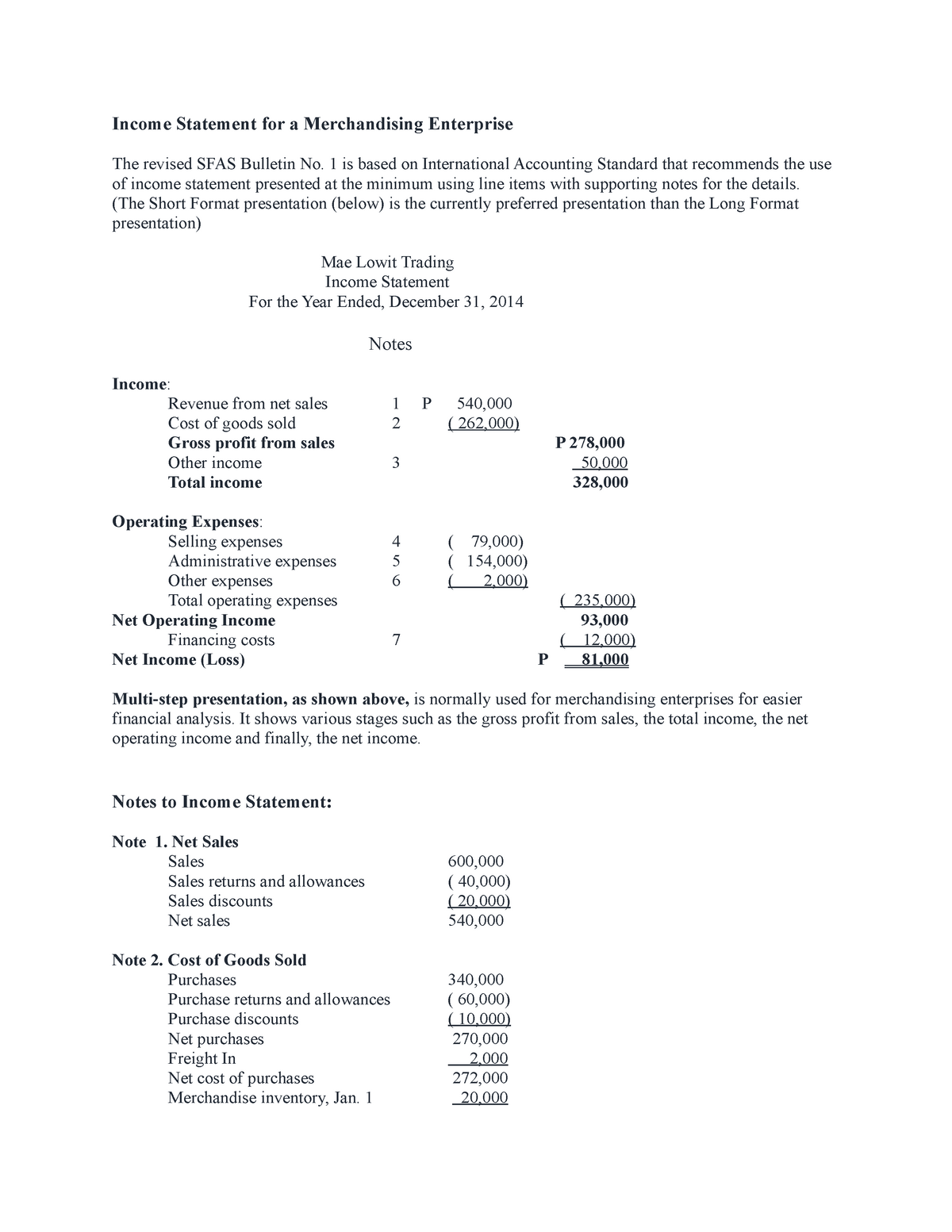

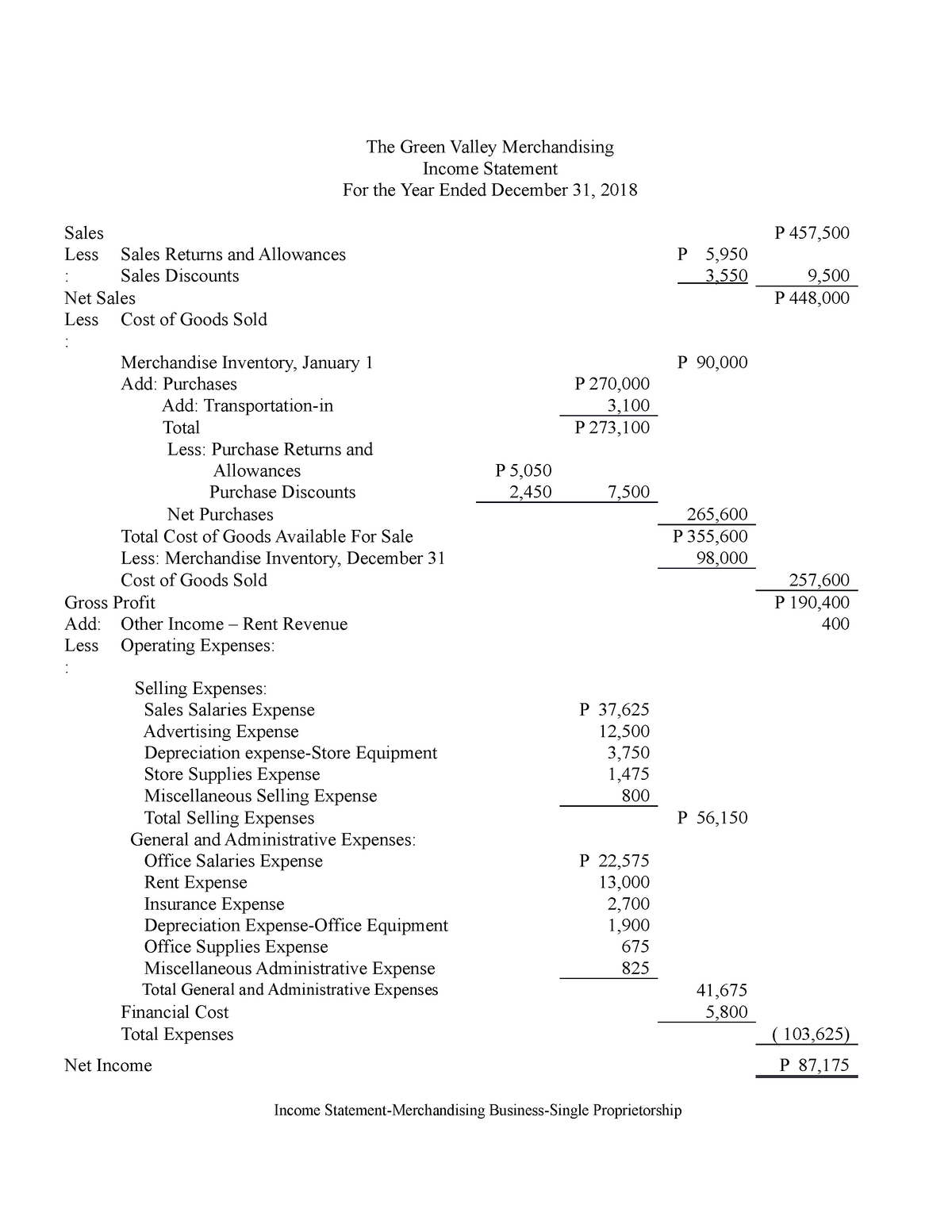

Income statement of a merchandising business. And (3) expenses, which are the company's other expenses in running the business. The basic income statement differences between a service business and a merchandiser are illustrated in figure 5.1. An income statement for merchandising differs from a service income statement in a number of ways.

Just like all income statements, the first line is revenue. Total operating expenses = selling expenses + administrative expenses. Merchandising a mystic in an era of minuscule music royalties , a large portion of that $16 million in earnings also comes from merchandising, which has further watered down marley’s.

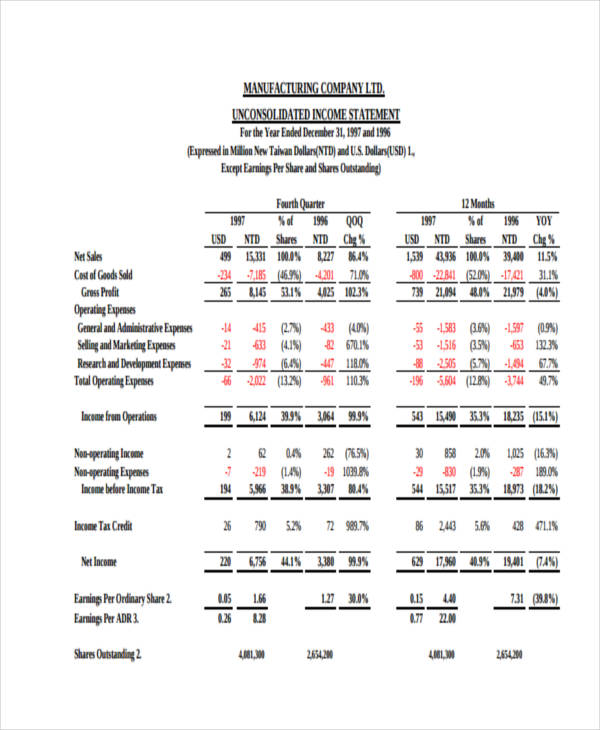

The income statement shows financial performance from operations first and then separately discloses gains and losses that fall outside the regular scope of operations. The presentation format for many of these statements is left up to the business. Sales revenue is the income generated from the sale of finished goods to consumers rather than from the manufacture of goods or provision of services.

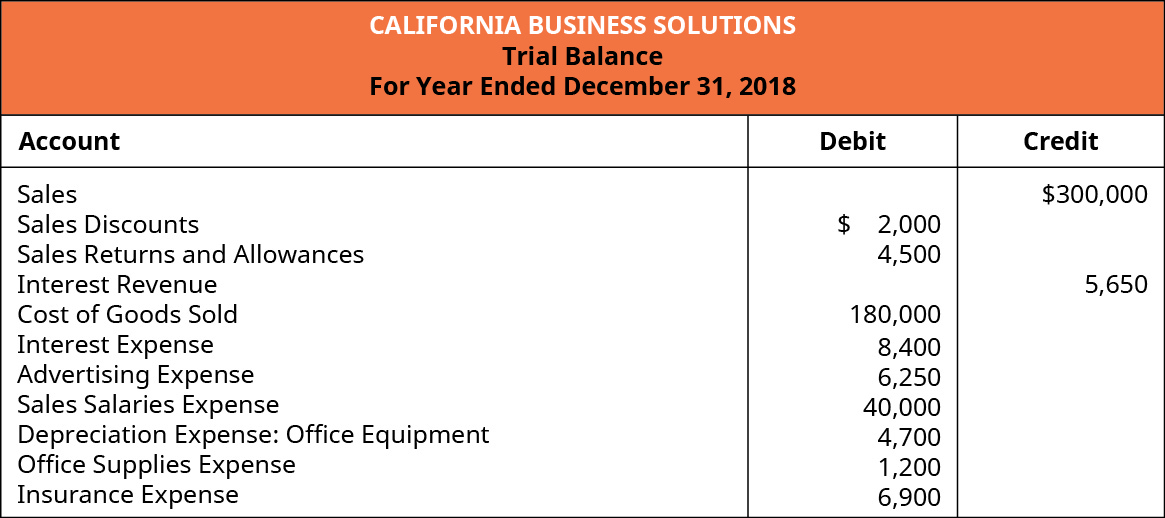

(1) sales revenues, which result from the sale of goods by the company; Add up all your revenue from sales during the reporting period and deduct your returns and concessions. Closing entries for merchandising accounts.

Total operating expenses = selling expenses + administrative expenses. (1) the name of the company, (2) the title of the financial statement, and (3) the period covered by the report. (2) cost of goods sold, which is an expense that indicates how much the company paid for the goods sold;

The presentation format for many of these statements is left up to the business. A single‐step income statement for a merchandising company lists net sales under revenues and the cost of goods sold under expenses. Six of the seven new accounts appear on the income statement and therefore are closed to retained earnings at the end of the accounting period.

The following june income statement shows these six accounts. Notice that cost of merchandise sold, an expense account, is matched up with net sales at the top of the statement. These largely relate to inventory items and the cost of goods sold, as well as provision for.

Merchandising companies prepare financial statements at the end of a period that include the income statement, balance sheet, statement of cash flows, and statement of retained earnings. Merchandising companies prepare financial statements at the end of a period that include the income statement, balance sheet, statement of cash flows, and statement of retained earnings. Sales is a revenue account that is decreasing.

Music world income statement for the year ended june 30,20x3 | revenues | | | net sales | | $1,172,000 | interest income | | 7,500 | gain on sale of equipment | | 1,500 To summarize the important relationships in the income statement of a merchandising firm in equation form: This simplified income statement demonstrates how merchandising firms account for their sales cycle or process.

A merchandising income statement highlights cost of goods sold by showing the difference between sales revenue and cost of goods sold called gross profit or gross margin. Service business the income statement starts with a heading made up of three lines. The income statement of a merchandiser begins with gross profit, which is the difference between sales revenues and cost of goods sold.

:max_bytes(150000):strip_icc()/incomestatement4-56a03edb5f9b58eba4af82ab.jpg)