Inspirating Tips About Iras Income Tax Statement

-for-employment-income.png?sfvrsn=a8f5e363_1)

On the top menu, click individuals and select file income tax.

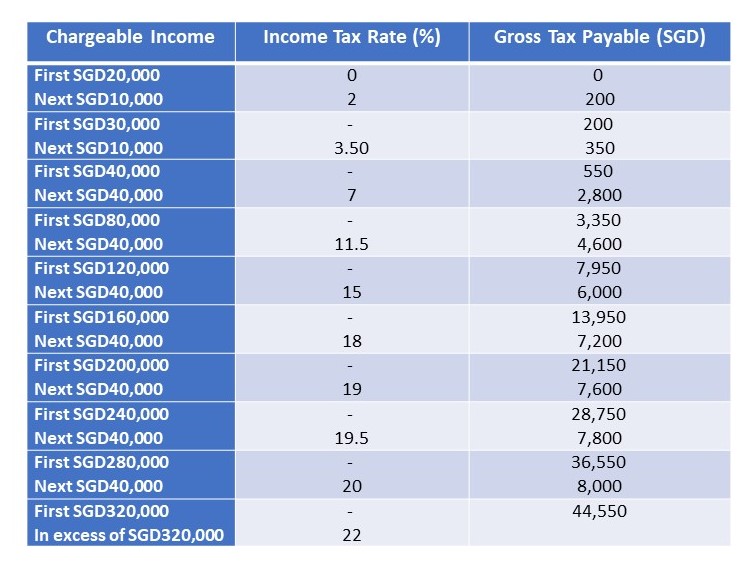

Iras income tax statement. Watch budget 2024 statement. Taxes corporate income tax corporate income tax there is a revised edition of the income tax act with effect from 31 dec 2021 and some provisions of the act have been. On 16 feb 2024, dpm and finance minister lawrence wong delivered the budget 2024 statement in parliament.

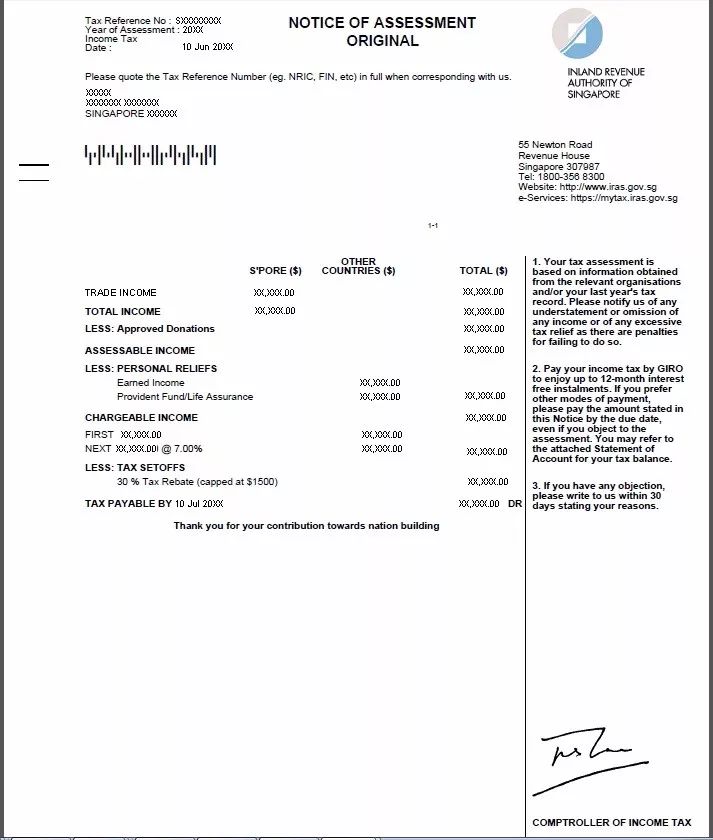

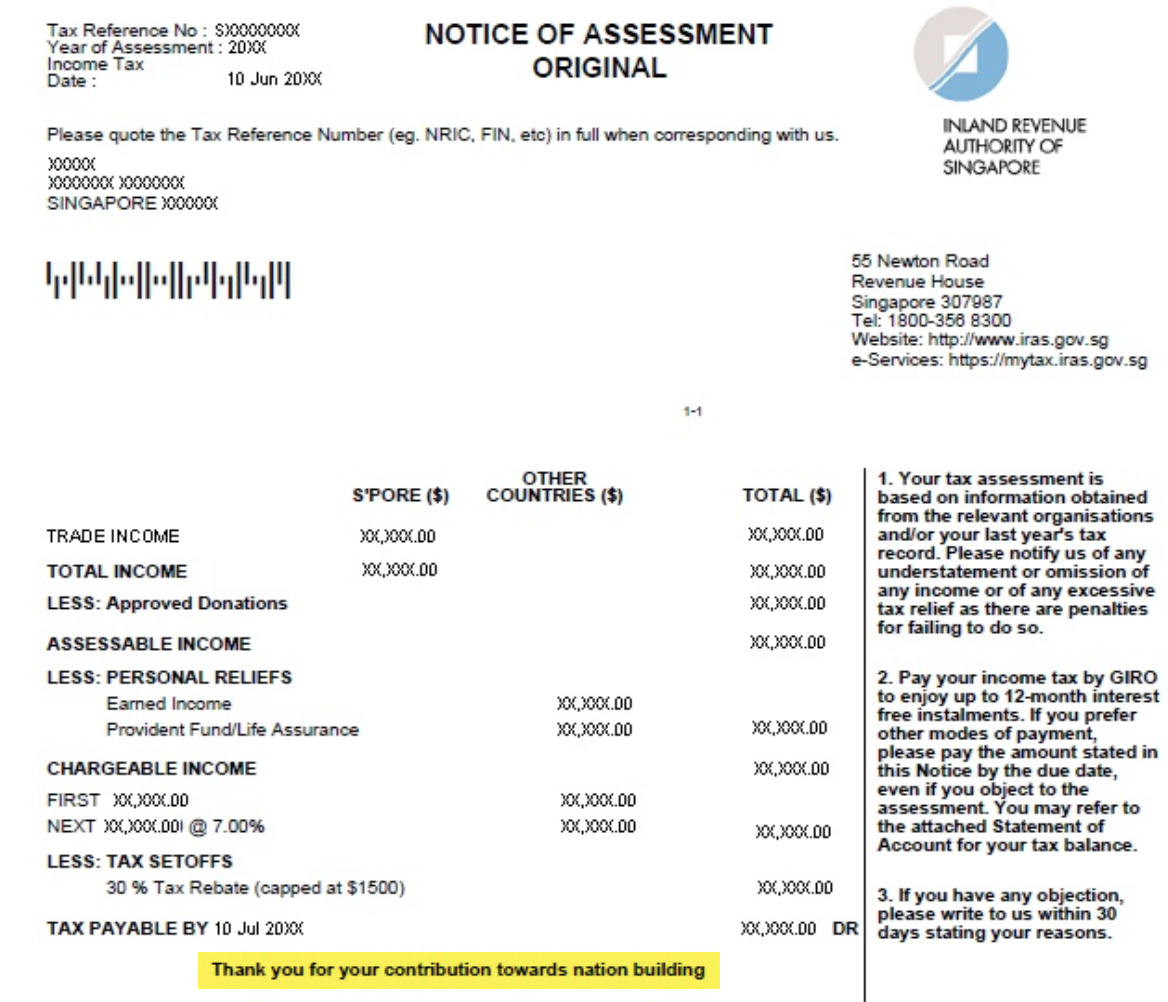

As iras sends out tax bills (digital or paper format) in batches, some taxpayers may receive them. Deputy prime minister and minister for finance, mr. What should i do?

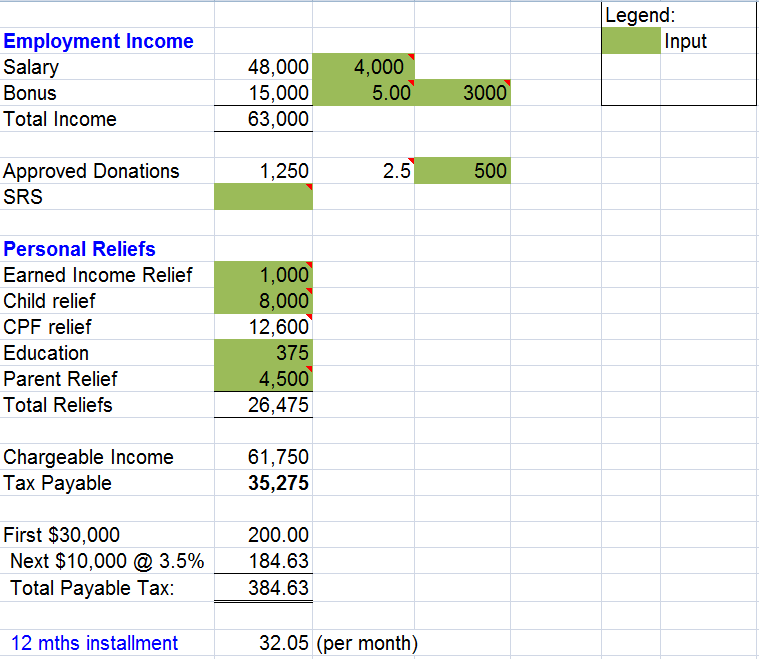

Form 5498 reports various types of ira contributions you make and other account information in the reporting boxes of the form. You can view and print your statement of account (soa) online by following the steps: A statement of the december 31 value of an individual’s ira, commonly called a fair market value (fmv) statement.

Eve of christmas, new year, and chinese new year: You may be selected for the direct notice of assessment initiative if you only. Contribution and investments exceeding ira contribution limits while you'll want to save as much as you can for your retirement, you don't want to contribute.

Box 1 shows the amount you. What you get tax return or tax account transcript types delivered by mail transcripts arrive in 5 to 10 calendar days at the address we have on file for you get. Basic guide to corporate income tax for companies;

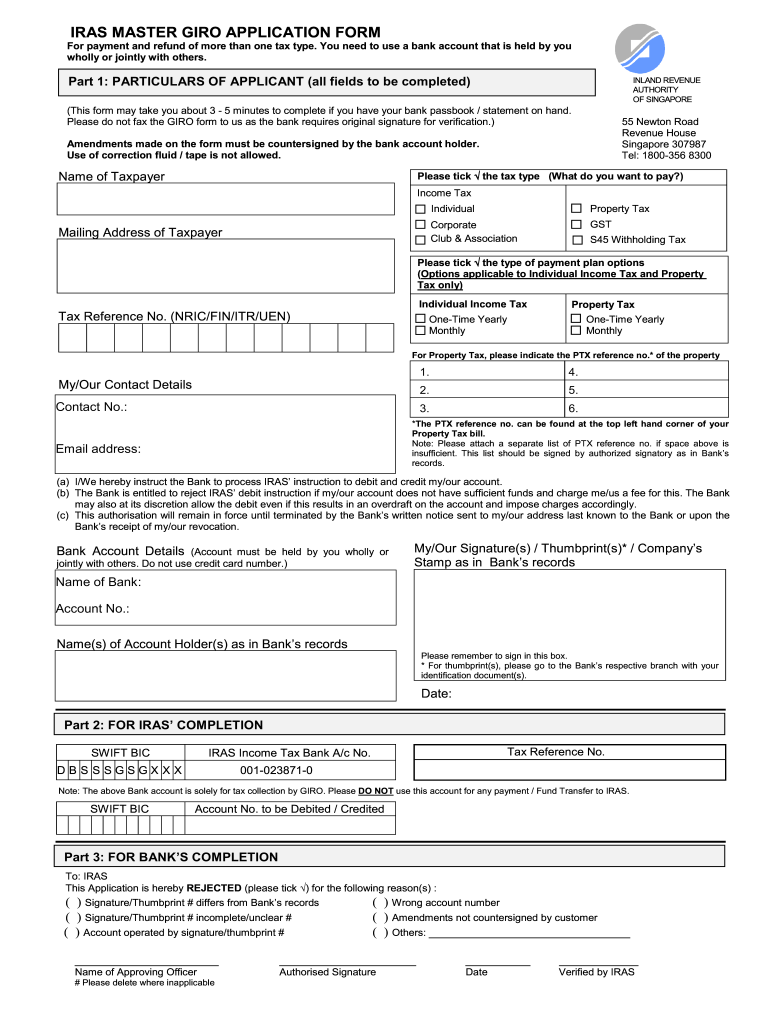

Iras provides guides and samples to help business owners learn more about. Back to mytax portal mytax portal is a. Find out if you need to file an income tax return for year of assessment 2023:

Chat with an officer online. Getting my tax assessment. Tax season 2024 find out all you need to know about individual income tax filing and your tax filing obligations.

Log in to mytax.iras.gov.sg with your singpass. Basics of corporate income tax; Brokerage tax statements will be delivered by the irs deadline listed below.

Monday to friday (excluding public holidays): A required minimum distribution (rmd). You may need several different documents depending on your sources of income, but here are a few common ones:

We send the statements in a phased approach to ensure you receive your tax statements as earliest. Lawrence wong, delivered the budget statement for the financial year 2024. If you have a traditional ira rather than a roth ira, you can contribute up to $6,500 for 2023 and $7,000 for 2024, and you can deduct it from your taxes.