Breathtaking Tips About Operating Activities Examples Cash Flow

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

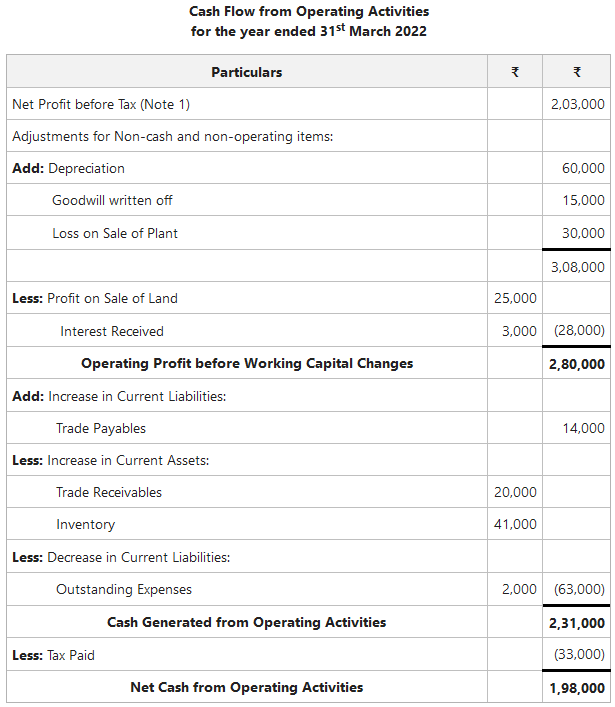

In accordance with international accounting standard of cash flow statement, the following activities or cash flows shall be the part of operating activities.

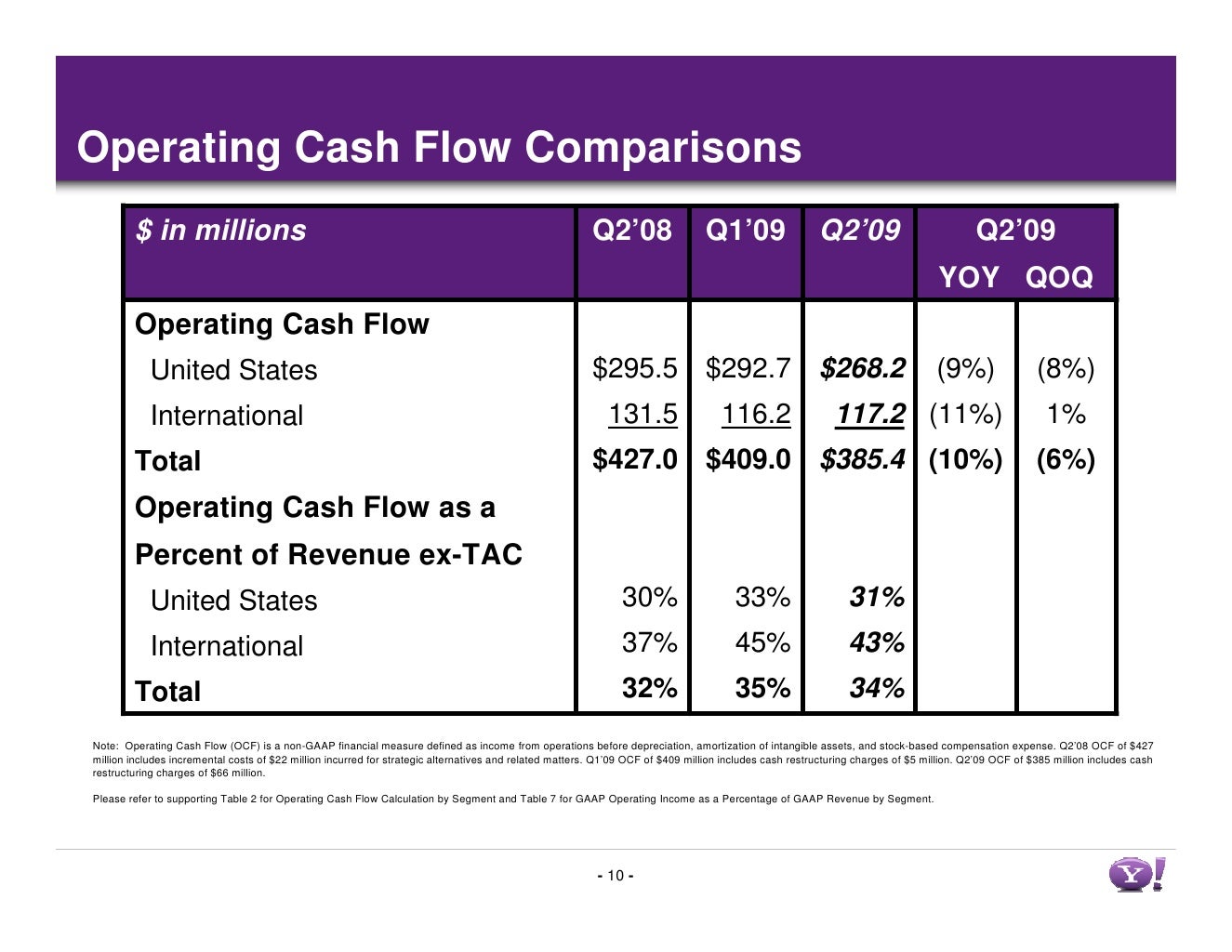

Operating activities examples cash flow. The company’s chief financial officer (cfo) chooses between the direct and indirect presentation of operating cash flow: Some common operating activities include cash receipts from goods sold, payments to employees, taxes, and payments to suppliers. Receipts from sales of goods and services interest payments income tax payments payments made to suppliers of goods and services used in production

In example corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $ (260,000) + $90,000. Investing activities include cash activities related to noncurrent assets. Cash flow from operations typically includes the cash flows associated with sales, purchases, and other expenses.

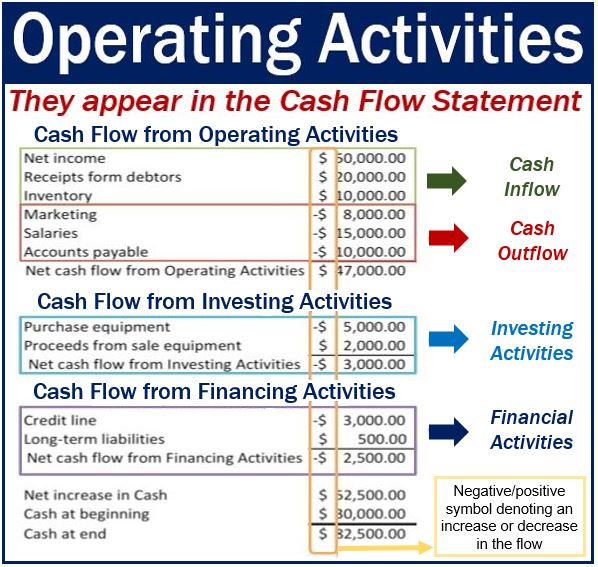

The movement of cash & cash equivalents or inflow and outflow of cash is known as cash flow. Operating activities include cash activities related to net income. Cash inflows are the transactions that result in an increase in cash & cash equivalents;

These activities also determine the profitability of the company and items categorized under this head are the primary revenue units of the company. Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Figure 12.2 examples of cash flow activity by category *receipts of cash for dividends from investments and for interest on loans made to other entities are included in operating activities since both items relate to net income.

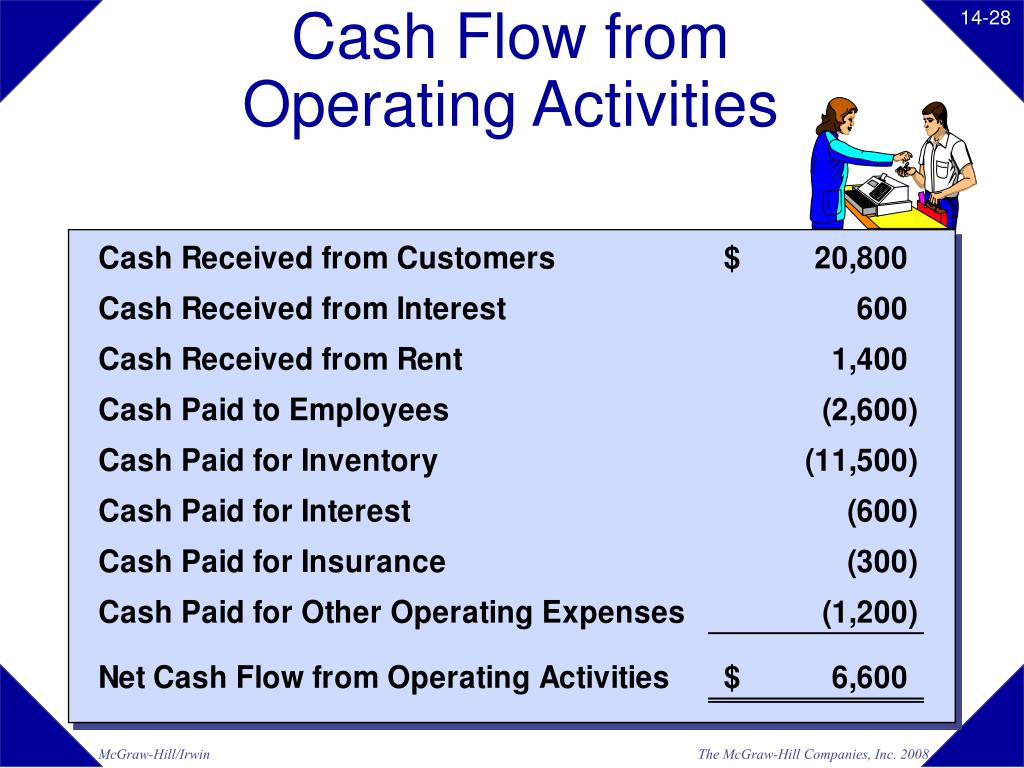

Operating cash flow represents the cash impact of a company's net income (ni) from its primary business activities. Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year; Some examples of cash flows from operating activities are shown below to help illustrate the basic concept:

Operating activities are the operations of a company directly associated with furnishing its commodities and services to the marketplace. Operating activities generate the majority of the cash flows for the company as it is directly linked to the core business activities of the company like sales, distribution, production, and so on; These activities can be found on a company's financial.

These operating activities might include: Example of cash flow from operating activities. These are the enterprise’s focus trading pursuits, such as producing, allocating, retailing and marketing a good or service.

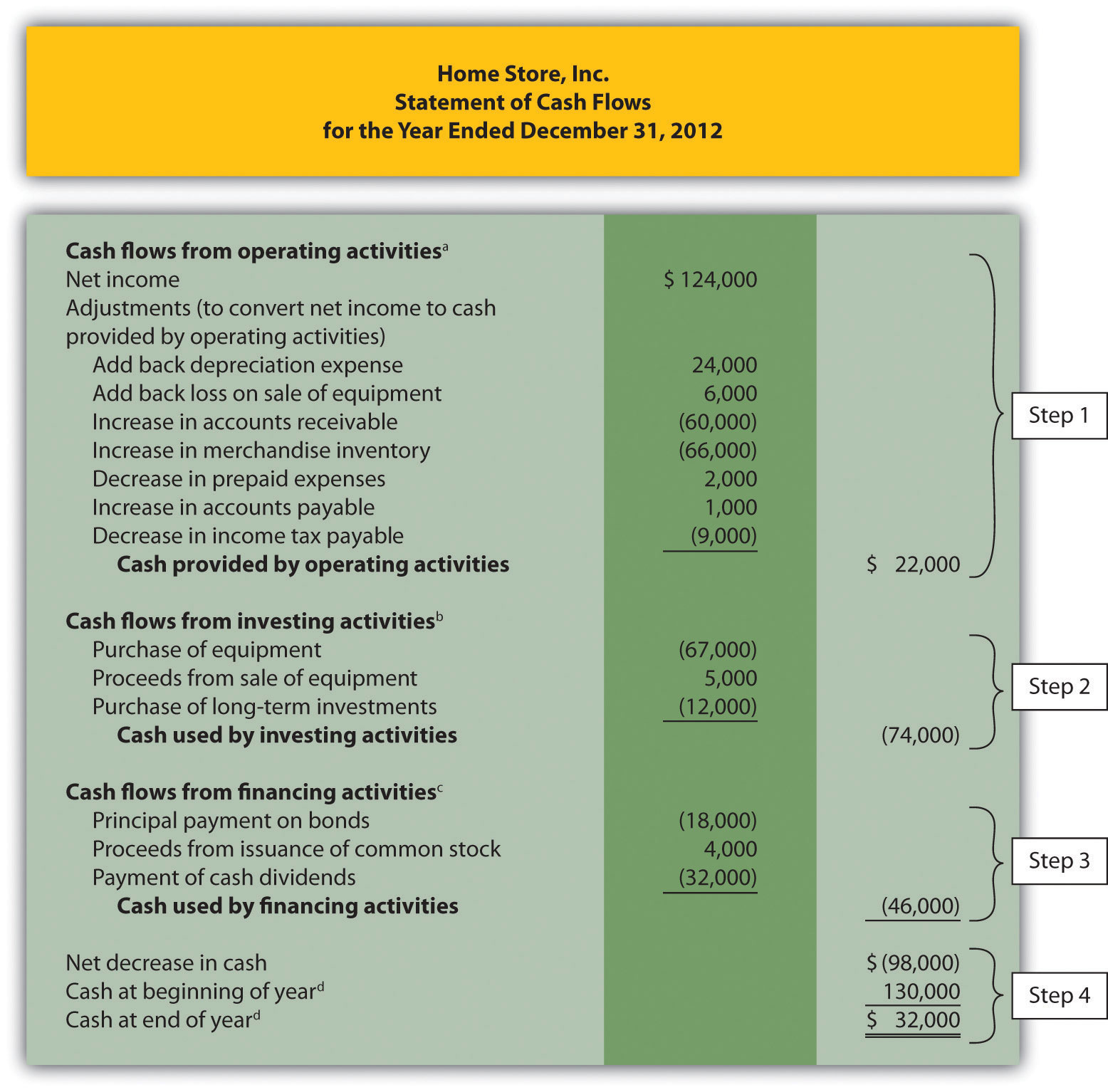

Example of cash flow statement: What does the cfo calculation consider? Cash receipts from sales of goods or services cash receipts from other income such as royalties, commissions etc cash paid to suppliers for goods and services

Whereas, cash outflows are the transactions that result in a reduction in cash & cash equivalents. Cash flow from operating activities: Positive operating cash flow (ocf) → greater discretionary free cash flow (fcf) negative operating cash flow (ocf) → less discretionary free cash flow (fcf)

Operating cash flow—also referred to as cash flow from operating activities. Learn more with detailed examples in cfi’s financial analysis course. Likewise, payments of cash for interest on loans with a bank or on bonds issued are also included in operating activities because.

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)