Amazing Tips About Statement Of Income For The Purpose Tds

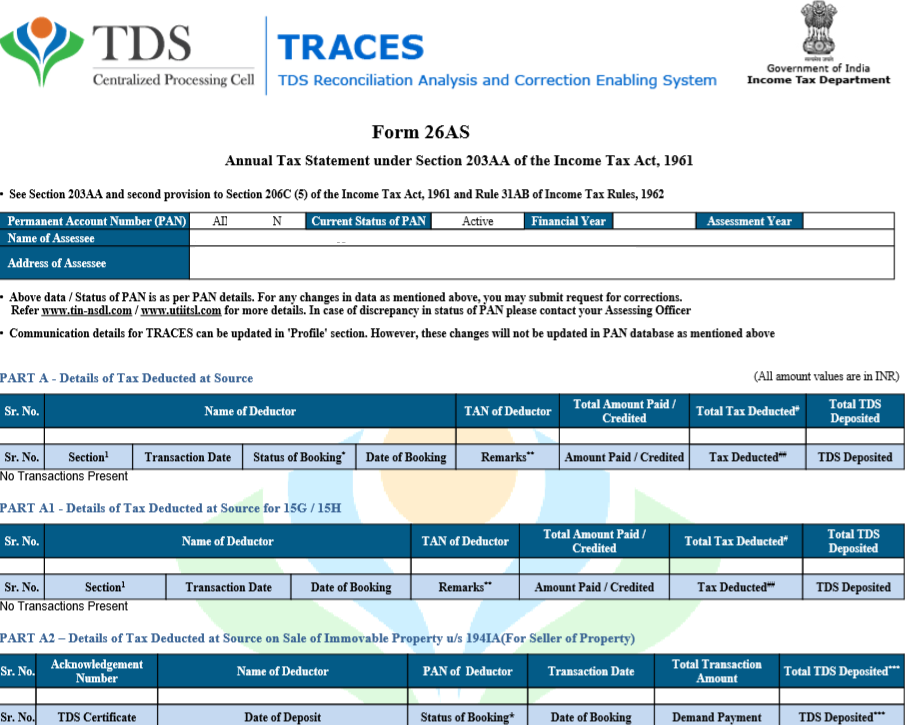

Tds required to be deducted = 10% on rs 1,00,000 = rs 10,000.

Statement of income for the purpose of tds. Tds is applicable on the following: Tds full form stands for tax deducted at source. Your browser will redirect to requested content shortly.

Applicability of tds. To upload tds, the steps are as below: The tds is a mechanism by which the tax is deducted at the source itself.

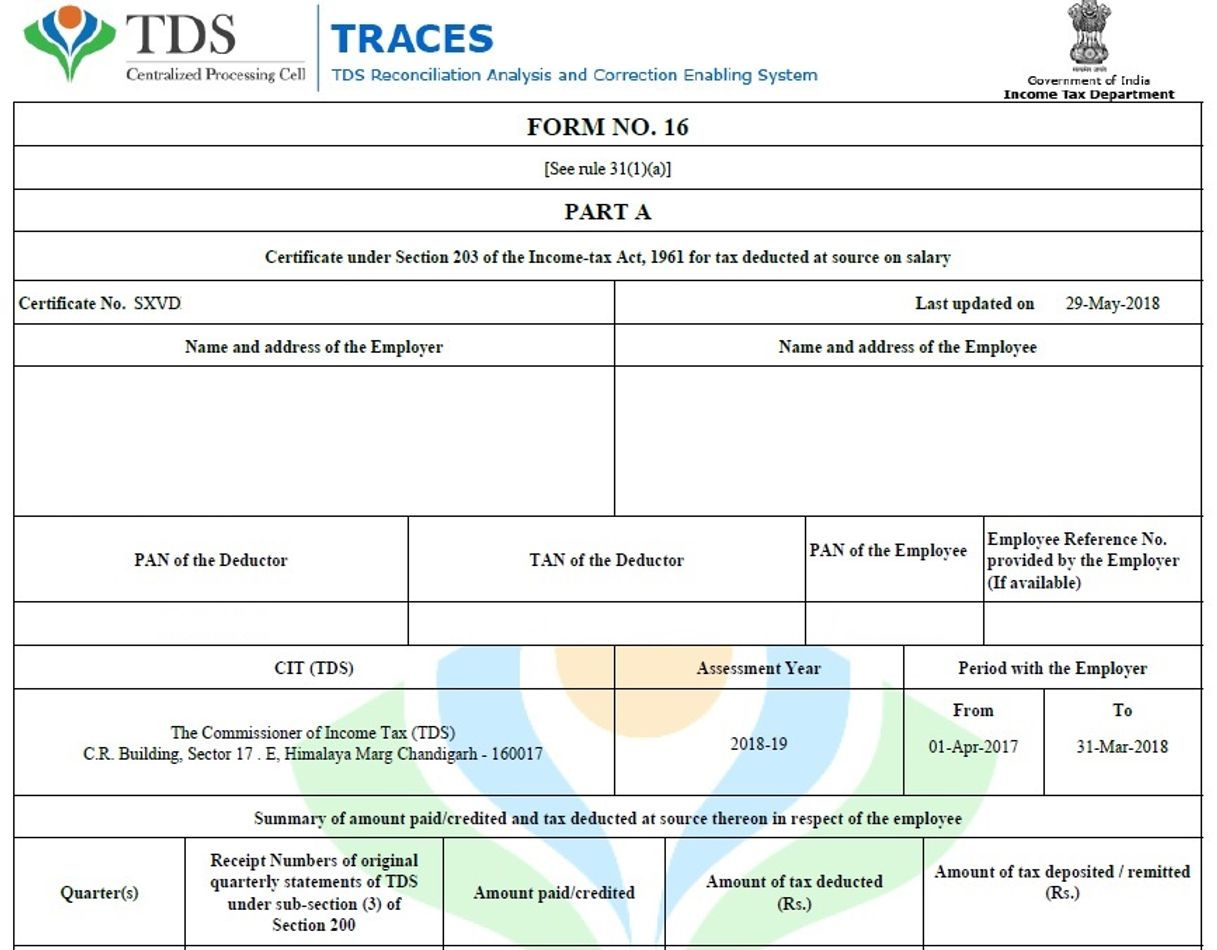

Maintaining accurate records and documentation relating to tds, such as tds certificates issued by the deductor, quarterly tds statements filed with the income. Form 24q is required to be submitted on. Enter user id (tan), password, and captcha.

By the persons making such payments.usually, the person receiving income is liable to pay income tax. The indian tax system imposes a tax deducted at source (tds) on certain incomes. Form 12b is a detailed statement showing income earned from salary.

It is the tax amount deducted by the employer from the taxpayer which is deposited to the it department on behalf of the. In comparison, form 12ba is a detailed statement listing all the perks received by the. It is submitted by the person deducting tds, i.e., tds.

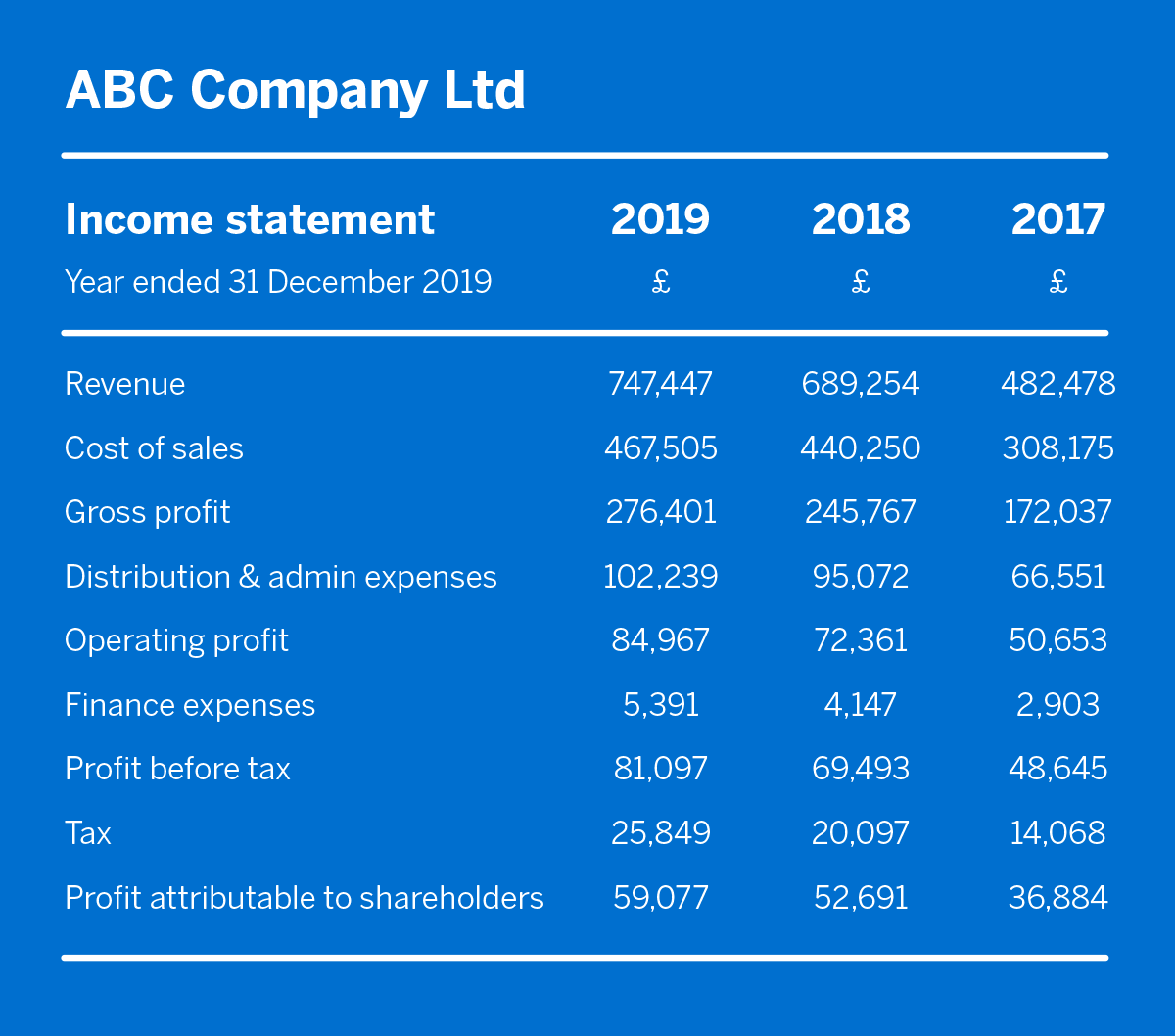

Tds returns are quarterly statements that contain the information pertaining to tds deducted and deposited. Tds or tax deducted at source is income tax reduced from the money paid at the time of making specified payments such as rent, commission, professional fees, salary, interest etc. What is tds return?

Form 24q is a tds return/ statement containing details of tds deducted from the salary of employees by the employer. Tds, or tax deducted at source, refers to the income tax deducted from payments made during specific transactions, such as rent, commission, professional.

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)