First Class Tips About Profit And Loss Calculation In Excel

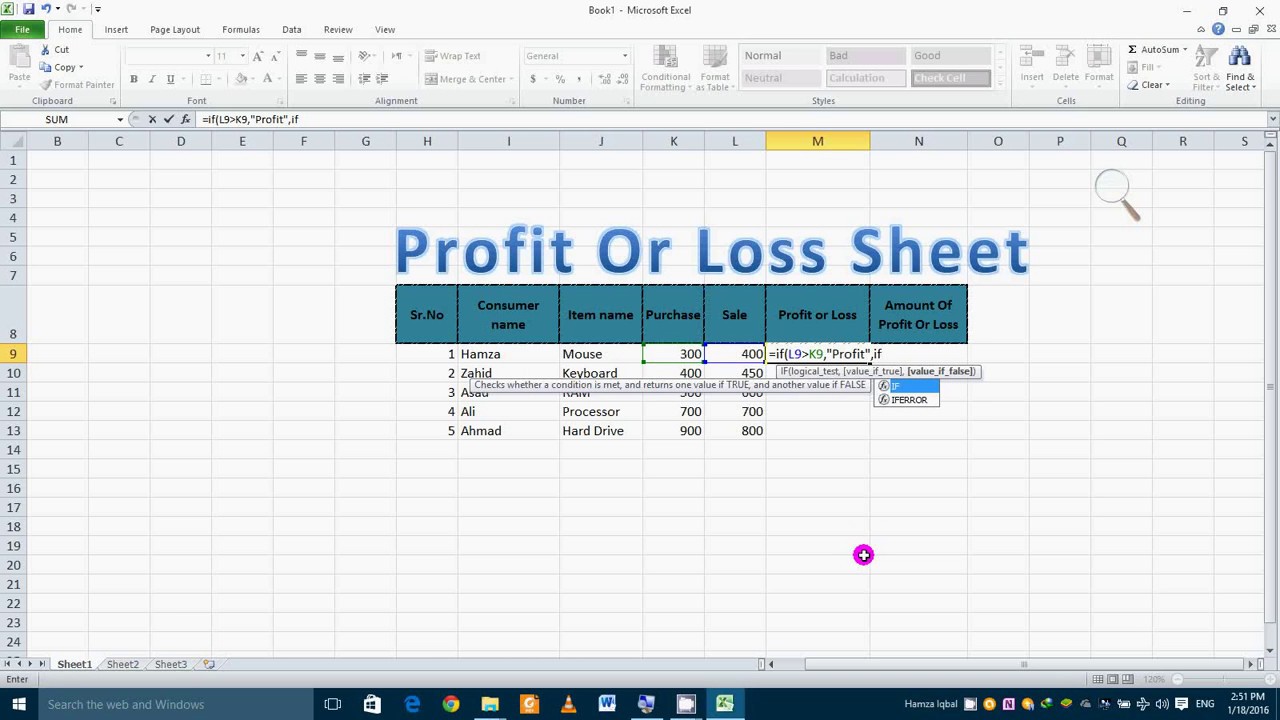

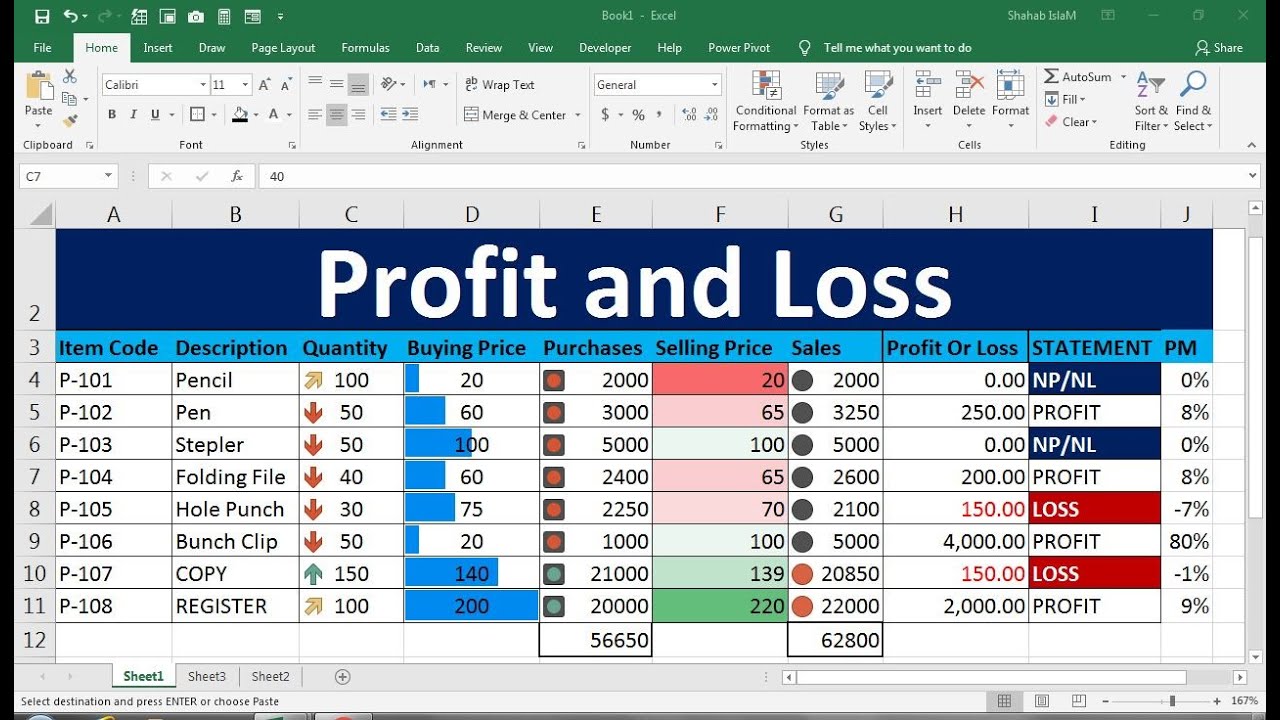

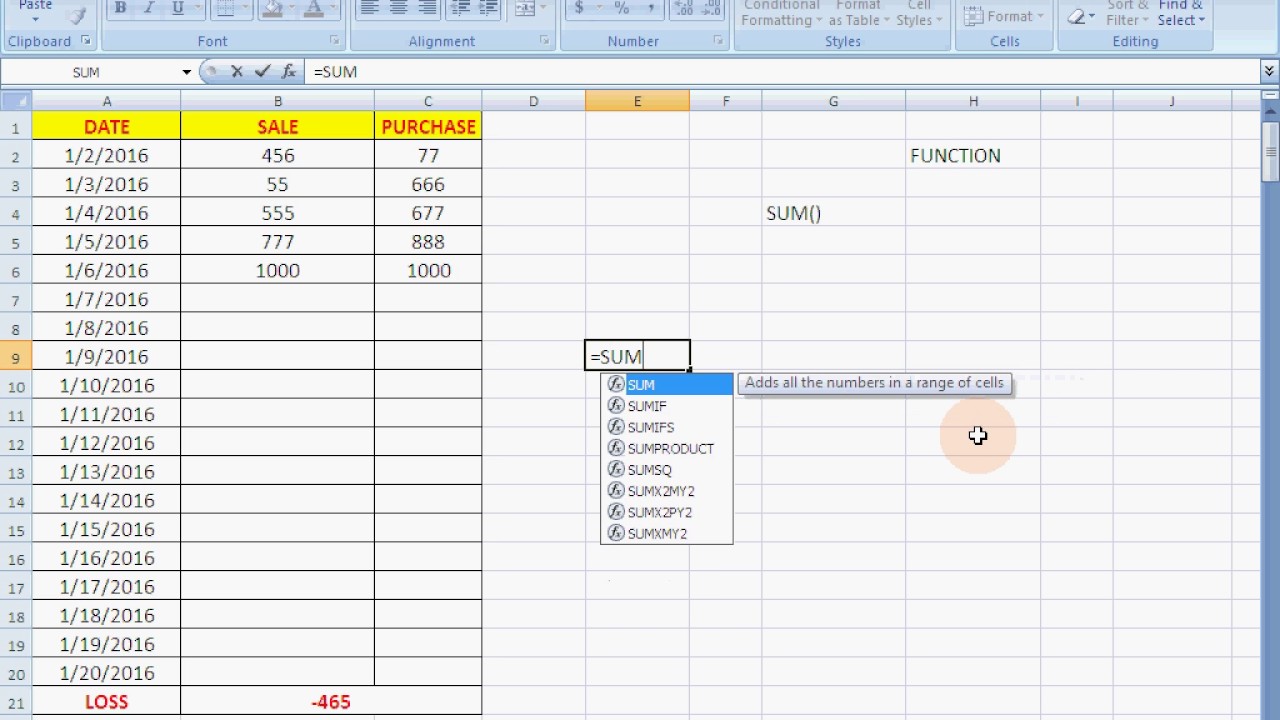

Here, in the above table, we’ve put some values that we are going to use to find the profit margin between the sale_price and actual_cost.

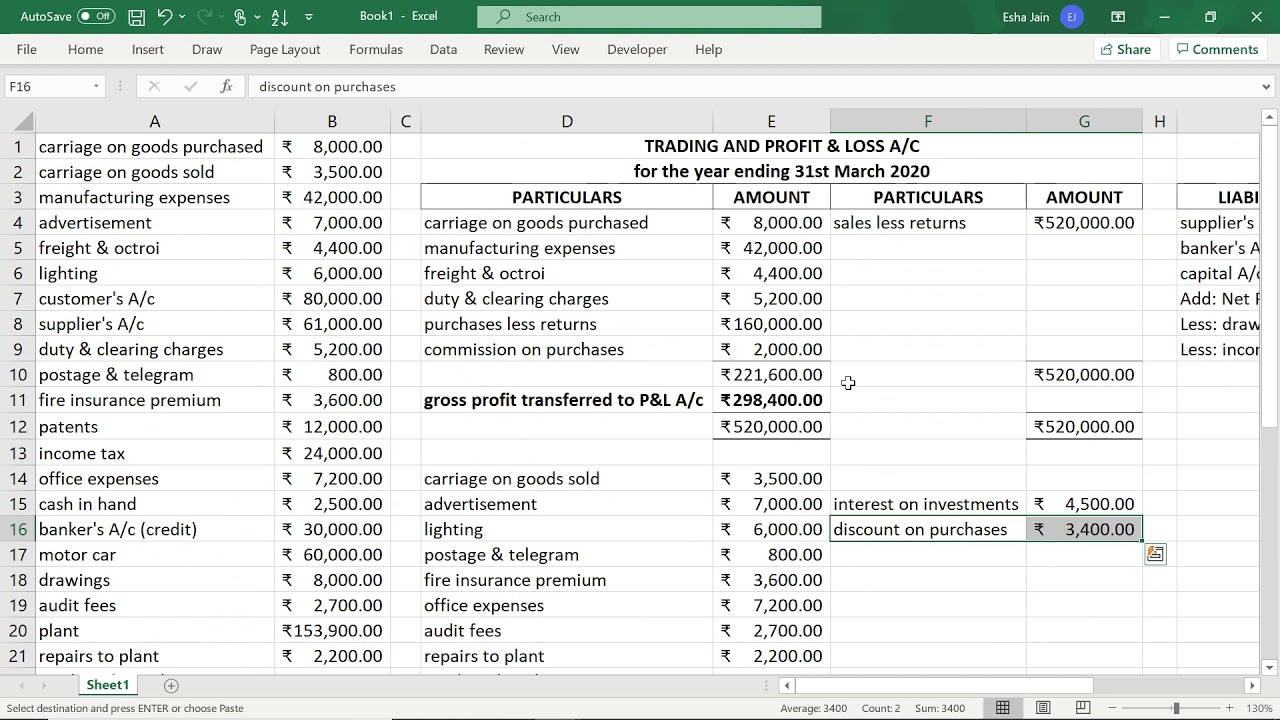

Profit and loss calculation in excel. Simply use the formulas explained on this page. To find gain, just subtract the previous number from the subsequent one. Selling price \hspace {0.2em} \,=\, \hspace {0.2em} =.

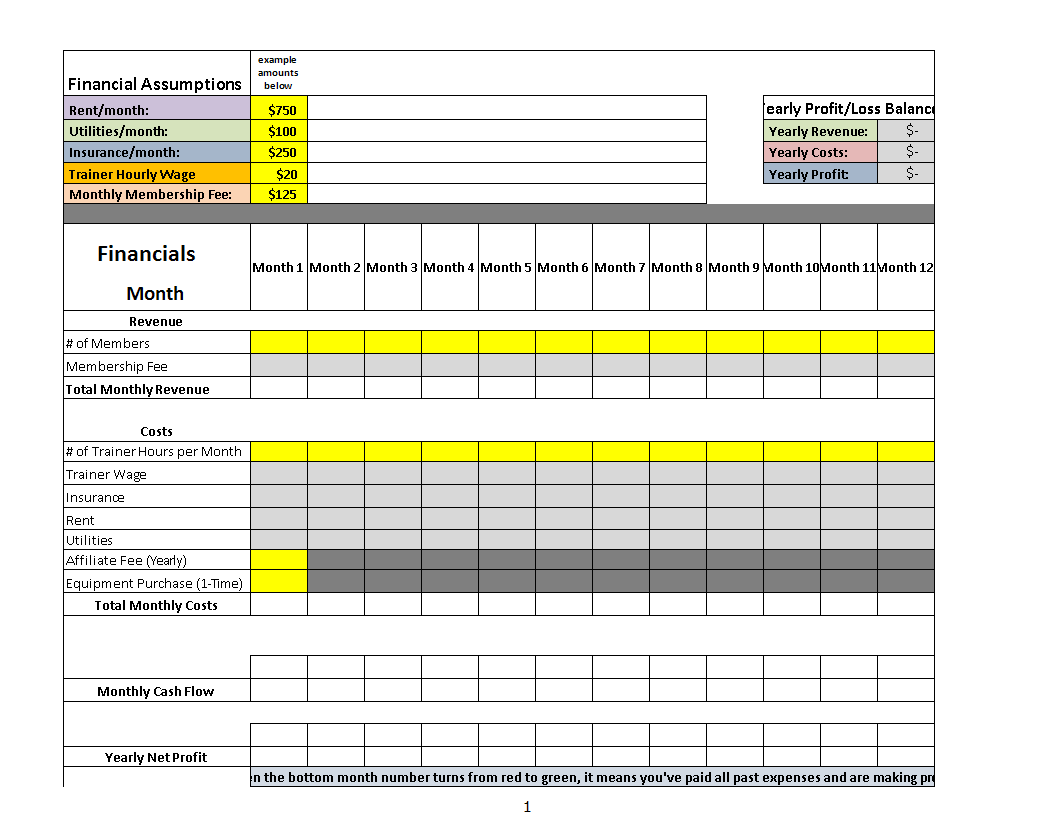

Rather than adding these three values up and dividing them by three yourself, the program performs and displays the calculation. Profit and loss calculator. Are the winter months particularly dreary?

In this scenario, you can type or choose the formula = (a1,b1,c1) in cell d1. Cost price \hspace {0.2em} \,=\, \hspace {0.2em} =. When might your biggest sales be, based off demographic buying tendencies?

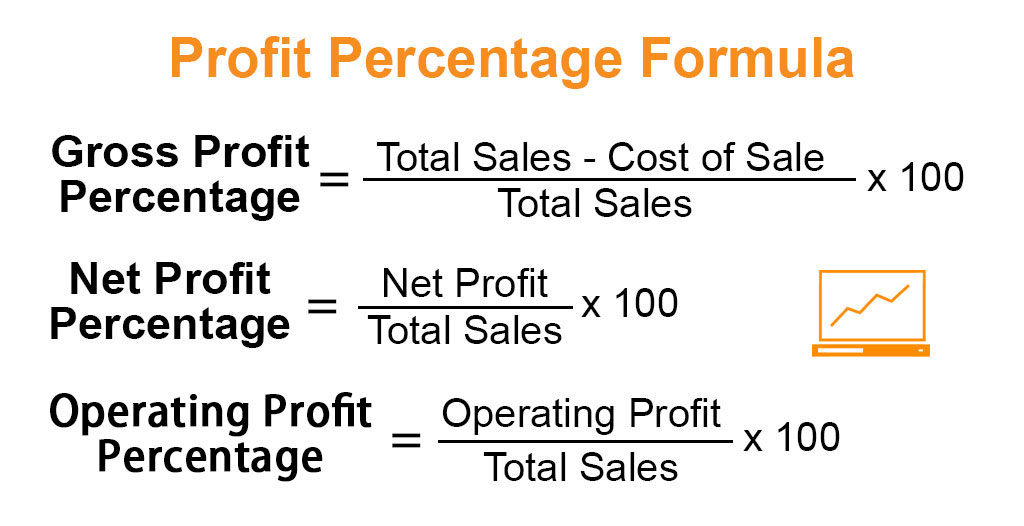

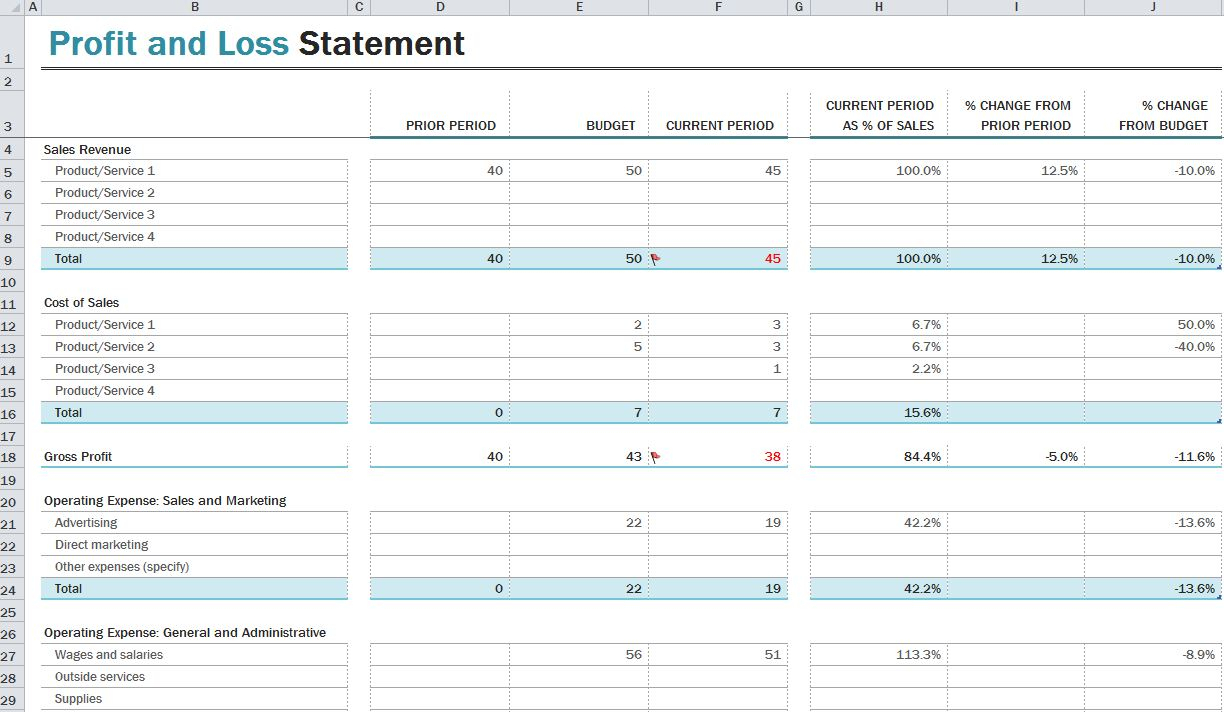

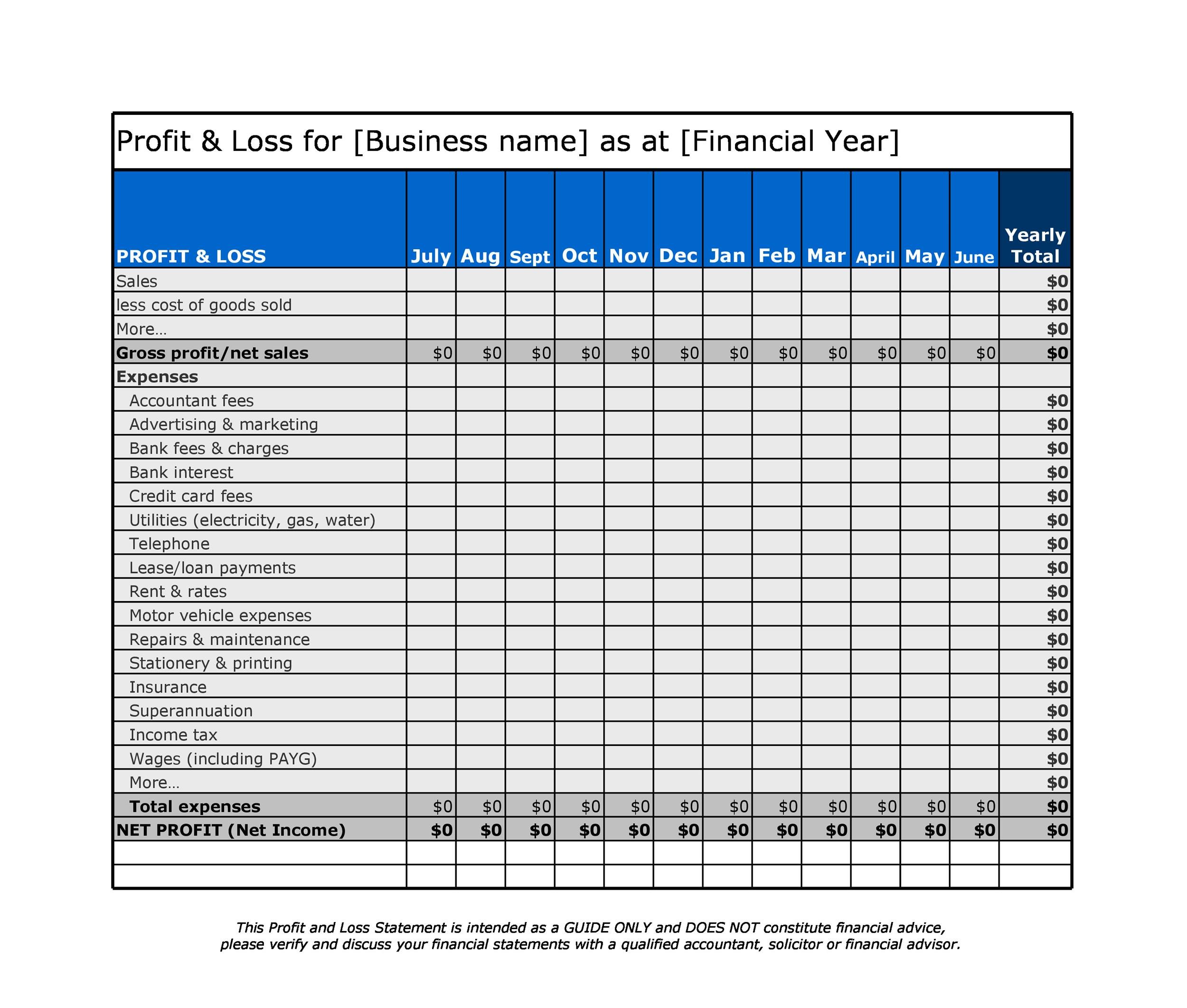

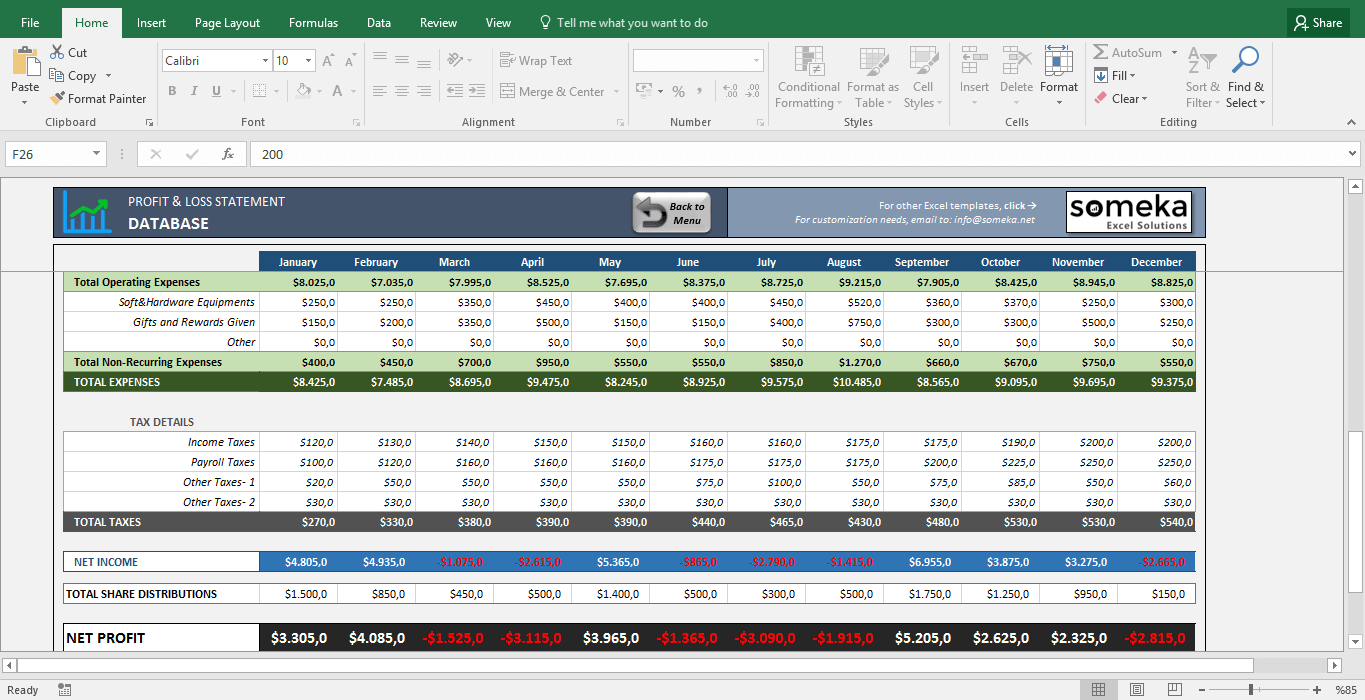

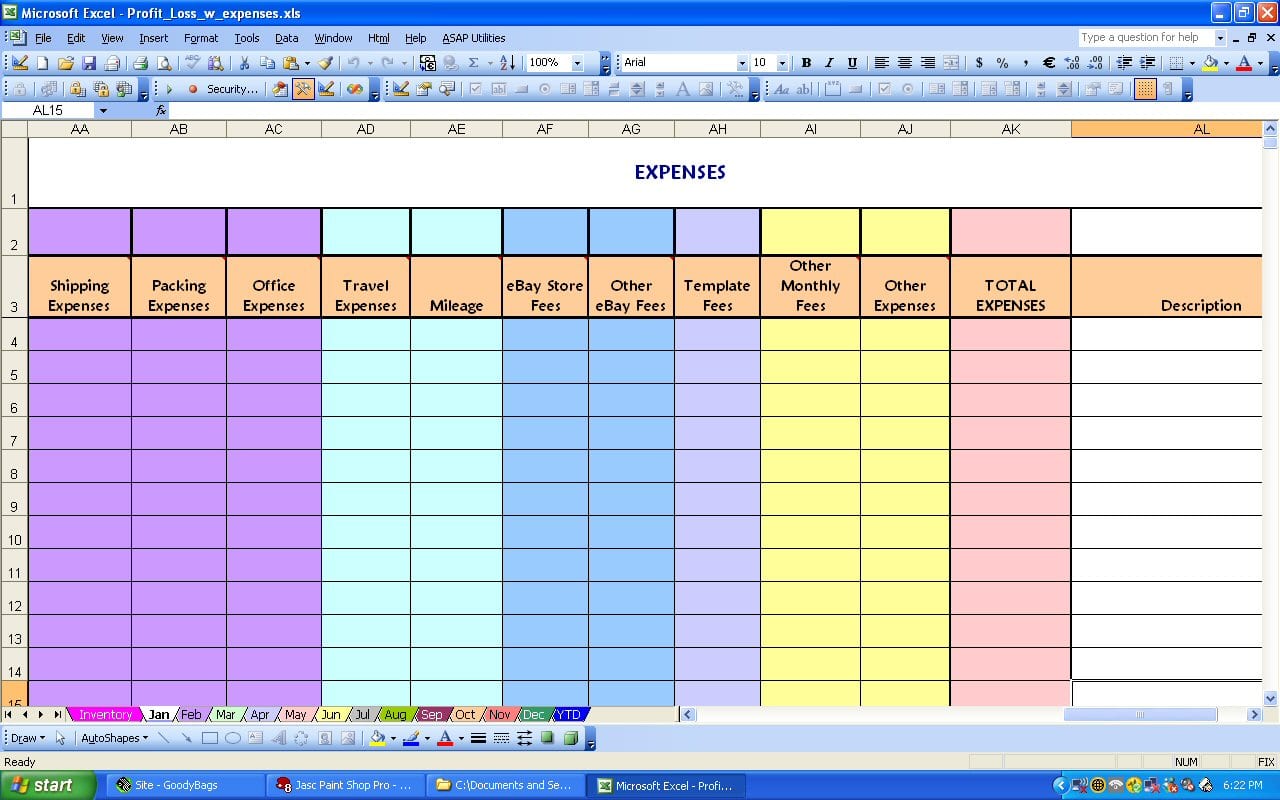

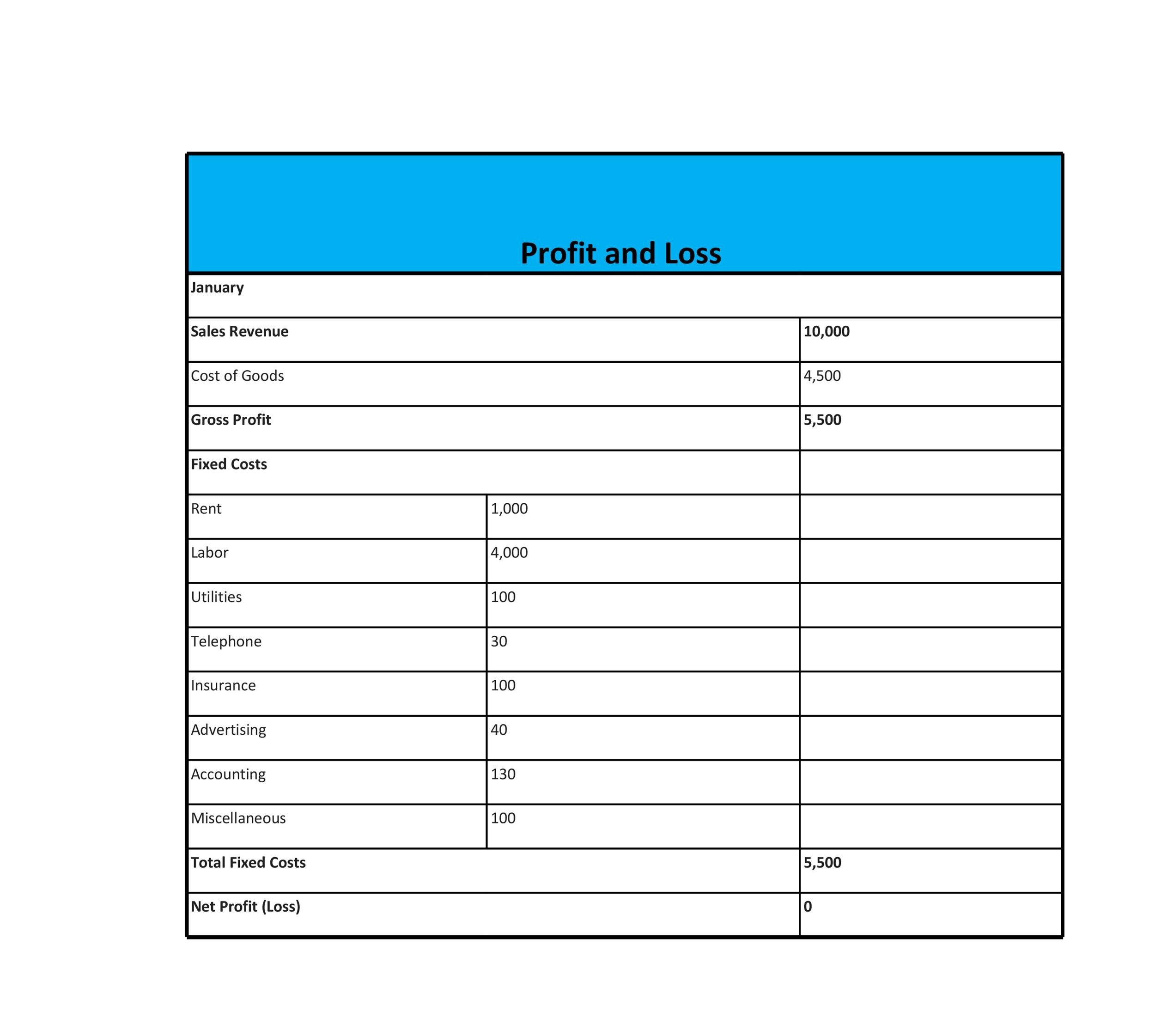

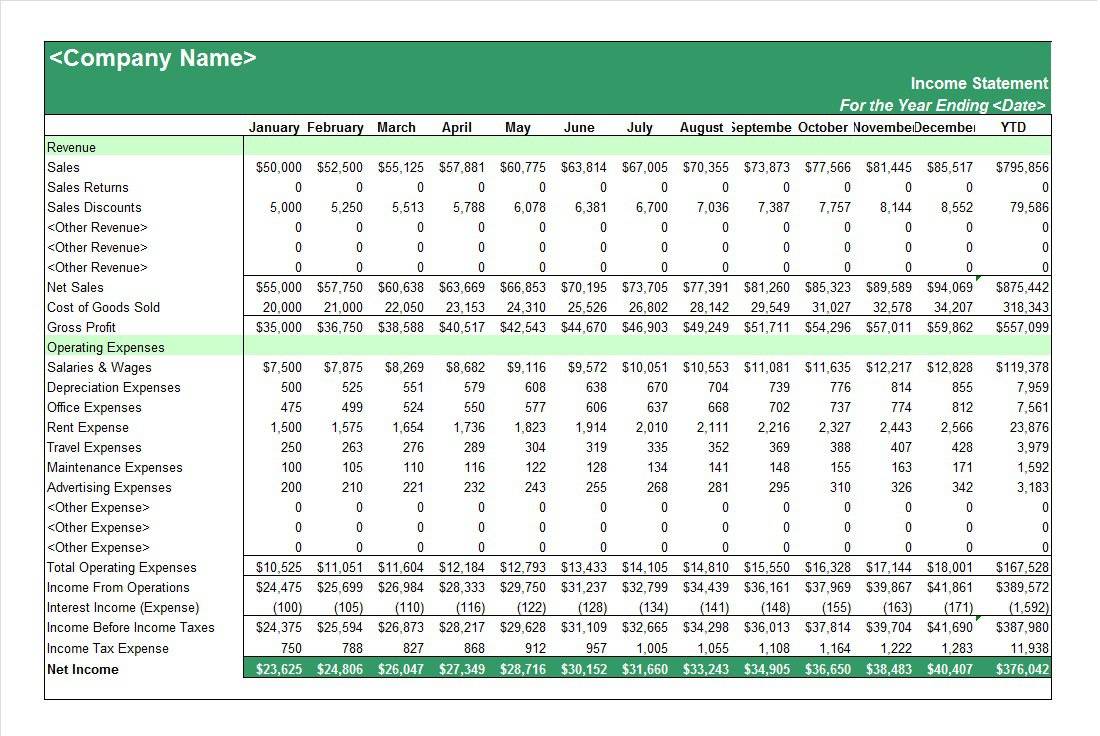

We can use the following general mathematics formula to determine percent profit or loss. Using excel formula to calculate gross profit percentage gross profit is the simplest form of profit. After entering your data into the spreadsheet, the template will calculate totals and generate graphs that display gross profit, total expenses, and profit or loss over time.

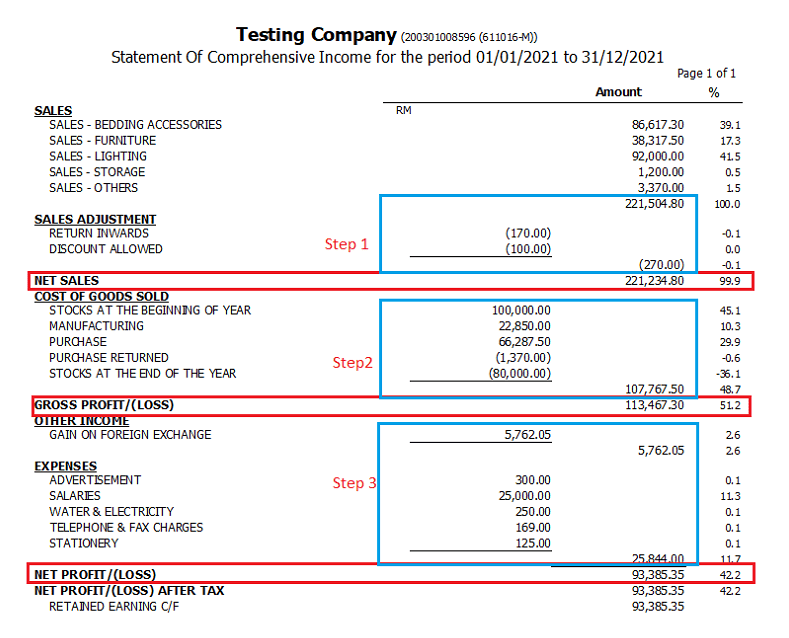

X=profit/price in the table shown, we have price and cost, but profit is not broken out separately in another column, so we need to calculate profit by subtracting cost from price: In this video, we'll show you, how to create a dynamic profit and loss statement, in excel sheet.it's a simple excel sheet format and so easy to make, with b. Calculating gross profit margin, operating profit margin and net profit margin in excel is easy.

Step 1 first of all, we need to prepare the data for the calculation of the profit margin. Earn profits → e.g. Regularly update your profit and loss statement to keep track of your business’s performance.

Take advantage of excel’s charting tools to visualize your financial data. How to use the profit and loss templates. Calculating profit or loss is essential for understanding the financial performance of a business and.

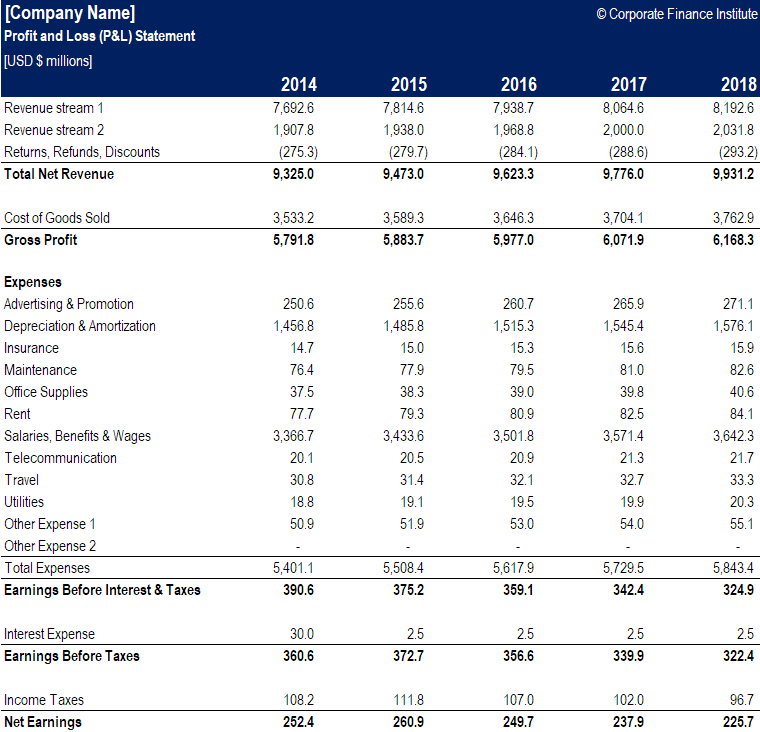

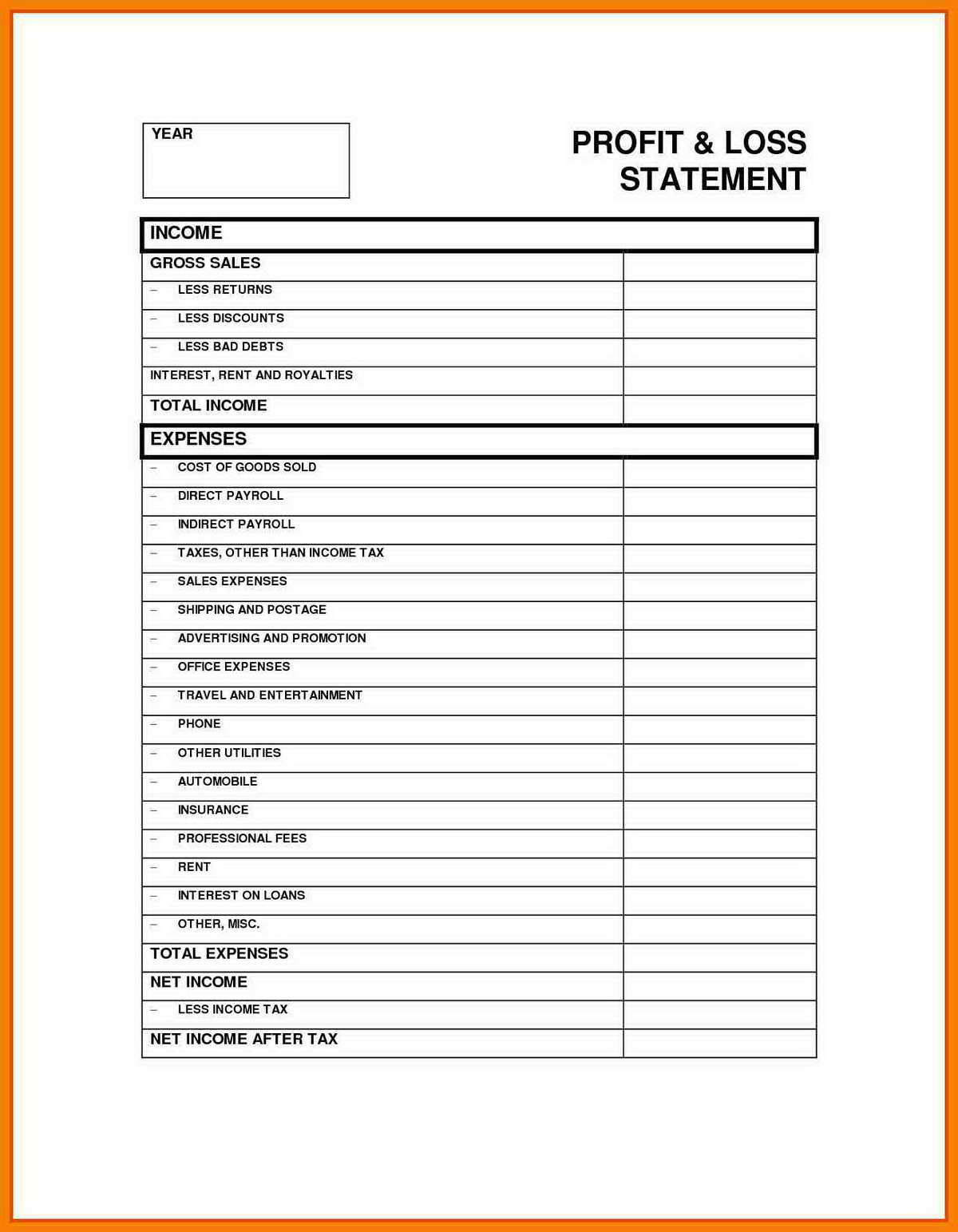

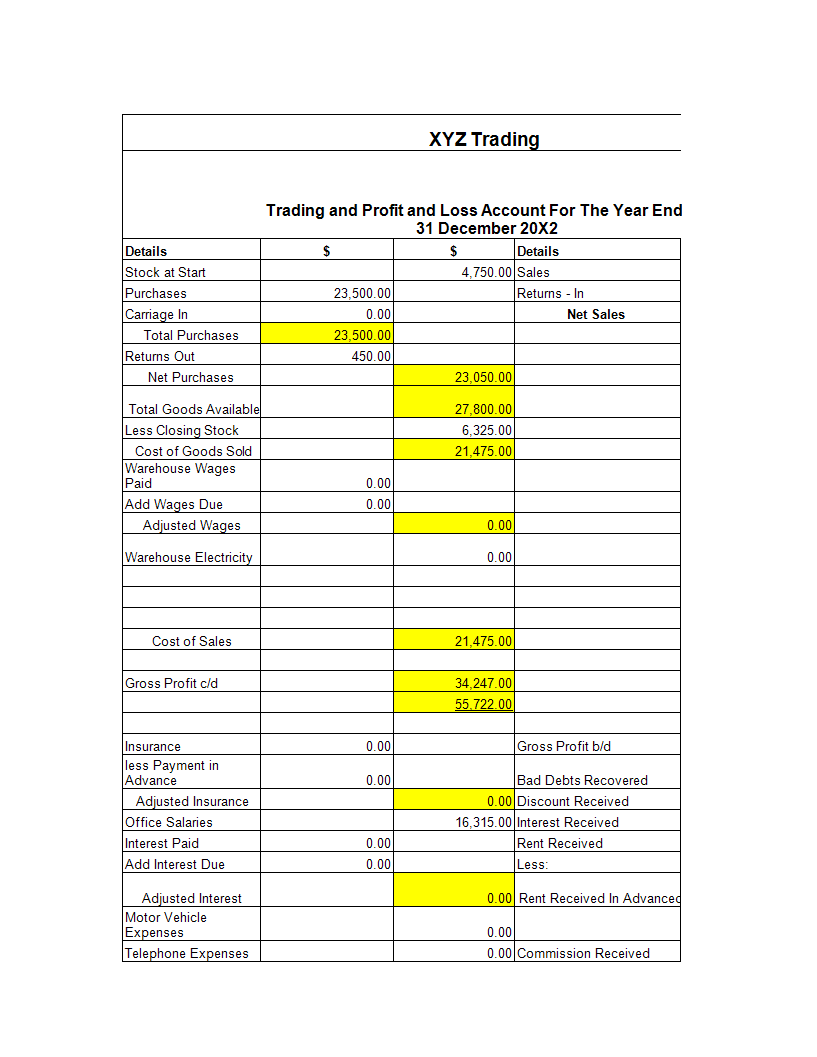

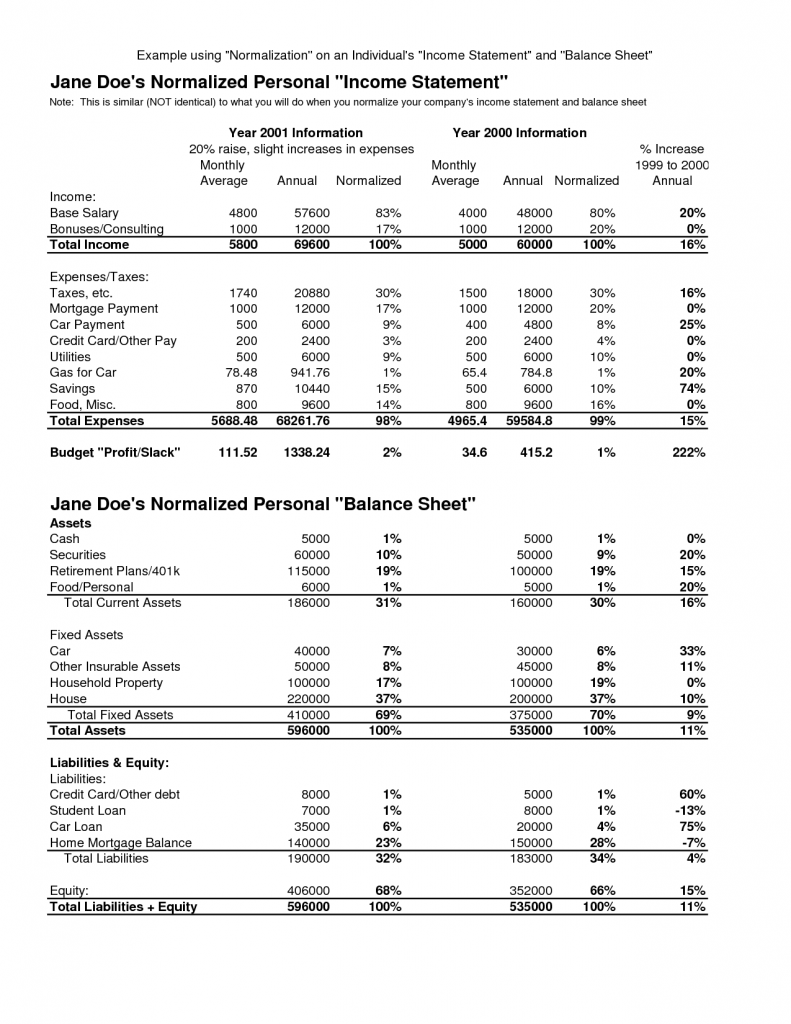

We subtract revenues from different types of costs to obtain net income (the company’s bottom line result). In this video we will learn to create stock management with profit and loss calculation in microsoft excel step by step.#stock_management#inventory_managemen. How to prepare the profit and loss statement (p&l) the profit and loss statement (p&l) can be prepared by an accountant under two different methods:

The general formula where x is profit margin is: Gross profit margin | operating profit margin | net profit margin. How to calculate profit or loss in excel introduction.

It is a preliminary profit idea. You’ll find examples, images and explanatory cases in addition to a free template for this important financial statement in the following sections. Entere a negative value for loss \hspace {0.2em} (\%) \hspace {0.2em} (%).