Awesome Tips About Non Operating Cash Flow

Cash flow from operations was $11.6 billion for the full year, up 5%;

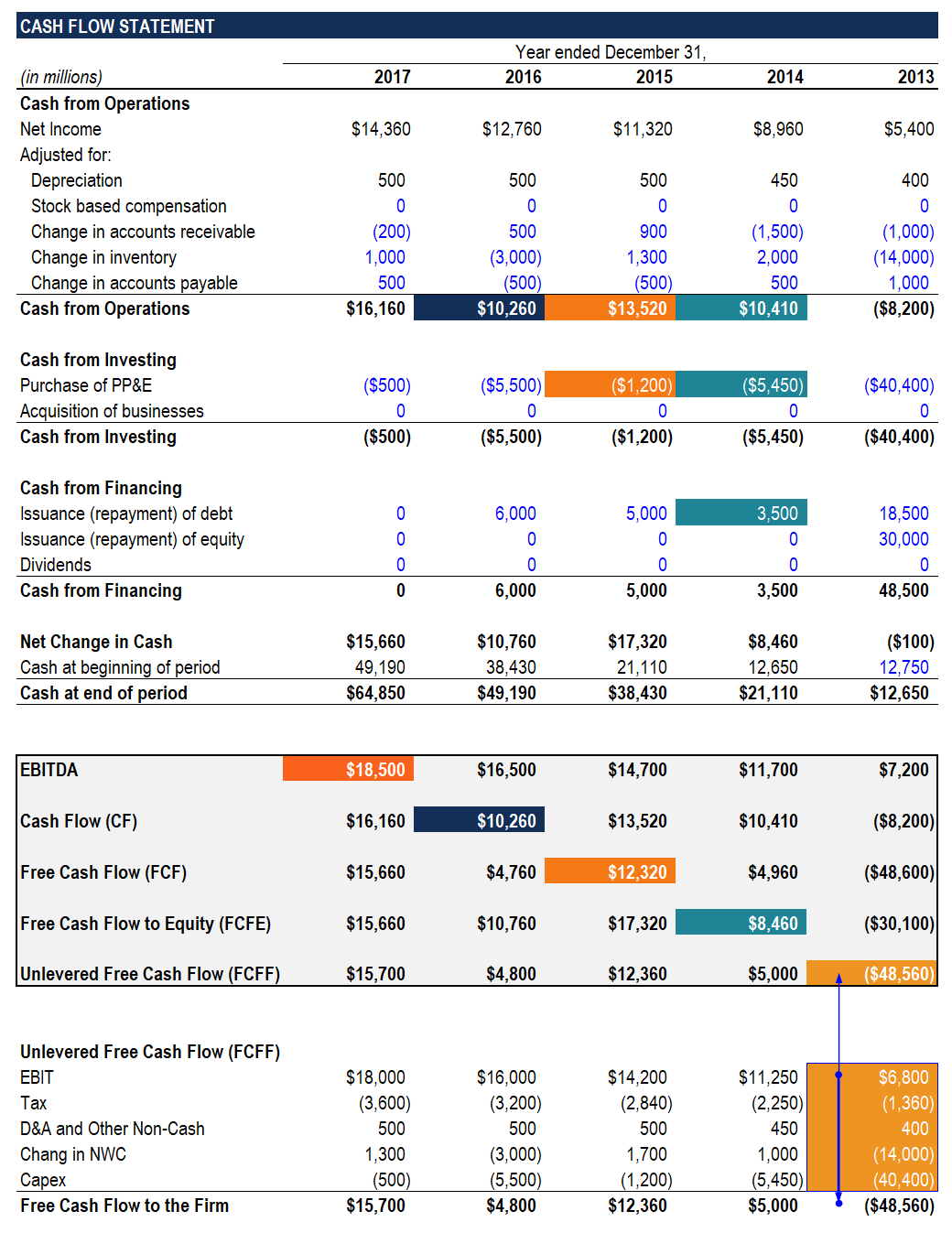

Non operating cash flow. Free cash flow was $2,029 million, or $2,1. Net operating cash flow was $4,087 million, or $4,187 million before changes in working capital (adjusted cfo). The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of.

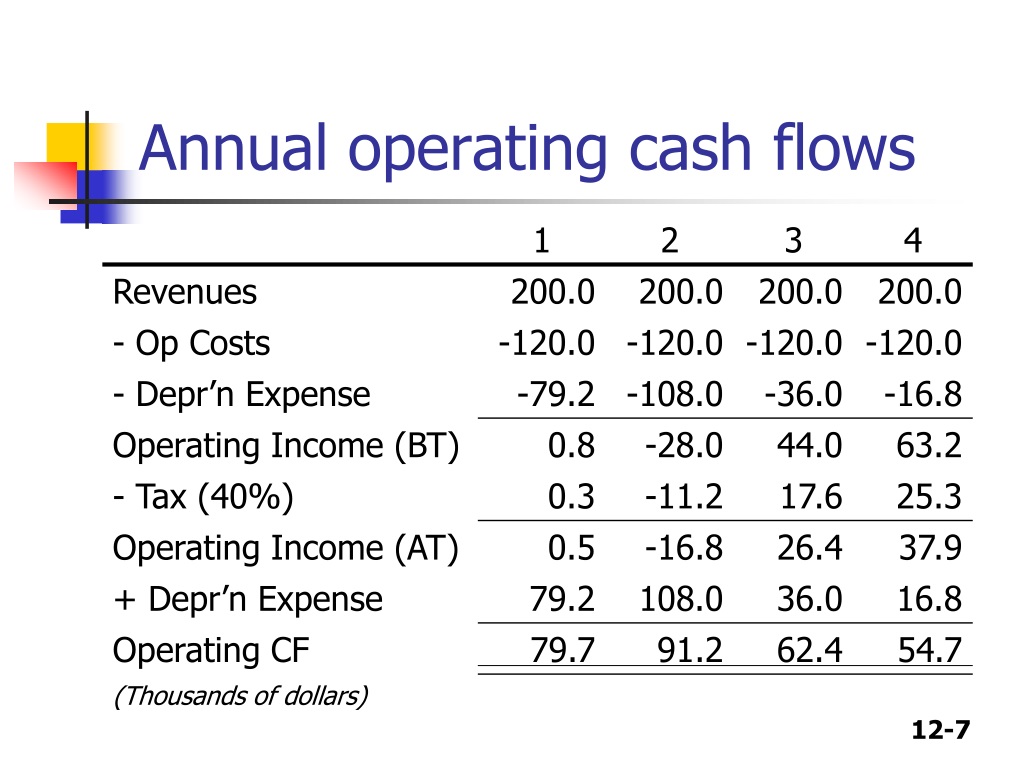

Free cash flow is net cash provided by operating activities less capital expenditures and capitalized software (together, capex). The operating income is the income from measures the cost of financing these assets. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the.

Cash has increased by $40. Add up all of the investment and financing inflows of cash. Investopedia uses cookies to provide you with.

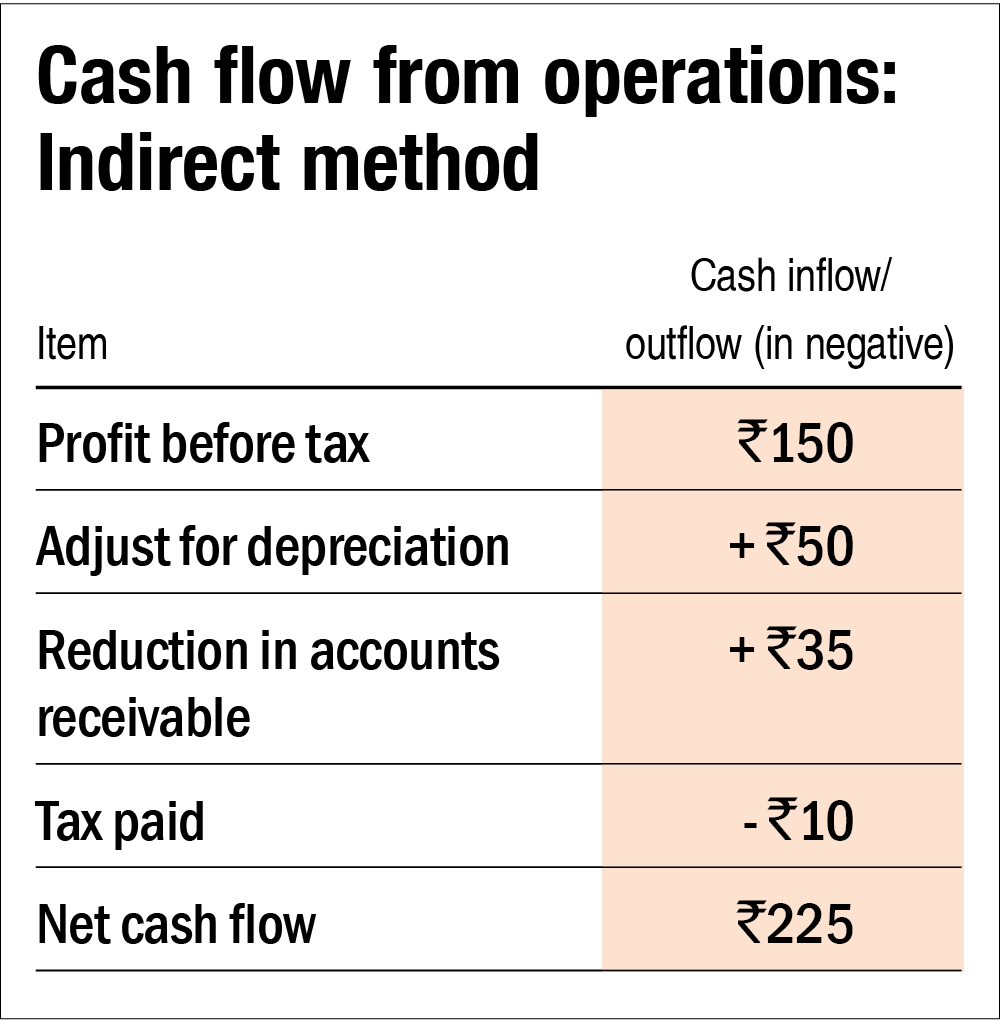

Easily compute key financial indicators to enhance fiscal strategy. The actual calculation of nonoperating cash flow is very straightforward. To the present, you have valued the operating have.

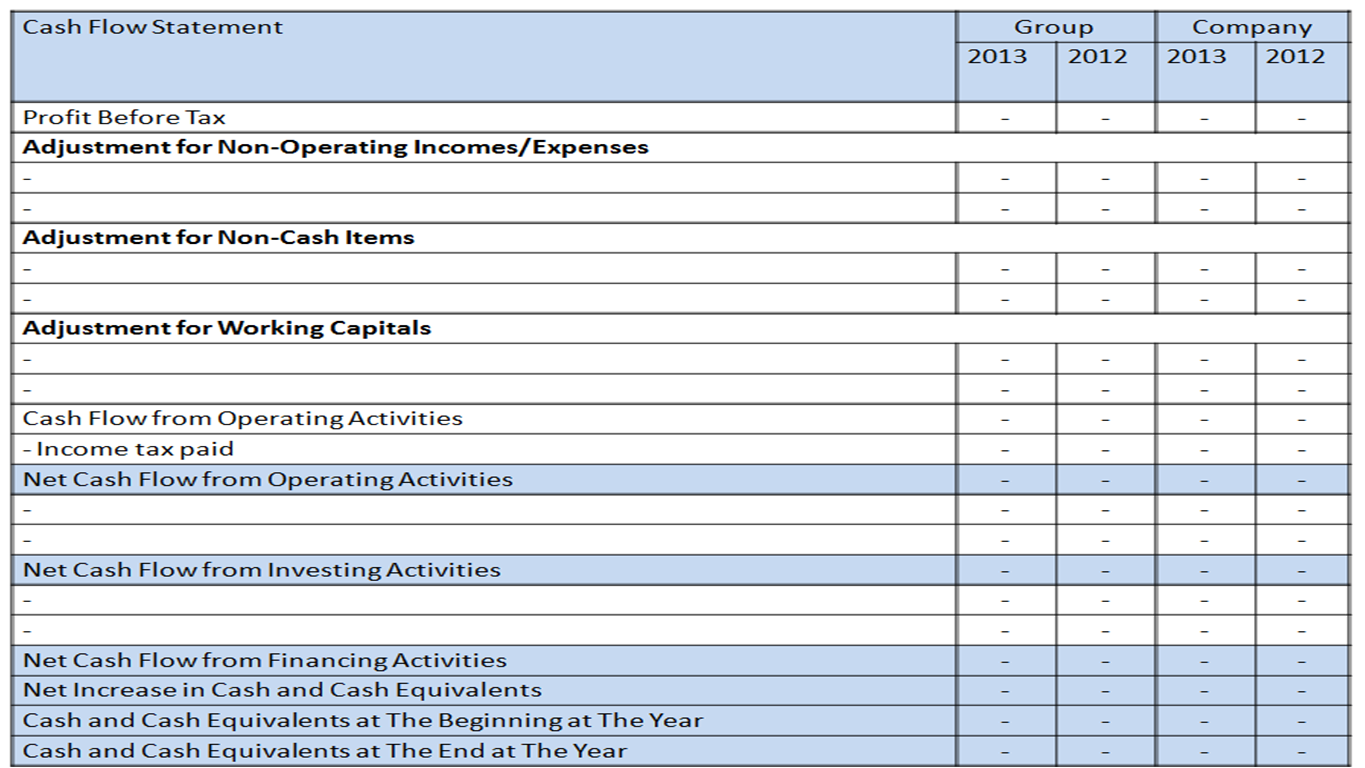

The “cash flow from operations” is the first section of the cash flow statement, with net income from the income statement flowing in as the first line item. Adjustments for noncash items in the reconciliation of net income to net cash flows from operating activities may include items such as: Do the same for all outflows.

The most common items that. The balance statement shows that assets are down by $40. Streamline your financial management with our free cash flow statement template.

/Applecash2019-80a52328f14a4b088790109627818e14.jpg)

:max_bytes(150000):strip_icc()/Non-OperatingCashFlow-9853c6dc478048eaaecf48d3f62c7177.jpg)