Smart Info About Ifrs 16 Standard

Ias 16 2021 issued ifrs standards (part a) ias 16 property, plant and equipment in april 2001 the international accounting standards board (board) adopted ias 16 property,.

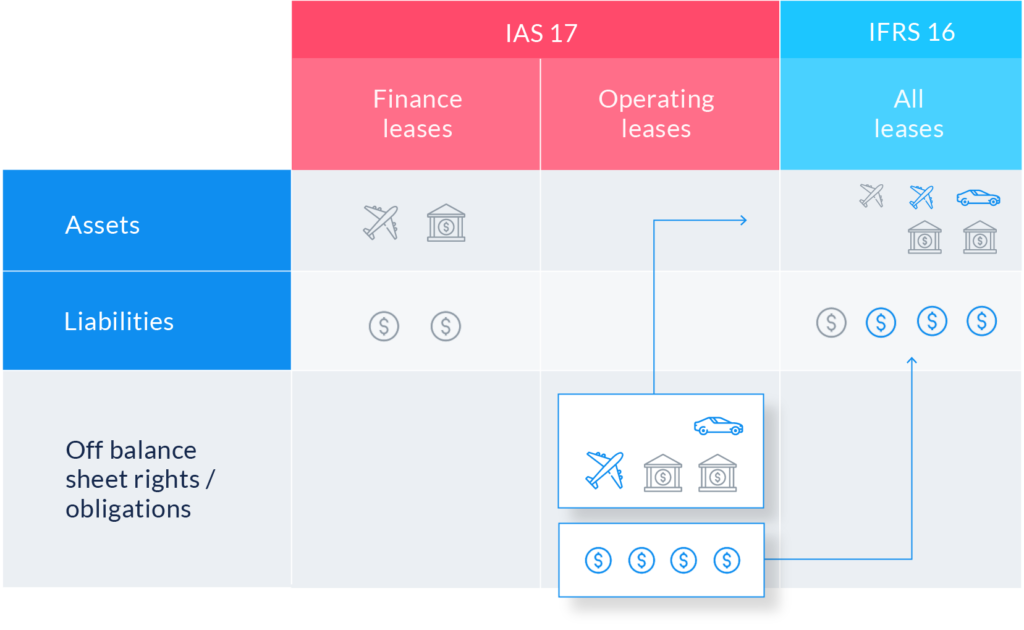

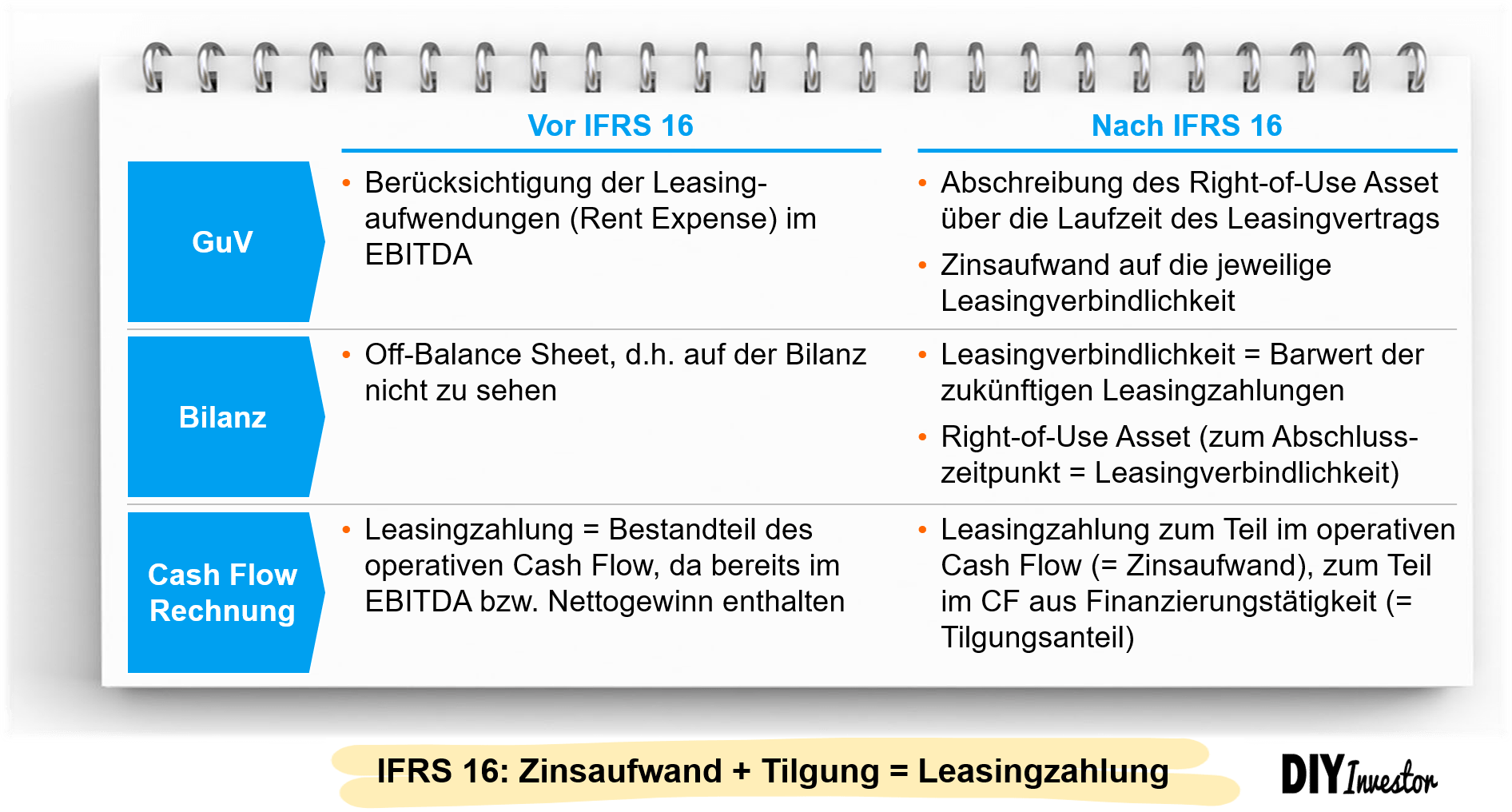

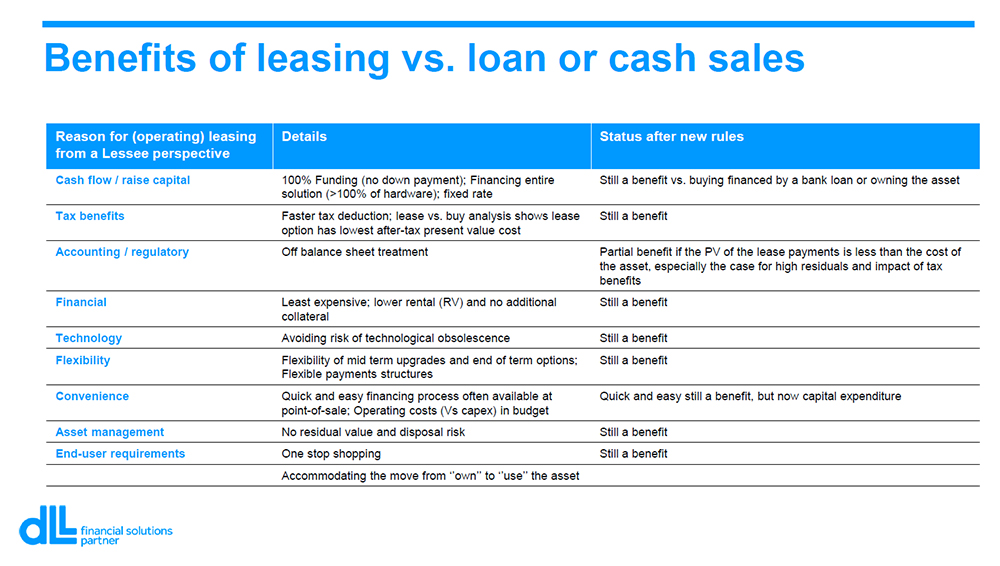

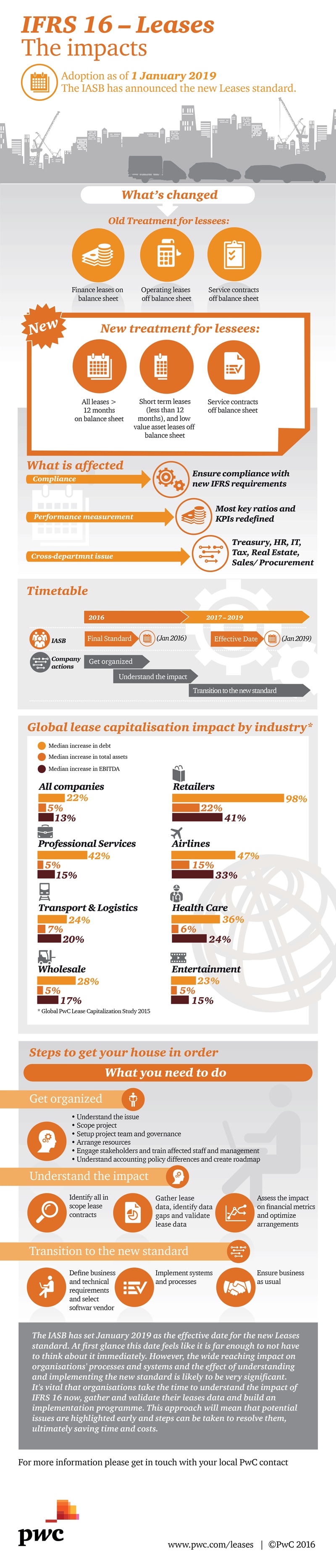

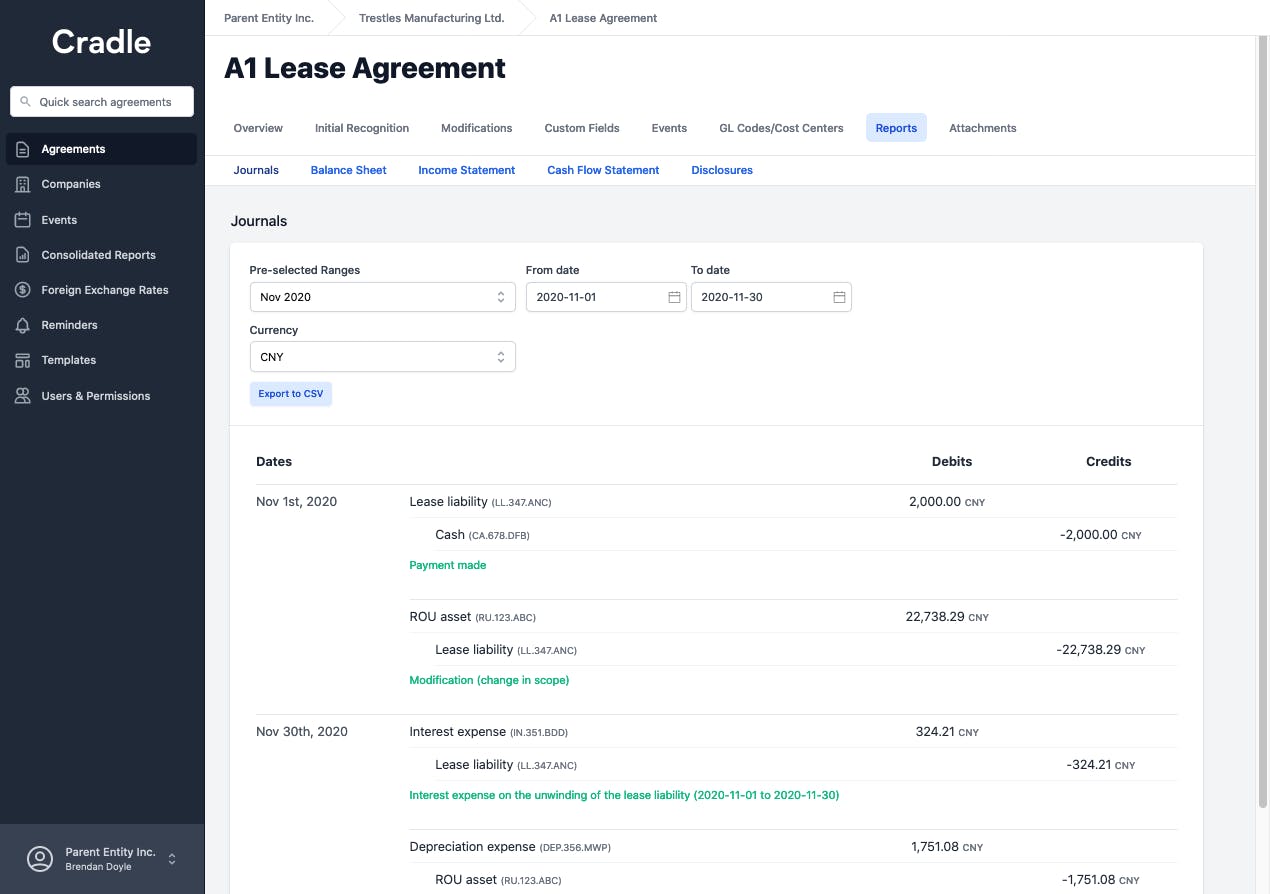

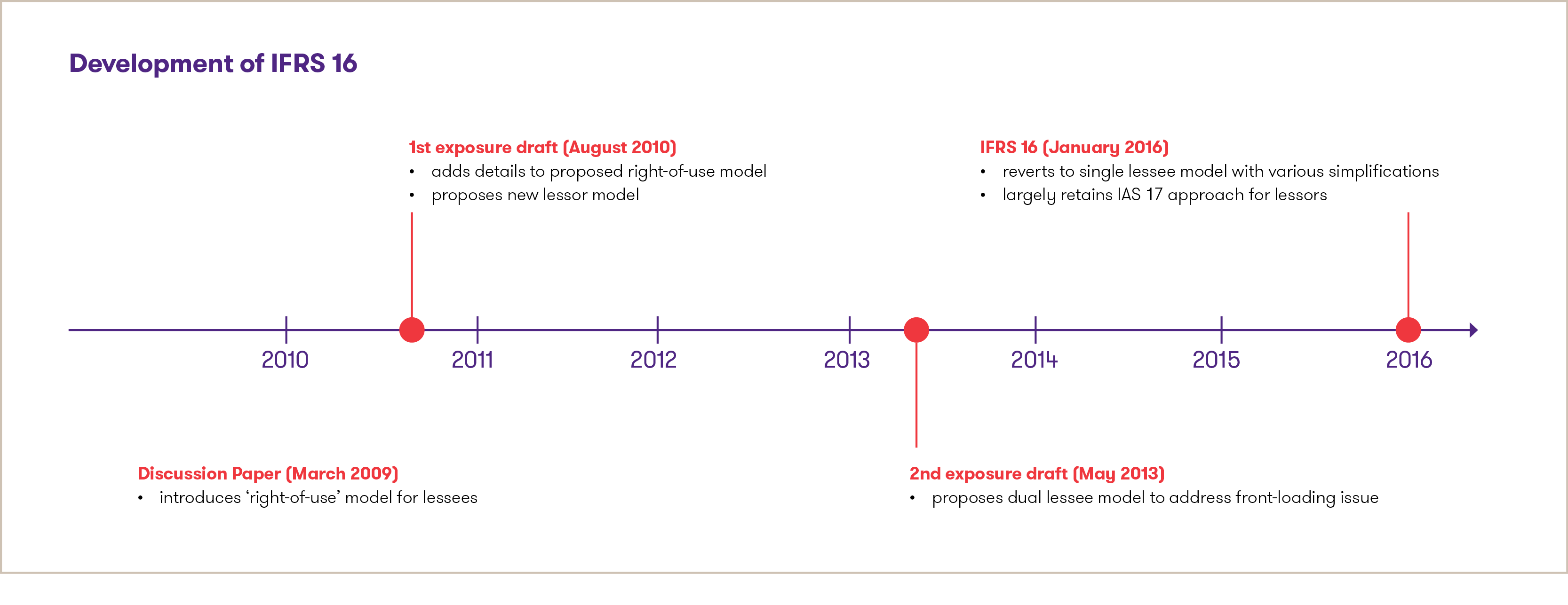

Ifrs 16 standard. Find out how to make transitions from ias 17 to ifrs 16, and the new exemptions under ifrs 16, including accounting entries examples and how they impacts sales and. International financial reporting standard (ifrs ®) 16, leases was issued in january 2016 and has been effective for periods beginning on or after 1 january 2019. Ifrs 16 requires such leases to be recognised on the balance sheet similar to finance leases.

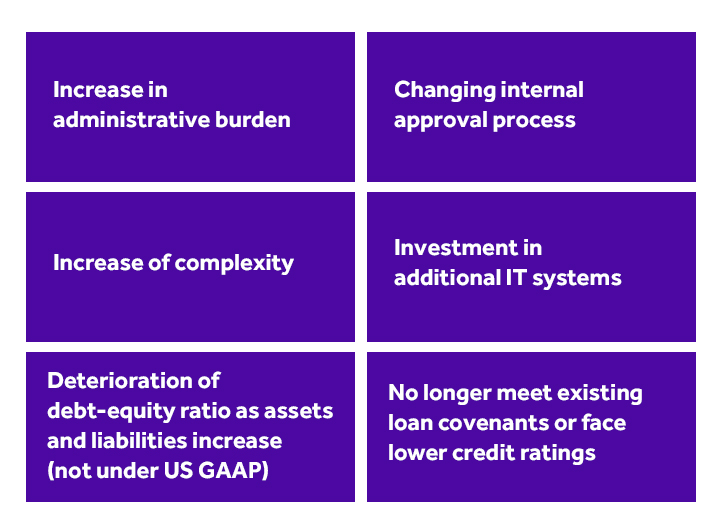

In january 2016 the board issued ifrs 16 leases. This will have significant impact on the financial statements of these businesses. Virtually every company uses rentals or leasing as a means to obtain.

A free 'basic' registration will. Ifrs 16 replaces ias 17, ifric 4, sic‑15 and sic‑27. It comes into effect on 1 january 2019.

The european financial reporting advisory group (efrag) has launched the second part of its survey. Derivatives that meet the criteria in paragraph 4.3.3 of ifrs 9 financial instruments. Reference to standard:

Early application is permitted, provided the new revenue standard, ifrs 15 revenue from. Ifrs 16 para 9, ifrs 16 app b para b9, ifrs 16 app b para b24 reference to standing text: Ifrs 16 leases, effective for annual reporting periods beginning on or after 1 january 2019, brought significant changes in accounting requirements for lease accounting, primarily.

To meet that objective, a lessee should recognise assets and liabilities arising from a lease. In january 2016 the board issued ifrs 16 leases. Ifrs 16 leases has now been successfully adopted by companies reporting under ifrs® standards.

Efrag survey on ifrs 16 — user perspective. Whilst cipfa fan has covered the ‘new’ leasing standard many times, we. The iasb published ifrs 16 leases in january 2016 with an effective date of 1 january 2019.

Ifrs 16 leases prescribes a single lessee accounting model that requires the recognition of asset and corresponding liability for all leases with terms over 12 months unless the. 15.5, 15.17, 15.19 background pharma. Ifrs 16 is an international financial reporting standard (ifrs) promulgated by the international accounting standards board (iasb) providing guidance on accounting for.

Ifrs 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the. Ifrs 16 is effective for annual periods beginning on or after 1 january 2019. It is the new normal for lease accounting around the world.

The ifrs 16 lease accounting standard is a recent standard issued by the ifrs foundation and the international accounting standards board (iasb) setting out the. Ifrs 16 leases continues to be a significant project for many local authorities. Requires lessees to recognise nearly all leases on the.