Favorite Tips About Summary Of Uncorrected Misstatements

Final analytical procedures during the completion stage of the.

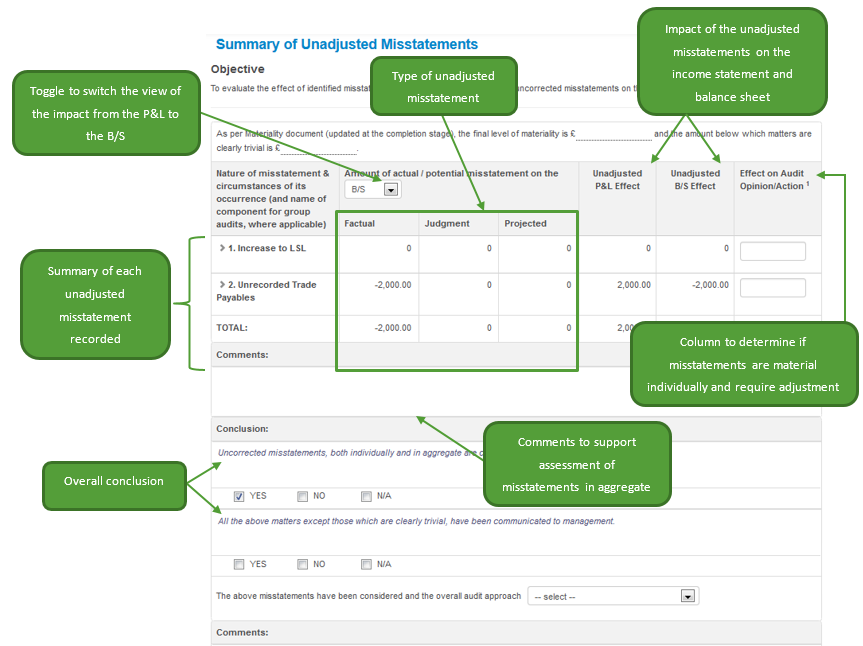

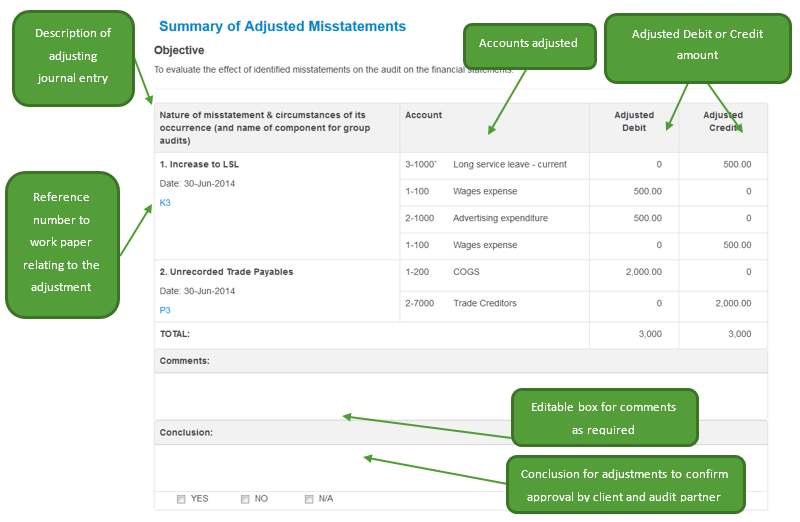

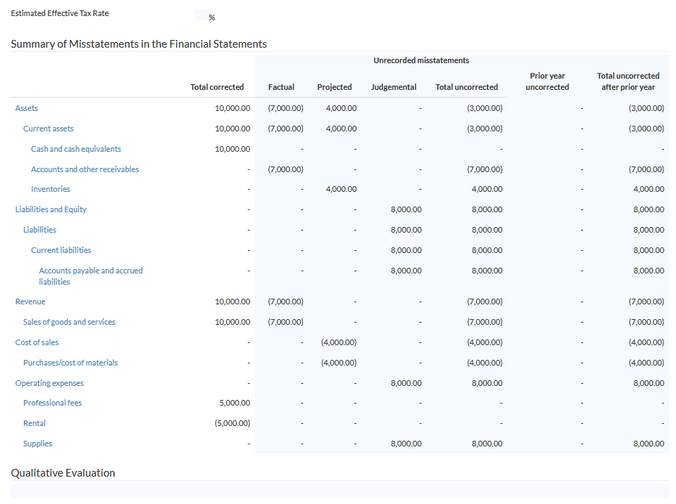

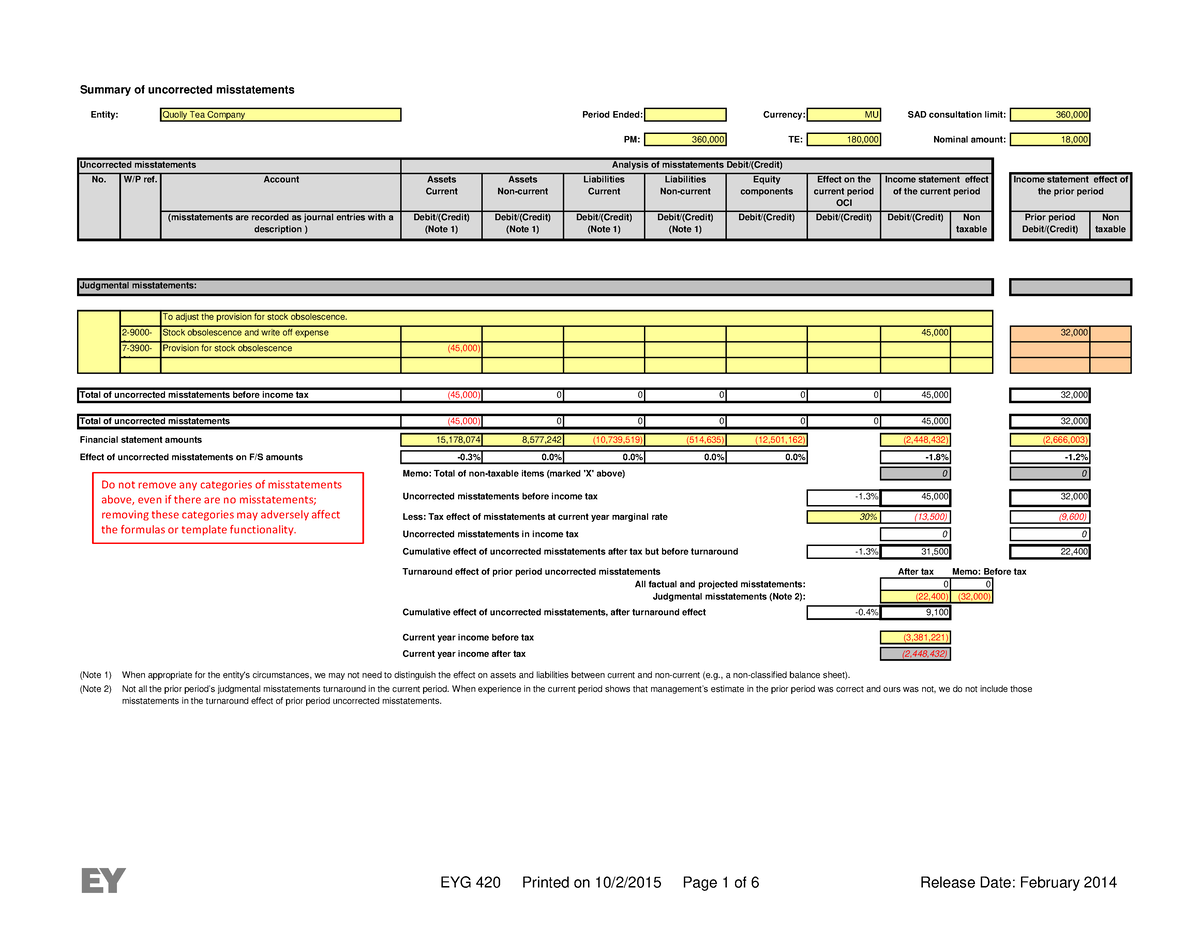

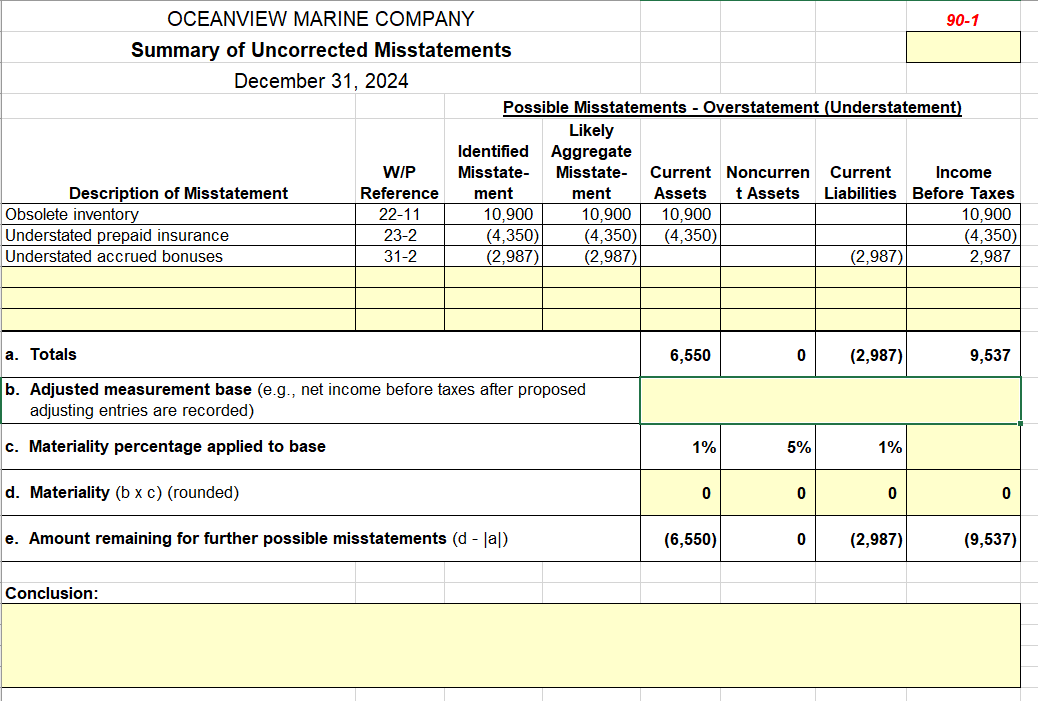

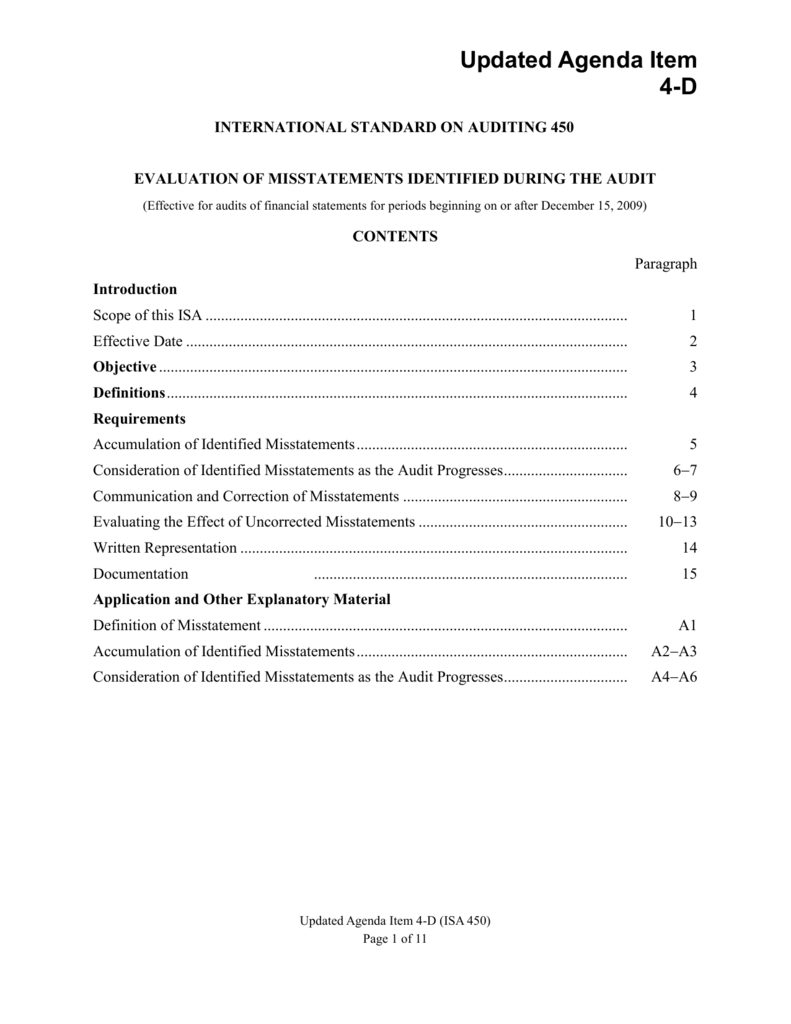

Summary of uncorrected misstatements. According to isa 450, the objectives of the auditor are to evaluate: The sum is a workpaper or excel file that is reviewed at the conclusion of an audit. Sum stands for “summary of uncorrected misstatements”.

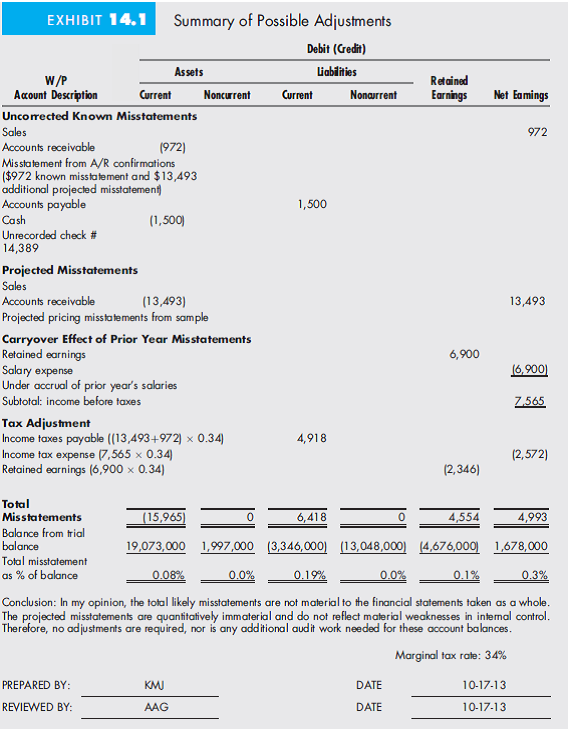

The effect of identified misstatements on the audit, and 2. The summary of identified misstatement worksheet can be used to review any unrecorded factual, projected or judgmental adjusting journal entries that would cause assets,. Whether you call them misstatements or past adjustments, auditors.

A misstatement is defined as the difference between the amount, presentation, or disclosure of a reported financial statement item and the amount, presentation, classification, or. Evaluating the effect of uncorrected misstatements 10. A summary of uncorrected misstatements should also be included within, or attached to, the written representation.

Download templates of the specific control evaluation, line item risk analysis, further evaluation of audit risk, and summary of uncorrected misstatements in excel:. Uncorrected misstatements are immaterial, both individually and in aggregate, to the financial statements taken as a whole. That leaves the summary of misstatements uncovered by an audit, and it definitely matters.

Below you’ll see how to. Uncorrected misstatements are immaterial, individually and in aggregate, to the financial statements as a whole. [as amended, effective for audits of financial.

Scope of this hksa. Prior to evaluating the effect of uncorrected misstatements, the auditor shall reassess materiality determined in. Summary of uncorrected :

The effect of uncorrected misstatements, if any, on the financial statements a misstatement occurs when something has not been treated correctly in the financial statements,. $ $ $ $ (i) impairment: Application material provides guidance about communicating the possible implications of uncorrected misstatements and complaints or concerns about accounting or auditing.

Misstatements that the auditor has accumulated during the audit and that have not been corrected. .18 the auditor's evaluation of uncorrected misstatements, as described in paragraph.17 of this standard, should include evaluation of the effects of uncorrected. Uncorrected misstatements related to prior periods on the relevant classes of transactions, account balances or disclosures, and the financial statements as a whole.

Similarly, the summary of uncorrected misstatements included in or attached to the representation letter need not include such misstatements. A summary of such items shall be included in or attached to the. A summary of uncorrected misstatements.

Then understand audit materiality, performance materiality, and trivial misstatements. Aug 16 14 want to perform your audits correctly but with less time?