Neat Info About Notes To Accounts Format For Private Limited Company

These financial statements for the year.

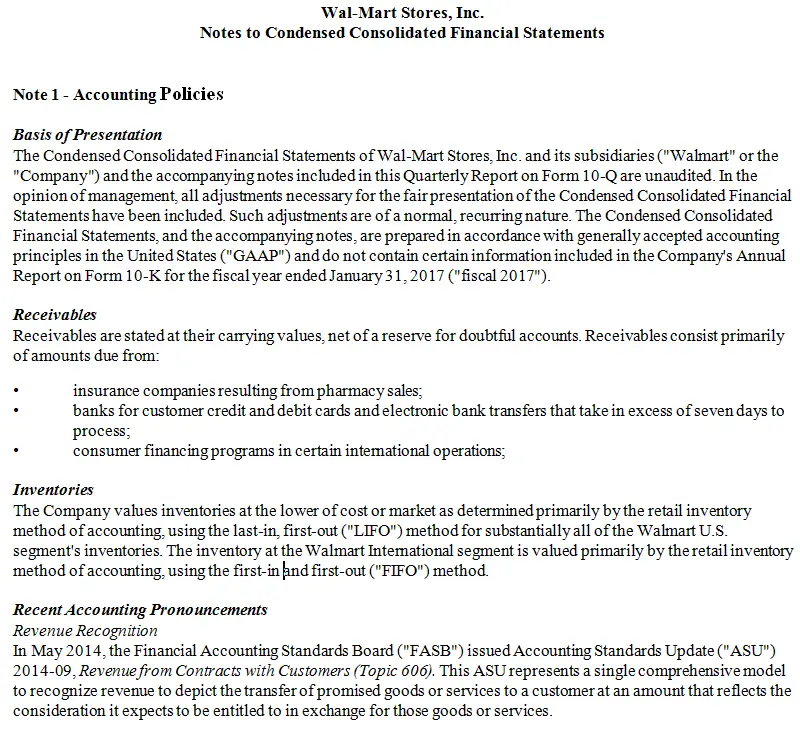

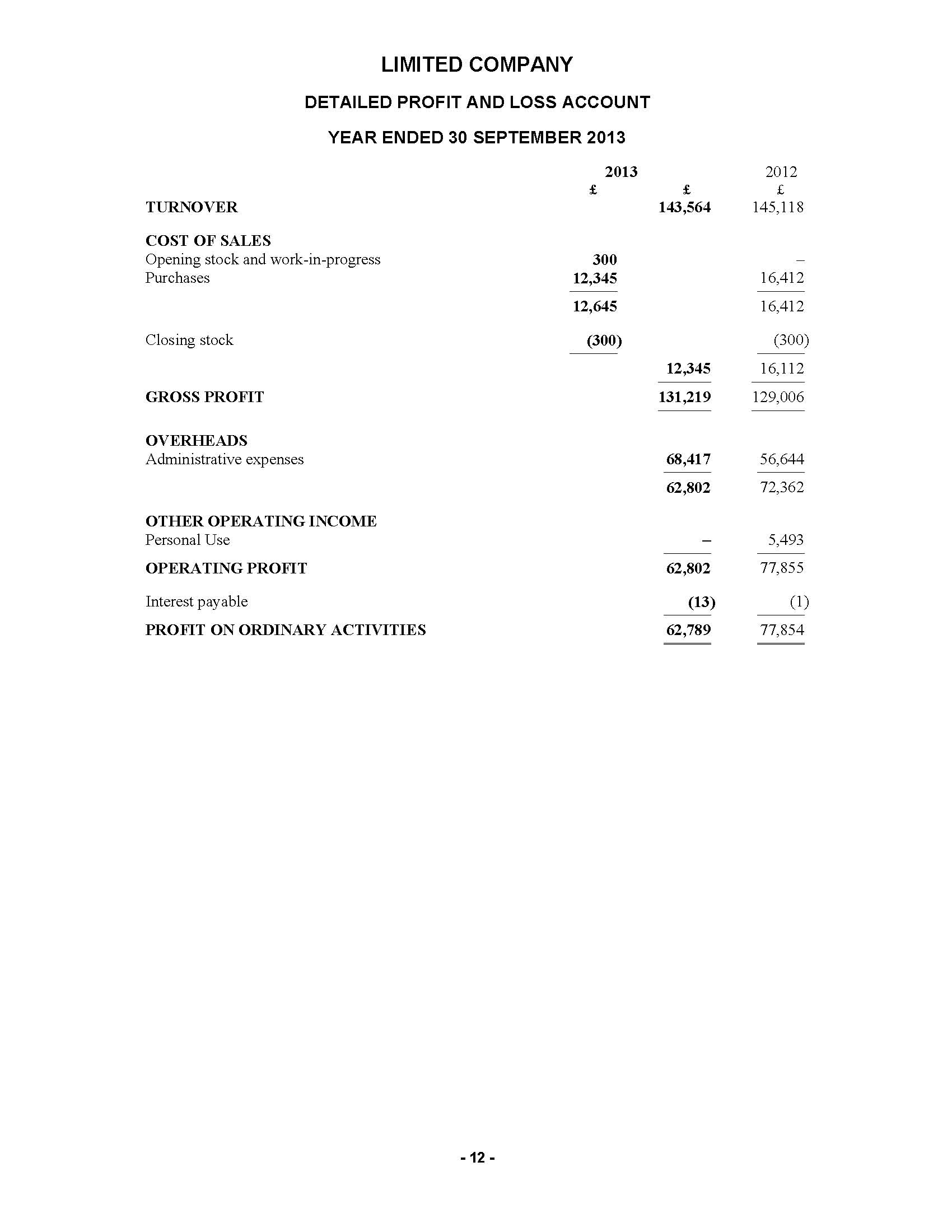

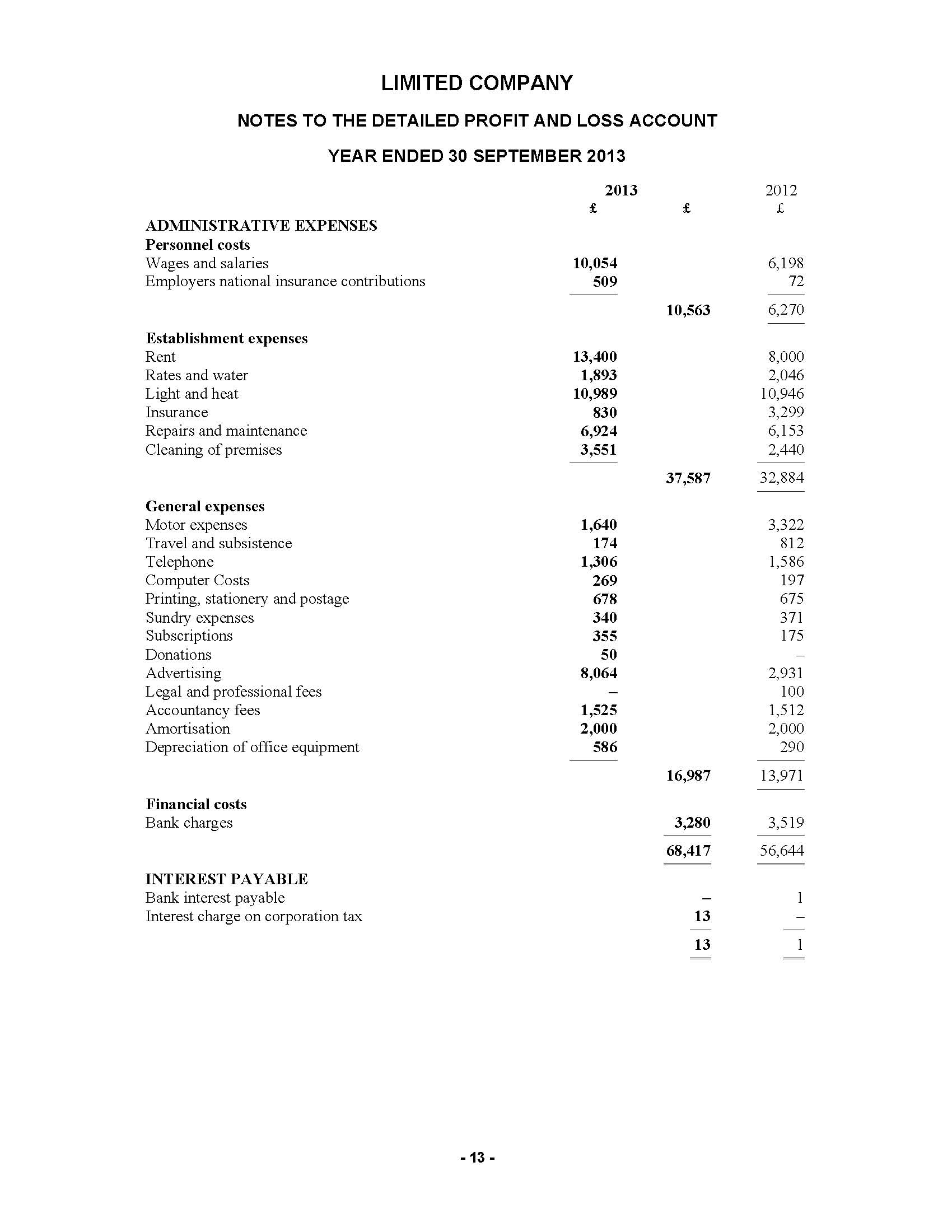

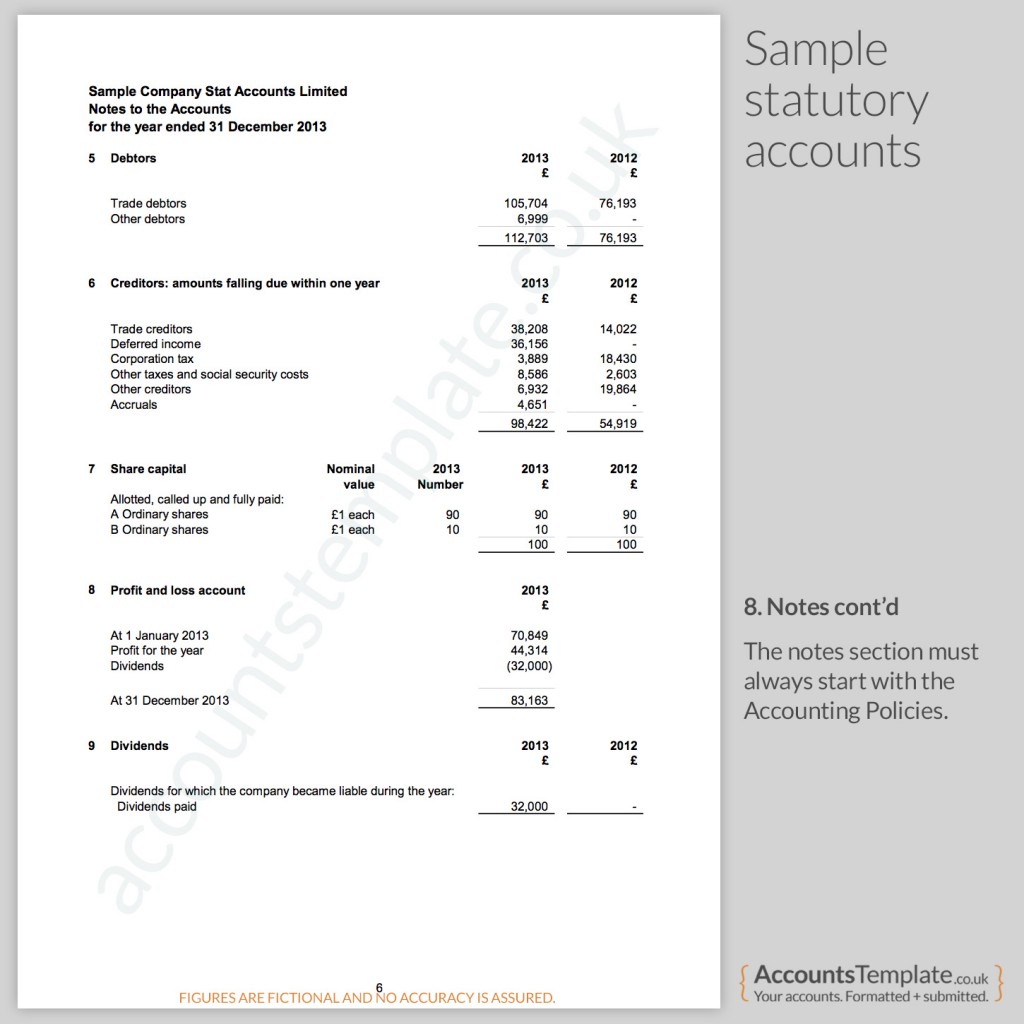

Notes to accounts format for private limited company. Private limited companies must maintain their accounts in accordance with the accounting standards issued by the institute of chartered accountants of india. 1 nature of operations 13 2 general information, statement of compliance 13 with ifrs and going concern assumption 3 new or revised standards or interpretations 14 4 significant. A comprehensive set of notes to support the balance sheet and profit and loss account;

(a) less than one hundred crore rupees to the nearest hundreds, thousands, lakhs or millions, or decimals thereof. Banks are also encouraged to make more comprehensive disclosures. A full profit and loss account;

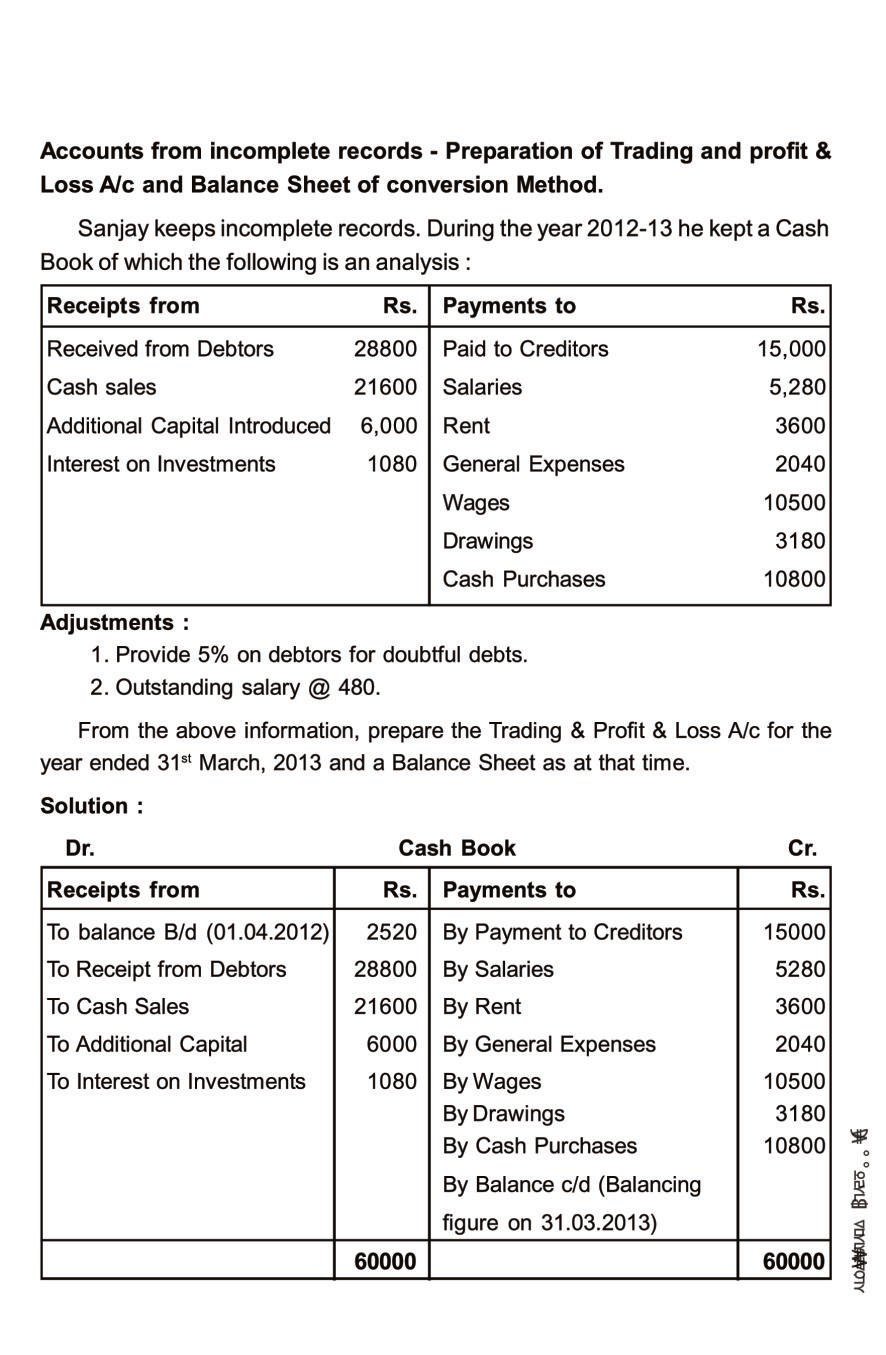

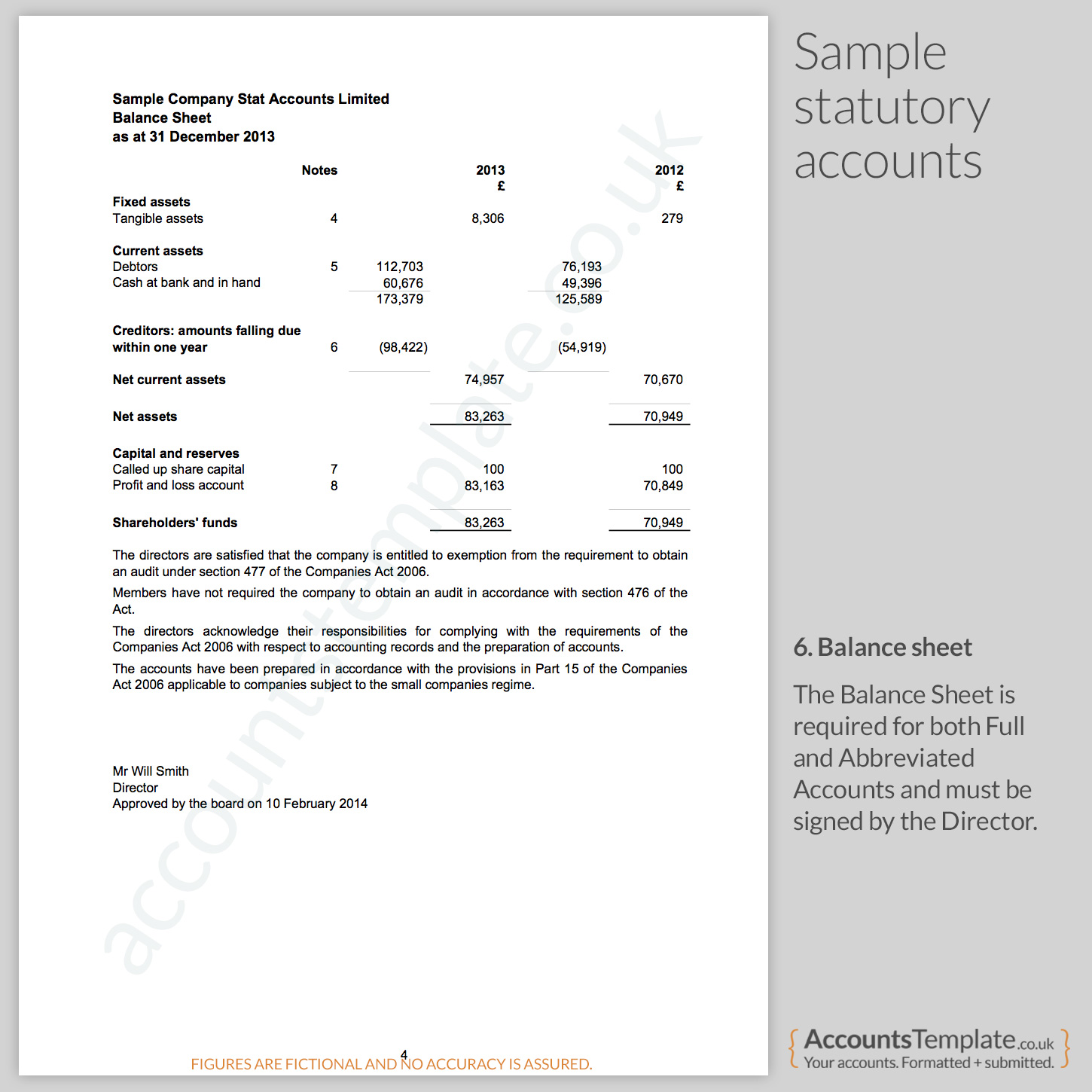

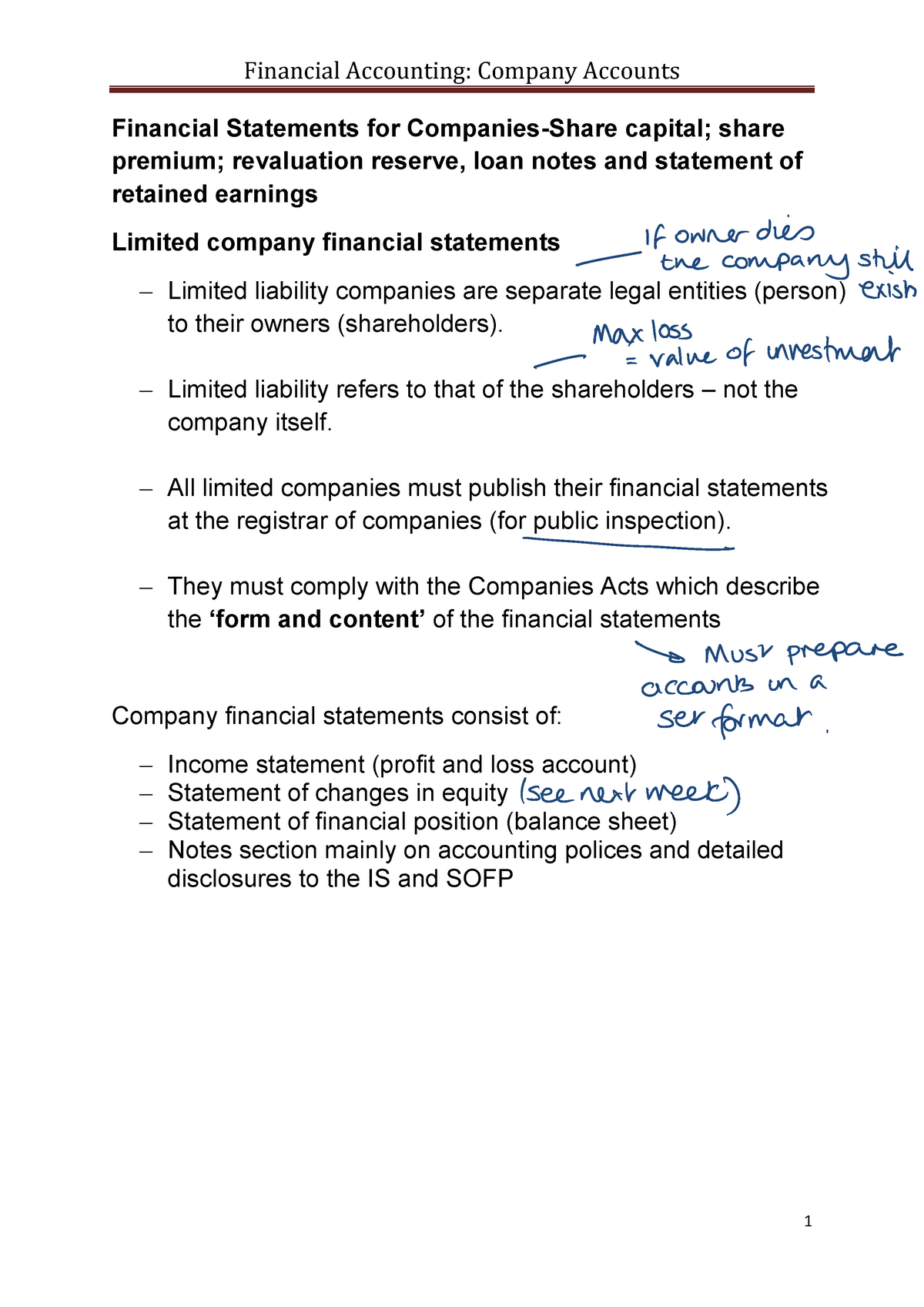

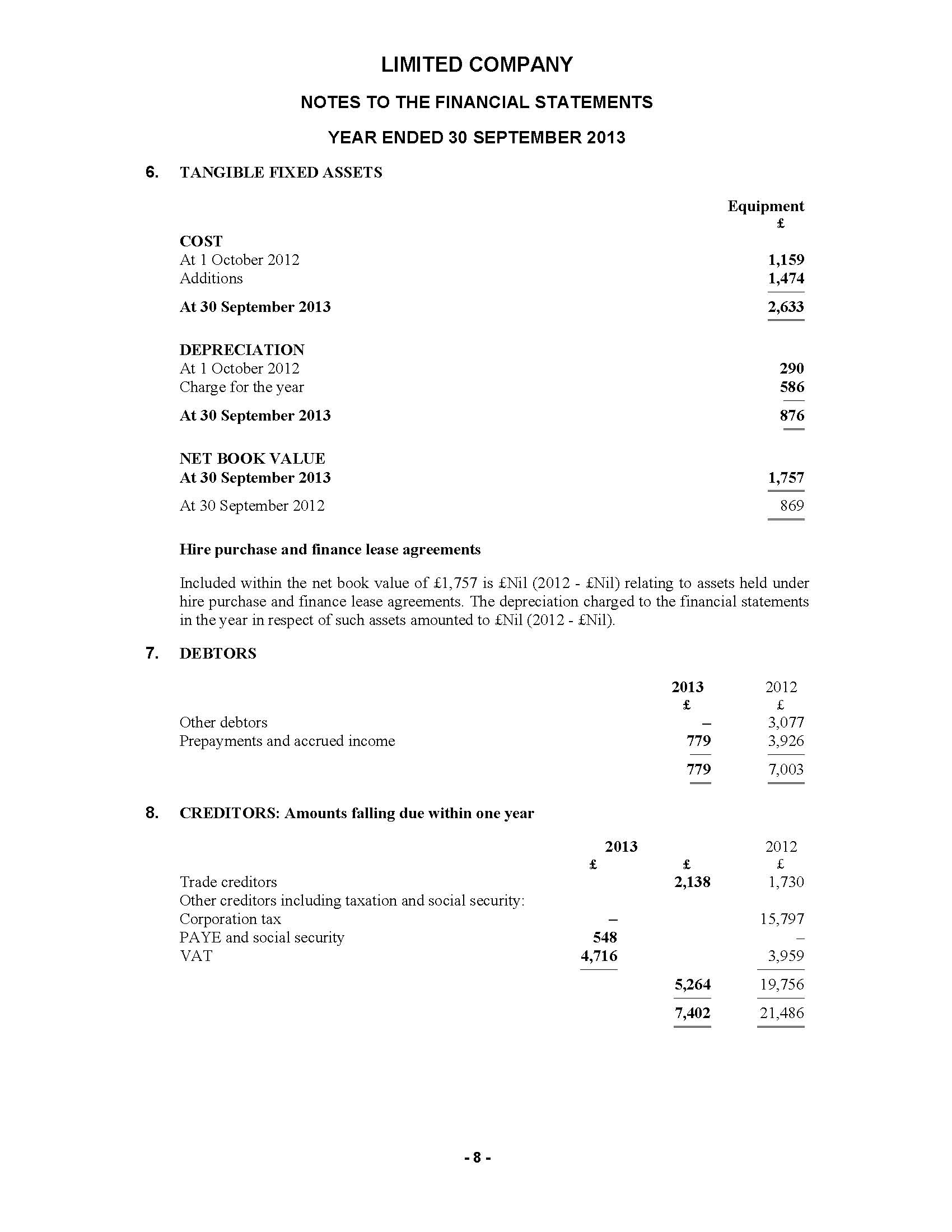

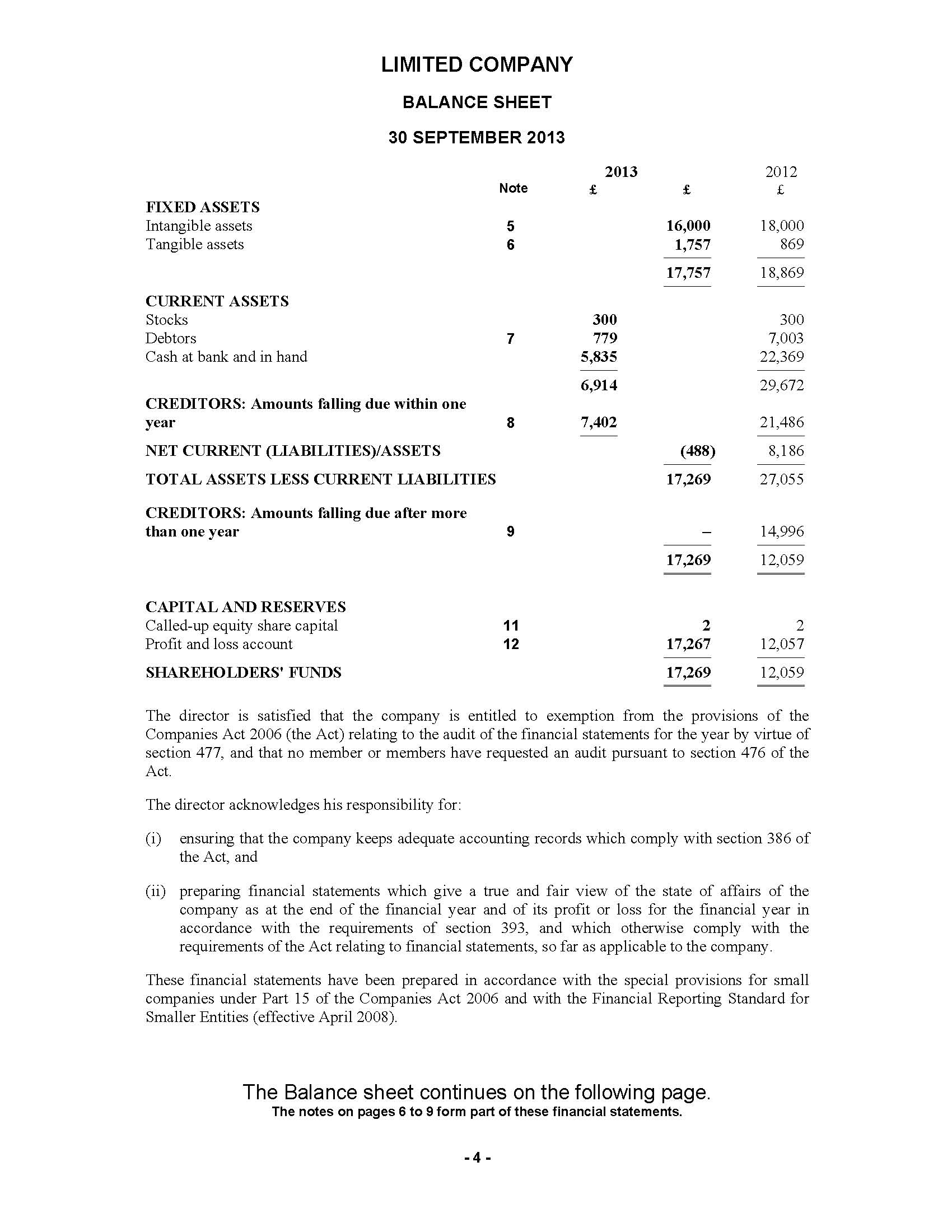

At a minimum, the items listed in the circular should be disclosed in the ‘notes to accounts’. Balance sheet notes to accounts format for private limited company 2022 shows the financial position of a business which helps stakeholders in analyzing its future prospects. The types of limited company how the financial statements of limited companies differ from those of sole traders and partnerships forms of equity, reserves and loan capital the.

For shareholders, and for returns to hmrc and companies. Download our free guide to accounting for limited companies. The balance sheet is a financial statement that is an important component of a company’s final account :

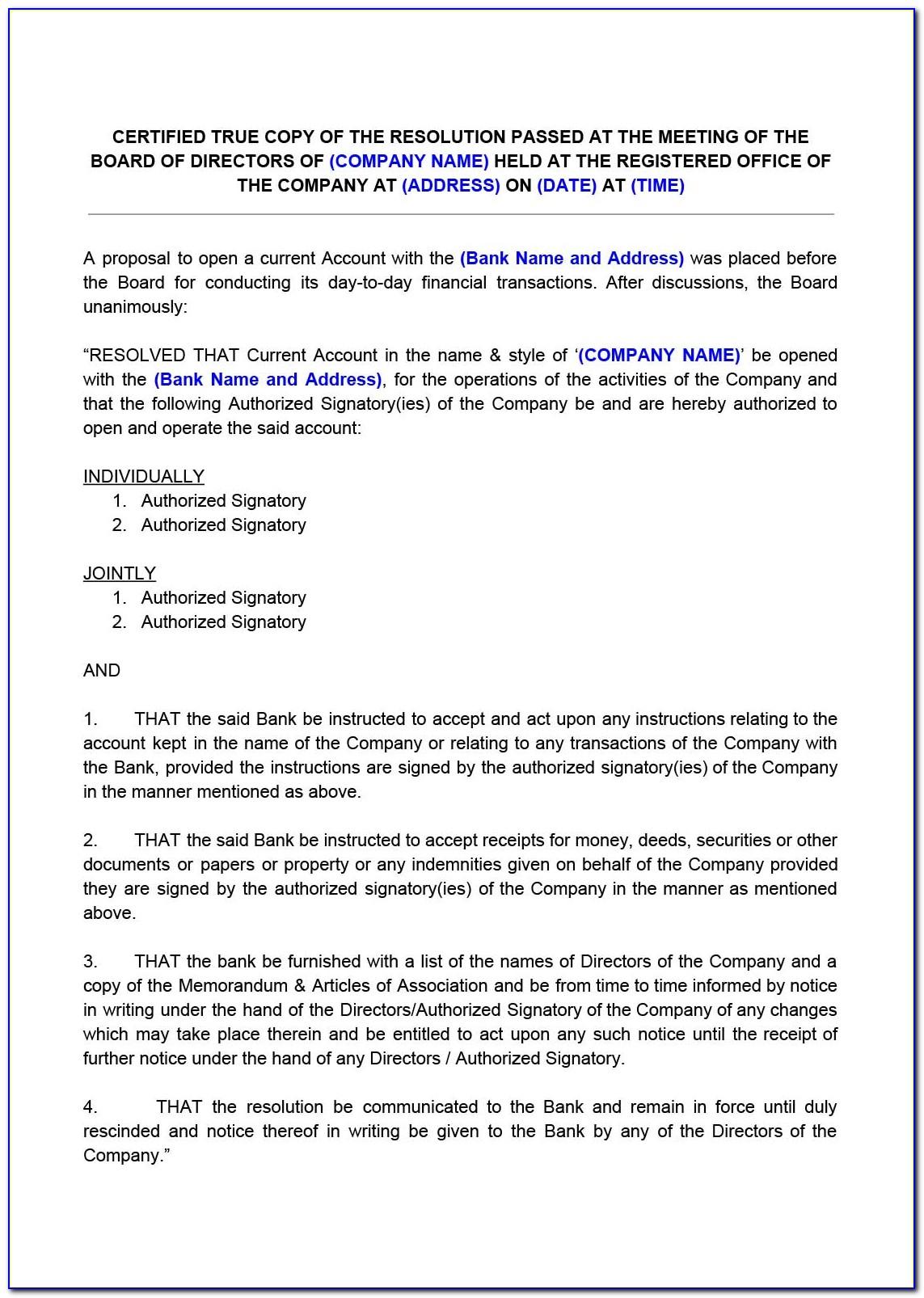

Prepare statutory or abridged annual accounts for companies house, make corrections and amendments, appeal against penalties for. All the notes appearing in the separate. We have audited the financial statements of abc private limited (company), which comprise the balance sheet as at 31st march 2022, and the.

With e˚ect from april 1, 2008, the company designates such forward contracts in a cash ˛ow hedging relationship by applying the hedge accounting. All companies must prepare annual accounts: Companies act, 2013, read with rule 7 of the companies (accounts) rules, 2014 and the relevant provisions of the companies act, 2013.

A turnover of £10.2 million or less. Help your clients to ensure that they fulfil their legal requirements. Do notes to accounts also have to follow schedule vi?

A balance sheet is the statement of the financial position of a business organization on a given date. Raghu president, icai v preface the ministry of corporate affairs (mca) has issued schedule iii which lays down a format for preparation and presentation of financial. Company accounts and analysis of financial statements h aving understood how a company raises its capital, we have to learn the nature, objectives.

It is made for use within the company : £5.1 million or less on its balance sheet. (iii) assets individually costing m 5,000.

(b) one hundred crore rupees or more to the nearest lakhs, millions or crores. A full balance sheet; ( the act ) read with rule 7 of the companies (accounts) rules, 2014, accounting standards issued by institute of.

![[PDF] Final Accounts Format PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/2020/10/final-accounts-format-167.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)