Ideal Tips About Us Gaap Ifrs

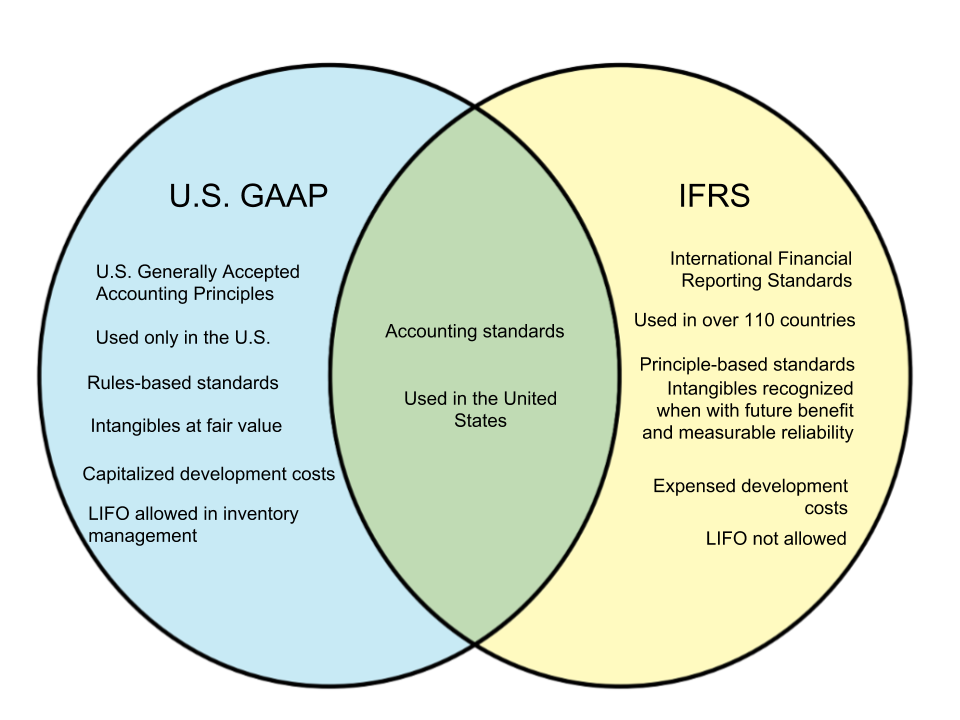

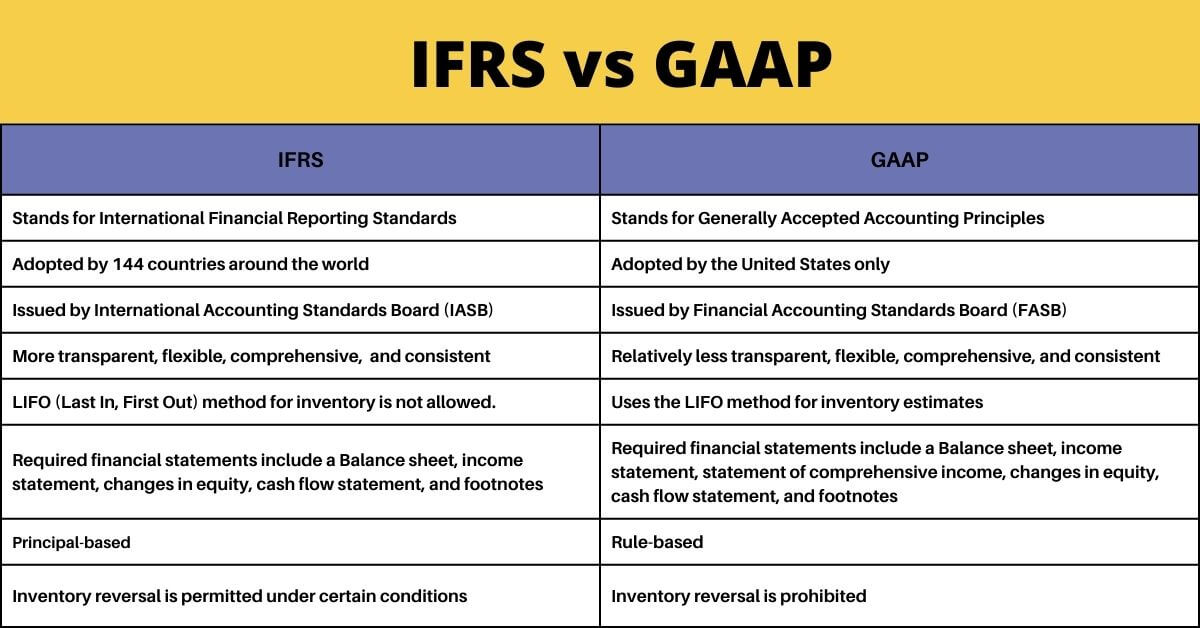

An overview the international financial reporting standards (ifrs), the accounting standard used in more than 144 countries, has some.

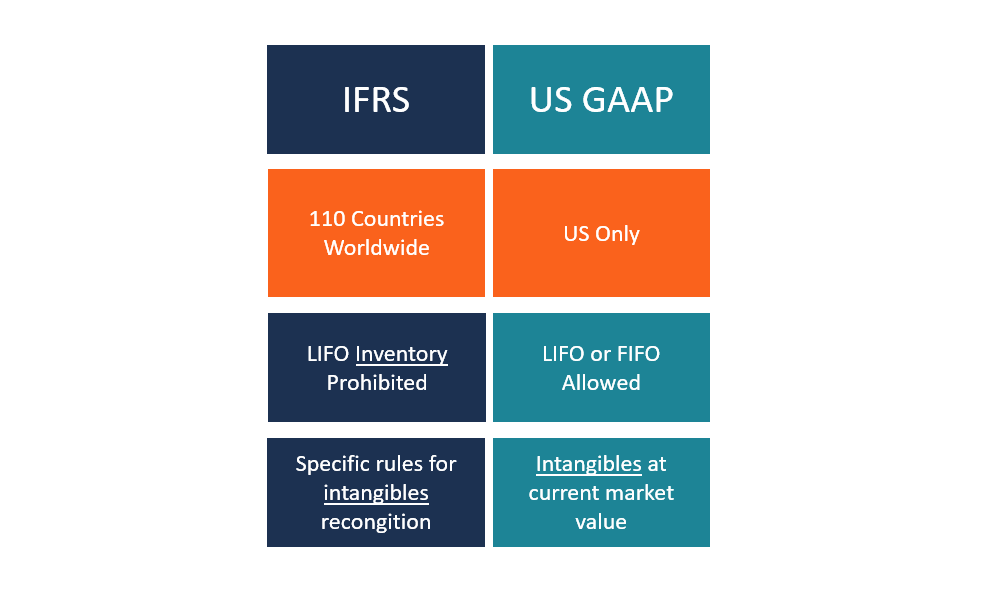

Us gaap ifrs. Gaap stands for generally accepted accounting principles, and it's based in the u.s. Ifrs tends to be a globally accepted standard for accounting, with usage in more than 110 countries, whereas us gaap. However, other nuances are emerging.

A pdf version of this publication is attached here: Us ifrs & us gaap guide. Compare actual financial statements in which results were reported under both ifrs and u.s.

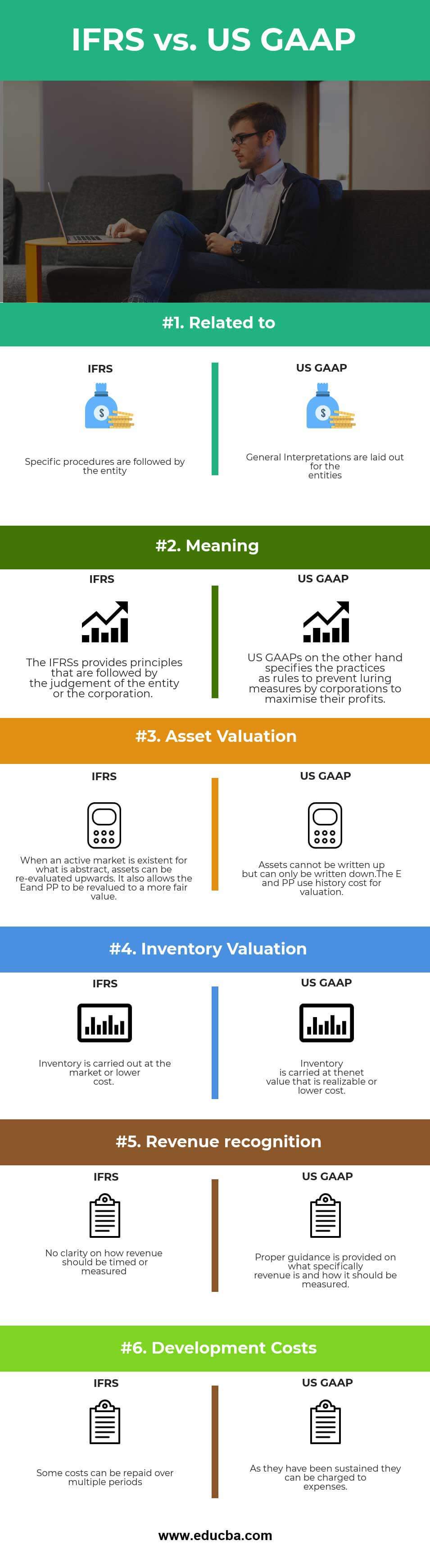

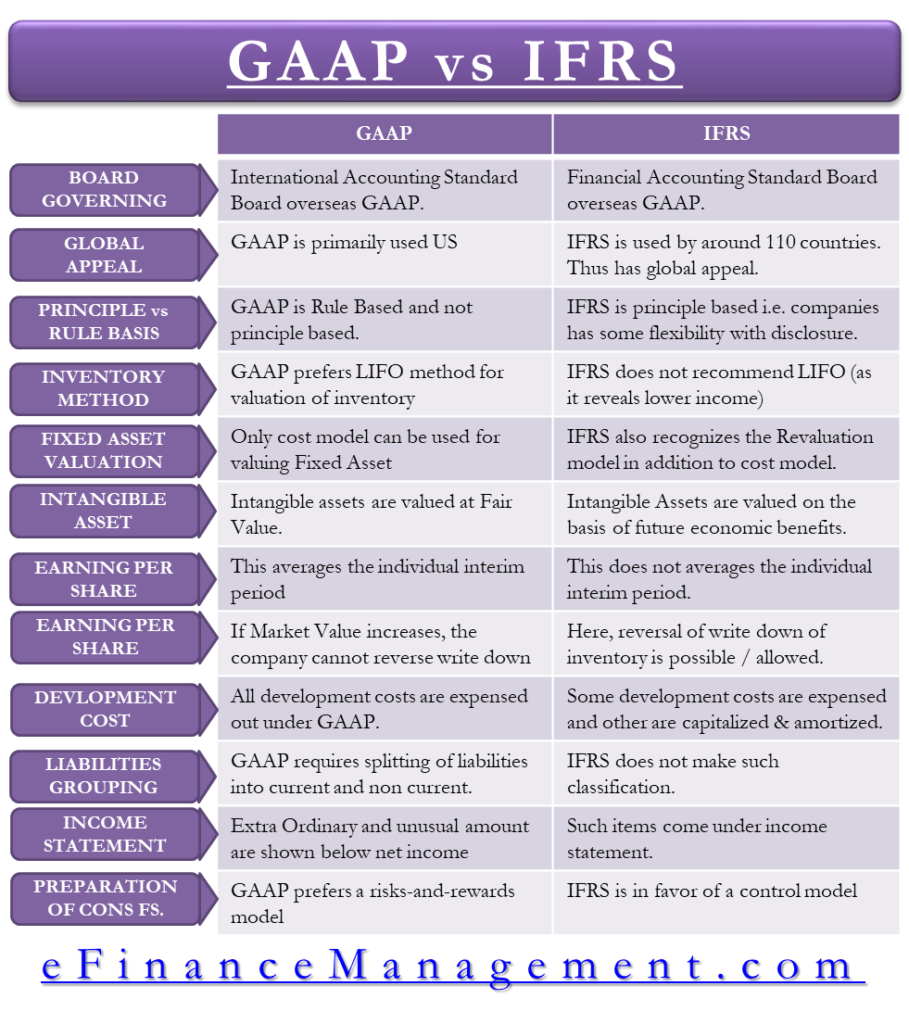

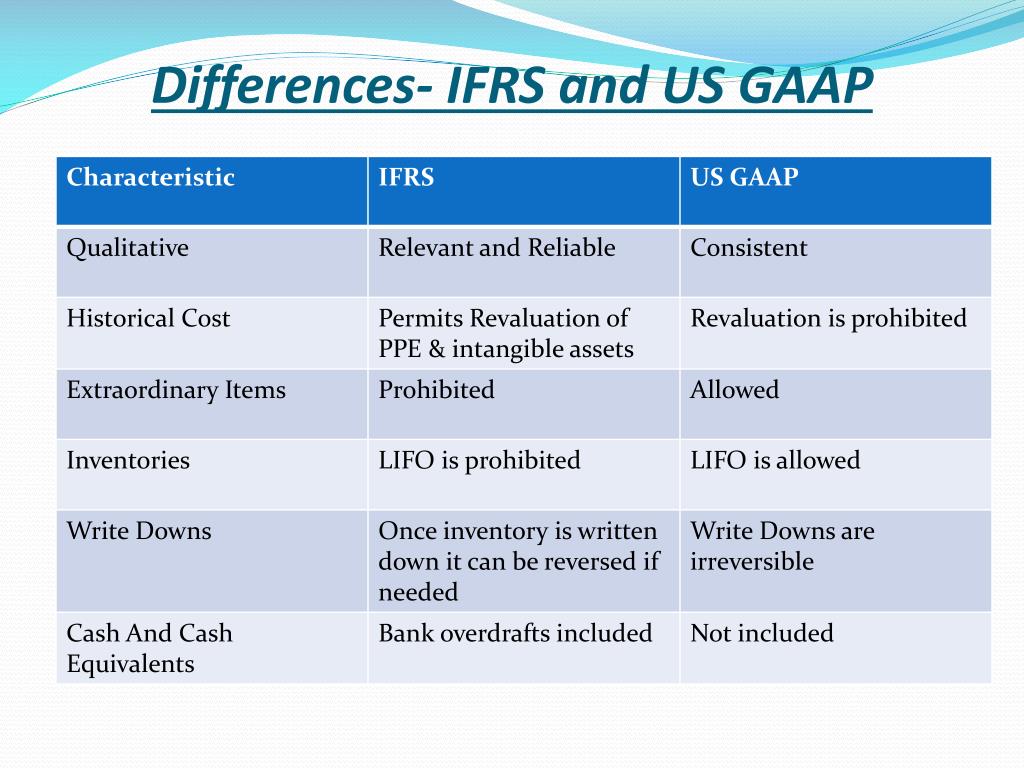

The key differences between gaap vs. About the ifrs and us gaap: One of the key differences between these two accounting standards is the accounting method.

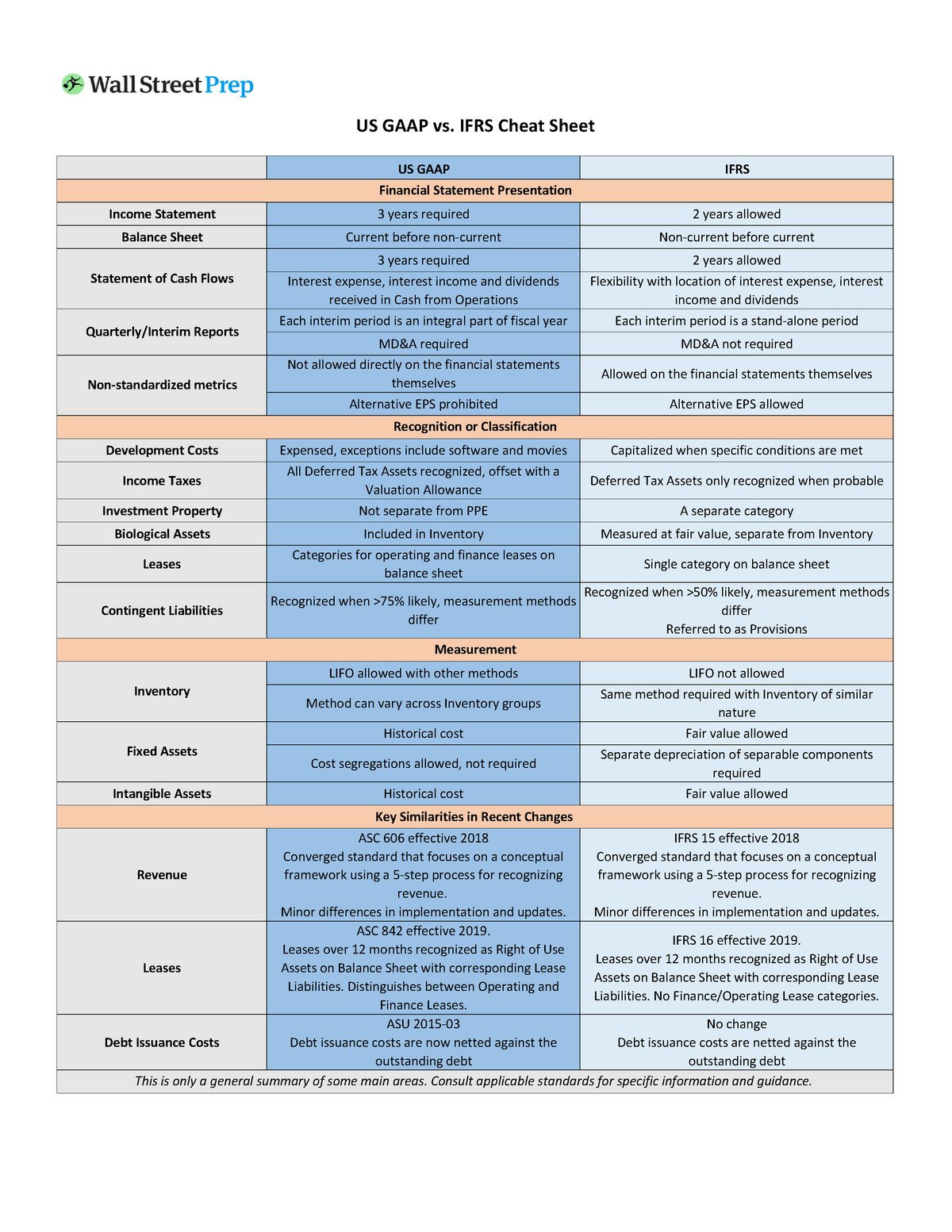

Ifrs is a set of international accounting standards, which state how particular. We are pleased to publish this 2023 edition of our comparison of ifrs accounting standards and us gaap, highlighting the key differences between the two frameworks. At the start of each chapter is a brief summary of the key requirements.

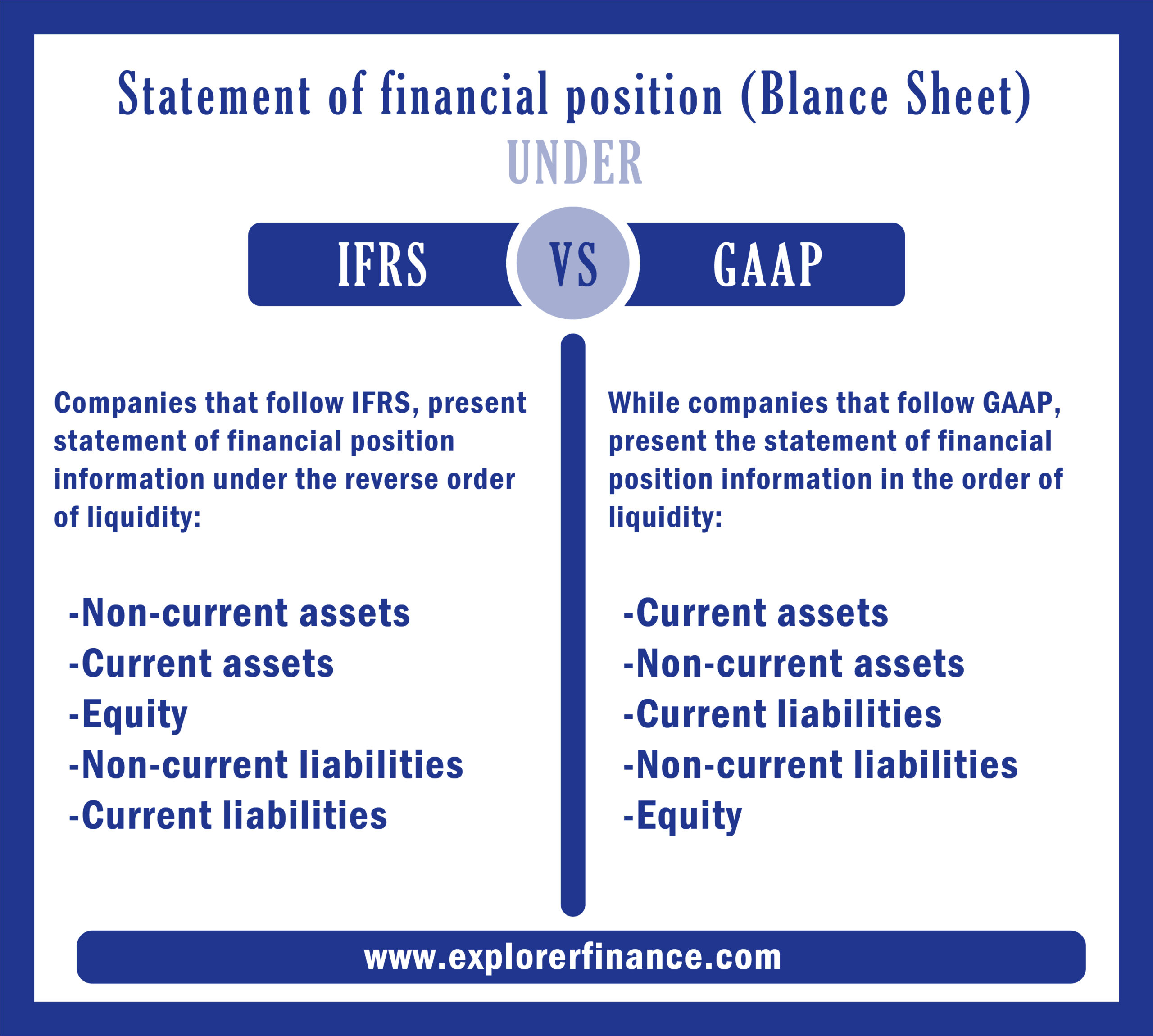

Similarities and differences guide sd 8.11 was updated to include discussion about a difference in the accounting for the impact of a change in tax. There are two global scale frameworks of financial reporting: Classification of a financial instrument as.

For preparers applying ifrs standards and public companies applying us gaap, lease accounting has been business as usual for a few years now under ifrs 16. Under ifrs accounting standards, the primary principle is that cash flows are classified based on the nature of the activity to which they relate. By setting ifrs in a relevant business context, international gaap® 2024 provides insights on how complex practical issues should be resolved in the real world of.

Ifrs & us gaap guide (pdf 3.4mb) pwc is pleased to offer our updated ifrs and us gaap:. This is a good time to. Us gaap, as promulgated by the financial.

Similarities and differences guide pwc is pleased to offer our updated ifrs and us gaap: It also addresses the accounting for income taxes,. There are two global scale frameworks of financial reporting:

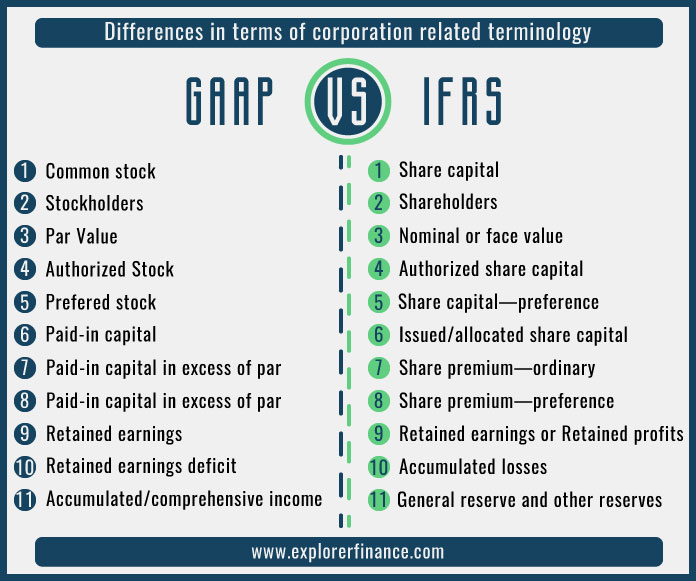

Could create or reduce us gaap and ifrs differences. Gaap and ifrs can be: Key differences between ifrs vs.

The treatment of developing intangible assets through research and development is also different between. Gaap and ifrs ® accounting standards — two of the most widely used accounting standards. Critical differences between ifrs and us gaap.