Awe-Inspiring Examples Of Tips About Owners Equity Definition Accounting

Owner's equity represents the owner's investment in the business minus the owner's draws or withdrawals from the business plus the.

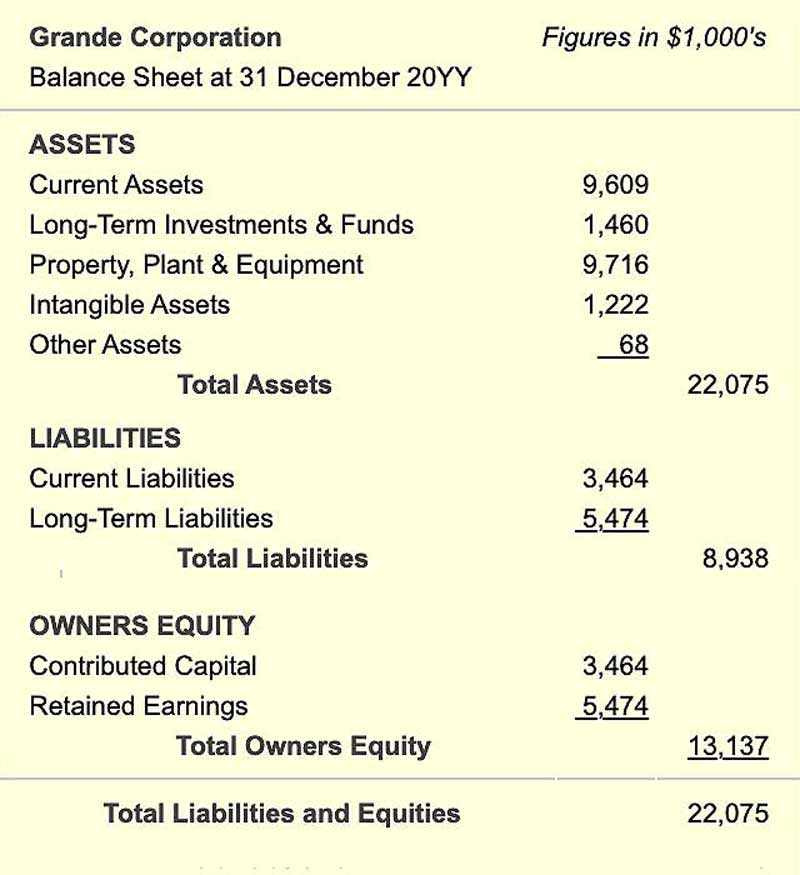

Owners equity definition accounting. Owner’s equity is listed on a. Owner's equity is one of the three main sections of a sole proprietorship's balance sheet and one of the components of the accounting equation: Owner’s equity is listed on a company’s balance sheet.

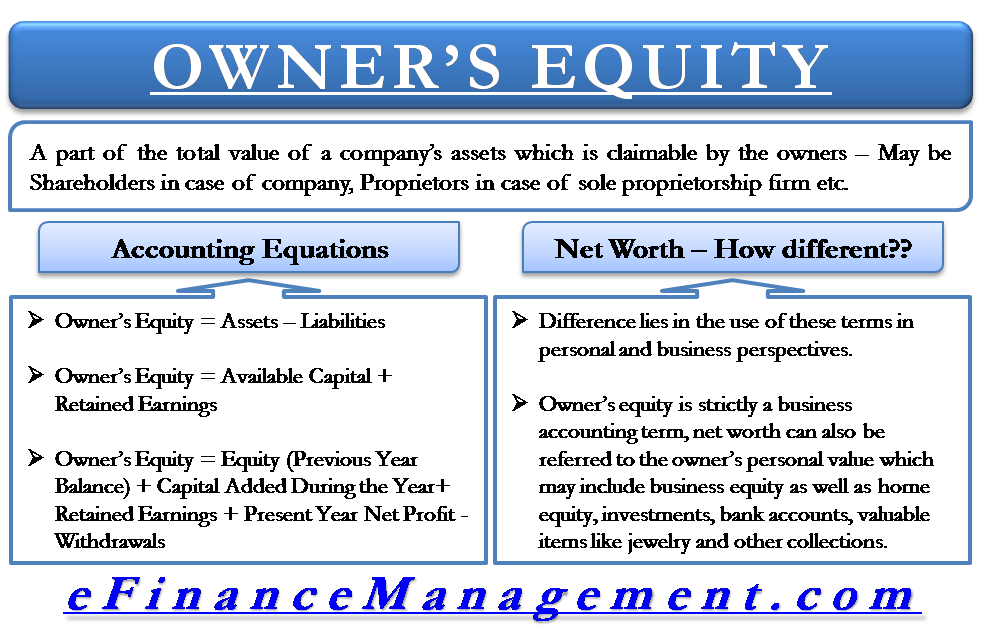

Owner’s equity is defined as the proportion of the total value of a company’s assets that can be claimed by its owners (sole proprietorship or partnership) and by its shareholders (if it is a corporation). Owner’s equity is the portion of a company’s assets that an owner can claim; Definition of owner's equity.

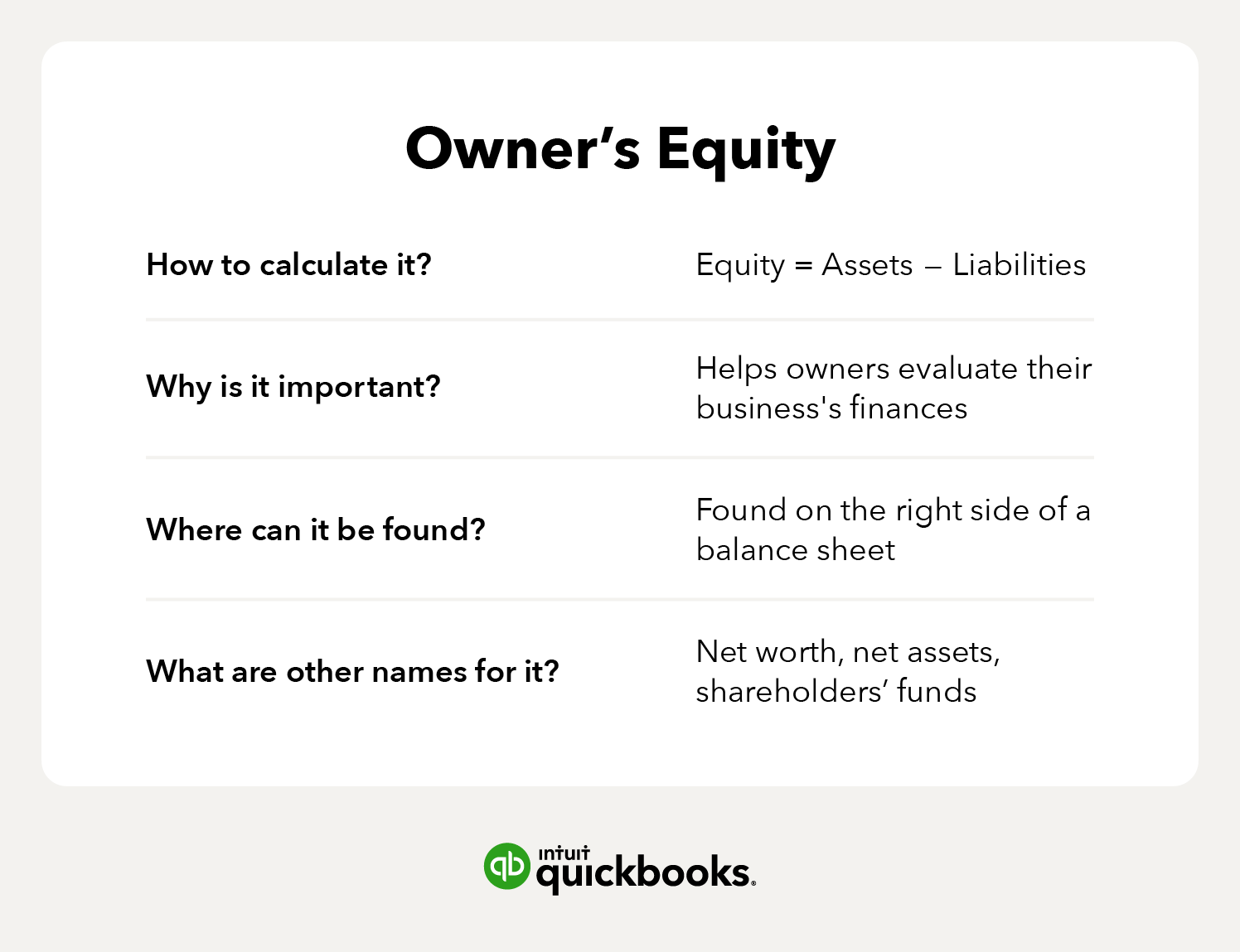

This equity is calculated by subtracting any liabilities a business has from its assets, representing all of the money that would be returned to shareholders if the business’s assets were liquidated. The proportion of the total value of assets of the company, which can be claimed by the owners (in case of a partnership or sole proprietorship) or by the shareholders (in case of the corporation), is known as the owner’s equity. For example, if the total assets of a business are worth $50,000 and its liabilities are $20,000, the owner’s equity in that business is $30,000, which is the difference between the two amounts.

Owner’s equity is what is left over when you subtract your business’s liabilities from its assets. Owner’s equity can be further broken down into four components: For llcs or corporations, the term used is shareholder’s or stockholder’s equity.

The term is typically used for sole proprietorships. In other words, if the business assets were liquidated to pay off creditors, the excess money left over would be. This represents the dollar value of resources.

It is generally considered to be the total assets of an entity, minus its total liabilities. Owners’ equity is the capital theoretically available for distribution to the owner of a sole proprietorship. It’s what’s left after subtracting a company’s liabilities from its assets.

Owner’s equity, often called net assets, is the owners’ claim to company assets after all of the liabilities have been paid off. What is owner’s equity? Assets = liabilities + owner's equity.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/_equity_final-a71099b17173432f813b15202e64459d.png)

:max_bytes(150000):strip_icc()/equityaccounting_definition_final_0929-d661a957ff764ef098318df380dede24.jpg)

:max_bytes(150000):strip_icc()/ShareholderEquitySE_V1-def750af6b7d42b78c60369d49f6e68f.jpg)