Fabulous Tips About Main Purpose Of Cash Flow Statement

One purpose of the statement of cash flows is that users of the financial statements can see the amount of cash inflows and outflows during a year in addition to the amount of revenue and expense shown on the income statement.

Main purpose of cash flow statement. How to read & understand a cash flow statement To check the organization’s liquidity: According to the online course financial accounting:

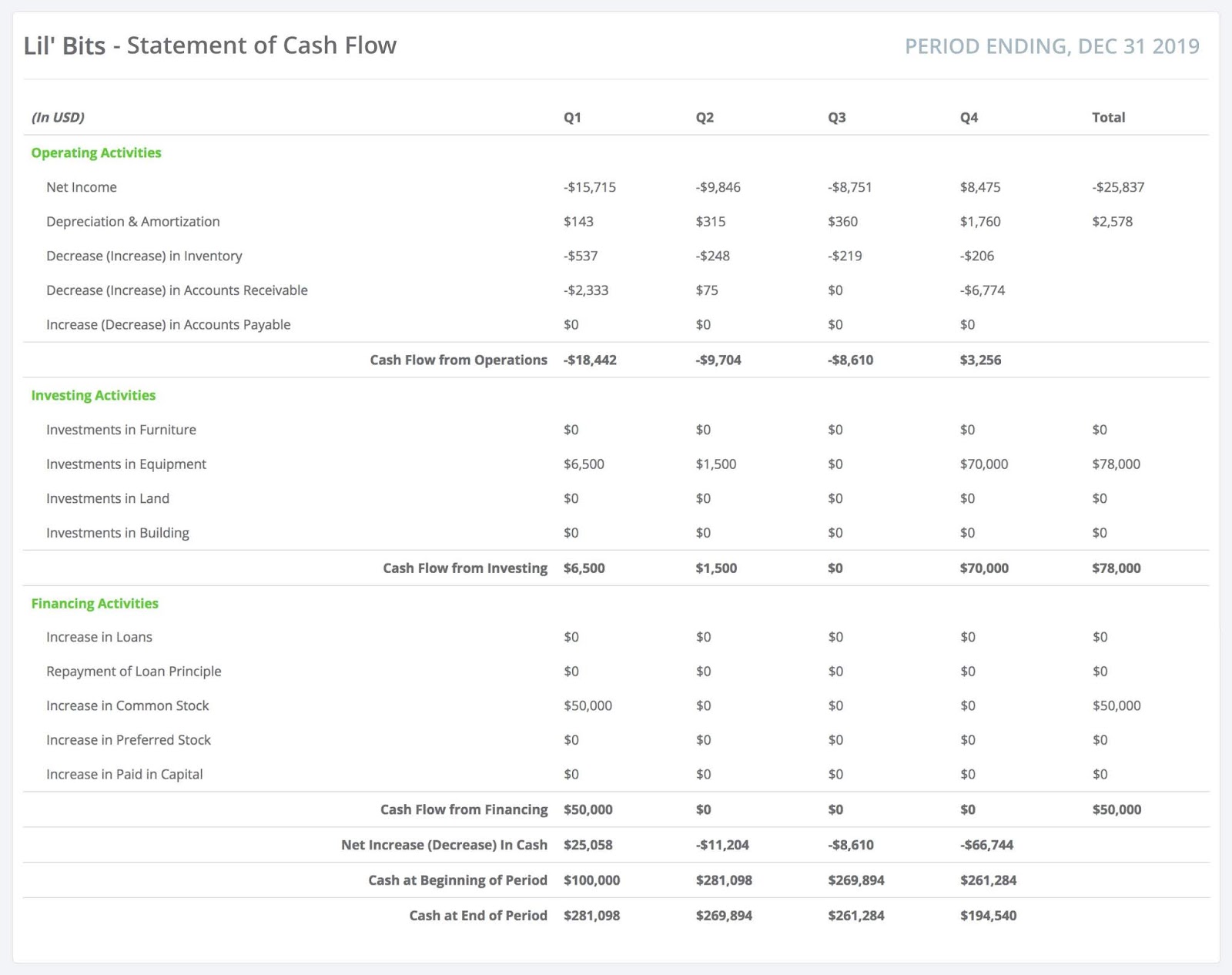

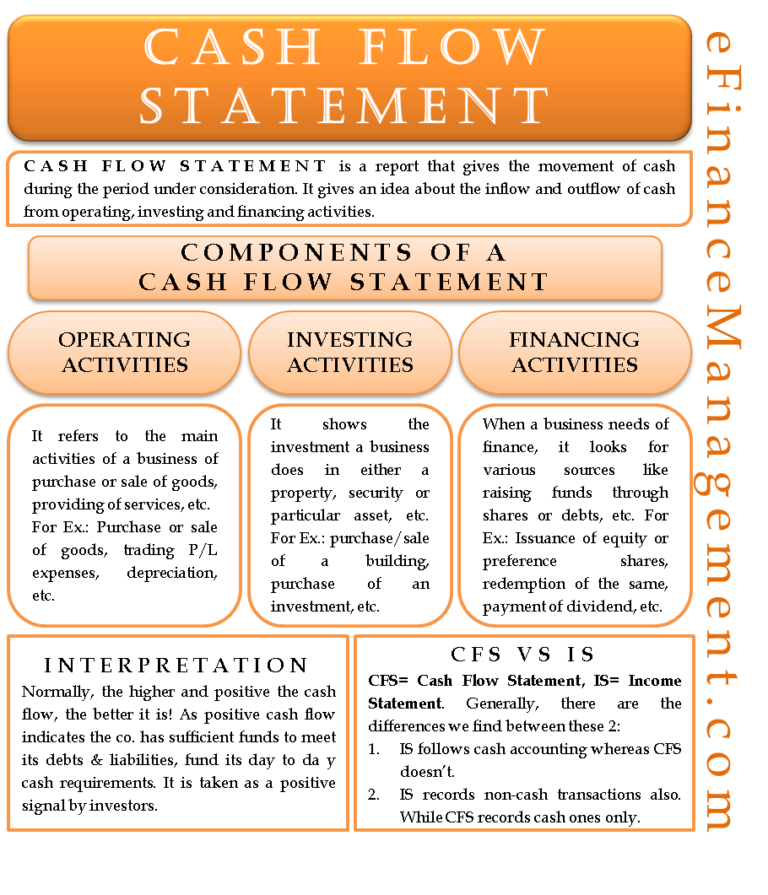

In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. Cash flow statements split your inflow and outflow of cash into three main categories:

The purpose of the statement of cash flows is to present cash inflows and outflows for a reporting period to the reader of the report. Explain the purpose of the statement of cash flow. A statement of cash flows classify cash receipts and payments according to whether they stem from operating, investing, or financing activities and provides definitions of each category.

The main purpose of the statement of cash flows is to report on the cash receipts and cash disbursements of an entity during an accounting period. Cash flow from operating activities cash flow from investing activities cash flow from financing activities cash flow from operating activities means all cash that comes from or goes into your business’s daily operations. The most important purpose of the cash flow statement is to determine the.

A cash flow statement prepare to calculate or determine the organization’s cash. This helps in critical periods, so they’re prepared when making investments, taking loans, repaying debts and even reducing the workforce if it’s affecting the business. The following are the purposes of cash flow statements:

A cash flow statement tells you how much cash is entering and leaving your business in a given period. This is important because cash flows often differ significantly from accrual basis net income.

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. The main purpose of the statement of cash flows is to report on the cash receipts and cash disbursements of an entity during an accounting period.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. A cash flow statement is the most important part of analyzing cash flows related to financing, operations, investments and profits. The main purpose of cash flow is to give business owners clarity on the movement of money in their company.

Essentially, the cash flow statement is concerned with the. The fasb statement encourages enterprises to report cash flows from operating activities directly by showing major classes of operating cash receipts and. It helps identify the availability of liquid funds with the organization in a particular accounting period.

Cash receipts and cash payments are summarized and categorized as operating, investing, or financing activities. The cash flow statement or statement of cash flows or scf identifies a company's major cash inflows and outflows that occurred the same period of time as the company's income statement and between the period's beginning and ending balance sheets. It can be used for keeping track of incoming and outgoing payments, giving insight into how much money is left after major transactions, and indicating potential sources for investment.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)