Who Else Wants Info About Trial Balance Debit And Credit Accounts Sheet Extract Format

Trial balance format nb1:

Trial balance debit and credit accounts balance sheet extract format. It is a statement prepared at a certain period to check the arithmetic accuracy of the accounts (i.e.,. How to make trial balance format debit and. A trial balance is a list of the balances of all of a business's general ledger accounts.

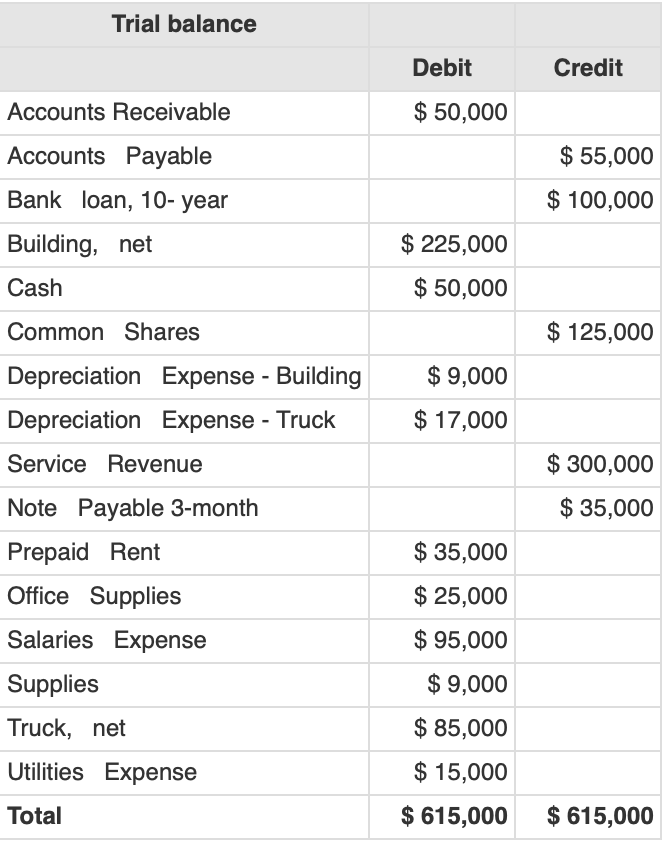

68 share save 2.1k views 10 months ago #trialbalance #excel #283 trial balance format debit and credit list. It is a statement of debit and credit balances that are extracted from ledger accounts on a specific date. As per the accounting cycle, preparing a trial balance is the next step after posting and balancing ledger accounts.

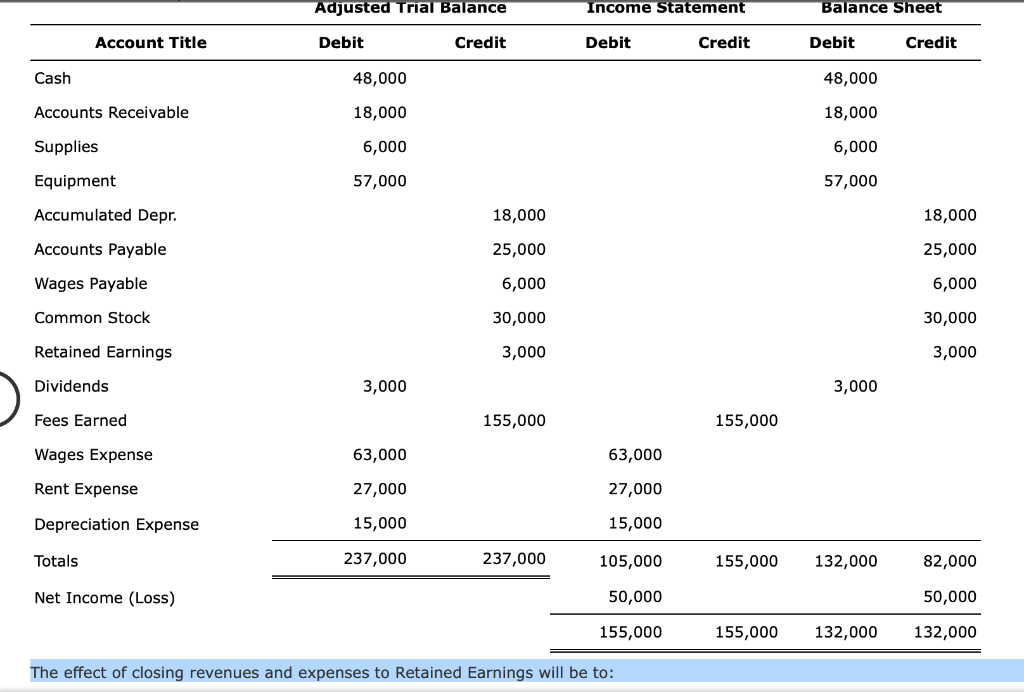

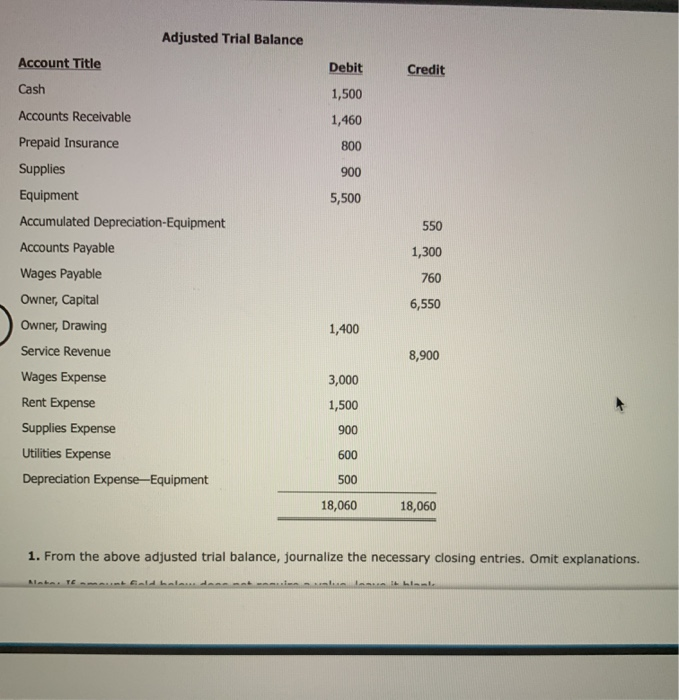

Identify which financial statement each account will. If the total of all debit values equals the total of all credit. What is a trial balance?

Your turn magnificent adjusted trial balance go over the adjusted trial balance for magnificent landscaping service. The term trial balance refers to the total of all the general ledger balances. Sep 26th, 2023 | 26 min read contents [ show] ever thought about what will happen if we do not segregate our financial transactions into debit and credit amounts?.

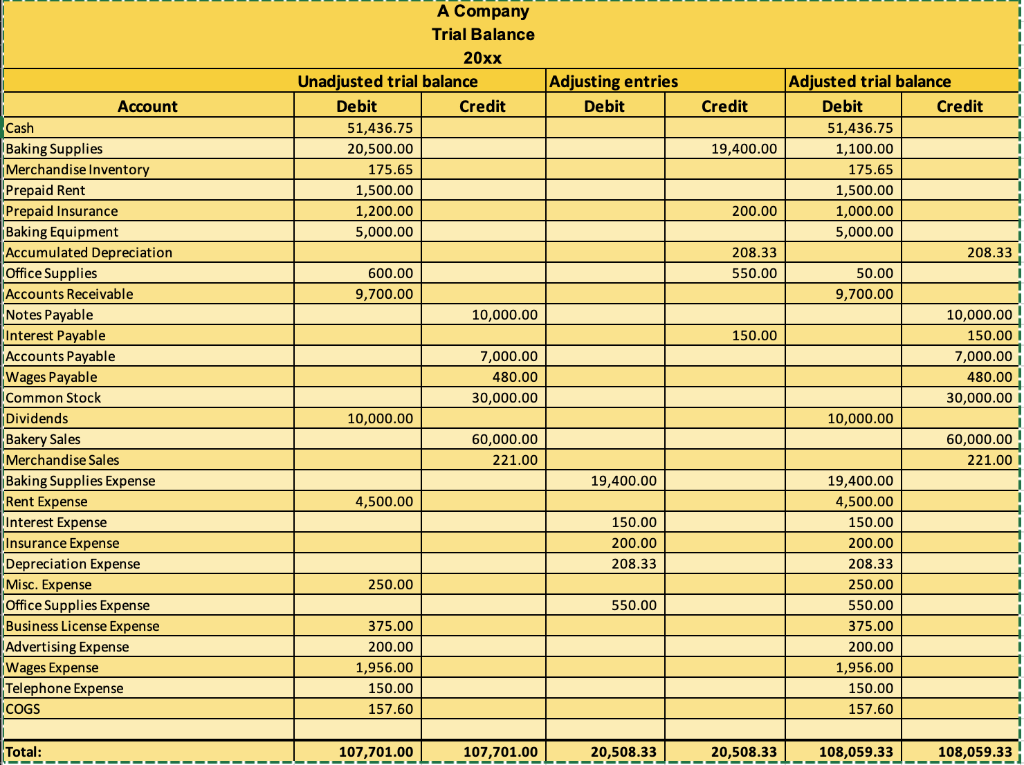

Opening inventory is part of the trial balance components and it is recorded on the debit side. First, we have created a cash book with payments and. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other.

In this excel tutorial, you will learn how to make a trial balance format in excel with debit and credit. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from. It consolidates each account's credit and debit balances to determine the overall credit and debit balances.

The difference between total debit entries and total credit entries of every ledger account must be balanced. It is a statement of debit and credit balances that are extracted on a. The trial balance is an accounting report or worksheet, mostly for internal use, listing each of the accounts from the general ledger together with their closing balances (debit.

The purpose of preparing a trial balance is to. Closing inventory is indicated as additional. We are looking to create a summary trial balance that has the following columns: