Ace Tips About Errors Revealed By Trial Balance

Errors of principle happen when an accounting principle is not applied.

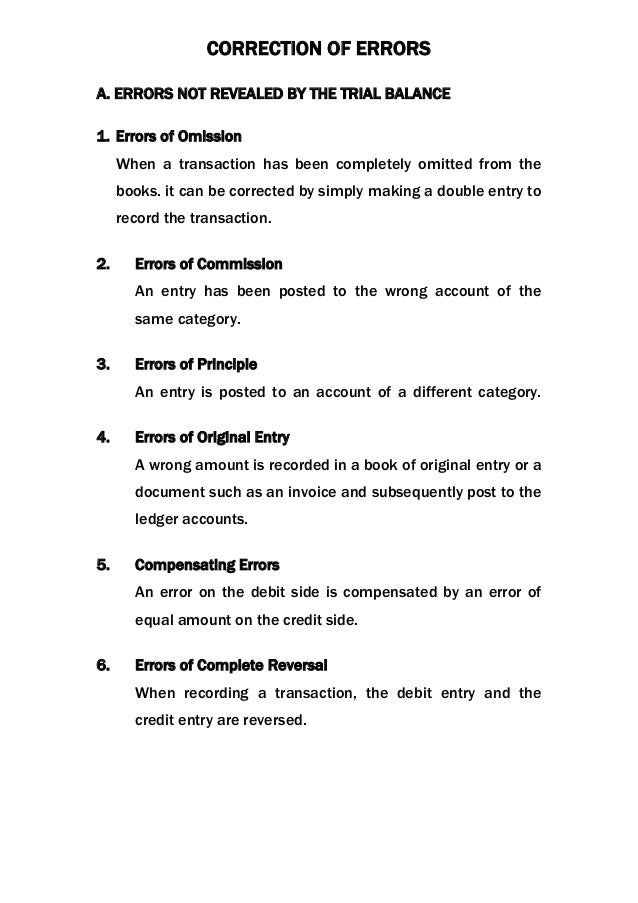

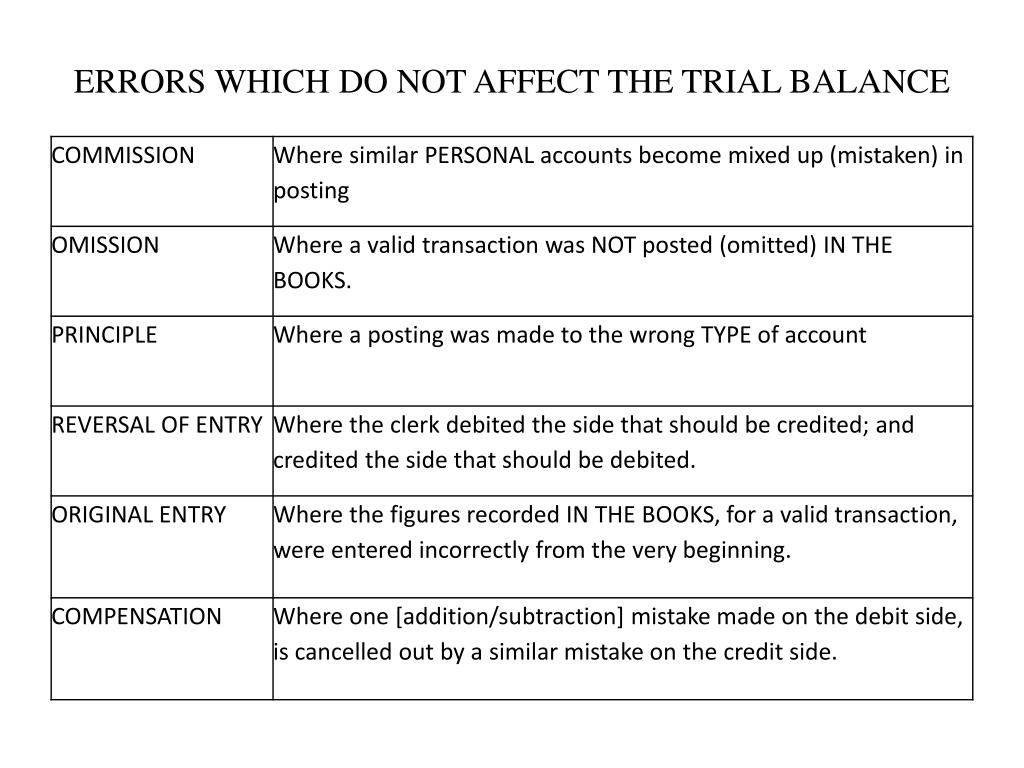

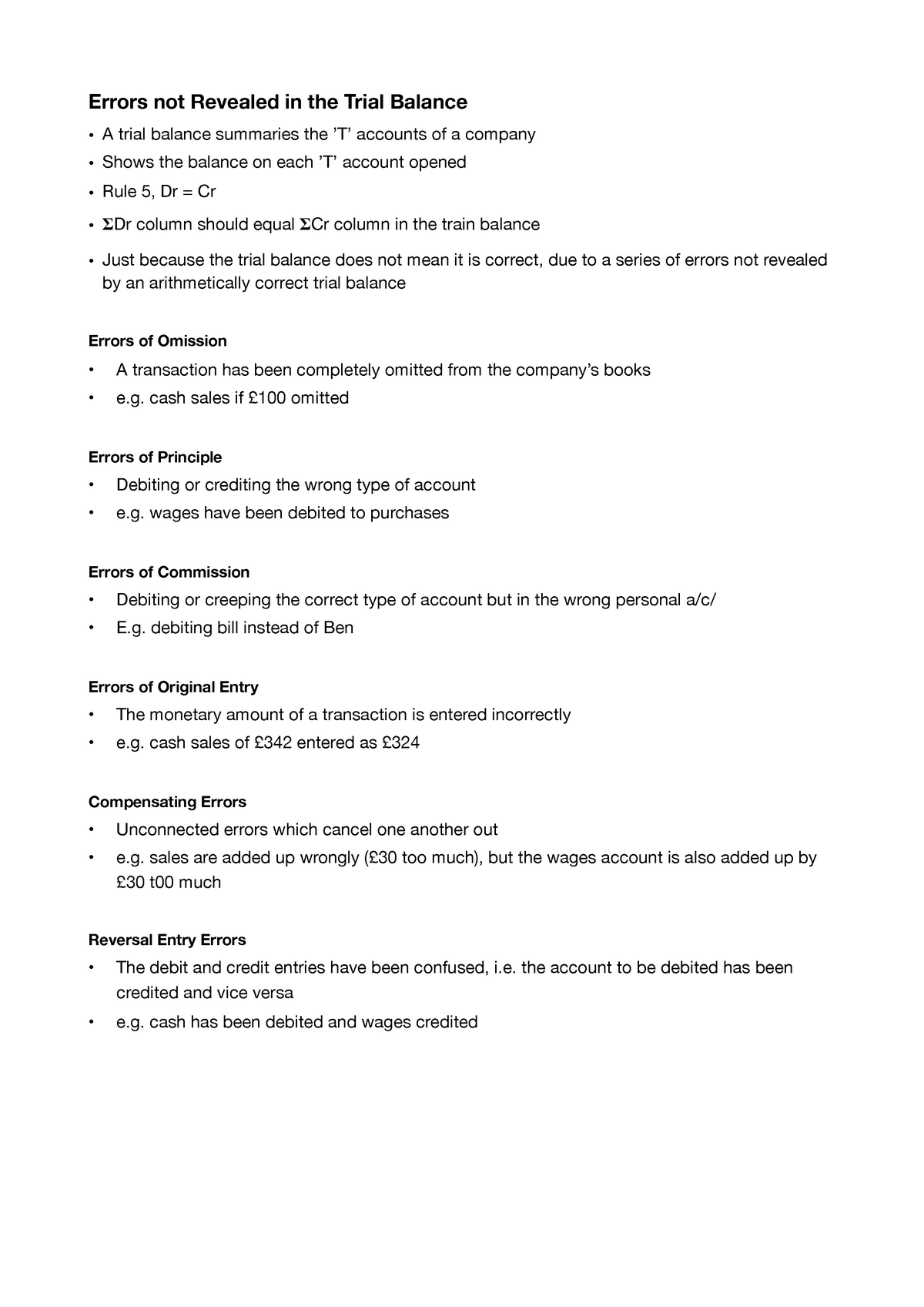

Errors revealed by trial balance. 2 types of limitations of trial balance are clerical errors, and errors of principles. The type of error in the table below will not be revealed by a trial balance (tb): Trial balance errors are errors in the accounting process that cannot be detected by the trial balance sheet.

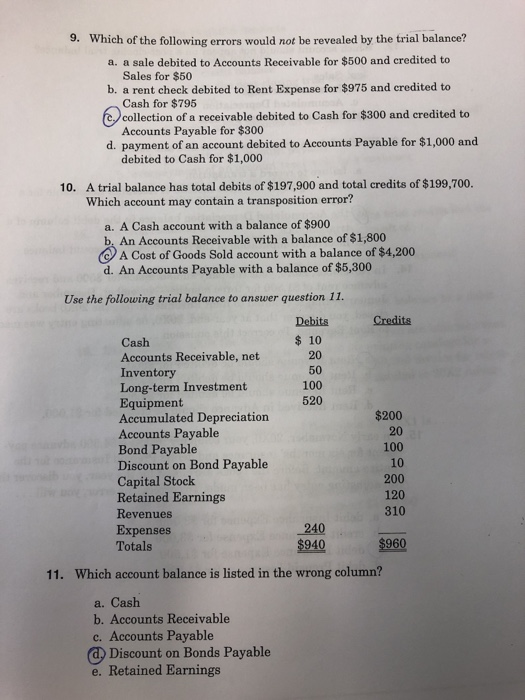

Errors that affect the trial balance usually involve only one account in any transaction. Addition or totaling mistakes in the trial balance, debit, and credit side. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

Note that for this step, we are considering our trial balance to be unadjusted. It serves to find and correct errors before they bring discrepancies in the financial statements, as well as bring out a clear picture of a company’s financial health. Error in the sum total of subsidiary book.

Some more (commonly seen) errors while preparation of the trial balance: These are of clerical nature and mostly affect the trial balance. Entries to the wrong account.

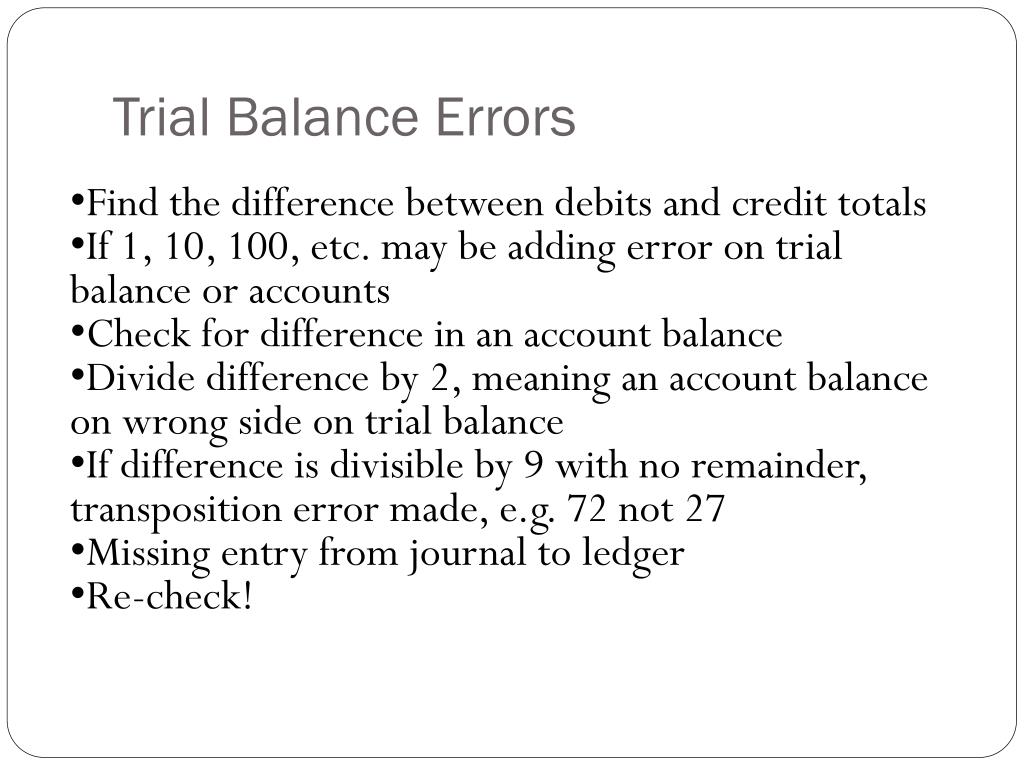

Second, if errors are not located, divide the difference carrying disagreement in the trial balance by 9. Trial balance errors refer to those mistakes hidden in the accounting process that the trial balance sheet cannot identify. Transposition errors and slide errors.

Wrong totaling of subsidiary books. Tally solutions | updated on: Recording a transaction incorrectly in a journal.

This brings the trial balance back to agreement. Posting in the wrong account. Errors not revealed by trial balance.

That account has either one of the following: First, verify the totals of both columns of the trial balance. Errors due to the wrong posting of transactions to the ledger, wrong totaling of accounts, wrong balancing of accounts, the wrong casting of the day books, or wrong recording of the amount in the journal or the day books are errors of commission.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. December 13, 2021 errors affecting trial balance errors not affecting trial balance errors which are not disclosed by trial balance procedure to locate errors in a trial balance the objective of preparing trial balance is to a counter check process to test the accuracy of posting. An entry made to the wrong account may be apparent with a quick glance at the trial balance, since an account that previously had no balance at all now has one.

Clerical errors are made by a human. The errors in a trial balance can be located by taking the following steps. This is due to there is also a type of error that do not reveal in the trial balance.