Smart Info About Wages Payable In Balance Sheet

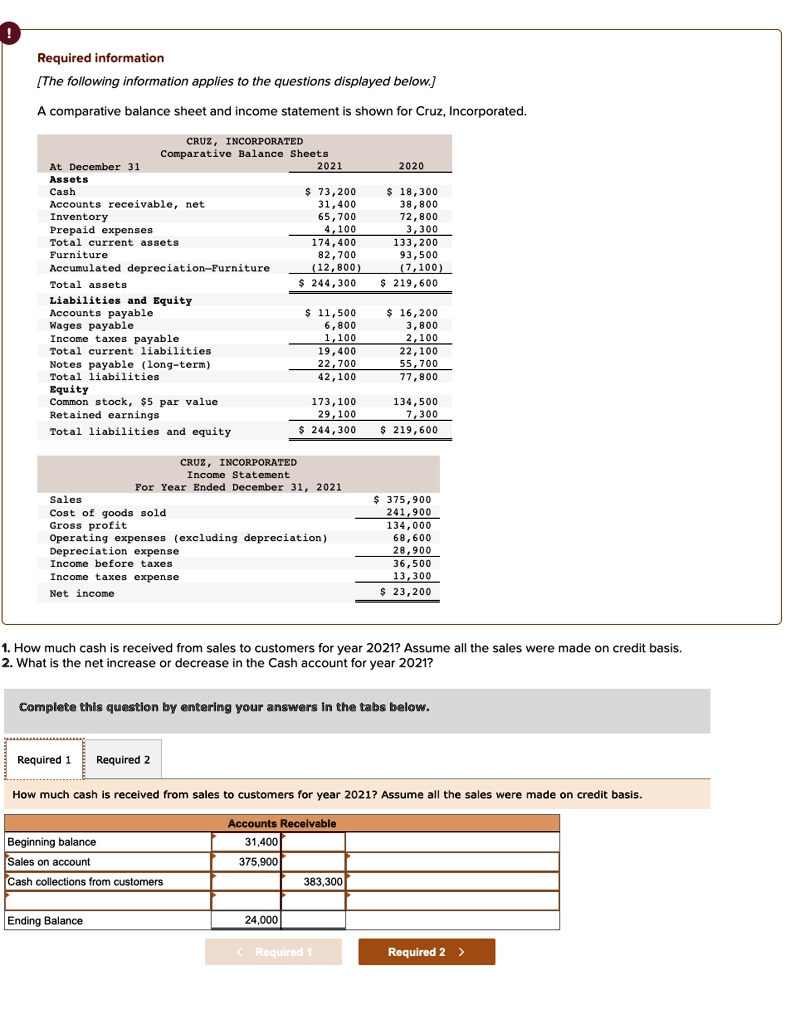

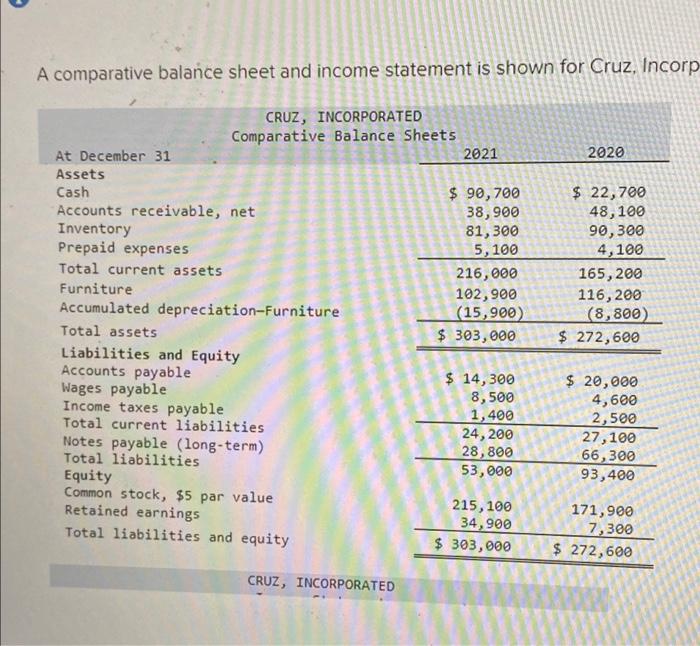

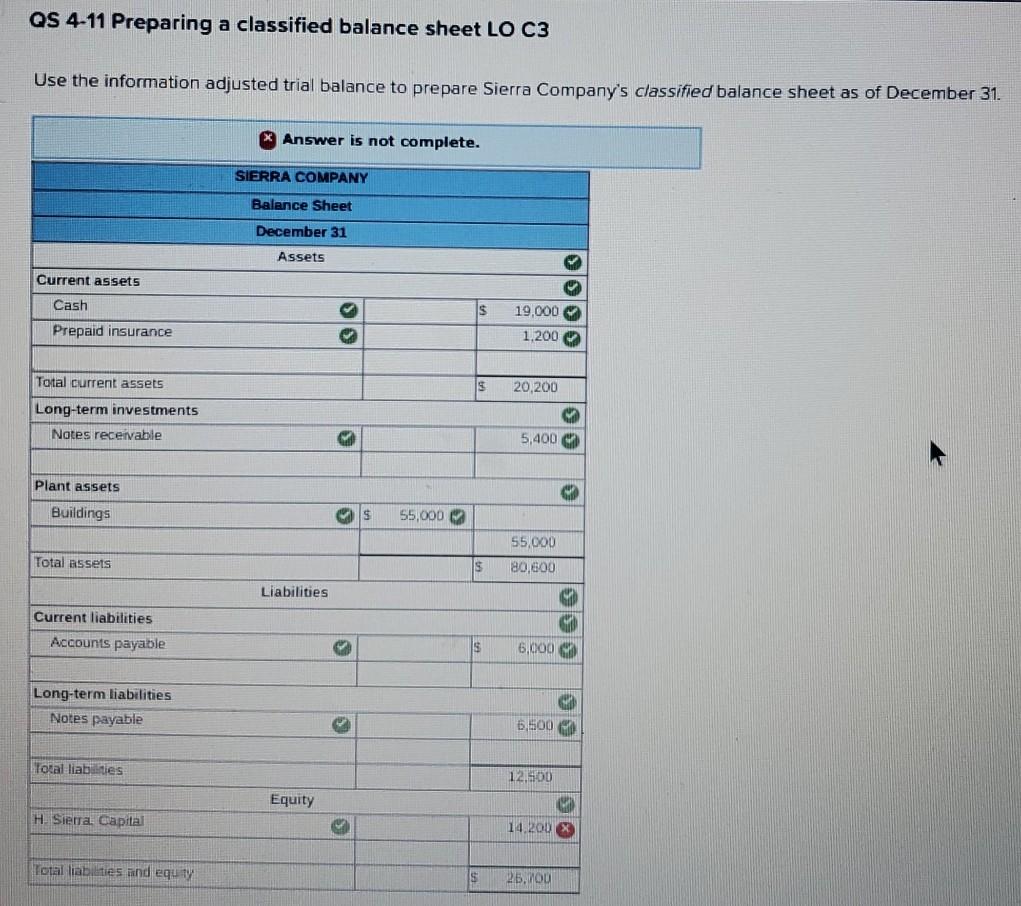

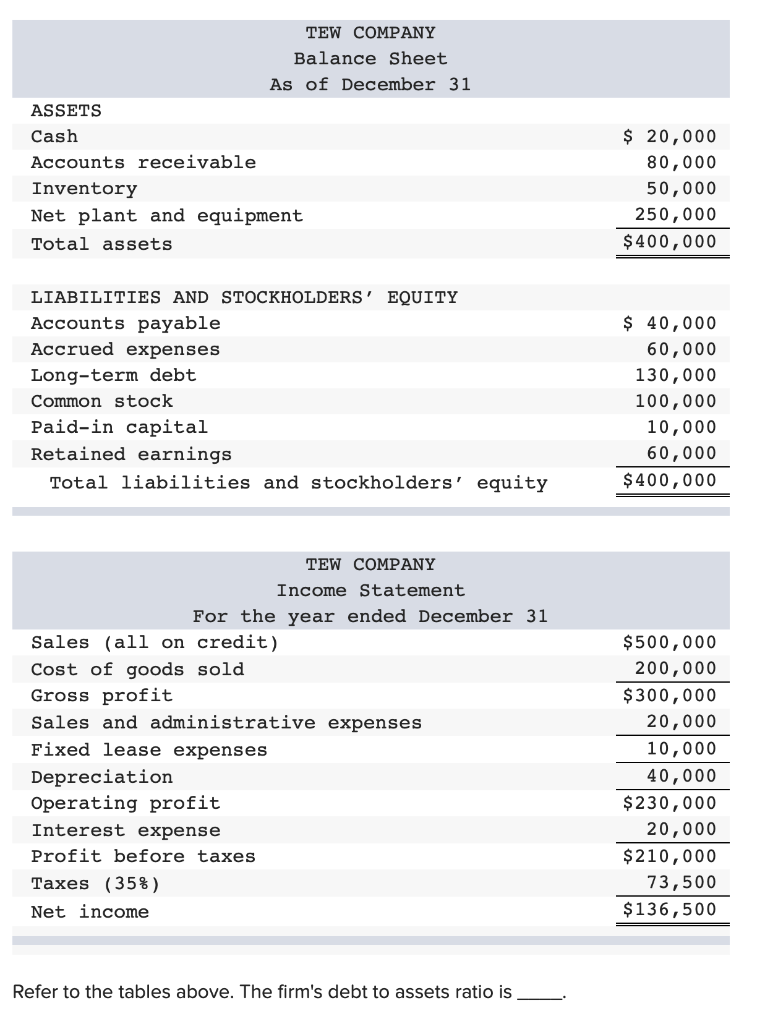

The total liabilities amount on the balance sheet would have been.

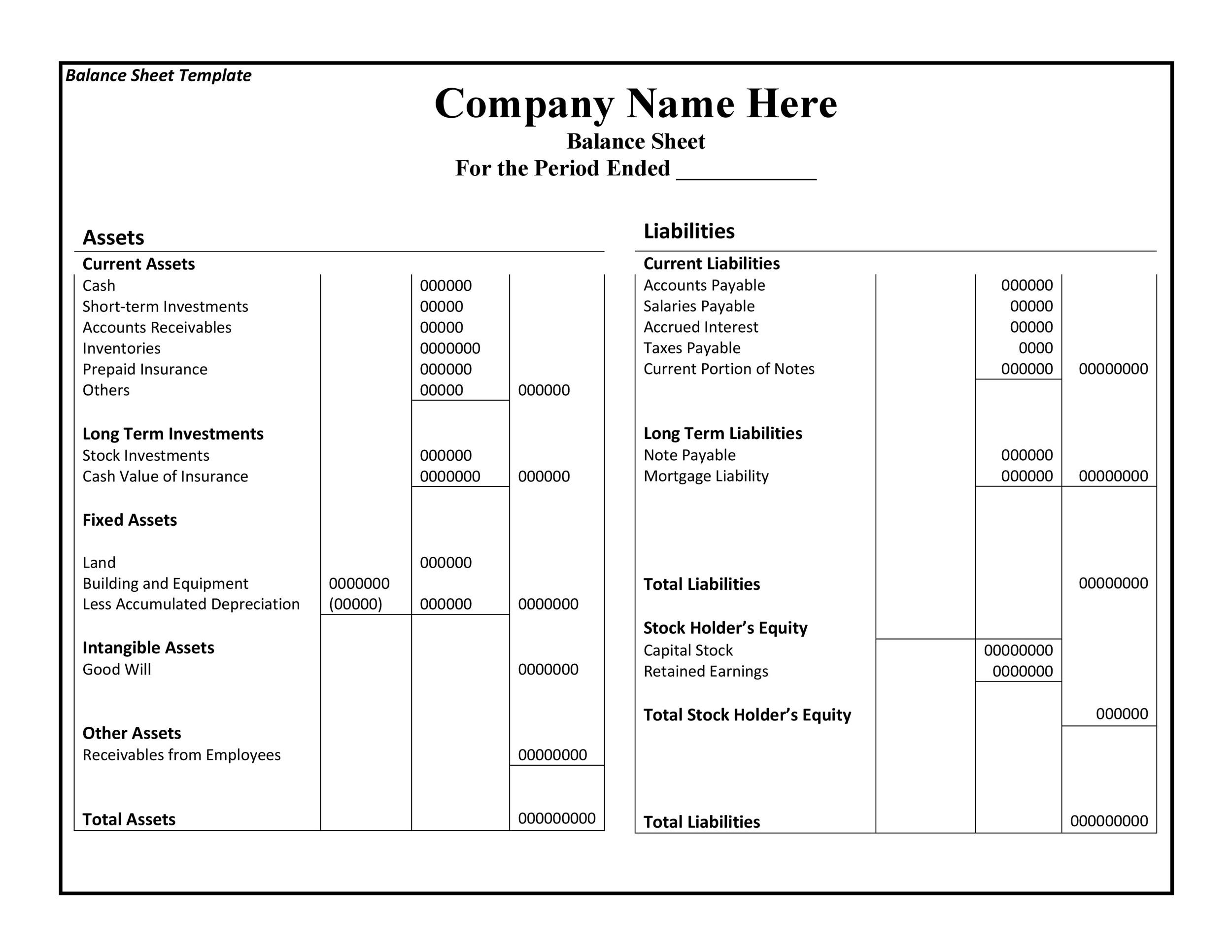

Wages payable in balance sheet. Labor on the balance sheet: A balance sheet provides a snapshot of a company’s financial performance at a given point in time. What is a balance sheet?

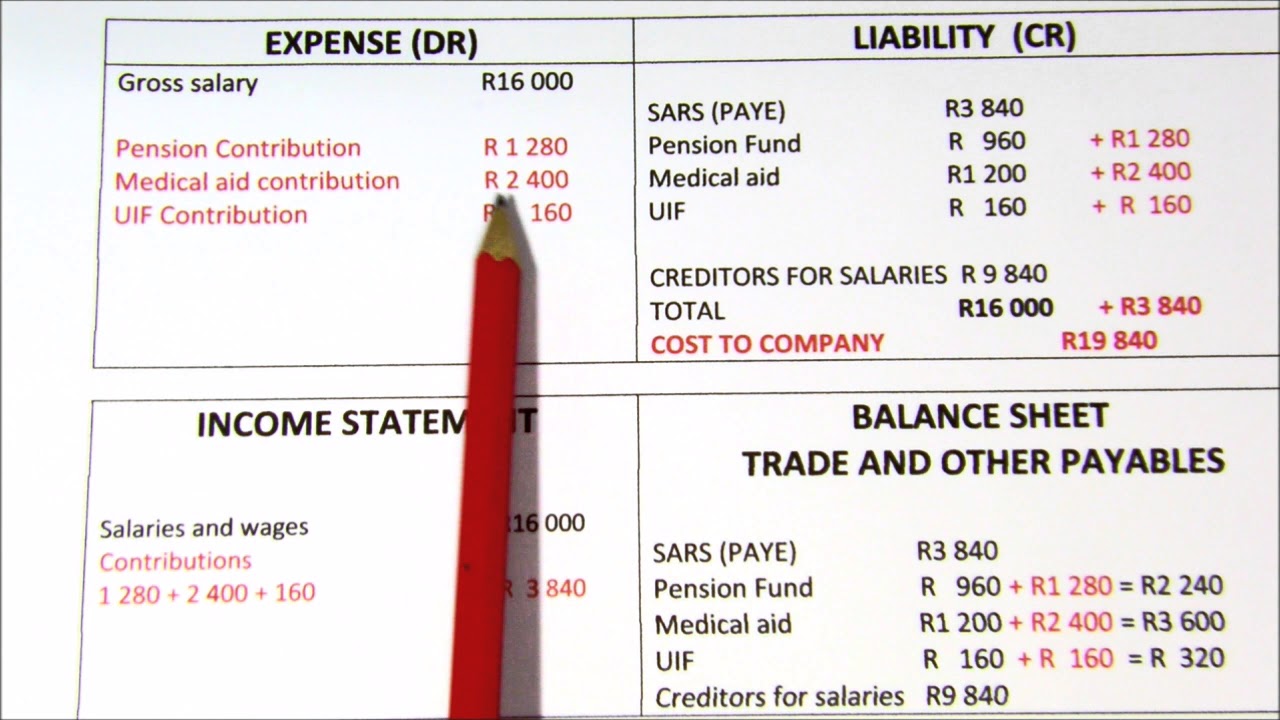

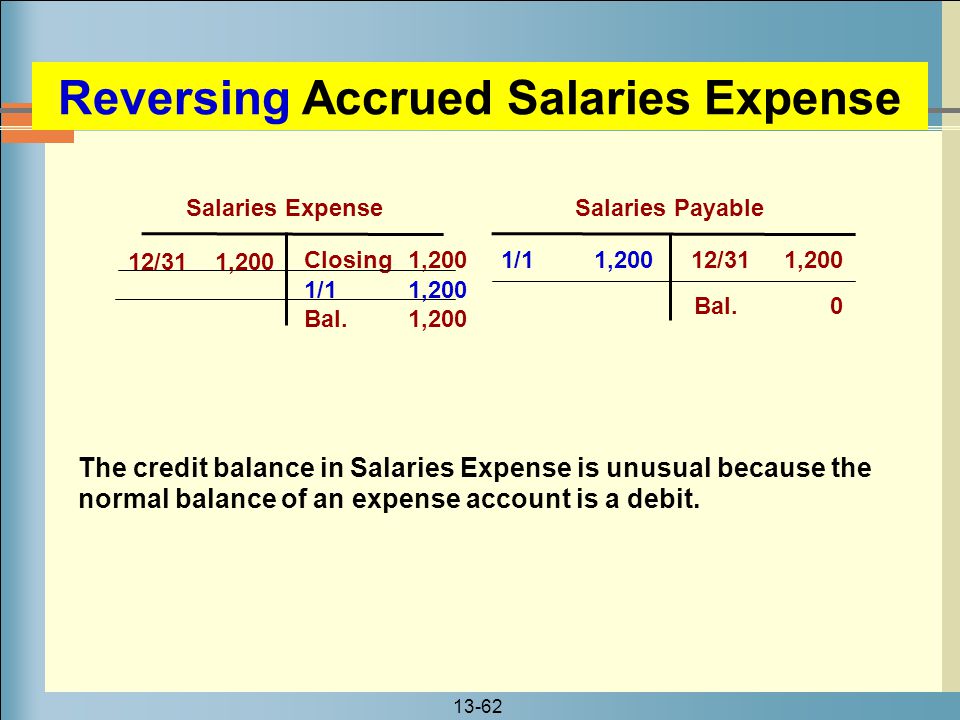

Theoretically, the salary payable account balance increases with credit and decreases with a debit. The wages payable amount on the balance sheet would have been too low ($0 instead of $400). What are accounts payable on a balance sheet?

Interest payable is a liability account that reports the amount of interest the company owes as of the balance sheet date. This financial statement is used. However, they affect the numbers on your balance sheet because you'll have more.

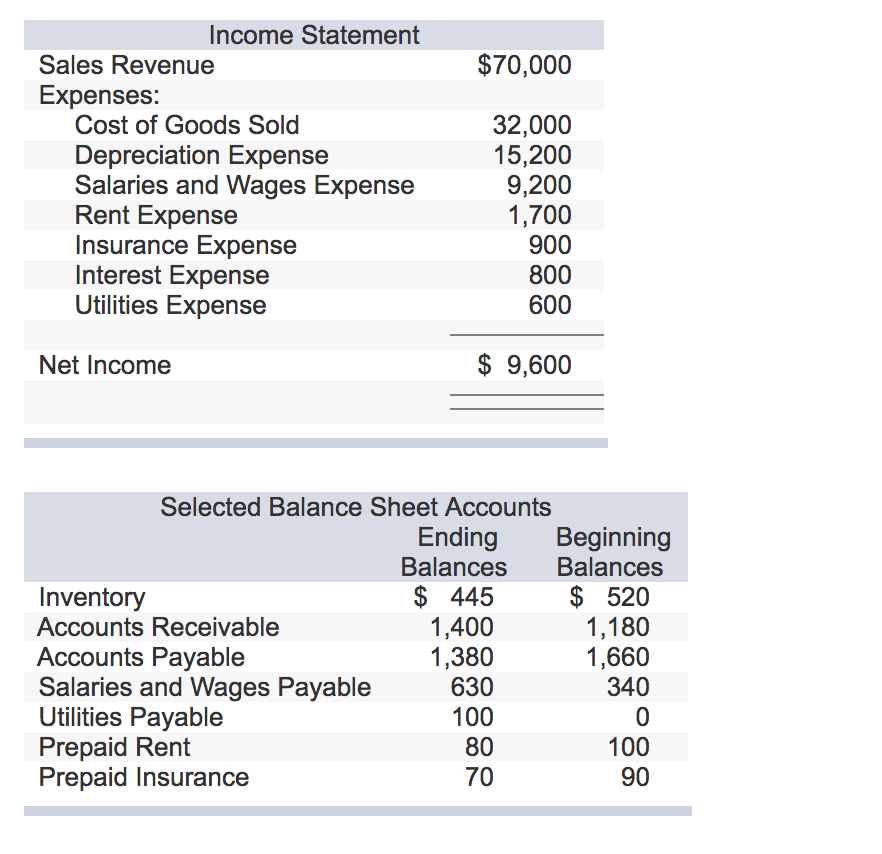

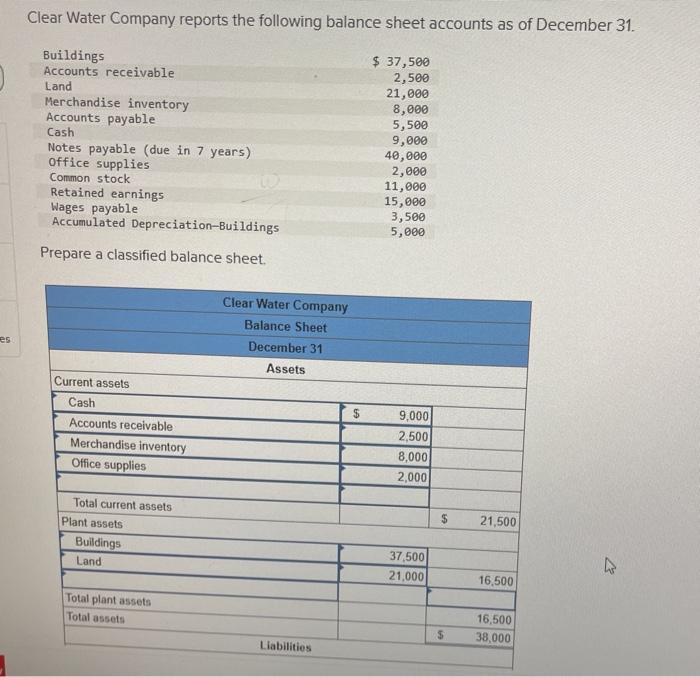

Total liabilities and owner’s equity: Salaries and wages payable are considered as a current liability on the balance sheet of the company. Salary payable is a current liability account containing all the balance or unpaid wages at the end of the accounting period.

The amount of salary payable is reported in the. Wages payable definition a current liability account that reports the amounts owed to employees for hours worked but not yet paid as of the date of the balance sheet. Salaries, wages and expenses don't appear directly on your balance sheet.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Presentation of wages payable. Wages payable is considered a current liability, since it is usually payable within the next 12 months.

This means that it is. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees remaining at the end of a reporting period. Salary payable vs salary expense.

Salaries payable is a liability account that contains the amounts of any salaries owed to employees, which have not yet been paid to them. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time.