Best Of The Best Tips About Common Size Financial

Komponen laba rugi⁄ pendapatan bersih× 100% sementara itu, dalam laporan neraca, formula untuk menghitung common size terbagi 3 yaitu untuk aktiva, liabilitas, dan ekuitas.

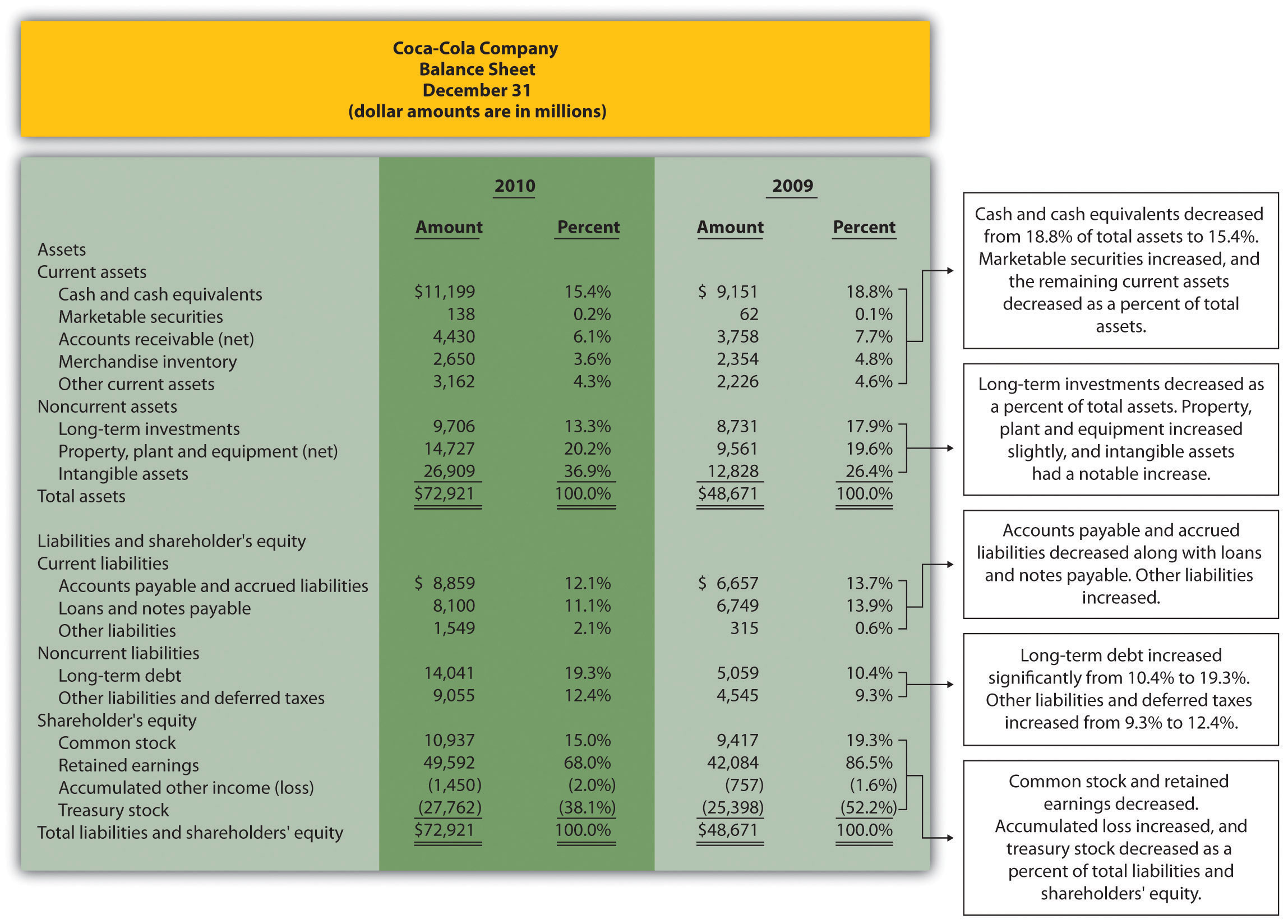

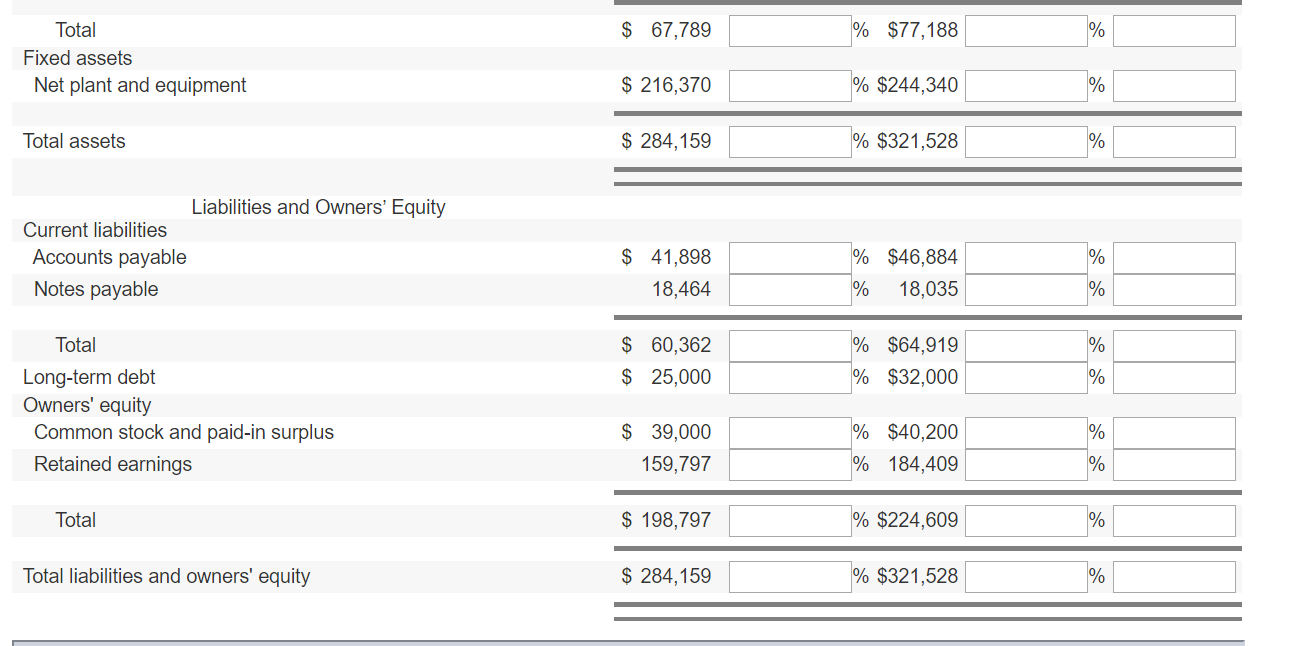

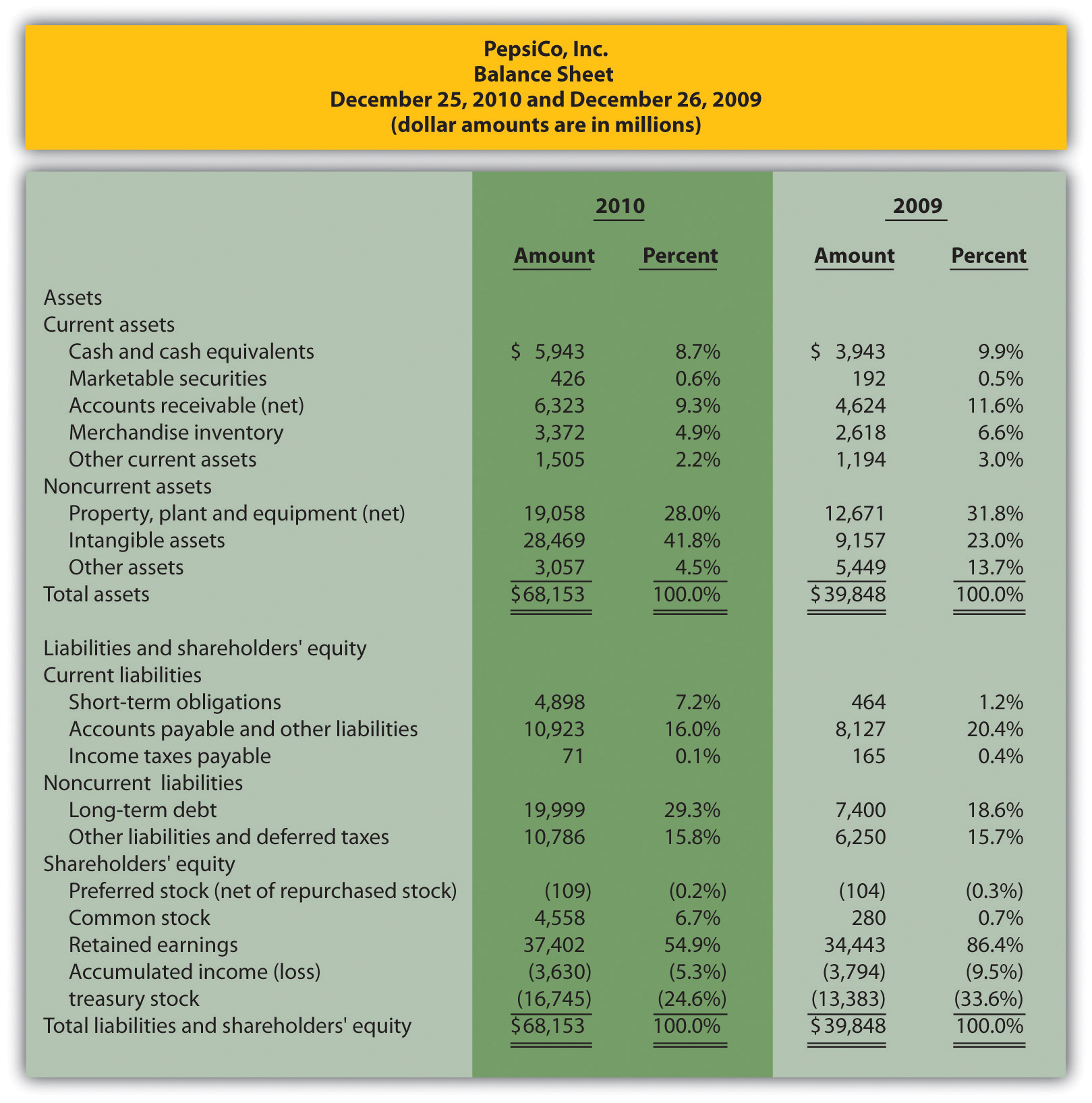

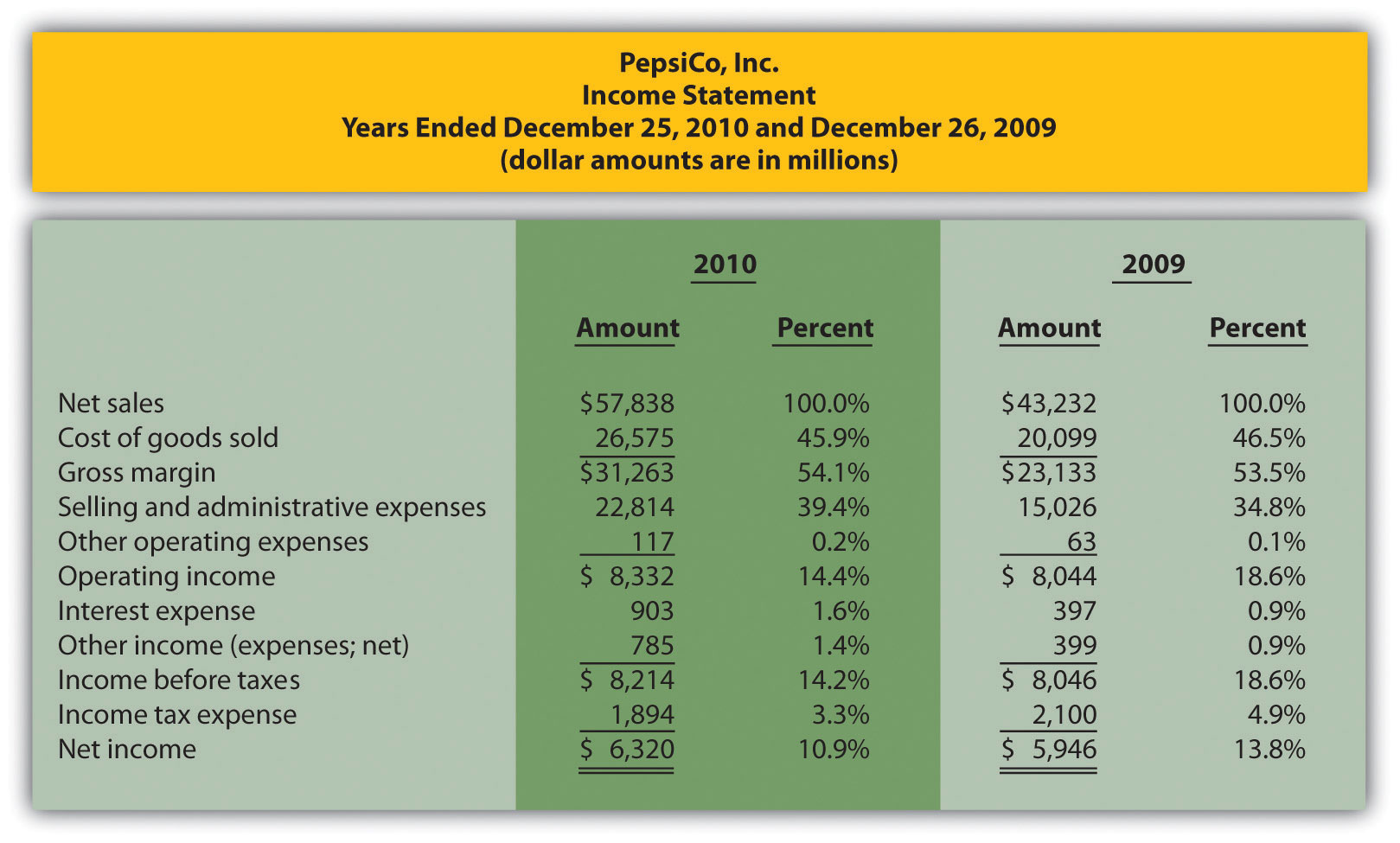

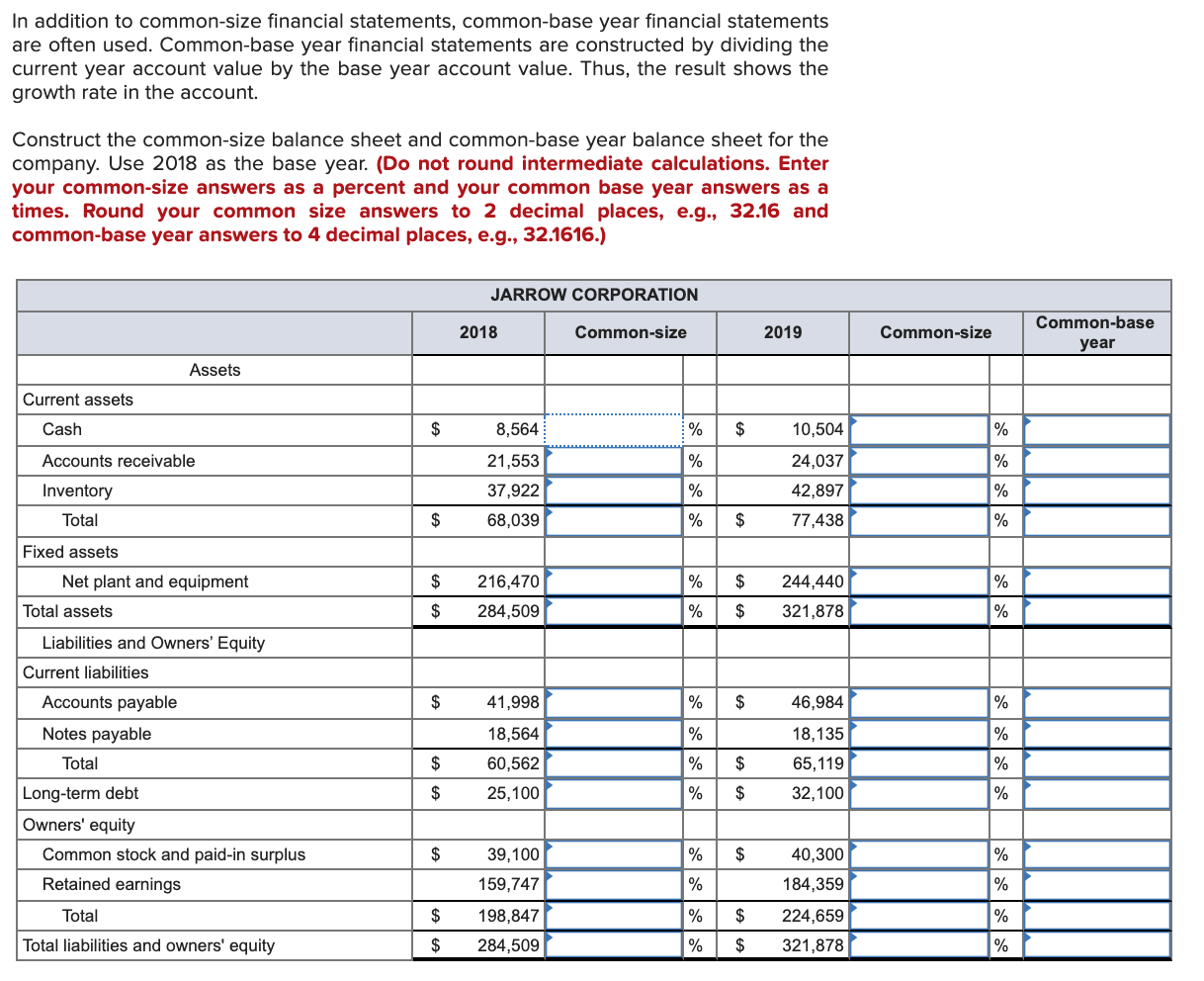

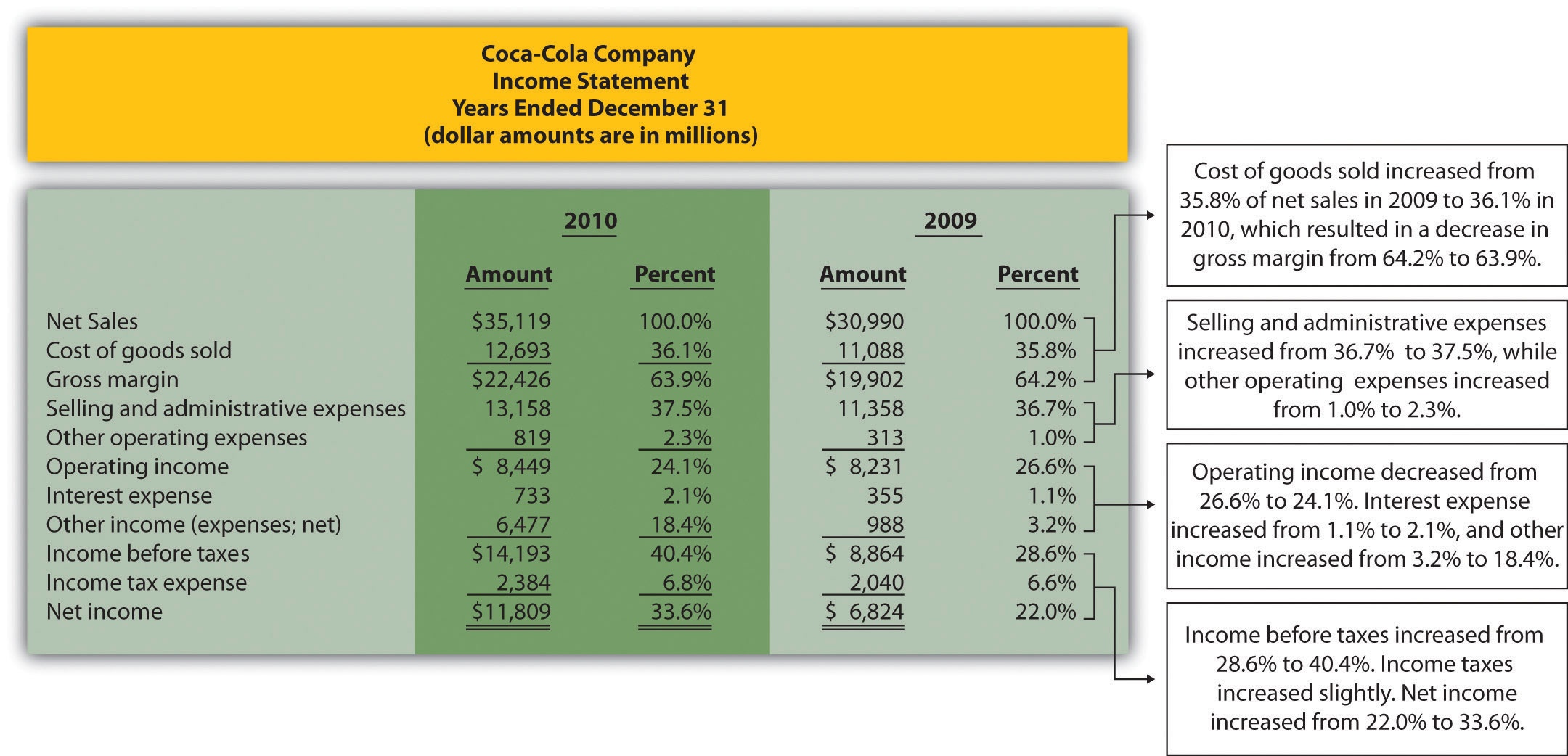

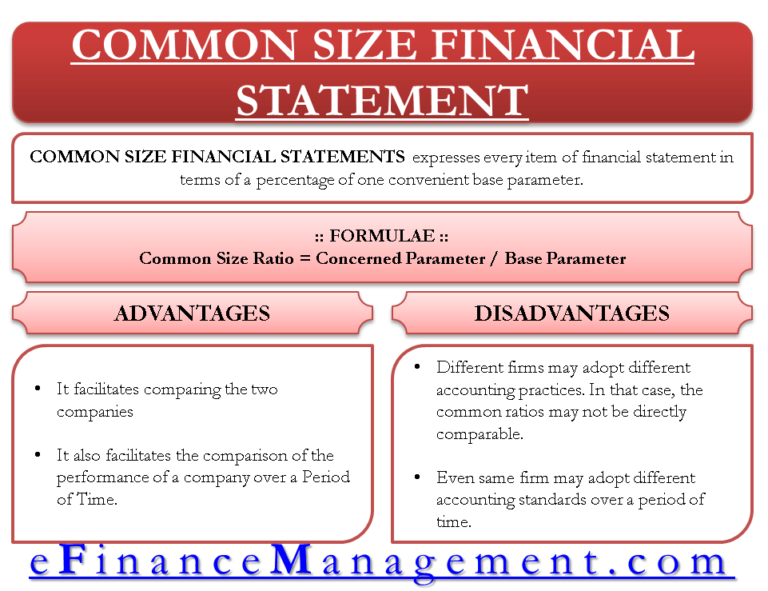

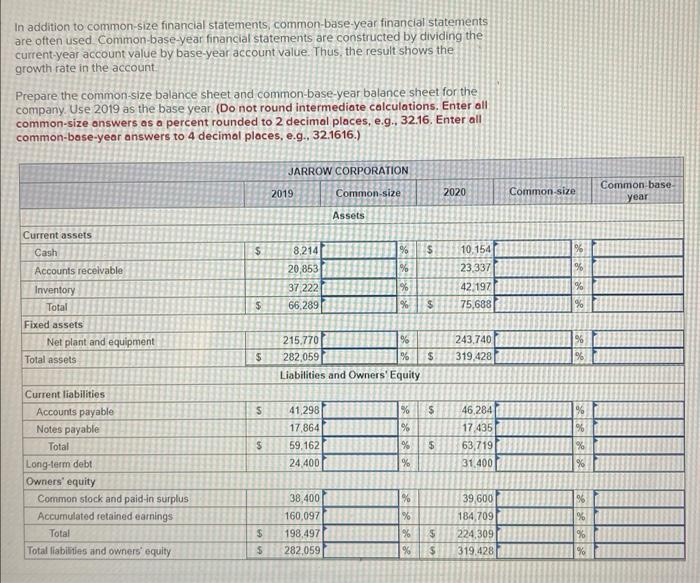

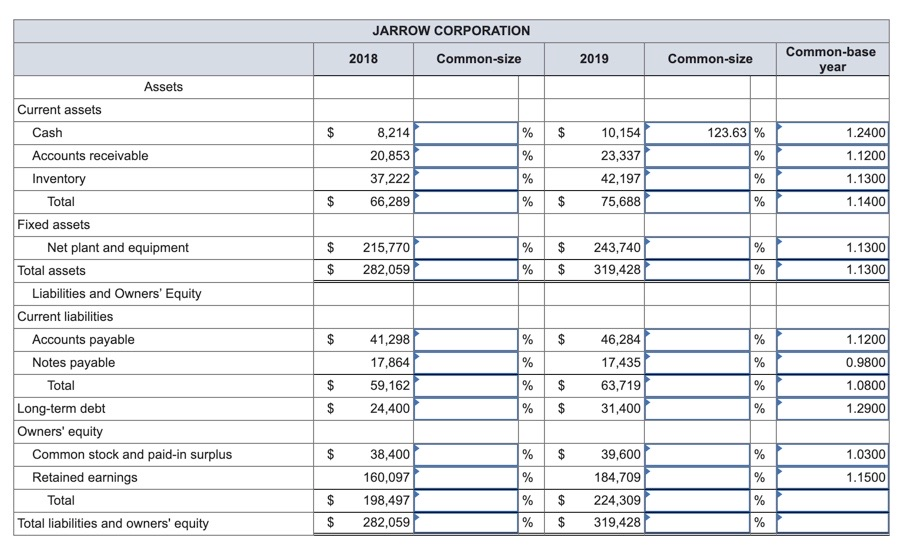

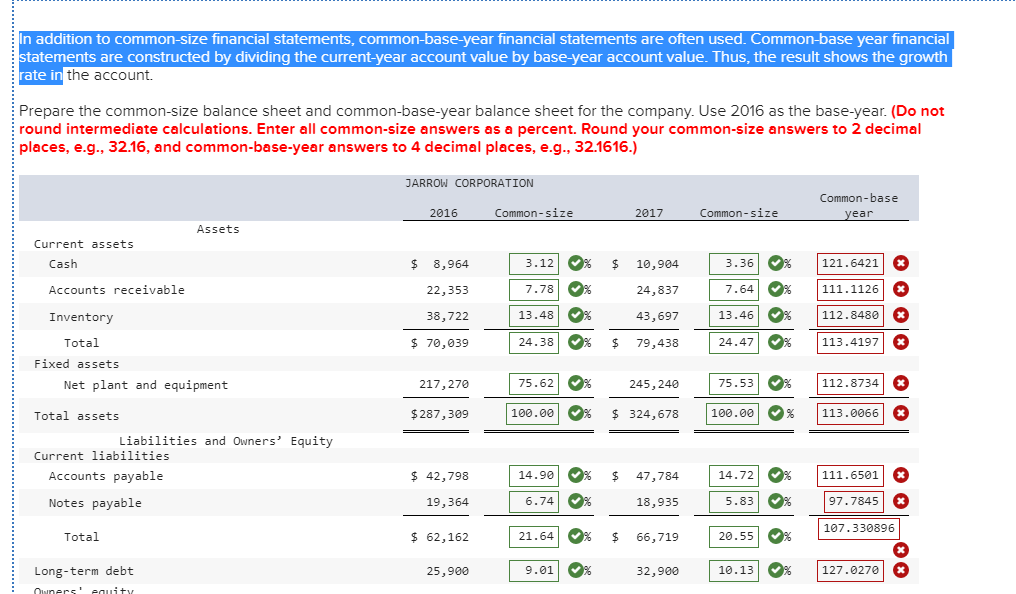

Common size financial. Common size analysis is used to visualize a company's financial performance. It presents financial information in a standardized format to better understand the relative. They aid in comparison, trend analysis, and benchmarking,.

Misalnya, untuk laporan laba rugi, formula untuk menghitung common size sebagai berikut: Income statements an income statement shows an organization's revenues and expenses during a period. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity.

A common size financial statement is a specific type of statement that outlines and presents items as a percentage of a common base figure. For all of 2023, global m&a value fell 16 percent to $3.1 trillion—a showing even weaker than the pandemic year of 2020. A common size balance sheet is a statement in which balance sheet items are being calculated as the ratio of each asset in relation to the total assets.

While the average deal size increased 14. A common size financial statement shows each line item on a financial statement as a percentage of a base figure. Finance ministerial regulation no.

Most commonly, this means that each. Common size financial statements can be extremely helpful to analysts and financial managers, but there are several drawbacks to using them: Common size financial statements express line items as percentages of total revenue or total assets.

Expressing each item on the income statement as a percentage rather than in. Here's how to perform common size analysis. One of the most effective tools to accurately analyze your financial statements is common size analysis.

22 may 2023 6 min read in this article what is common size analysis? A common size financial statement displays items as a percentage of a common base figure, allowing for easy analysis between companies or across different periods. 4 key principles of common size analysis what types of businesses benefit the most from common.

Common size financial statement analysis involves converting the numbers in a financial statement into percentages relative to a common base. Types of common size analysis 1. Rumus laba rugi common size:

It allows for easy comparison.

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/GettyImages-958271424-f3ba20e3eed44d3789d442353cf9b5c9.jpg)

:max_bytes(150000):strip_icc()/CommonSizeFinancialStatement_Final_4199098-2582cfa2dd3649949be139d870822c73.png)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)