Fine Beautiful Info About Difference Between Income Statement And Cash Flow

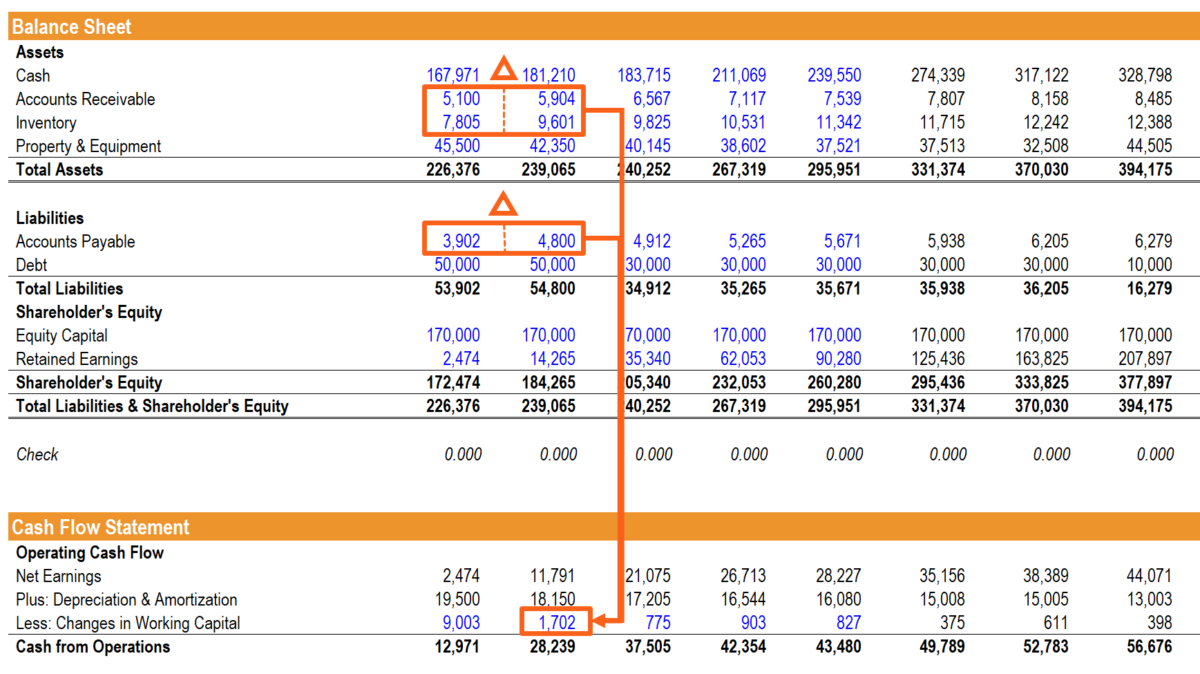

Each of the types of cash flow results in a calculation that can be analyzed.

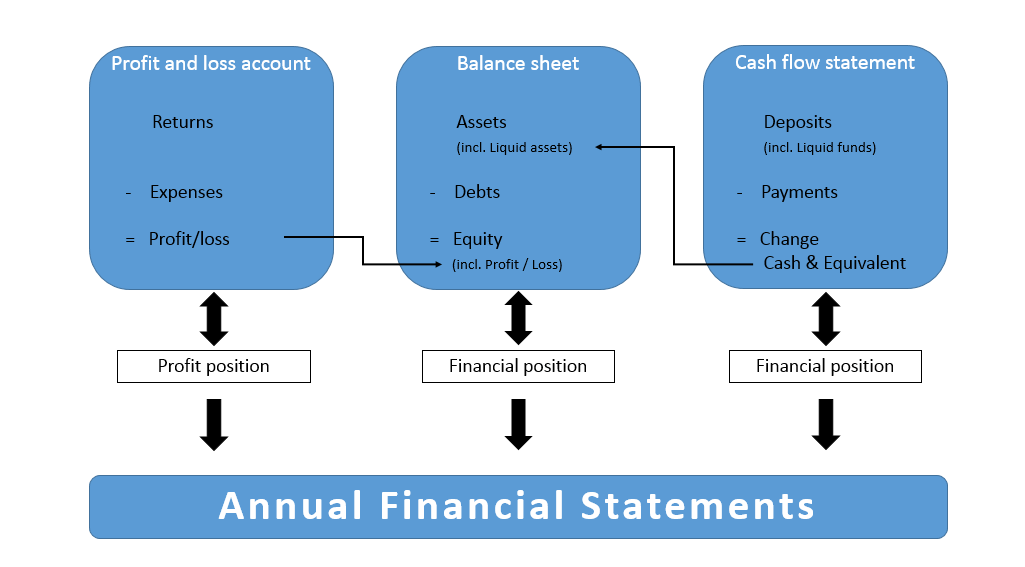

Difference between income statement and cash flow statement. The balance sheet shows a company’s assets, liabilities, and shareholders’ equity at a particular point in time. Are you still figuring out what differentiates a cash flow statement from an income statement? This is referred to as the indirect method.

Why do shareholders need financial statements? Each quarter and every year, your accountant gives you a set of financial statements. Do dividends go on the balance sheet?

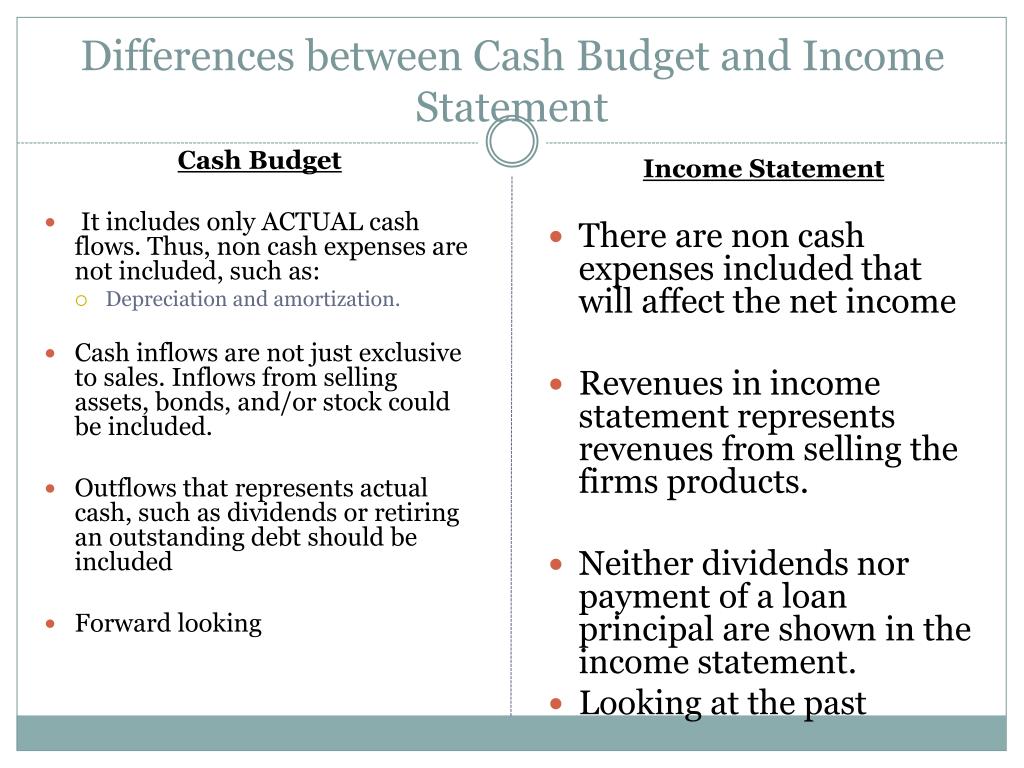

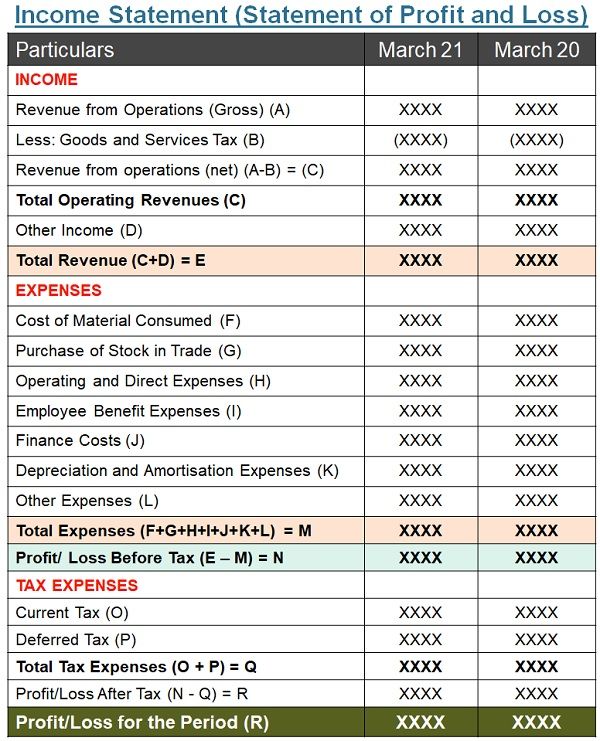

Key differences the income statement, often termed as the profit and loss statement, provides an overview of a company's revenues and expenses over a specific period,. What’s the difference between a cash flow statement and an income statement? The cash flow statement is linked to the income statement by net profit or net burn.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. But, analyzing them both together offers deeper insights that they can use for effective planning and forecasting. The income statement illustrates the profitability of a company under accrual accounting rules.

The most common financial statement is the income statement, which shows a company's revenue and. Here’s a detailed guide outlining the major differences between them. A cash flow statement tells you about the overall flow of money into and out of a company.

Another technique, called the direct method, can also be used to prepare the cash flow statement. A cash flow statement shows the exact amount of a company's cash inflows and outflows, either. Financial statements report a company's financial information.

The one you'll use will depend on the financial decision you need to make, because a cash flow statement provides you with a different set of information from the information presented in an. Business leaders need to know the key differences between a cash flow statement vs income statement to gain a clear assessment of their financial position. Cash flow statement vs.

Whereas an income statement documents revenues, gains, expenses and losses, the balance sheet includes theoretical money, such as that owed to the company but not yet collected. Learn about how the income statement, balance sheet, and cash flow statement are interconnected and used to analyze company performance. Updated december 12, 2022 there are various ways companies can determine whether they’re performing well financially.

Similarly, companies have been presenting their financial statements as they approach. This post breaks down all the important differences between income statement and cash flow. Which one should i use?

View a balance sheet template. In the preparation of a company’s cash flow statement, data from both its income statement and balance sheet is utilized. The income statement operates on the accrual system of accounting whereas statement of cash flows records actual receipt and payment of cash and cash equivalents in a given financial year.