Outrageous Tips About Statement Showing Interest Income From The Irs

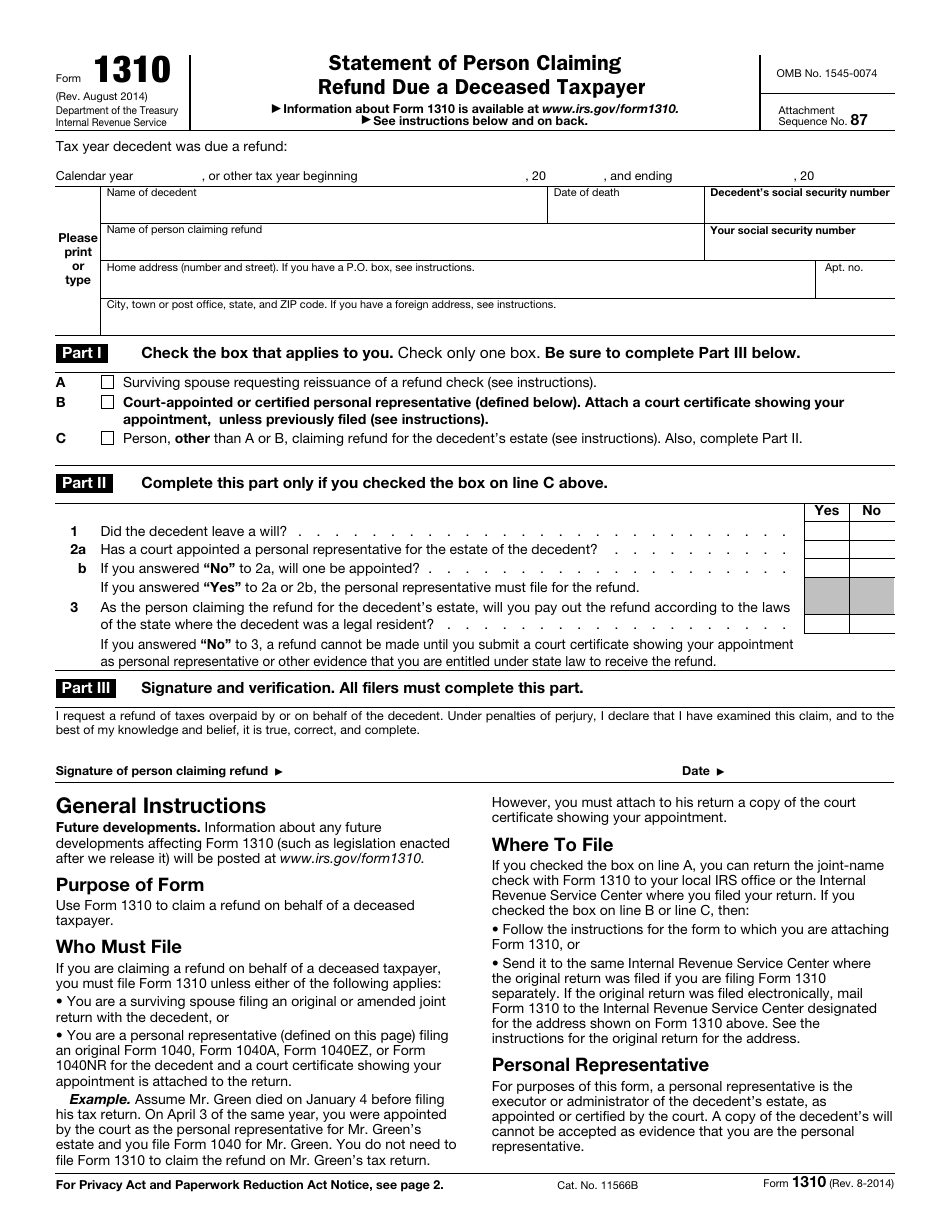

The irs took so long last year to pay refunds they paid interest on it.

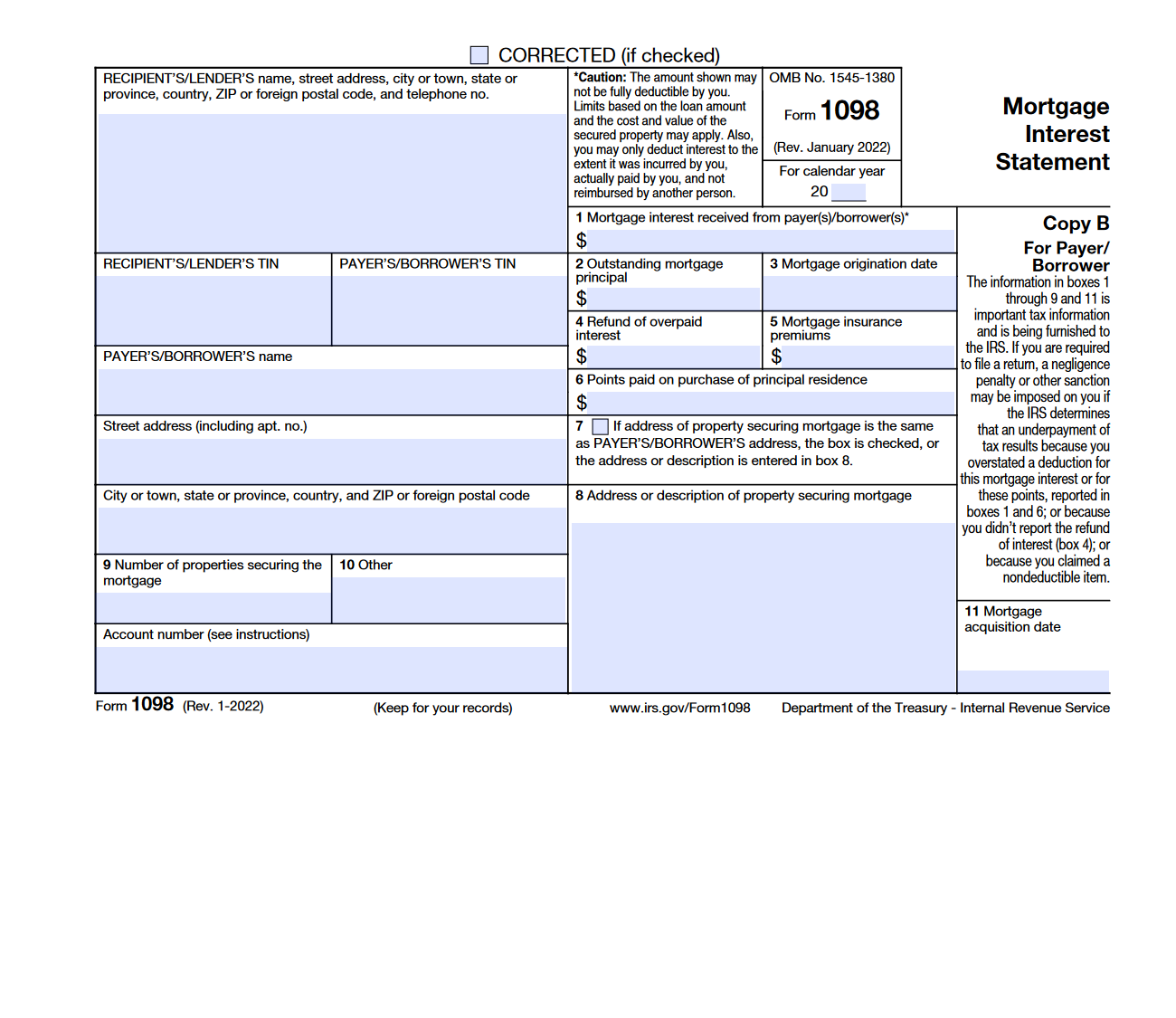

Statement showing interest income from the irs. The irs charges underpayment interest when you don't pay your tax, penalties, additions to tax or interest by the due date. 1 best answer helenac new member to enter your irs interest form: If you receive interest of at least $10, the irs will send.

If you got back your taxes late, the irs is required to pay interest after a certain amount of time. Statement showing interest income from the internal revenue service calendar year 2019 total interest paid or credited: The irs treats interest earned on money in a savings account as taxable income.

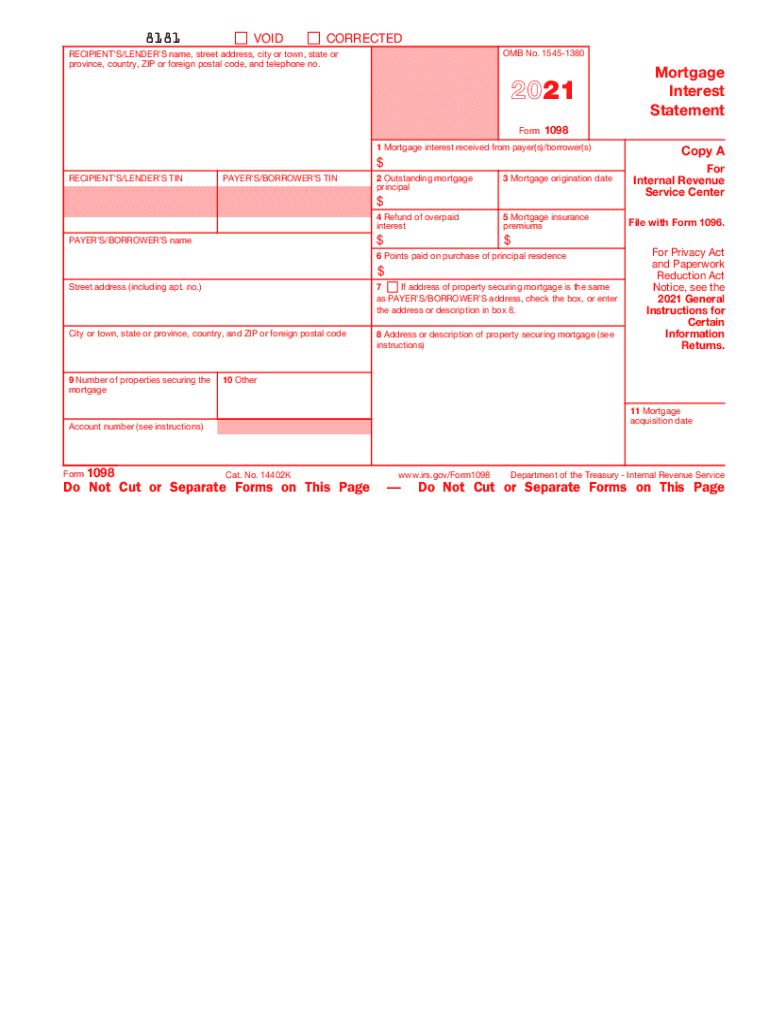

If you purchased your home before dec. 1 best answer. Your financial institution issues a 1099 form if you earned at least $10 in.

This is probably what you are referring to. For the most recent version, go to irs.gov/form1099int. If you receive an interest payment, you must report the interest on your 2020 federal income tax return.

Still, the agency says you should call only if it's been at least 21 days since you filed your taxes online or if the where's my refund tool tells you to. To whom you paid amounts reportable in boxes 1, 3, or 8 of at. $54.55 this is not a tax bill.

16, 2017 and are a single or joint filer, you can deduct interest paid on the first $1 million of your mortgage. When a new york judge delivers a final ruling in donald j. Enter interest from the irs like a 1099int and put the amount in box 1.

Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions in penalties.