Awesome Info About Depreciation On Trial Balance

Understand the trial balance's role and identify adjustments like depreciation.

Depreciation on trial balance. Many candidates struggle with certain adjustments in the exam. These credit balances would transfer to the credit column on the adjusted trial balance. This article explains how to treat the main possible post trial balance adjustments, including:

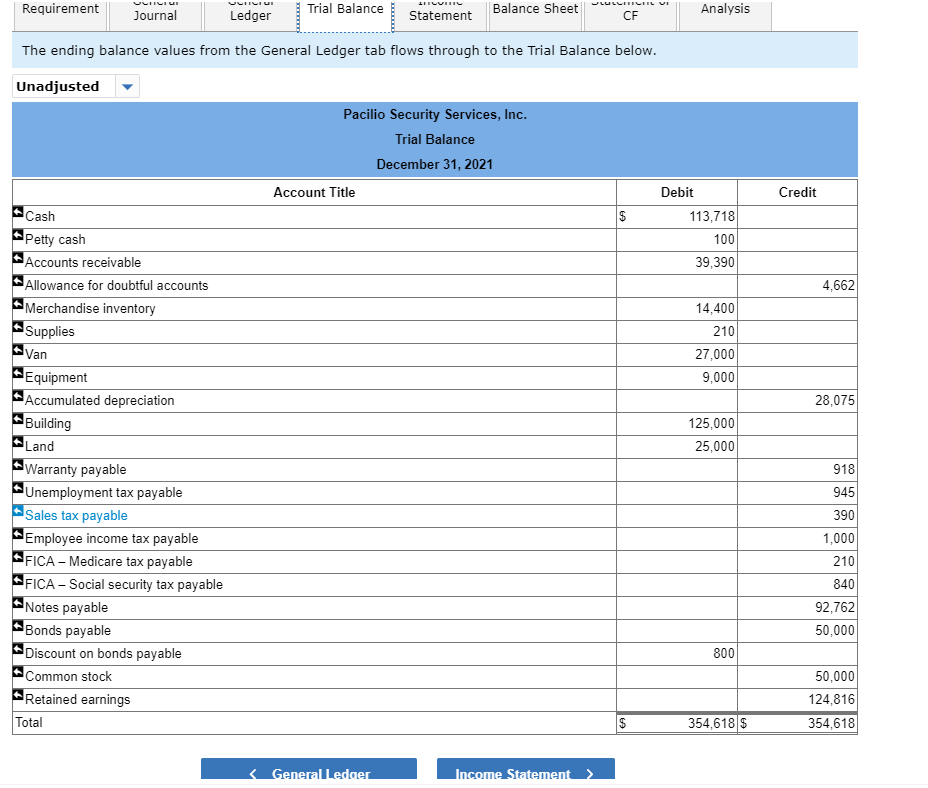

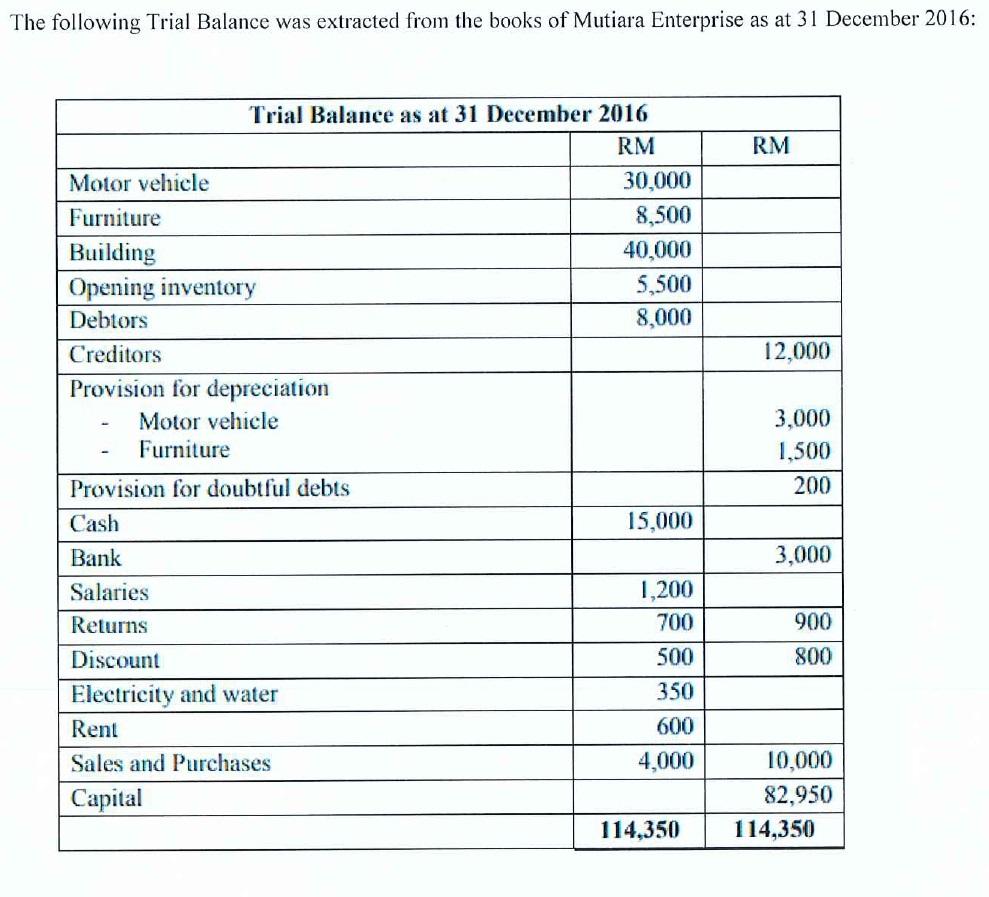

The value of most of the assets reduces over a period of time. Once the trial balance information is on the worksheet, the next step is to fill in the adjusting information from. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

1 trial balance in this chapter we will bring together the material from theprevious chapters and produce a set of financial statements from a trialbalance. The cost for each year you own the asset becomes a business expense for that year. Depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up in that year.

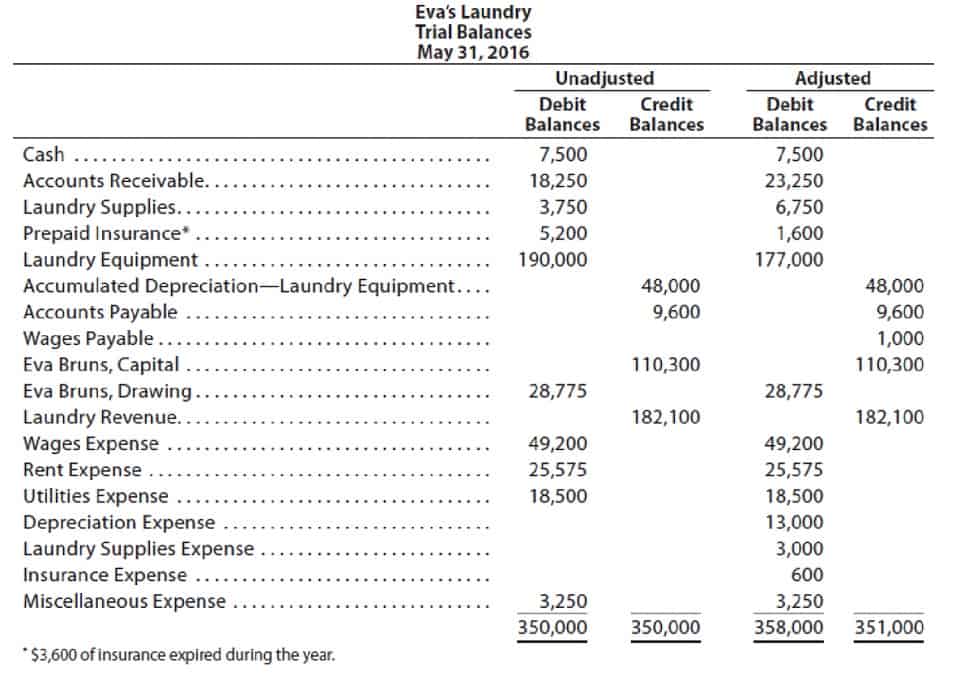

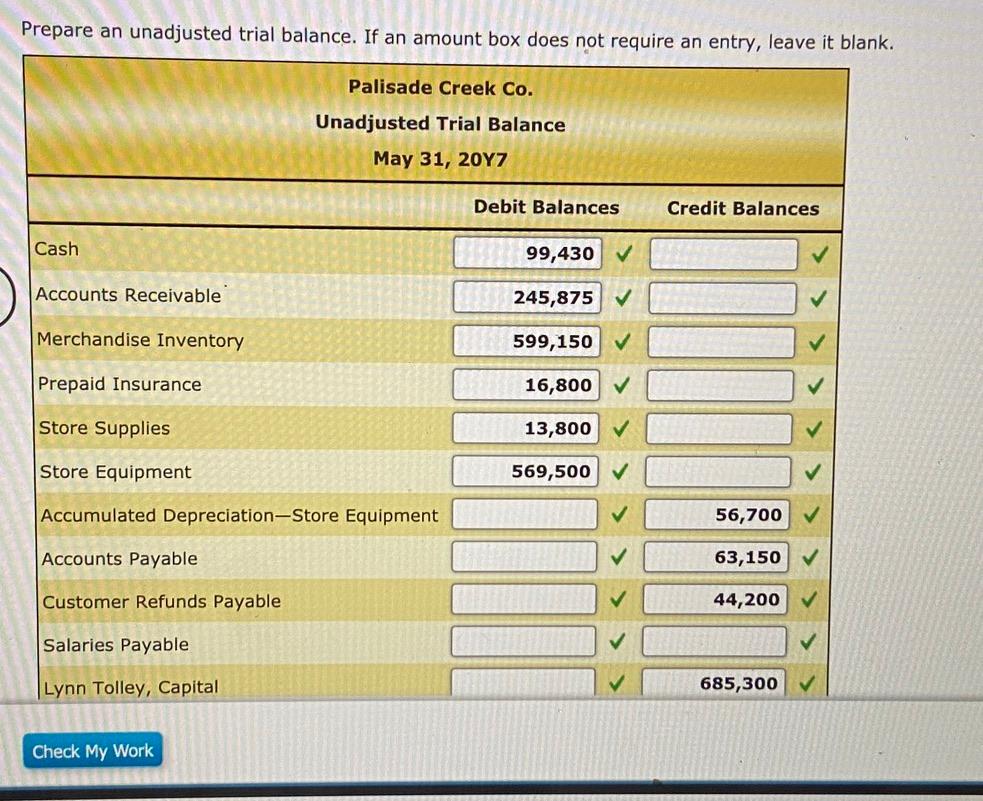

There were no depreciation expense and accumulated depreciation in the unadjusted trial balance. After incorporating the $900 credit adjustment, the balance will now be $600 (debit). A trial balance is a list of all accounts in the general ledger that have nonzero balances.

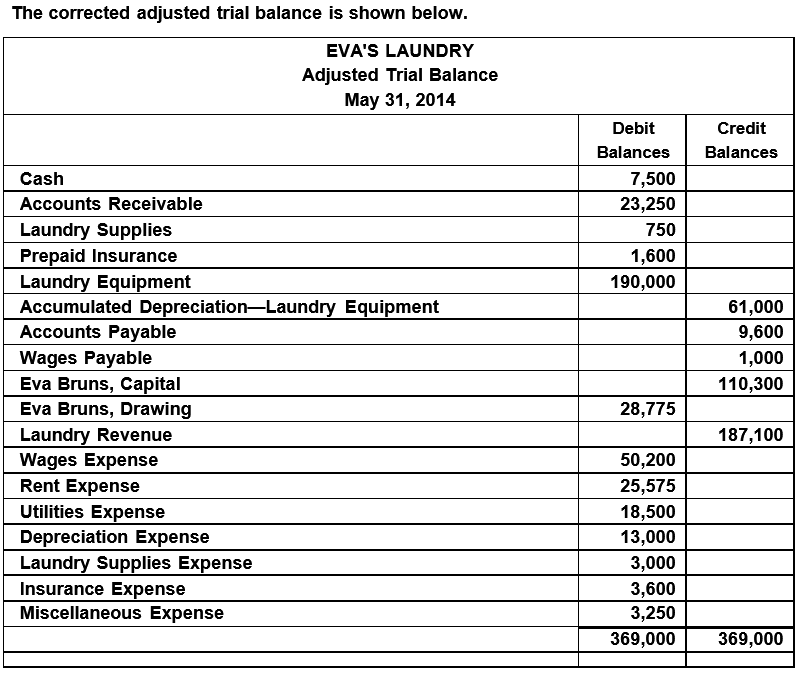

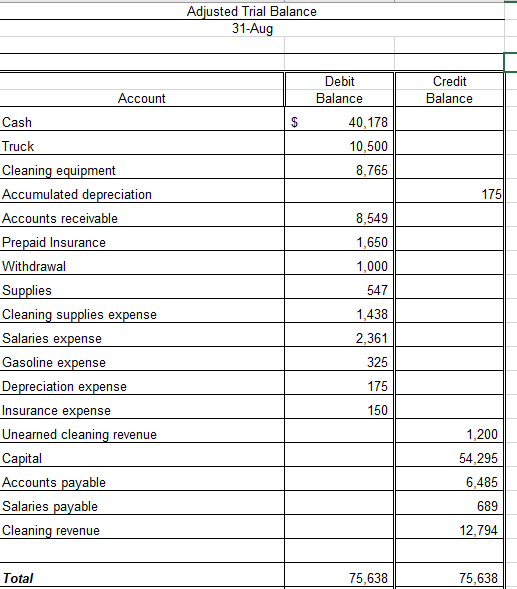

This statement comprises two columns: Print the adjusted trial balance and verify that all adjusting entries have been made. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.

A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. Accumulated depreciation is nothing but the sum total of depreciation charged until a specified date. Why accumulated depreciation is a credit balance each year, the depreciation expense account is debited, expensing a portion of the asset for that year, while the accumulated depreciation.

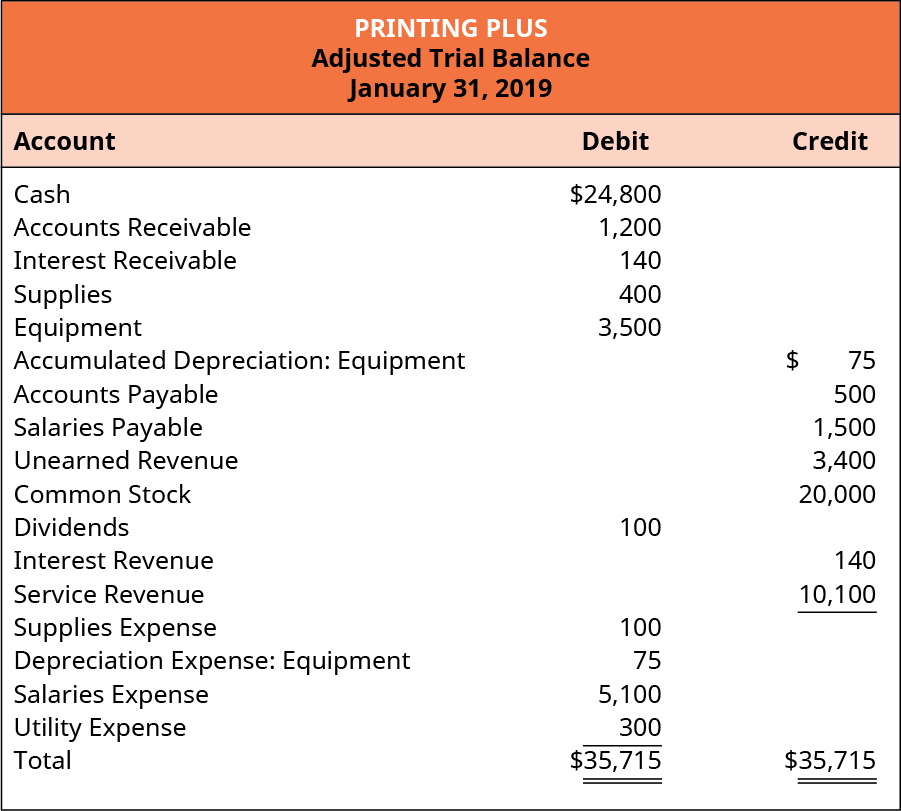

If we go back and look at the trial balance for printing plus, we see that the trial balance shows debits and credits equal to $34,000. It’s a common practice to record the assets at their historical cost but over a period of time, does the value of the asset remain the same as at the time of its purchase? Because of the adjusting entry, they will now have a balance of $720 in the adjusted trial balance.

An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. The accumulated depreciation is shown as a “credit item” in the trial balance. The debits and credits include all business.

This will involve adjusting for the following items: The accumulated depreciation is set as an asset account within the trial balance. Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc.

This may include charging off a portion of prepaid expenses, adjusting the reserve for doubtful accounts, recording expense accruals, and recording depreciation and amortization expense. At this point the entrepreneur/ learner should note that the depreciation amount to be charged in the profit and loss account of the organization can be computed using either of the four key methods (ie straight line, reducing balance, revaluation and. Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal.