Exemplary Info About Income Statement For Limited Company

Today, lets focus on how to read an income statement.

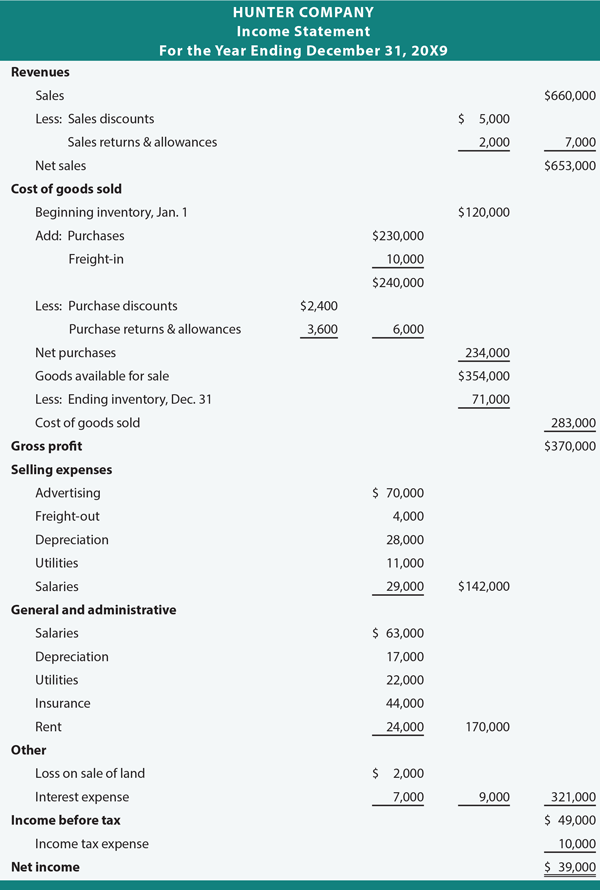

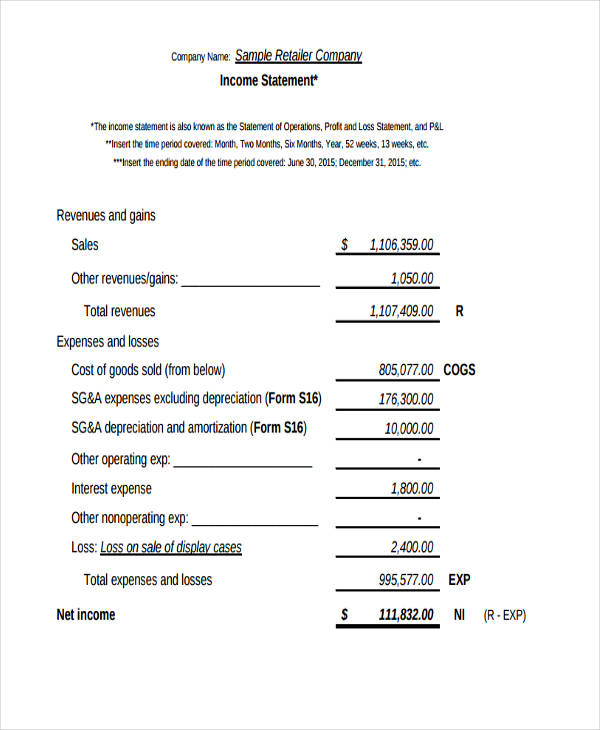

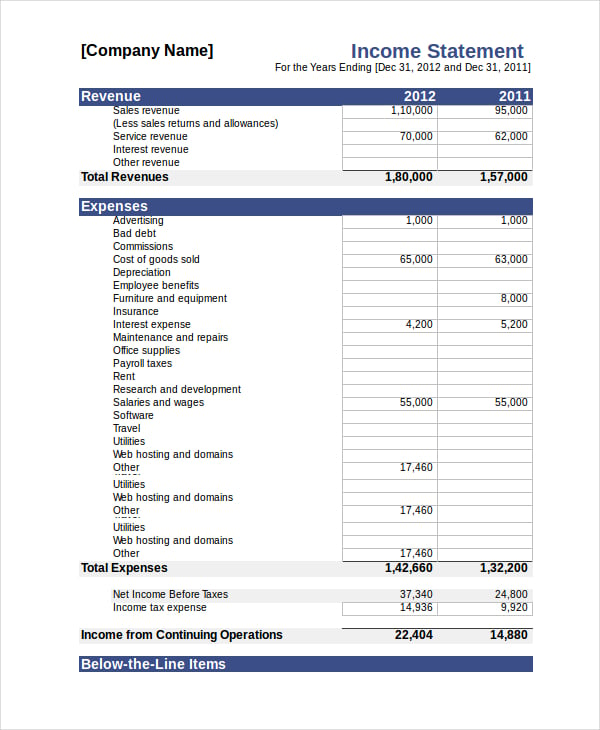

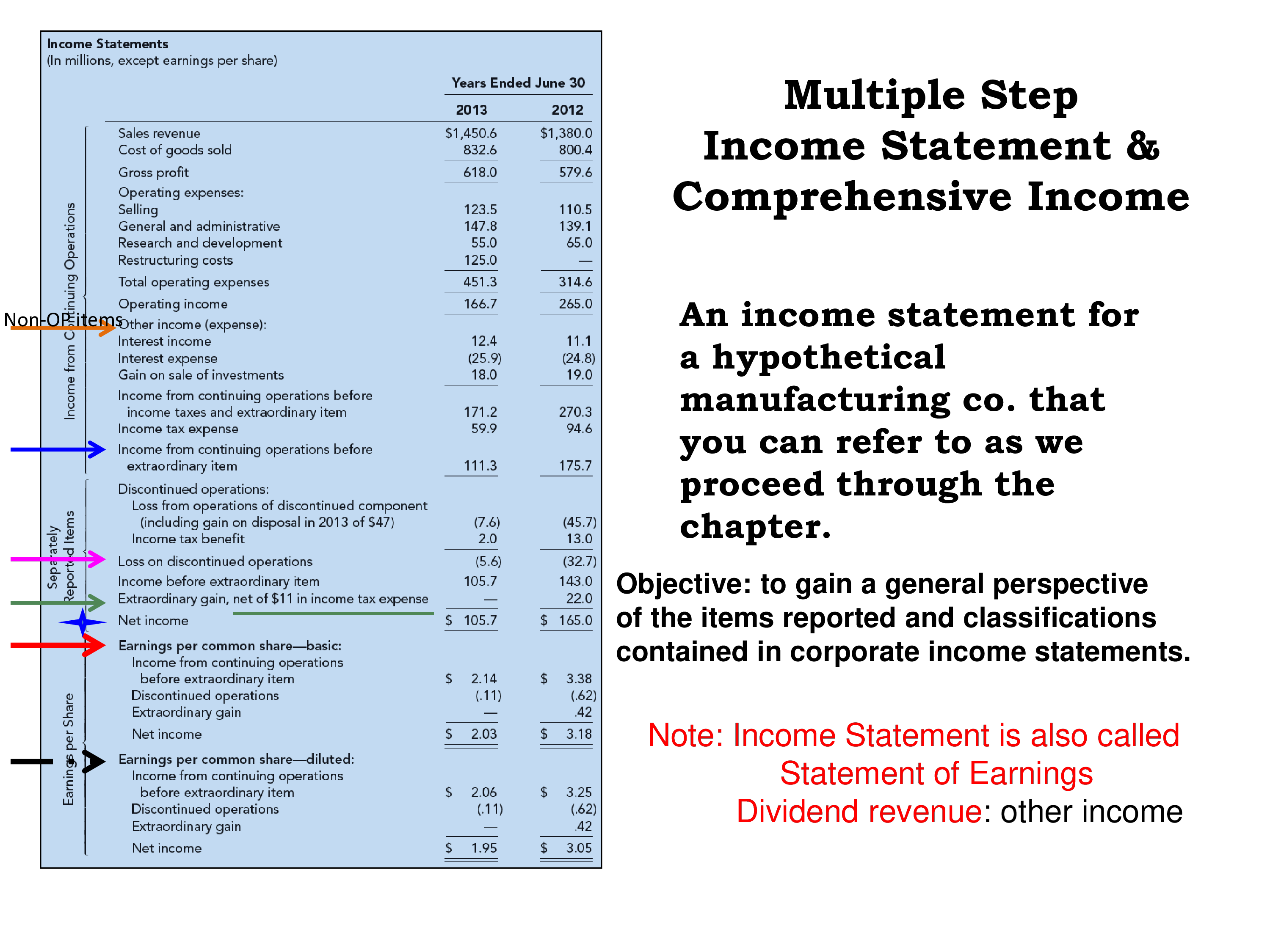

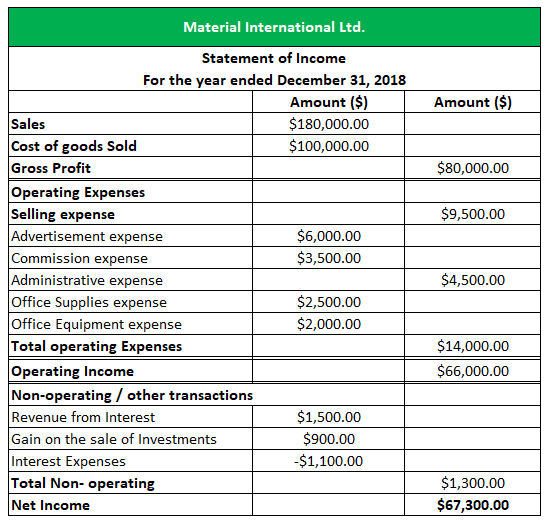

Income statement for limited company. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. It is part of the annual accounts submitted to companies house. The income statement can either be prepared in report format or account format.

Statement of financial position, statement of profit or loss and other comprehensive income, statement of changes in equity and statement of cash flows. For annual accounts after the first ones, the deadline is 9 months after the end of the company’s financial year. The income statement focuses on four key items:

However, there are quite a few accounting and legal rules which are relevant to the preparation of company accounts. It shows a business’s revenues, expenses, and net income (or loss) during an accounting period. Trading statement and operating update for the six months ended 31 december 2023.

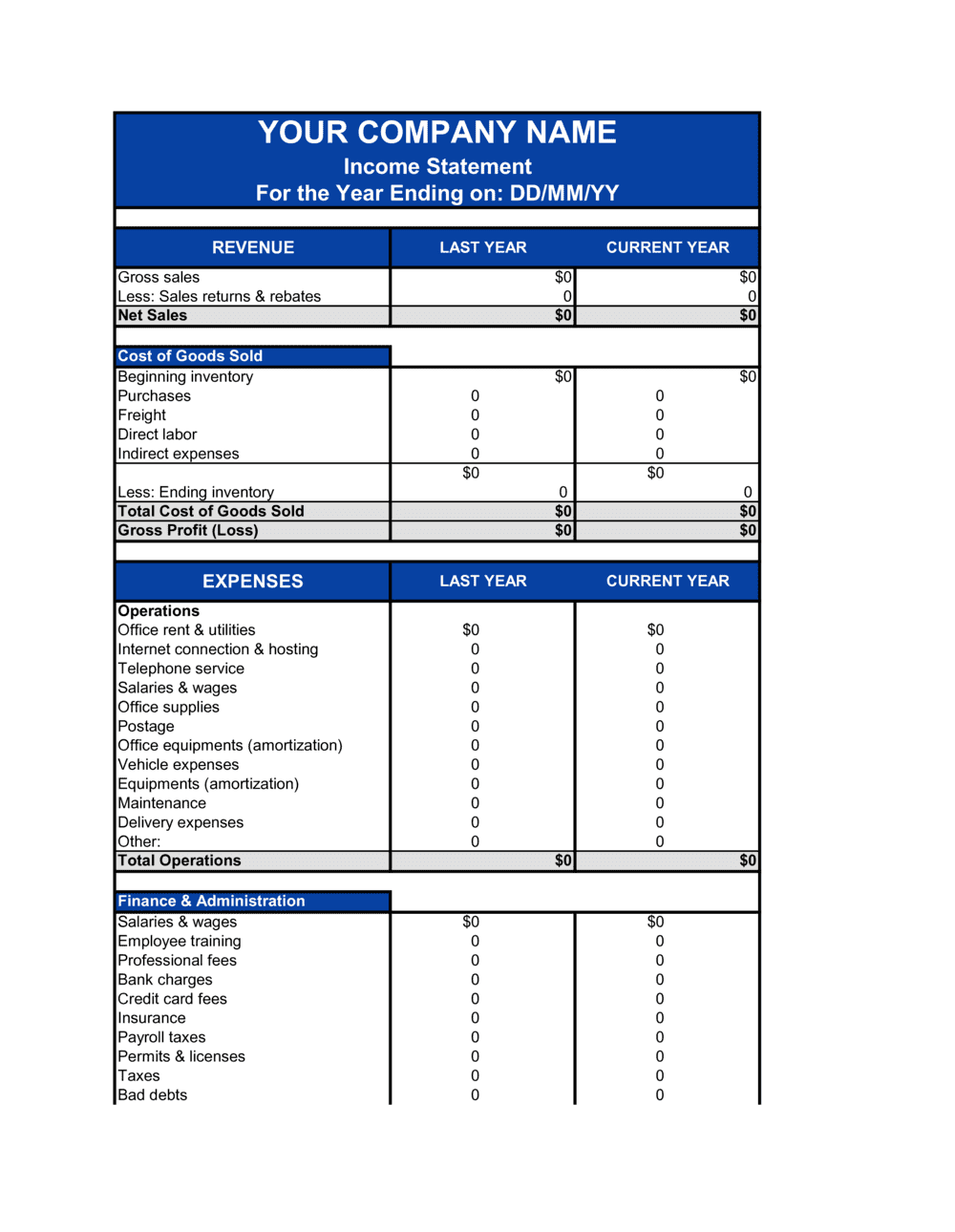

Harmony gold mining company limited registration number 1950/038232/06 incorporated in the republic of south. Enter the number of customers and the average sale per customer to determine your total monthly sales. An accountant typically prepares the reports.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. An income statement is a financial report detailing a company’s income and expenses over a reporting period. Outline the structure of the profit and loss account (income statement) of a limited company classify the categories of income and expenditure that comprise the profit and loss account appreciate the alternative profit and loss.

Revenue from operations and other revenue. Company’s financial statements income statement. Revenue, expenses, gains, and losses.

The income section is usually divided in 2 parts. The income statement is one of a company’s three main financial statements. The income statement is a historical record of the trading of a business over a specific period (normally one year).

Sales on credit) or cash vs. In section 5.1 you will look at the balance sheet and income statement for a sole trader. The income statement serves several important purposes:

The techniques used in preparing the financial statements for companies are the same as those you learned in chapter 5. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Use this monthly small business income statement template to track and manage your small business finances.

Then, enter your operating, payroll, and office expenses to determine your total expenses. An income statement is a financial statement that reports a company’s revenues, expenses, gains, and losses over a specific period, typically a quarter or a year. There are two ways of presenting an income statement.

![Complete Guide to Statements [+ examples and templates]](https://www.deskera.com/blog/content/images/2020/06/Screenshot-2020-06-29-at-1.49.31-PM.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)