Casual Tips About Debt Investments Short Term Balance Sheet

Find out more about them and how they impact the balance sheet.

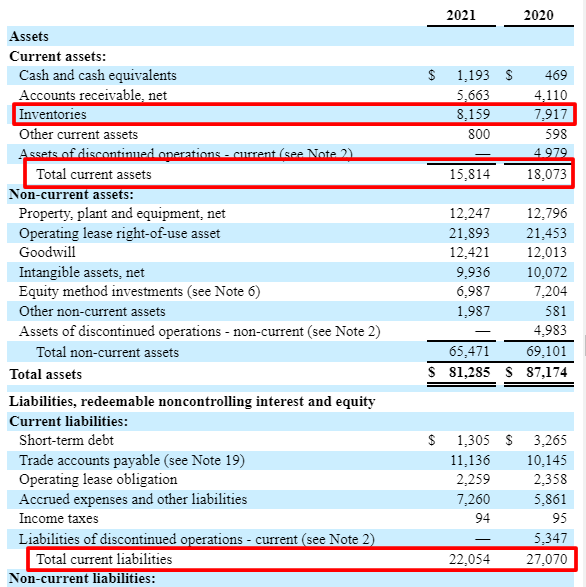

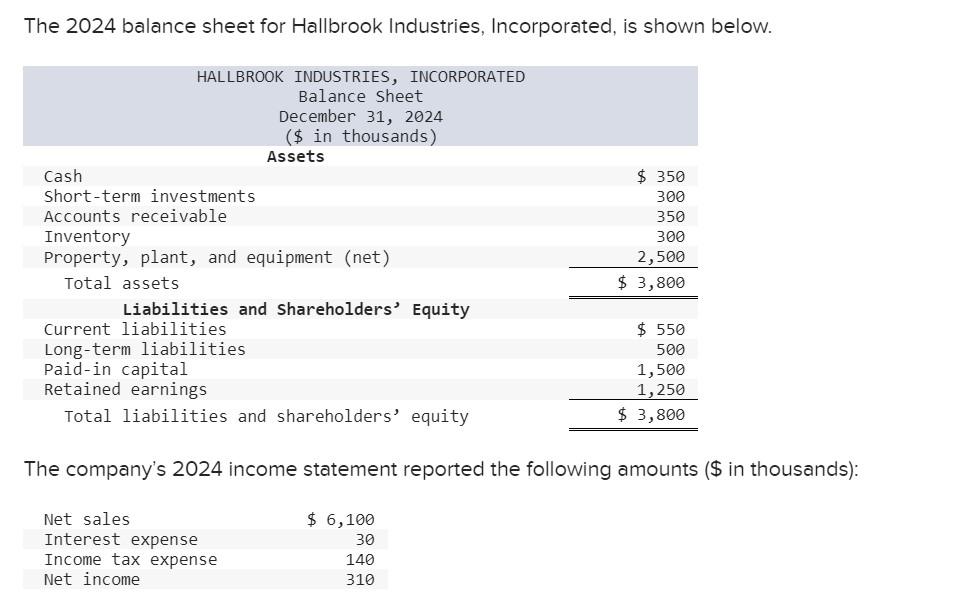

Debt investments short term balance sheet. Return on assets divides a firm's net income by total assets. If the investment is intended to be temporary, it is categorized as a current asset. It is listed under the current liabilities portion of the total liabilities section of a company’s balance sheet.” companies accumulate two kinds of debt, financing, and operations.

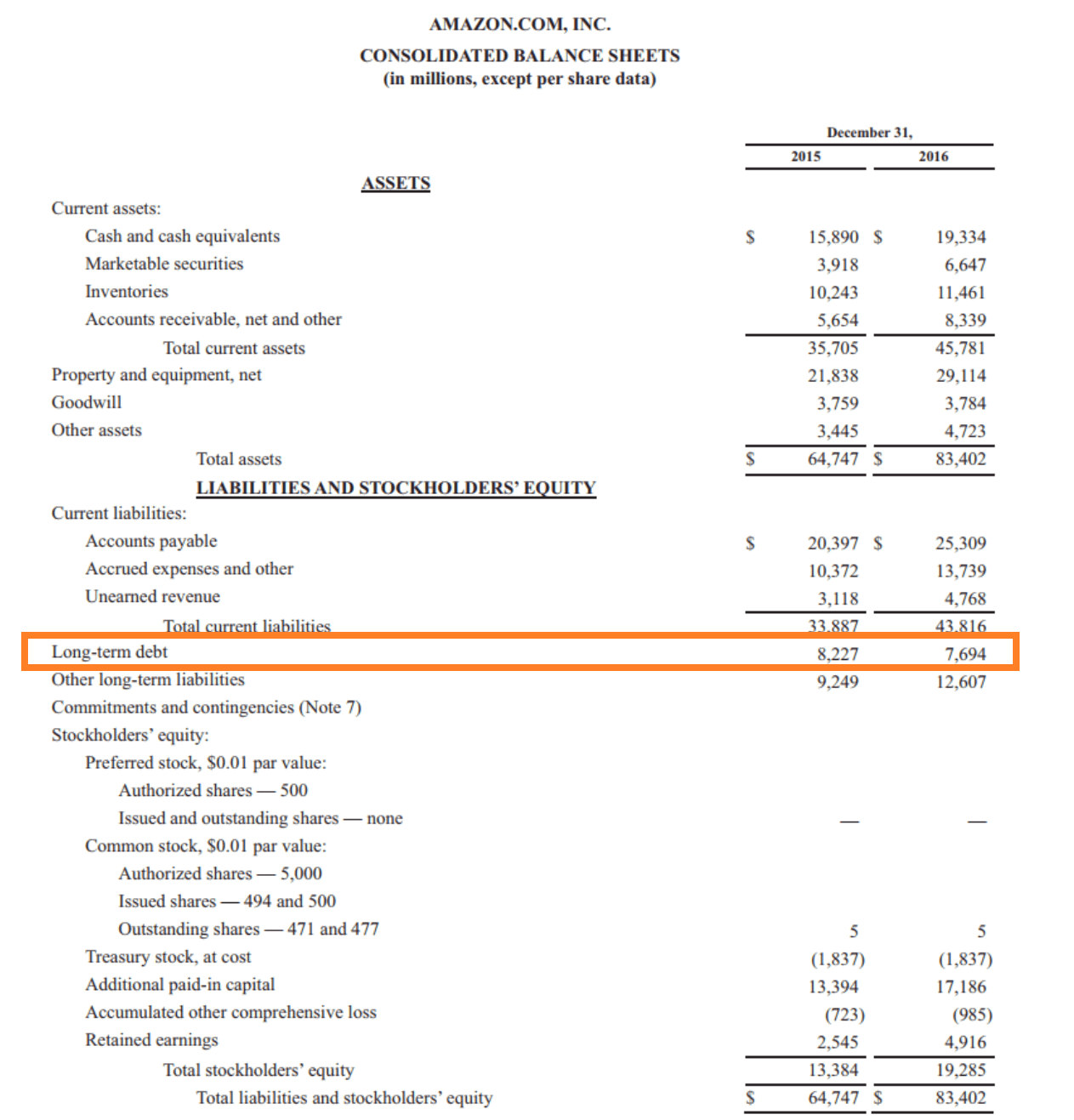

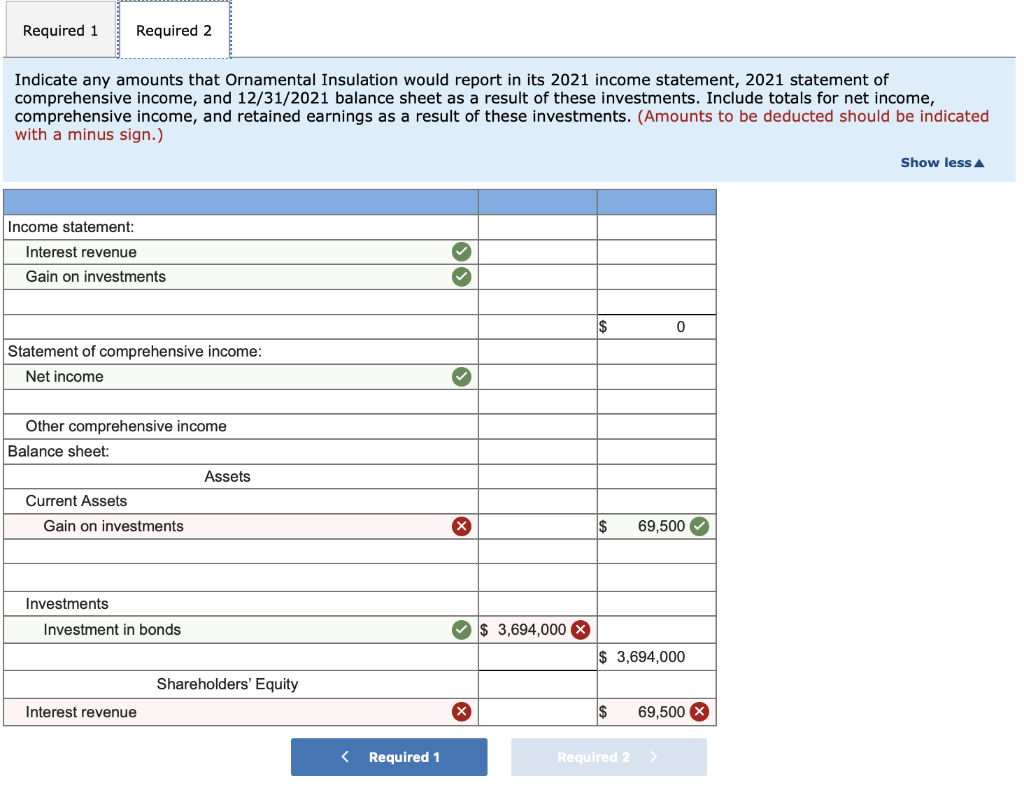

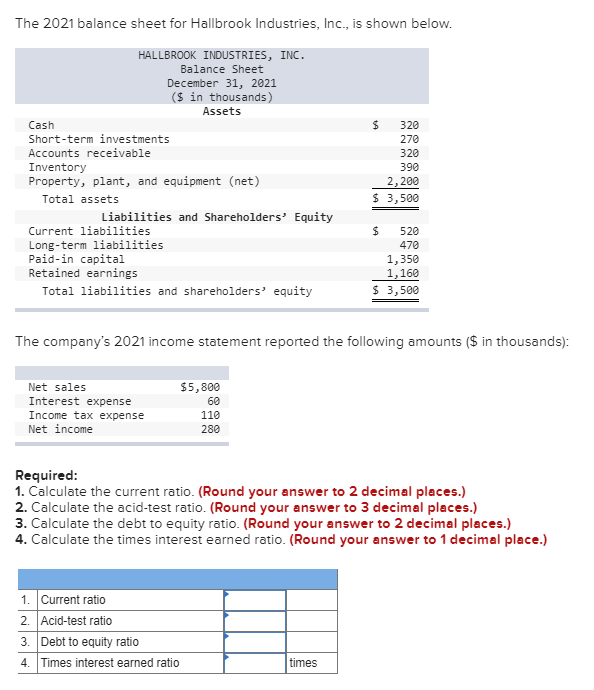

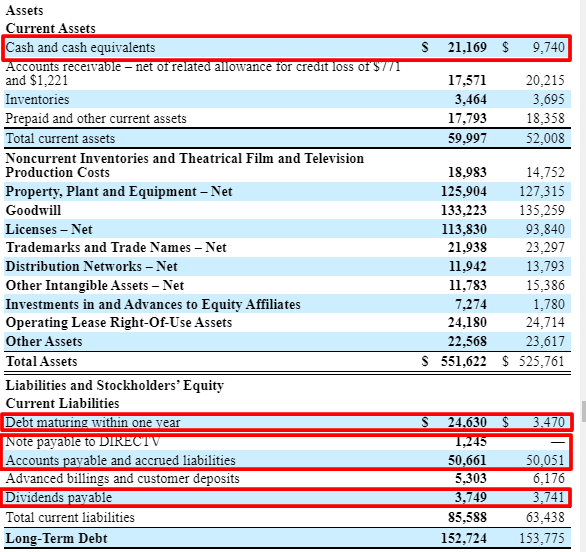

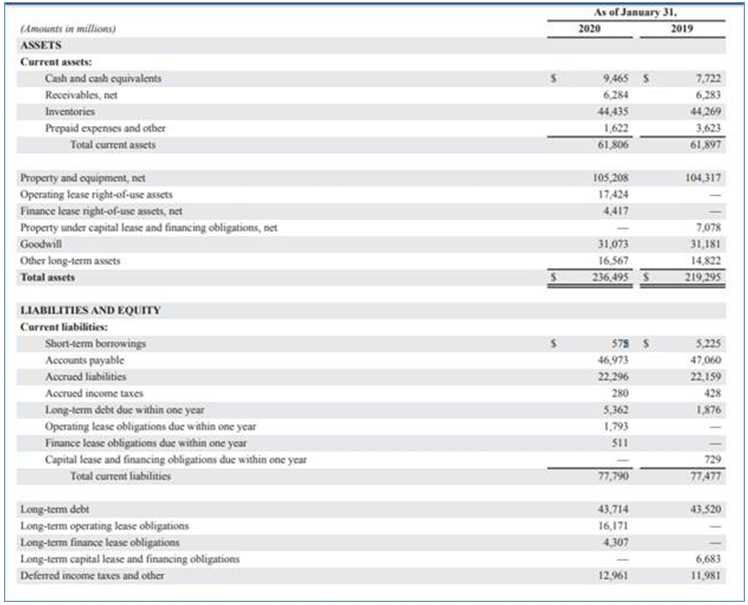

Reporting these investments on the balance sheet depends on management’s intent. First, it can impact a reporting entity's ability to raise funds. 12.3 balance sheet classification — term debt publication date:

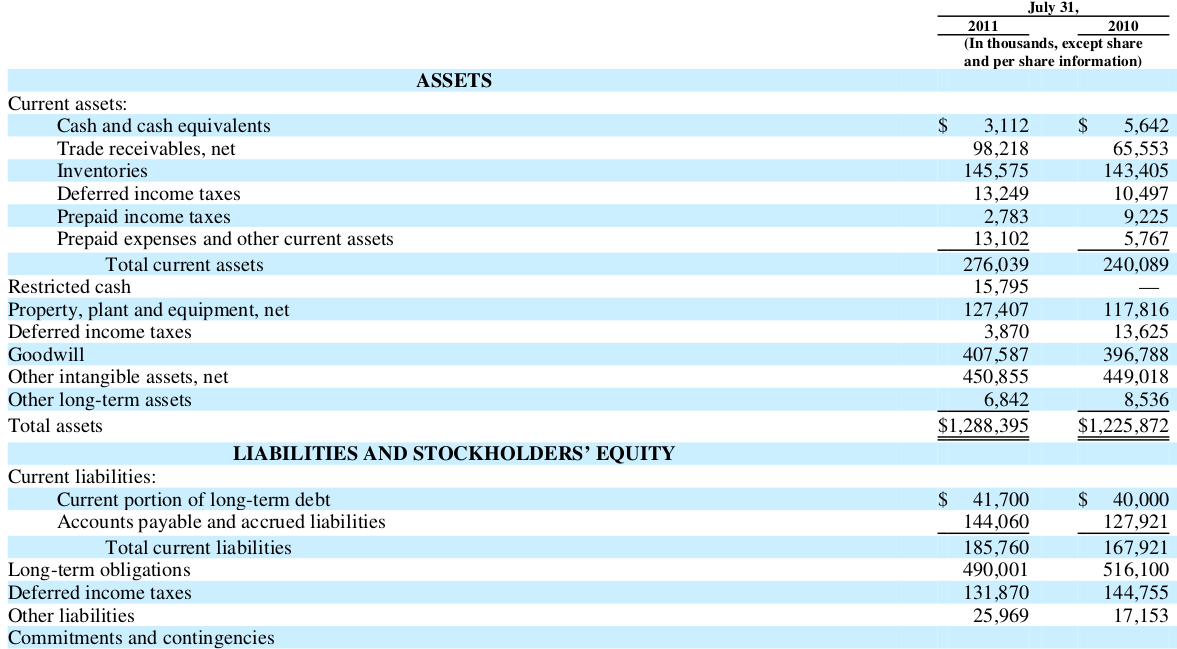

In simple terms, long term debts on a balance sheet are those loans and other liabilities, which are. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. When analyzing a company’s financial position, the balance sheet provides crucial insights into its assets, liabilities, and equity.

To calculate net debt using microsoft excel, find the following information on the company's balance sheet: In a balance sheet, total debt is the sum of money borrowed and is due to be paid. These investments are considered short‐term assets and are revalued at each balance sheet date to their current fair market value.

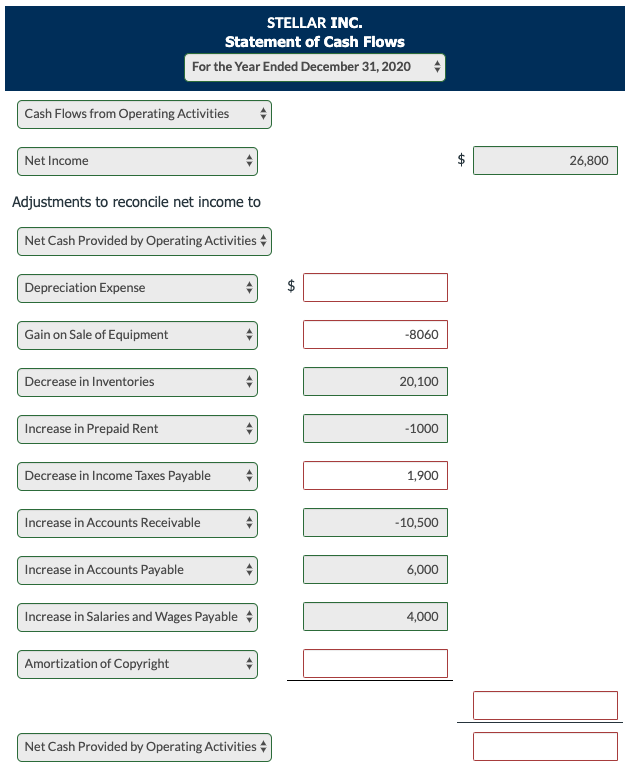

Balance sheet provides a snapshot of a company's assets, liabilities and shareholders equity at a specific point in time. Entities are required to present the individual amounts for the three categories of debt investments either on the face of the balance sheet or in the notes to the financial statements. 31 may 2022 us financial statement presentation guide 12.3 accurate debt classification is important for reasons beyond simply complying with us gaap.

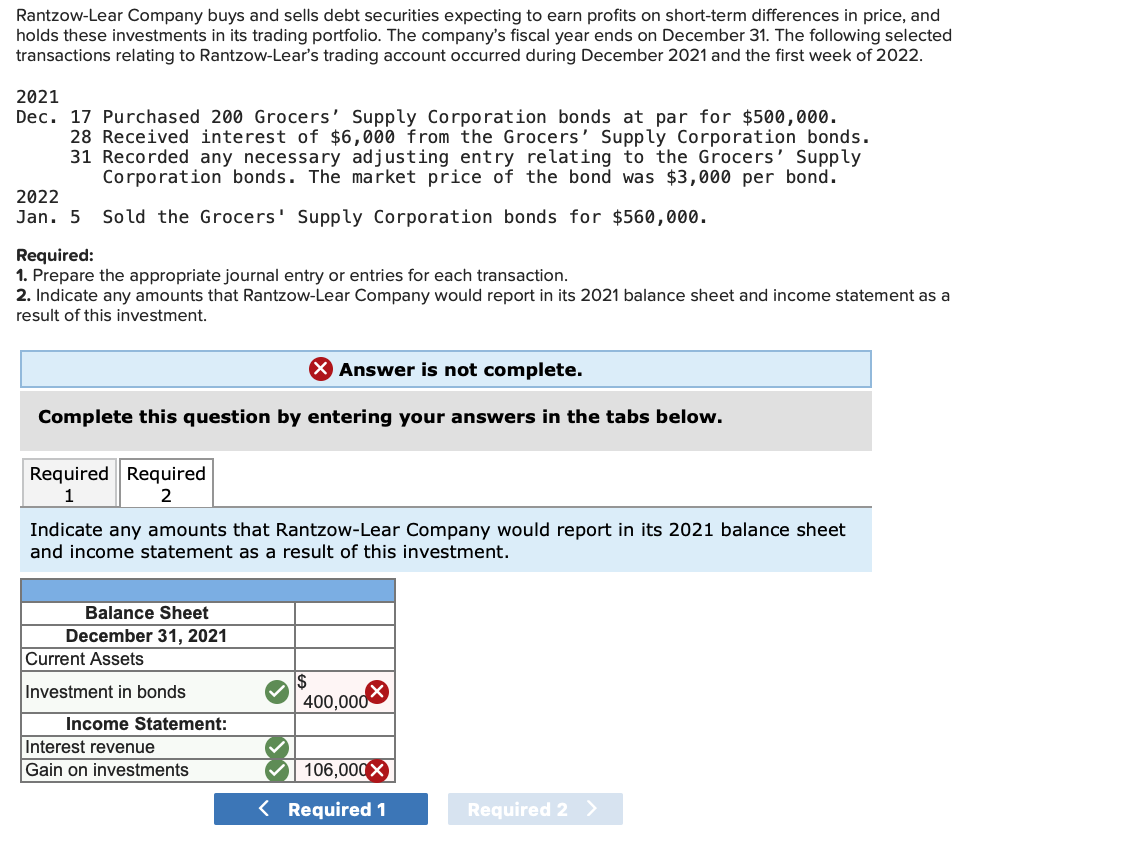

How do companies use debt investments? The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Debt and equity investments classified as trading securities are those which were bought for the purpose of selling them within a short time of their purchase.

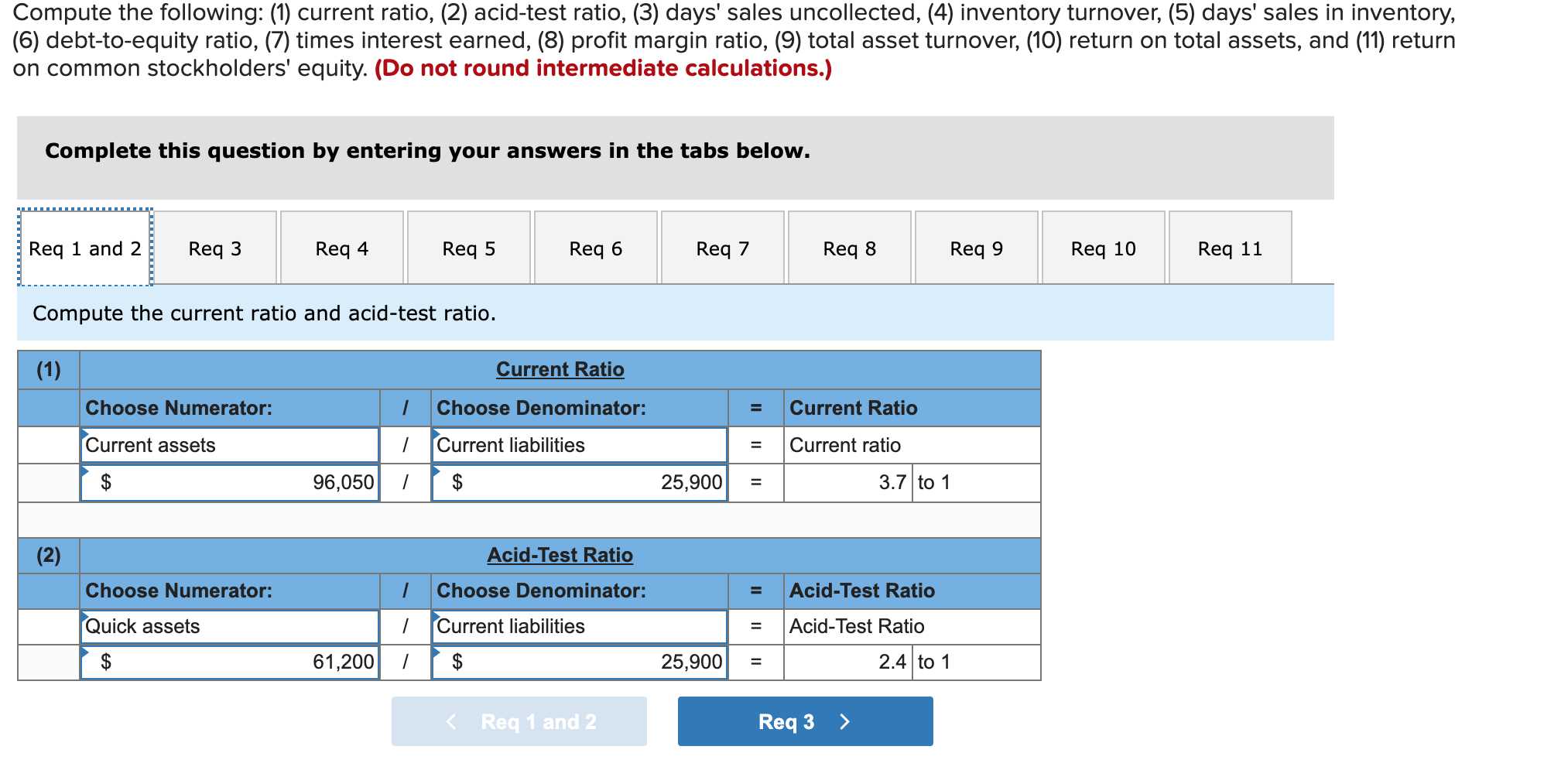

They are financial assets that are expected to be converted into cash within a relatively short period, typically one year or less. The ratios that you can figure out from these valuations are important, too. Two ratios include return on assets (roa) and return on equity (roe).

Short term investments explained. One significant aspect of a balance sheet is debt investments, which are monetary obligations that a company holds to earn a return. Cash flow activities are required to be presented separately for the three categories of debt investments.

Trading debt investments are recognized at their cost on the balance sheet and any fluctuation in their value is simultaneously recognized in income statement. In this article, we will delve into the concept of debt investments on balance sheets, their implications, and their impact on various stakeholders. No, debt investments are not typically classified as current assets on a company’s balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)