Unbelievable Info About Objectives Of Common Size Income Statement

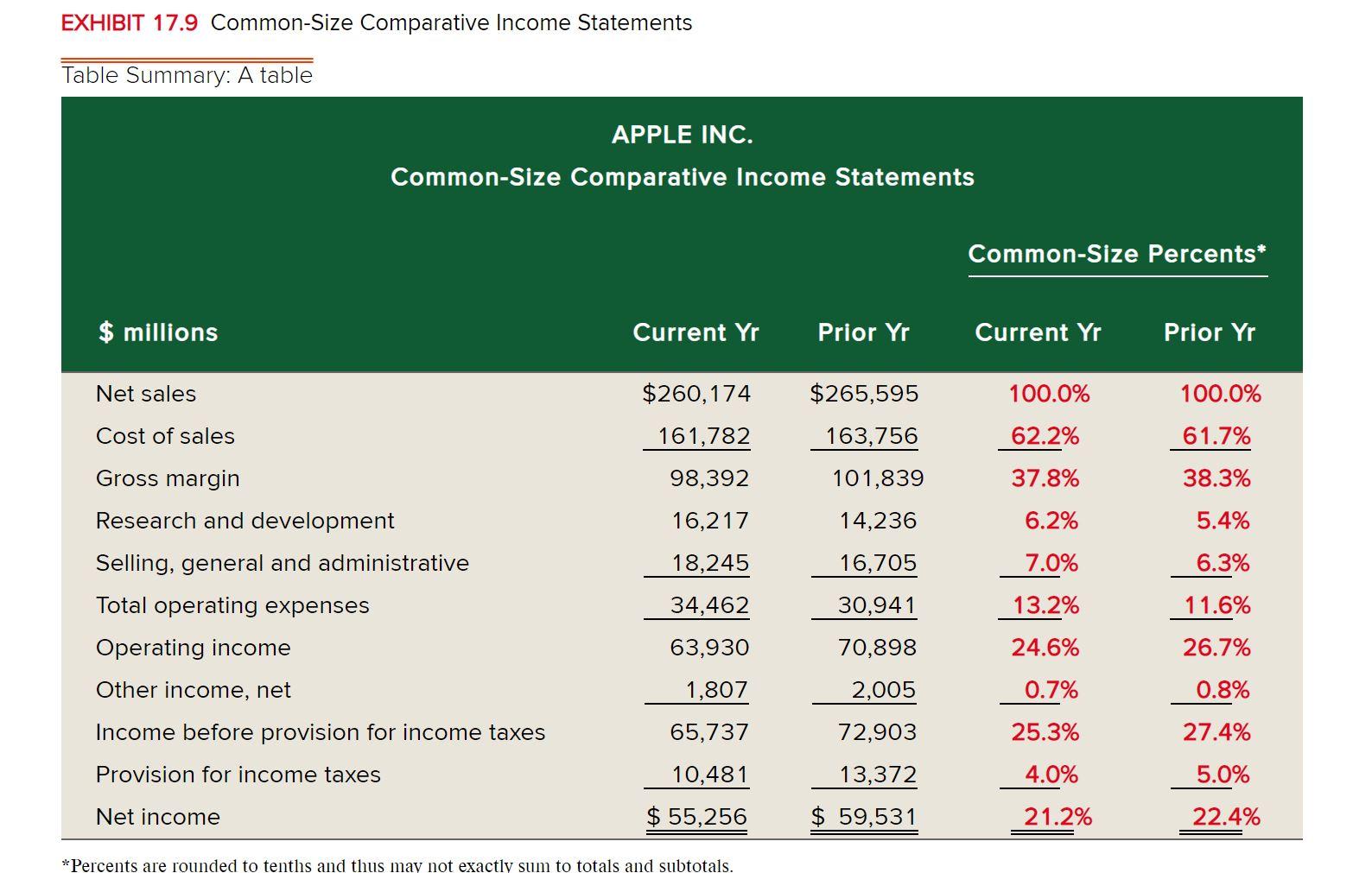

It also allows investors to identify company performance patterns beyond what is presented in the basic income statement.

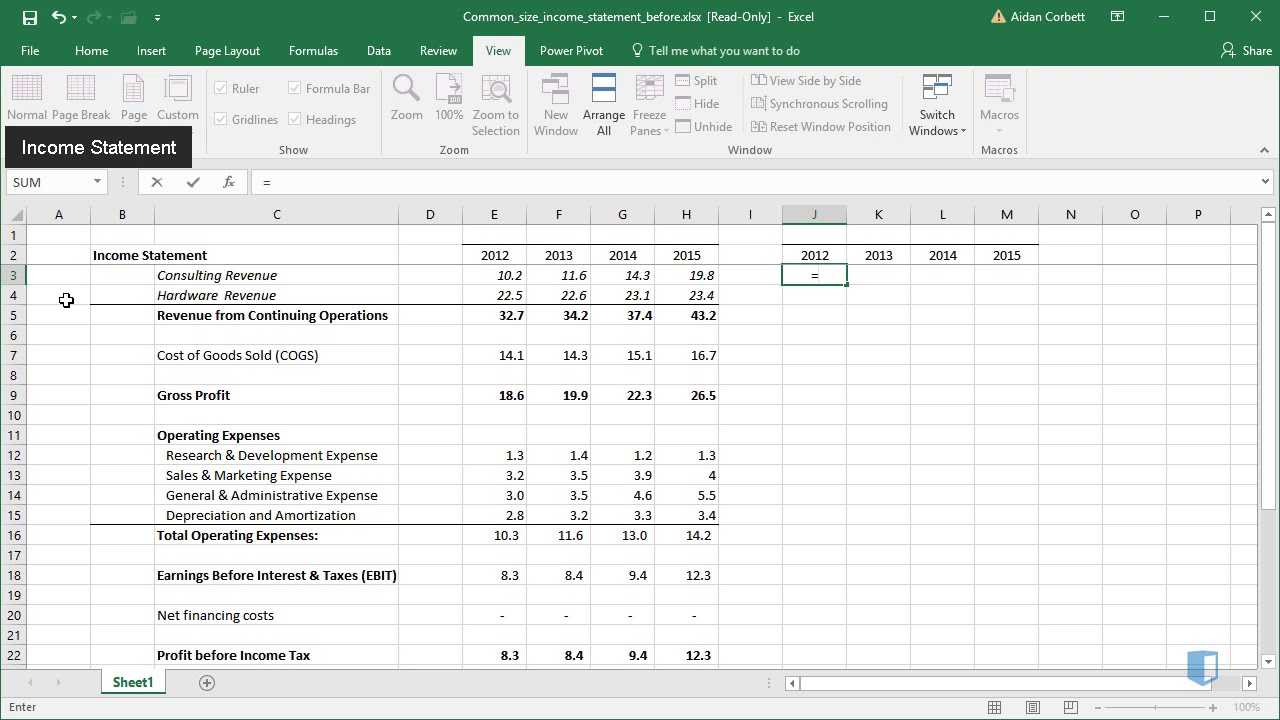

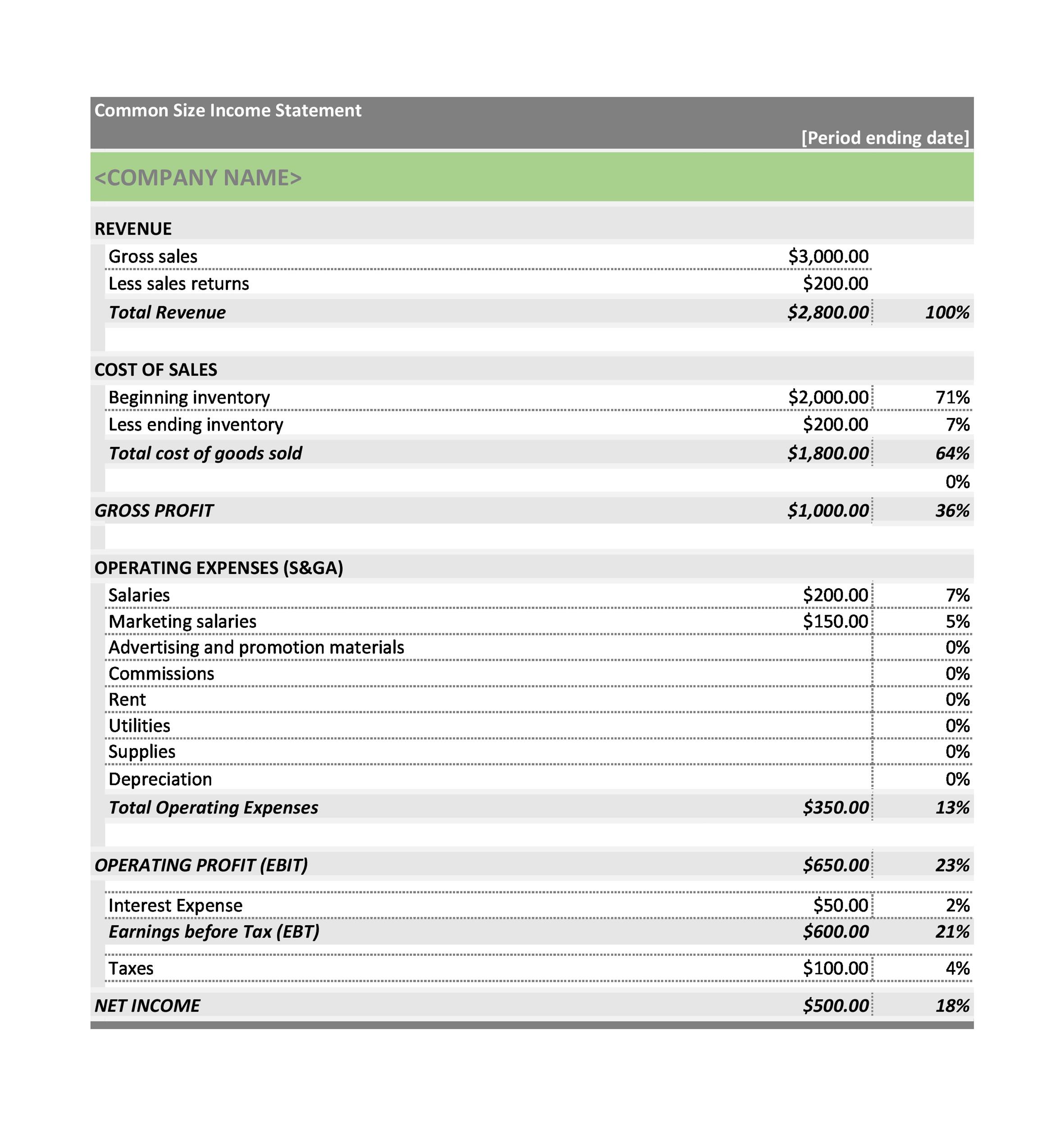

Objectives of common size income statement. A common size income statement is an income statement in which each line item is reported as a percentage of net sales. Let us take the example of walmart inc.’s annual report for the year 2018 to illustrate the computation of a common size income statement. If we only look at the above balance sheet, it doesn’t make much sense.

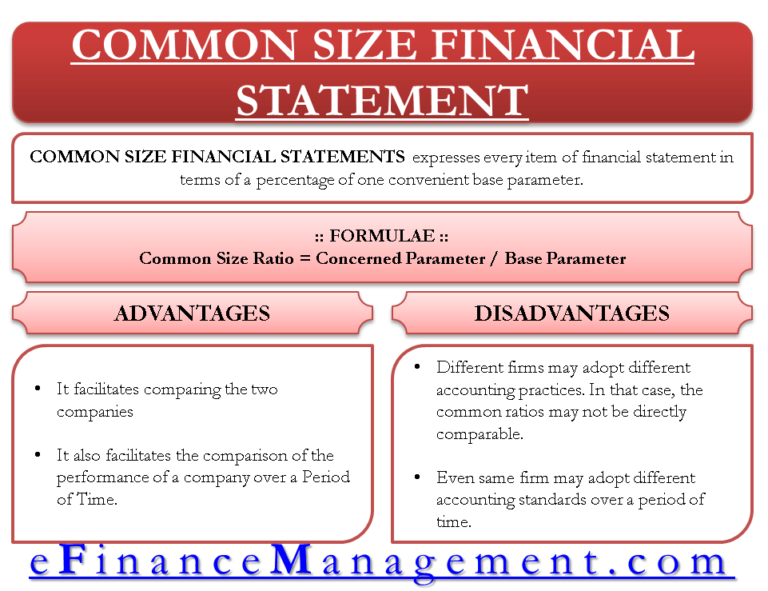

Common size analysis is used to visualize a company's financial performance. Also, comment on the trend witnessed in some of the major cost components during the last three years. Business managers and investors use this type of financial statement to analyze a company’s cost ratios and profit margins—and to compare them to those of other companies.

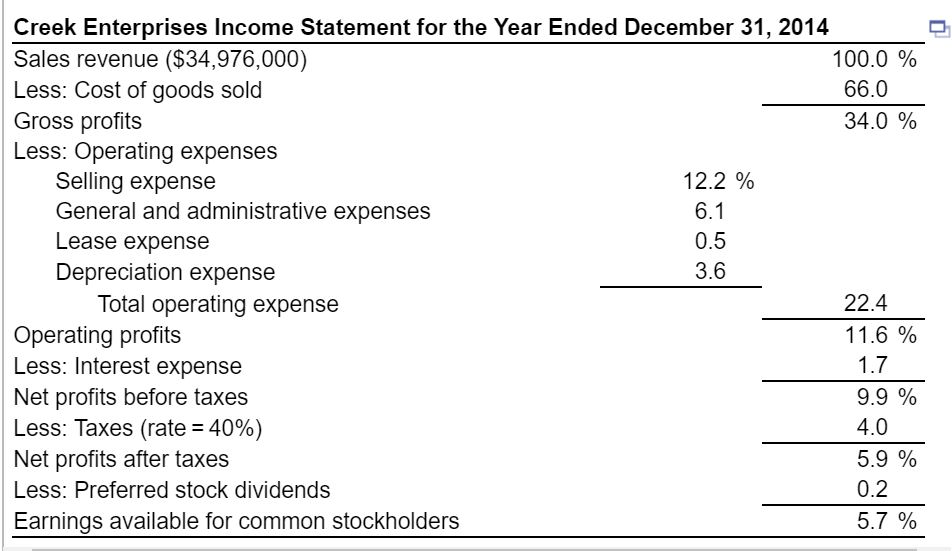

Common size income statement this is one type of common size statement where the sales is taken as the base for all calculations. It presents financial information in a standardized format to better understand the relative proportions of different components and their impact on the company's overall financial health. Use of common size income statement

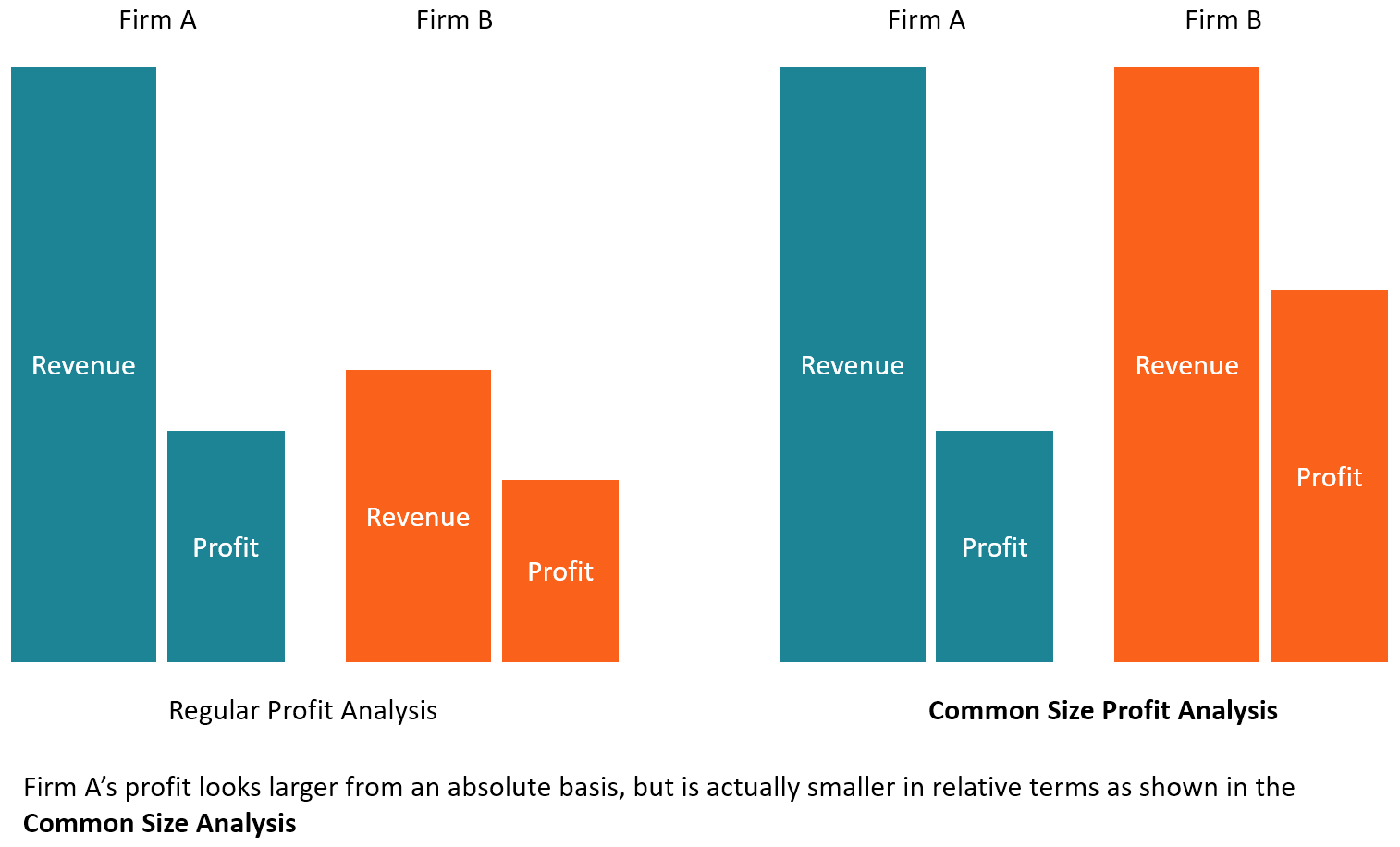

If you just looked at numbers, it might seem like this company did better in 2022. This makes it easier to compare figures from one period to the next, compare departments within an organization, and compare the firm to other companies of any size as well as industry averages. (1) to evaluate information from one period to the next within a company and (2) to evaluate a company relative to its competitors.

Common size analysis evaluates financial statements by expressing each line item as a percentage of a base amount for that period. For each line item on this sample income statement, we've shown the percentage that it makes up of total revenue. Common size financial statements provide analysts the opportunity to compare companies based on different variables.

Common size analysis is applied to the balance sheet, income statement, and cash. A common size financial statement displays items as a percentage of a common base figure, total sales revenue, for example. A common size financial statement is a financial statement or balance sheet that presents itself as a percentage of the base number of sales or assets.

Income statement items are stated as a percent of net sales and balance sheet items are stated as a percent of total assets (or total liabilities and shareholders’ equity). What is a common size income statement? Objectives of common size income statement.

Therefore, the calculation of each line item will take into account the sales as a base, and each item will be expressed as a percentage of the sales. It is also prepared to study the trend in different items of incomes and. A common size income statement is a quick and handy way of understanding each line item’s relationship to the top line.

The formula for common size analysis is the amount of the line item divided by the amount of the base item. This arrangement is used to examine changes in the percentages from period to period for financial analysis purposes. The actual numbers may be reported adjacent to the percentages.

A common size income statement is an income statement in which each line item is expressed as a percentage of the value of revenue or sales. The common size income statement is a valuable tool for analysts to understand how a company’s performance has changed over time. A common size income statement occurs when every line item on the income statement is shown as a percentage of sales.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)