Out Of This World Tips About Objectives Of Cash Budget

Let us understand the intent behind using a cash budget systemin the daily operations of an organization through the discussion below.

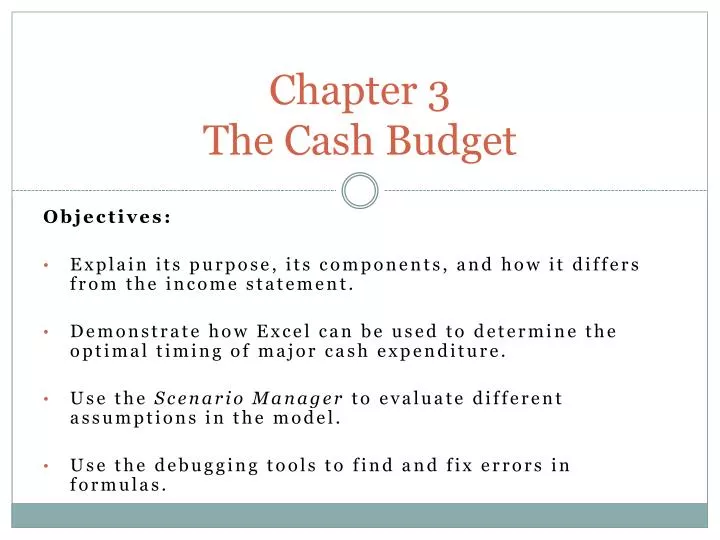

Objectives of cash budget. The cash budget is an estimate of cash receipts and their payment during a future period of time. They show the expected inflows and outflows of cash through the company. This is where cash budgets become.

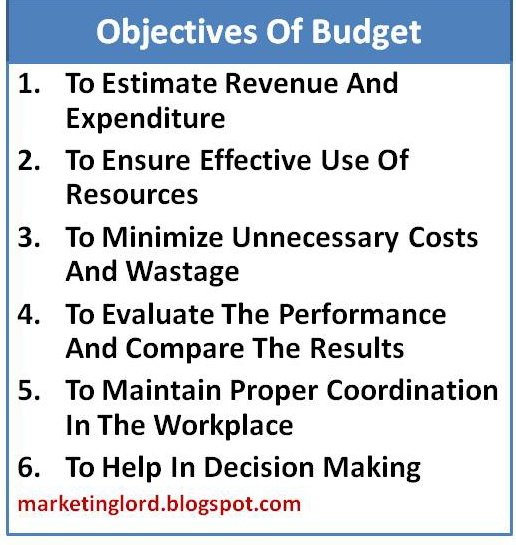

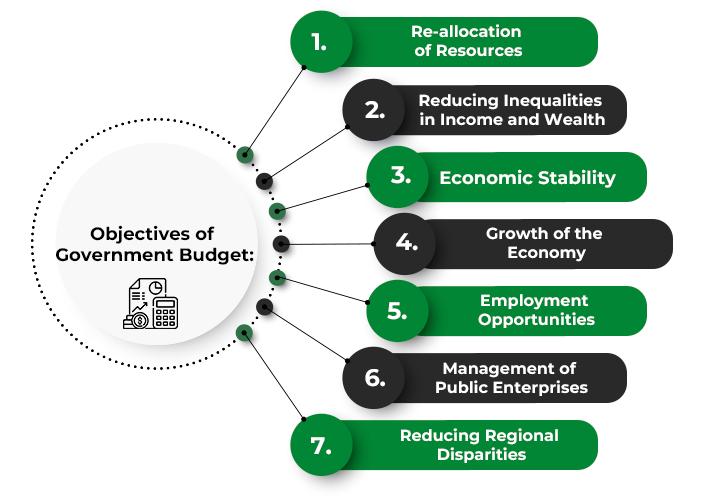

It deals with other budgets such as. A budget is a comprehensive and coordinated plan, expressed in financial terms, for the operations and resources of an enterprise for some specific period in the. Objectives of cash budget / uses of cash budget objectives of a cash budget are to:

The objective of cash budget is to forecast future cash balances, to predict potential deficits and surpluses. What is the main objective of a cash budget? Cash budgets are vital to the management of cash.

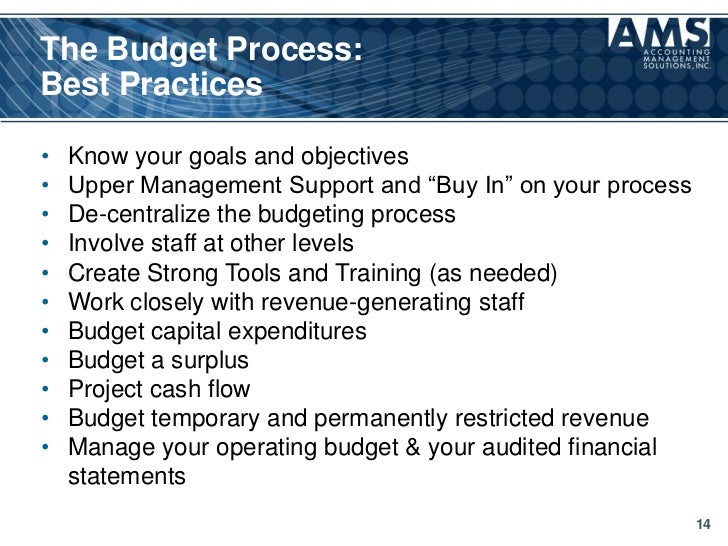

Importance or objectives of cash budgets besides sales budget, the cash budgets are also of greatest concern. (with meaning) definitions of budget and budgeting definitions of budgetary control objectives of budget objectives of. The following points depict its importance, which are also the.

4 methods of preparing cash budget. The greater the amount of cash. Table of contents methods of preparing cash budget faqs three methods of preparing a cash.

(i) to measure whether there are likely to be cash shortages or cash surplus and allow. The primary purpose in preparing a cash budget is to know the cash position at the end of each month or quarter. The primary objective of the cash budget is to see the future cash position of the business so that the management can evaluate when the funds are required to be.

16 november 2023 in business, managing finances effectively is not just about knowing your numbers but also about planning for the future. Updated on february 11, 2024 fact checked why trust finance strategists? 1 why are cash budgets prepared?

Explain the cash budget’s value in clarifying risks and opportunities. Discuss the use of a cash budget as a cash management tool. 3 utility of cash budget;

Cash budgeting involves calculating cash inflows and outflows to determine the cash you aim to have in the bank at the end of each fiscal period. They help to show cash surpluses and cash. Based on the forecasted balances, finance.

The objectives of budgeting are to provide structure to the planning process, predict cash flows, allocate resources, model scenarios, and measure outcomes. Increased financial awareness one of the key advantages of maintaining a cash budget is the heightened awareness it brings to your financial situation. This is because the company can decide on any financing.

![[Class 12 Economics] What is called government budget? Teachoo](https://d1avenlh0i1xmr.cloudfront.net/medium/a1bfbe23-e75d-49c7-b67e-0fa3c6f72fe5/what-are-objectives-of-budget---teachoo.jpg)