Casual Info About Interest Balance Sheet

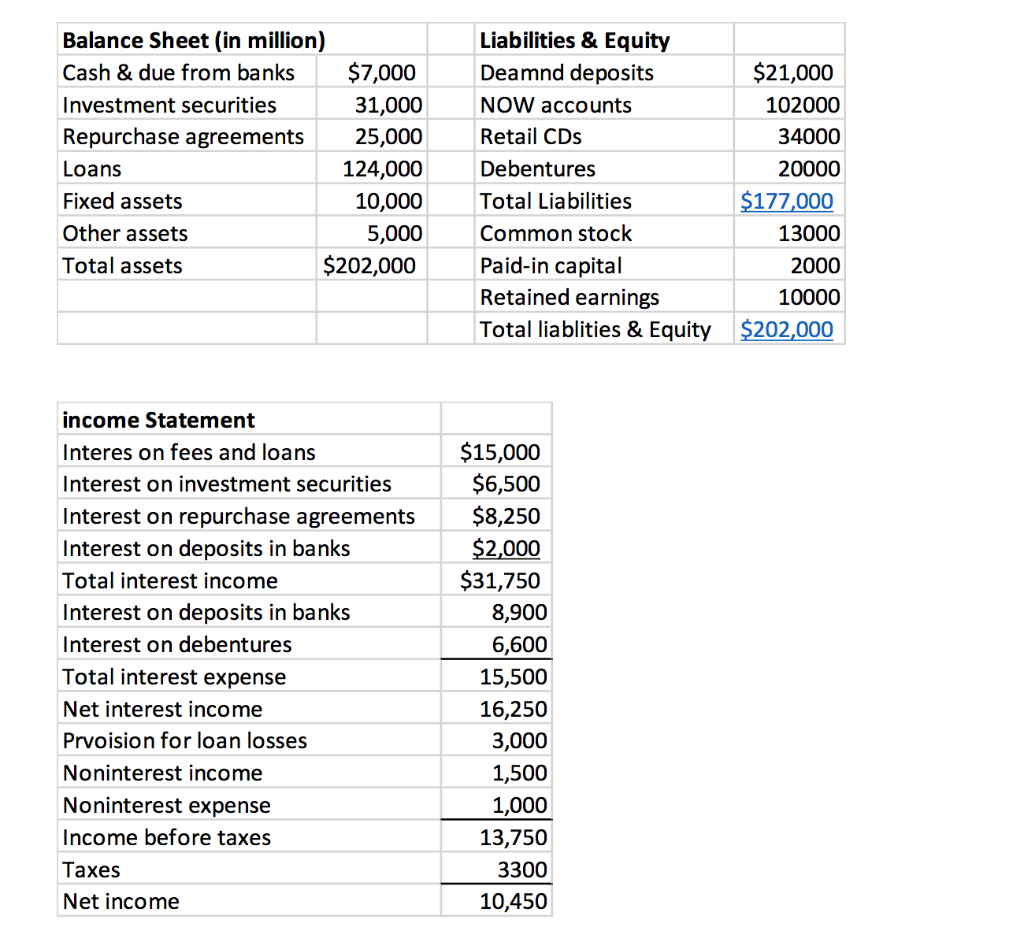

Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet.

Interest balance sheet. The balance sheet displays the company’s total assets and how the assets are. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. How you create an accrued interest journal entry depends on whether you’re the borrower or lender.

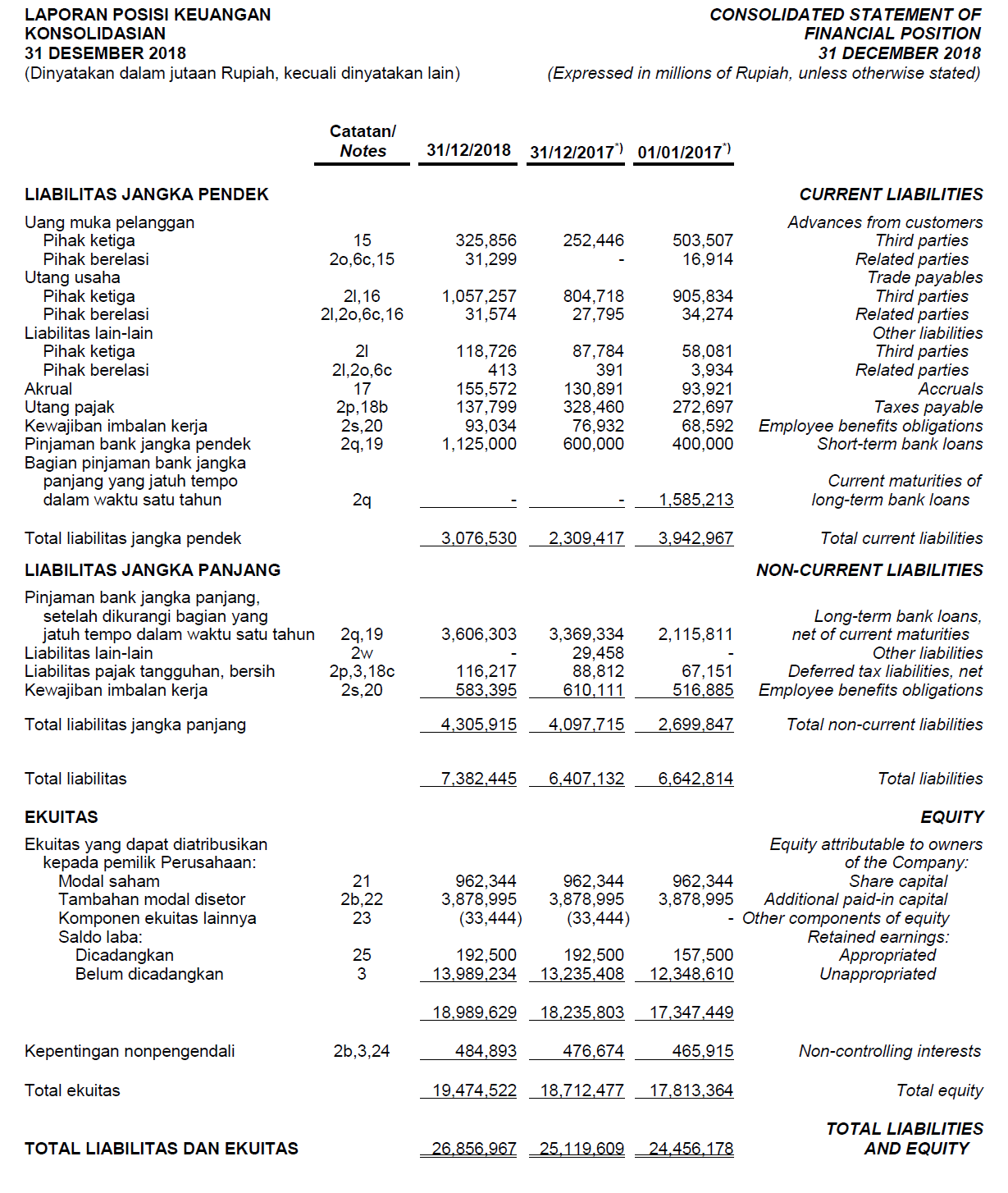

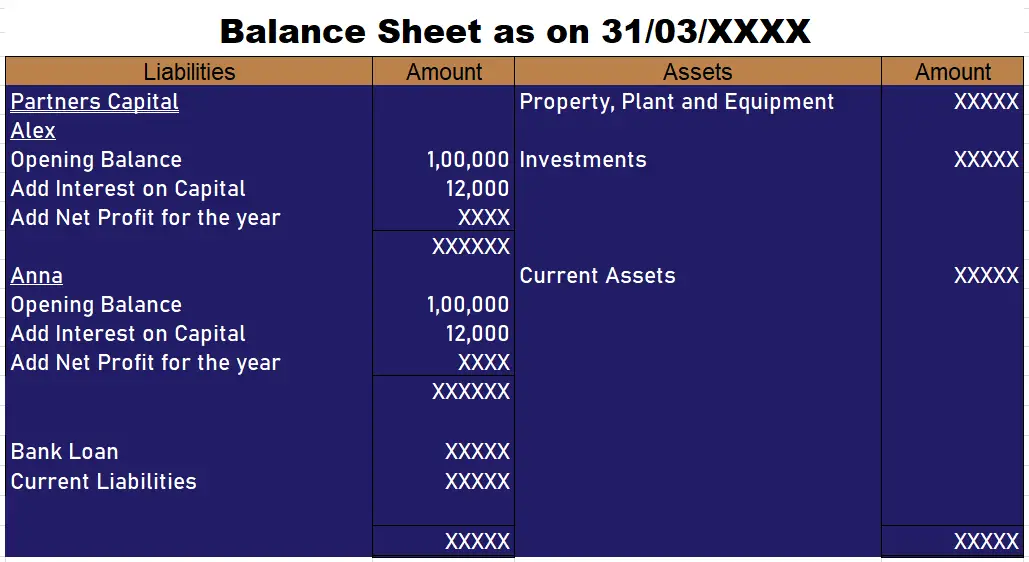

The bank of canada could wind down its quantitative tightening program as soon as april and will most likely do so no later than june, an economist at the royal bank of canada predicted in a report this week. When a parent company (“parent co.”) owns at least 50% of another company (“sub co.”), the noncontrolling interest represents the portion the parent does not own:. A balance sheet should always balance.

The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity. If a firm has to pay interest associated with a business debt account, this figure is also registered on the balance sheet. Balance sheet the minutes indicated some officials said it may be appropriate to start slowing the pace of the balance sheet runoff, a process known as quantitative tightening.

The program, through which the central bank reduces assets on its balance sheet, is a form of monetary tightening that. Unlike an interest expense incurred for any other purpose, capitalized interest is not expensed. What is a balance sheet?

The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. That $95 billion pace is nearly double the peak rate of $50 billion the last time the fed trimmed its balance sheet, from 2017 to 2019. On the december 2011 balance sheet, the $10,200 that is principal due in the next 12 months will be the loan payable, current portion.

Learn how balance transfer credit cards can help you manage debt and save on interest costs. The runoff of the bond portfolio has brought the total size. Interest payable is a liability account, shown on a company’s balance sheet, which represents the amount of interest expense that has accrued to date but has not been paid as of the date on the balance sheet.

Interest income is the amount paid to an entity for lending its money or letting another entity use its funds. For lenders, accrued interest is: The calculation that is carried out includes the retained earnings, as well as dividends.

Get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. Warning future interest payments are not included on the.

Assets must always equal liabilities plus owners’ equity. This financial statement is used both internally and externally to determine the so. To forecast interest expense in a financial model, the standard convention is to calculate the amount based on the average between the beginning and ending debt balances from the balance sheet.

Lenders list accrued interest as revenue and current asset, respectively. Since no interest is payable on december 31, 2022, this balance sheet will not report a liability for. Where is interest expense on the balance sheet?

/what-is-minority-interest-balance-sheet-5954948e3df78cdc29e922b2.jpg)