Can’t-Miss Takeaways Of Tips About Ifrs Balance Sheet Order

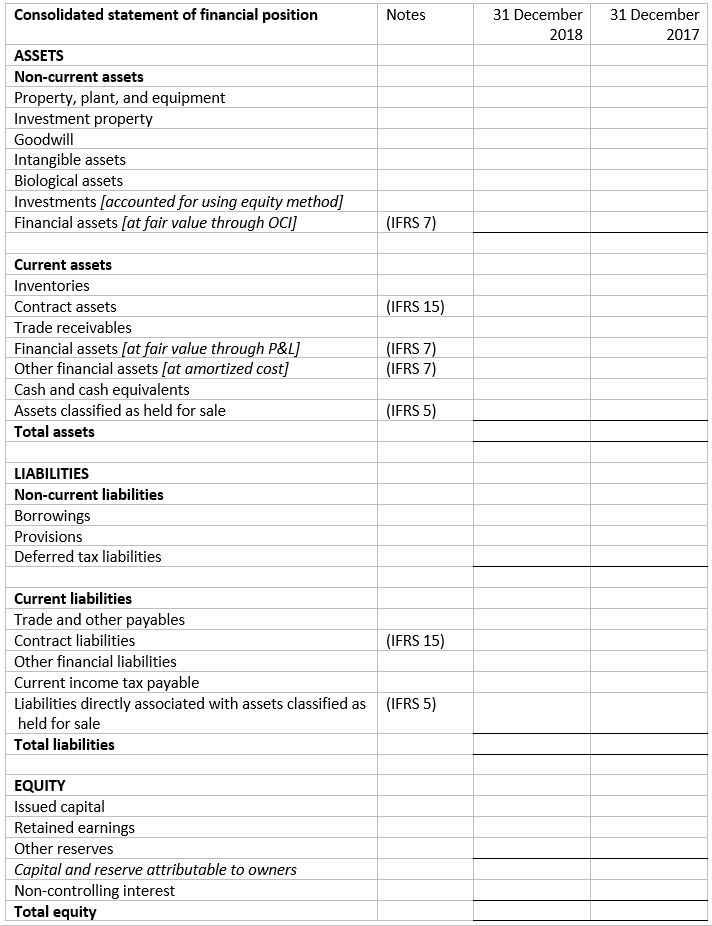

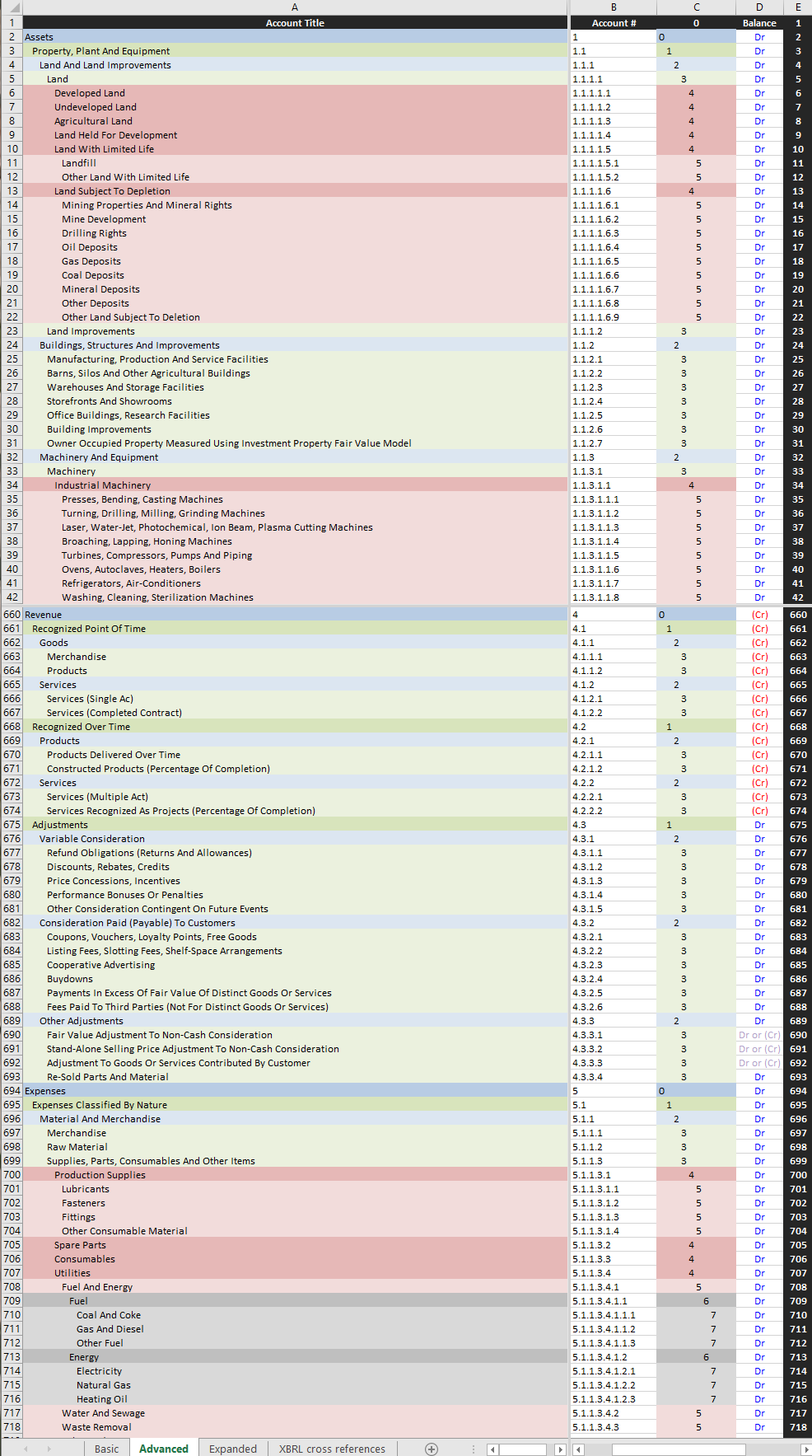

One of the features of this ifrs is that it includes guidelines for the structure and content of financial statements, including information about the statement of profit or loss and other comprehensive income (p&l and oci) and the statement of financial position (balance sheet).

Ifrs balance sheet order. Companion guide to the prudential ifrs 17 briefing this guide supports the ifrs 17 briefing by: Under us gaap, assets are listed in decreasing order of liquidity; Net cash € 10.7 billion.

Dividend of € 1.80 per share; Ifrs 1 sets out the procedures that an entity must follow when it adopts ifrss for the first time as the basis for preparing its general purpose financial statements. Ias 1 serves as the main standard that outlines the general requirements for presenting financial statements.

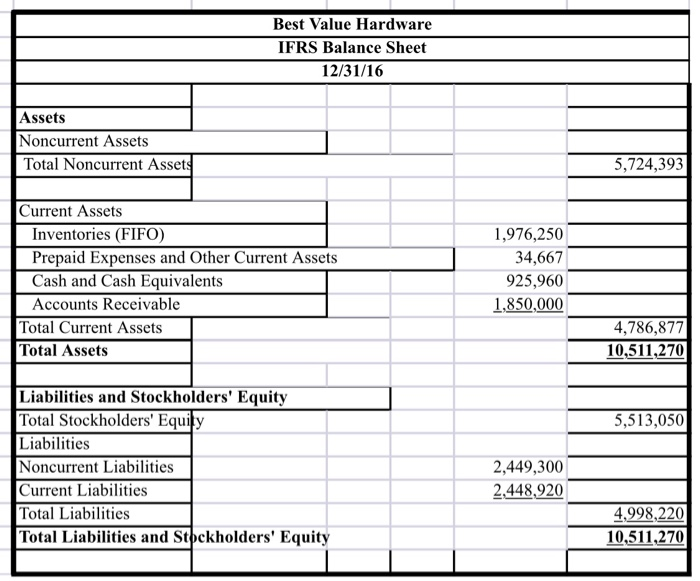

Dsos were up at 141 days. Under ifrs, balance sheets are presented fixed assets first, while us gaap reports start with cash. Ias 1 sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content.

Our guides to financial statements help you to prepare financial statements in accordance with ifrs accounting standards. Looking at the balance sheet, we ended the quarter with leverage of 1.6x net debt to ebitda. Balance sheet us gaap lists assets in decreasing order of liquidity (i.e.

Special dividend of € 1.00 per share. One of the key differences between gaap vs ifrs balance sheet is the listing order of assets. It requires an entity to present a complete set of financial statements at least annually, with comparative amounts.

The balance sheet of a firm records the monetary value of the assets owned by that firm. This document provides an example of how such statements might look like for the year ended 31 december 2018. Ability to work on own initiative, prioritise work to deadlines and pay attention to detail.

Assist with the annual budgeting process. 15.2.1 balance sheet—offsetting assets and liabilities. Gaap addresses such things as revenue recognition, balance sheet, item classification, and outstanding share measurements.

In accounting and finance, equity is the residual claim or interest of the most junior class of investors in. Making the most of what’s presented in financial statements Here are four key differences between gaap and ifrs.

Free cash flow before m&a and customer financing € 4.4 billion; Under ifrs, balance sheets are presented fixed assets first, while us gaap reports start with cash. It is applicable to ‘general purpose financial statements’, which are designed to meet the informational needs of users who cannot demand customised reports from an entity.

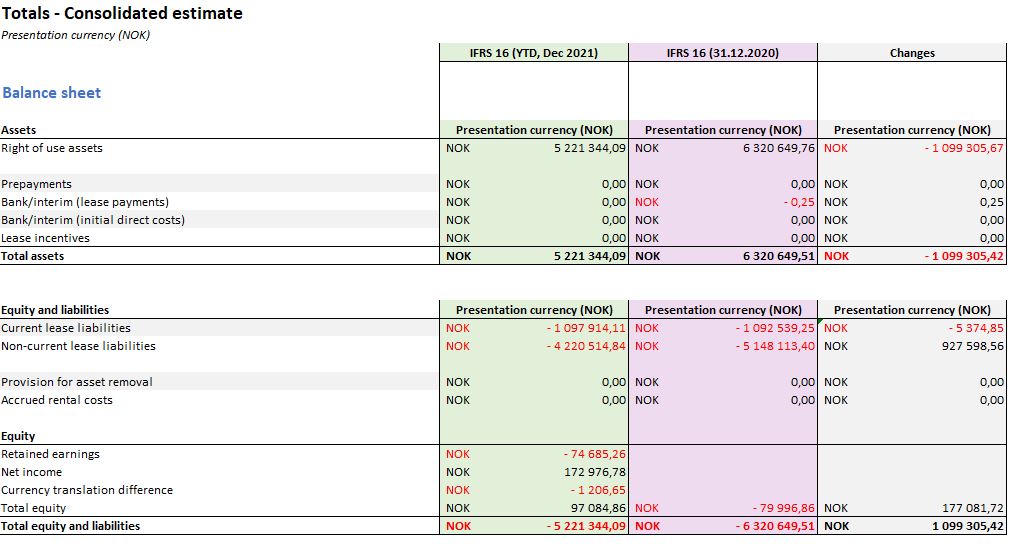

The way a balance sheet is formatted is different in the us than in other countries. Consolidated statement of profit or loss 5 consolidated statement of comprehensive income 7 consolidated statement of financial position 8 consolidated statement of changes in equity 10 consolidated statement of cash flows 11 notes to the ifrs example consolidated 12 financial statements Quarterly balance sheet reconciliation.