Wonderful Tips About Intercompany Transactions Consolidated Financial Statements

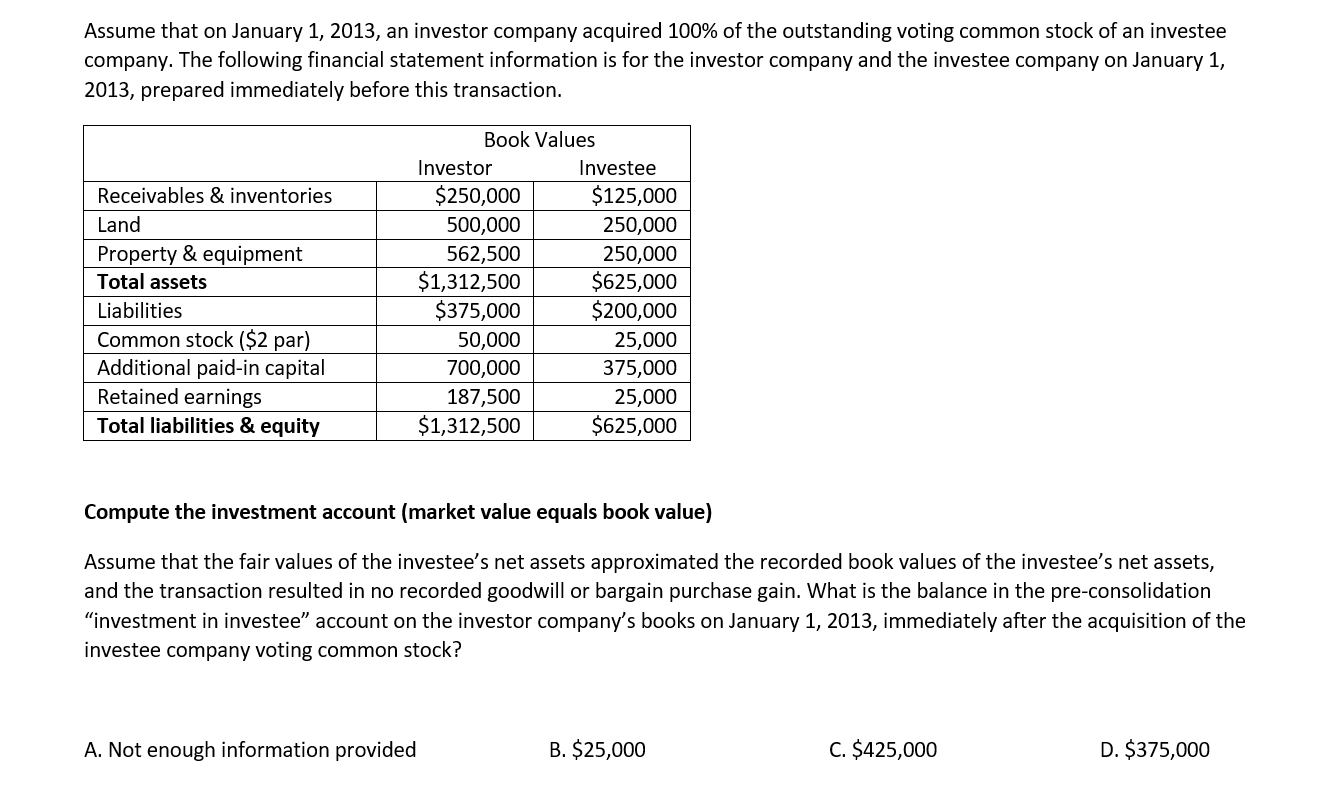

A transaction with an investee (including a joint venture investee) that is accounted for as a deconsolidation of a subsidiary or a derecognition of a group of assets in accordance.

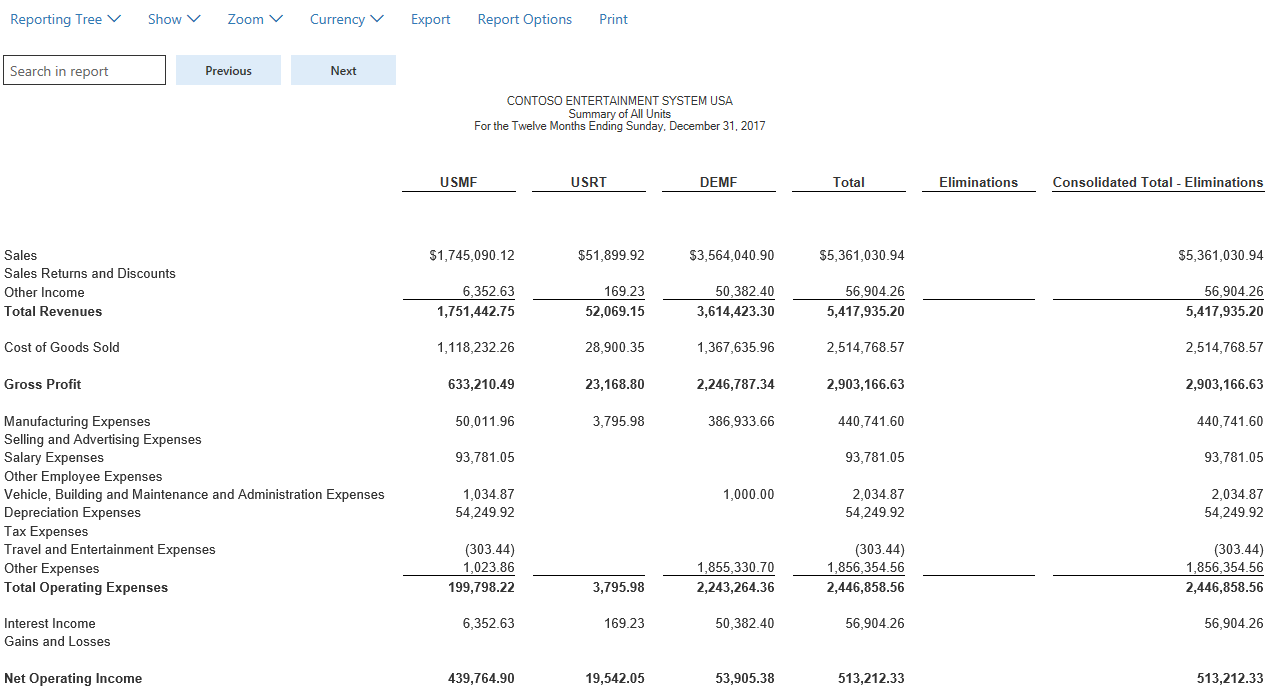

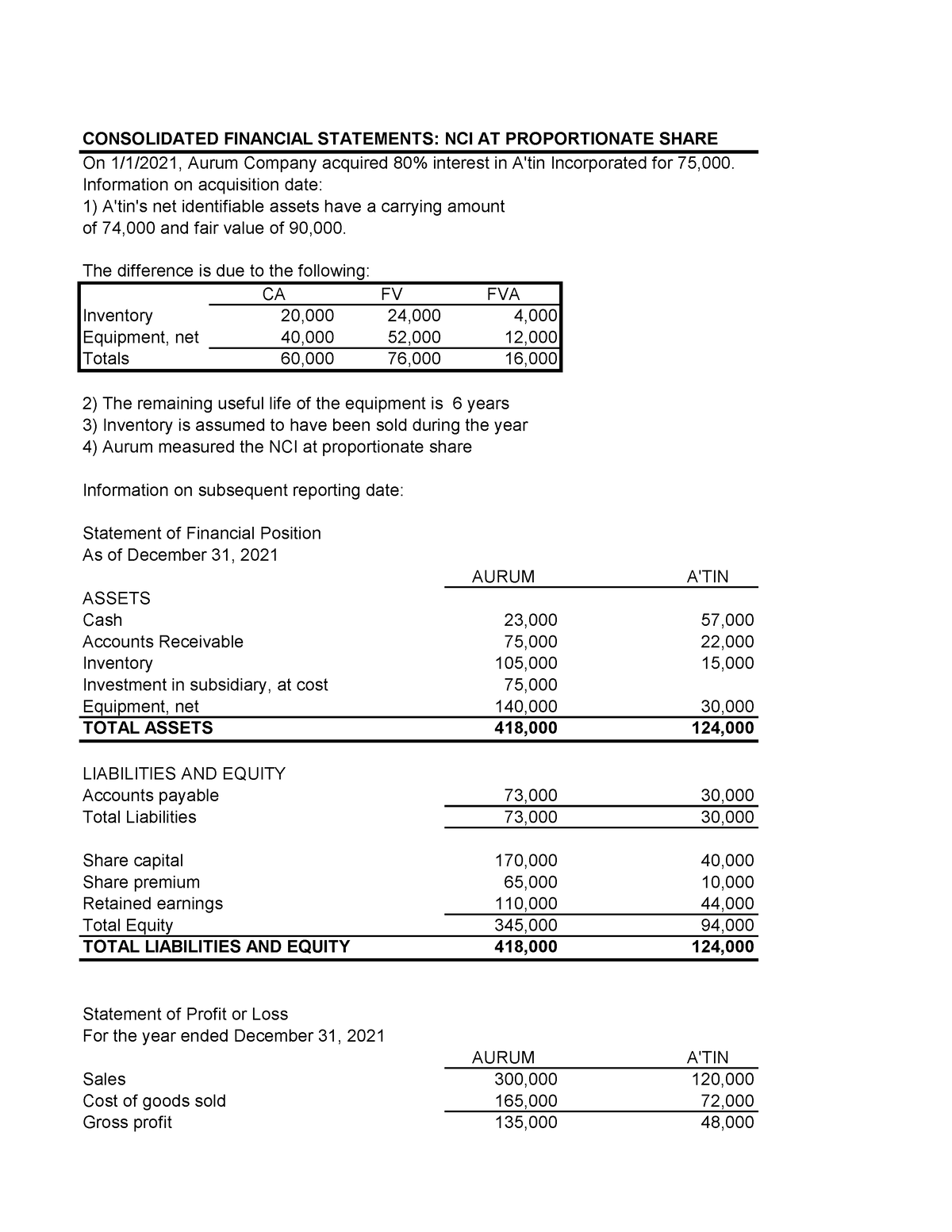

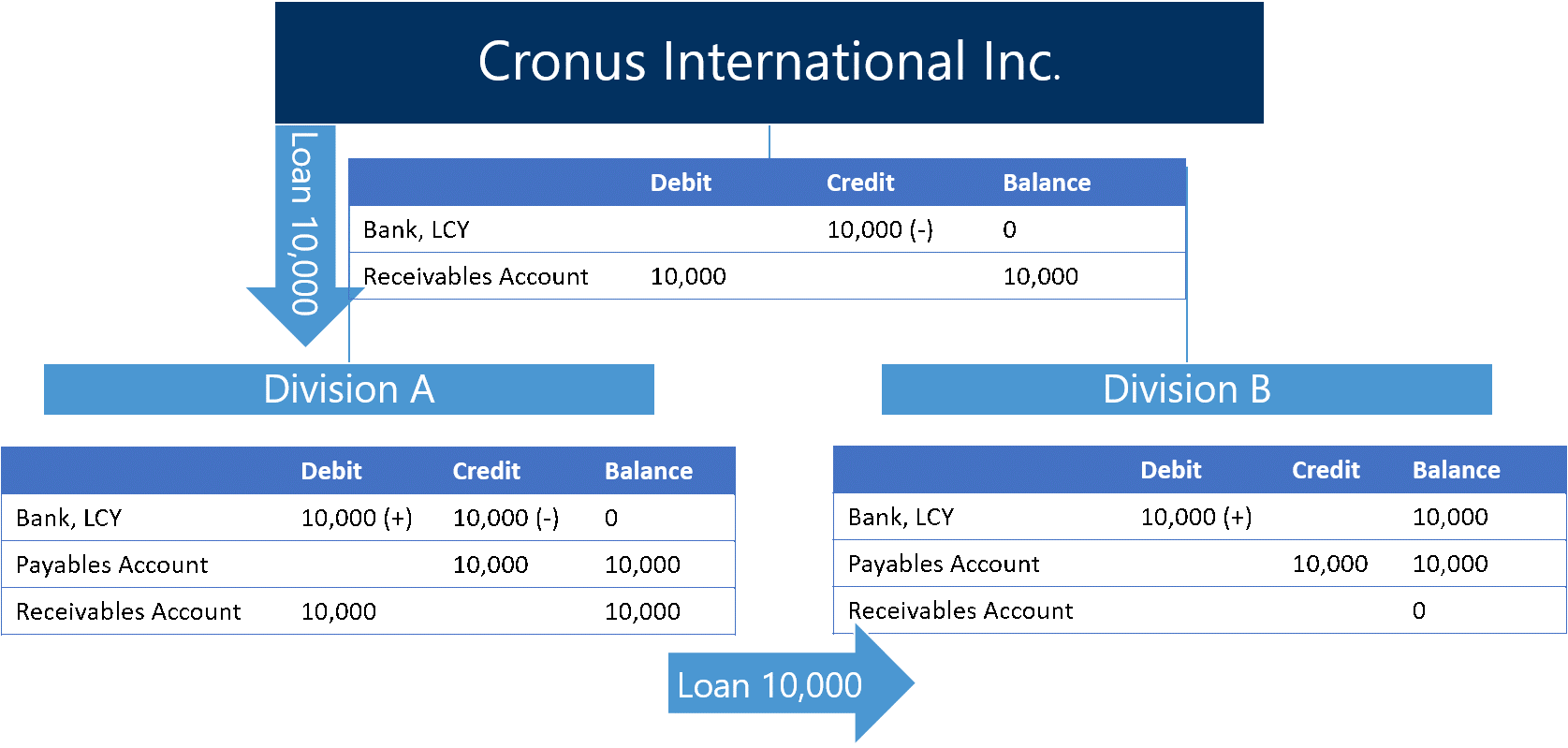

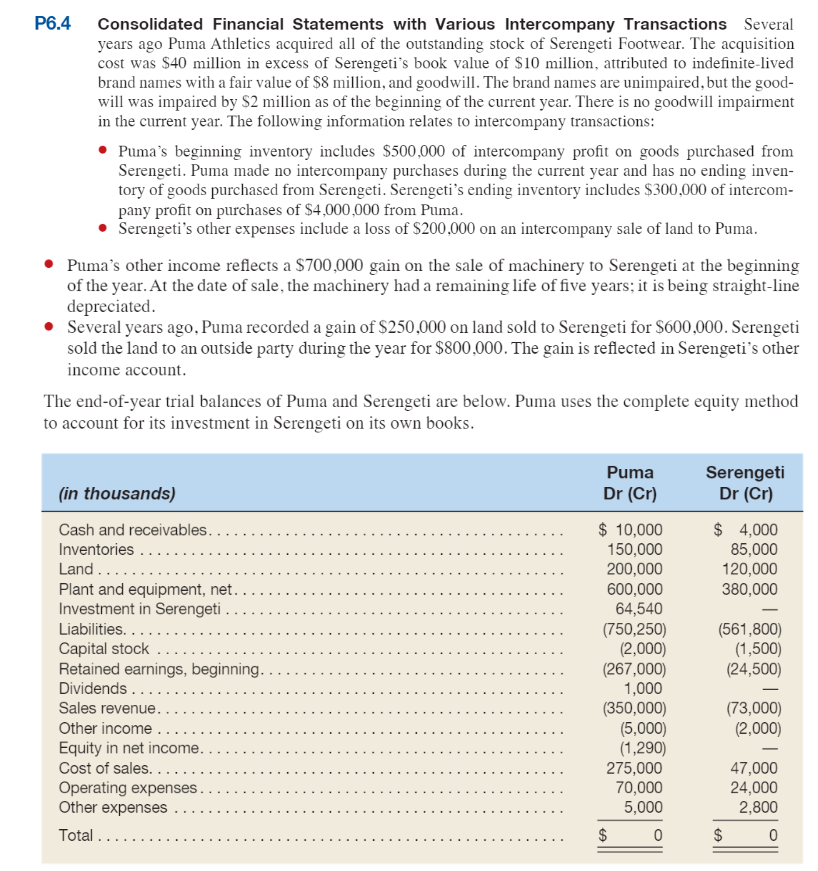

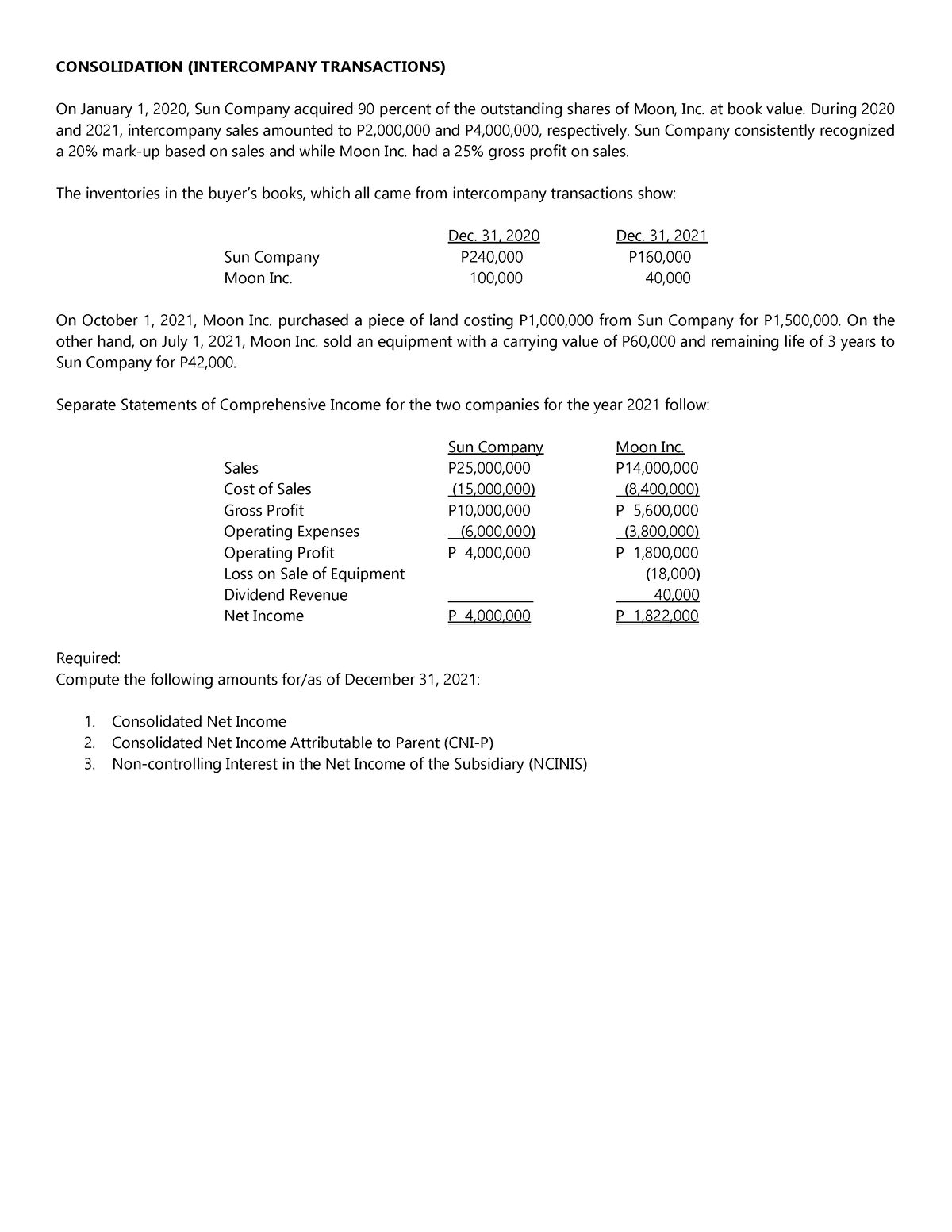

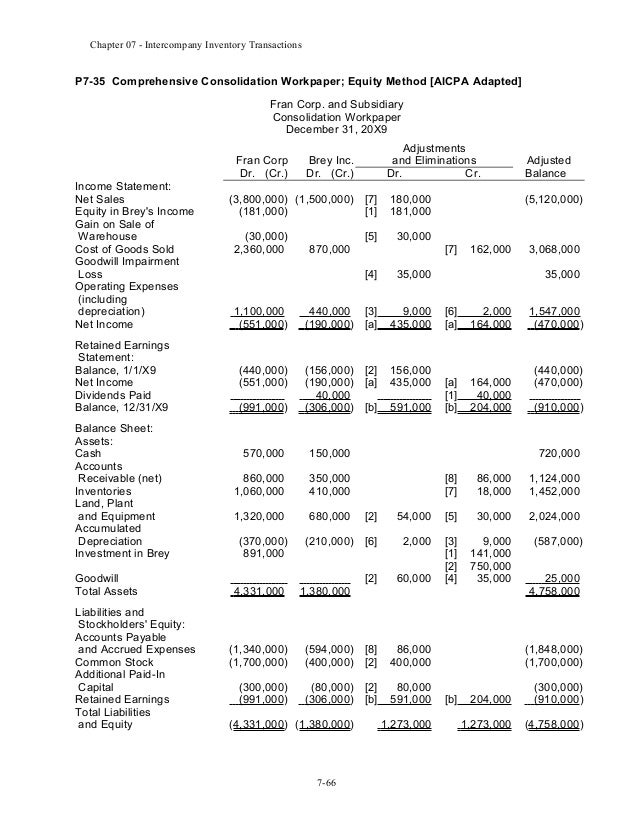

Intercompany transactions consolidated financial statements. The financial statements of each company within the group. An intercompany transaction is a transaction that occurs between two firms or departments within the same organization. Traditionally, creating consolidated financial statements involves a meticulous dance with spreadsheets.

Amounts subtracted from gross income are. Finance teams can spend hours navigating through endless worksheets,. Intercompany eliminations show financial results without transactions between subsidiaries.

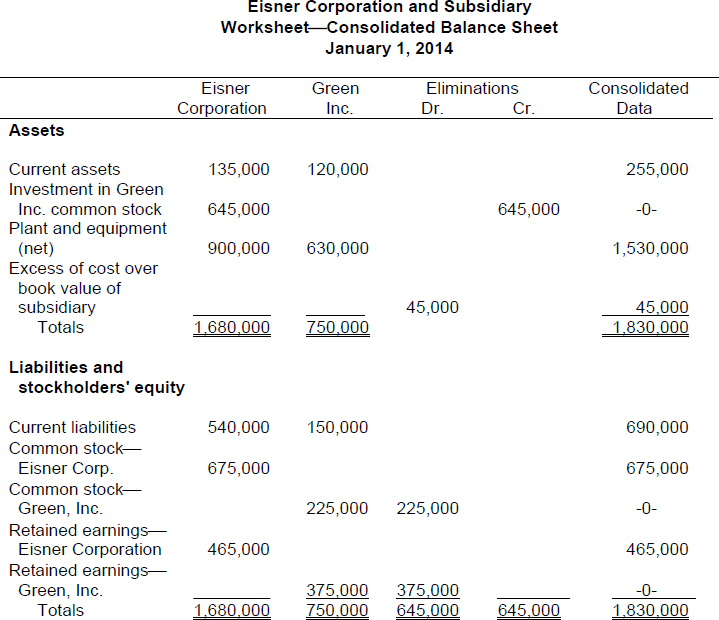

Companies that make up a business combination frequently retain their legal identities. Eliminating intercompany transactions. The consolidated financial statements are presented in millions of euros, rounded to the nearest million.

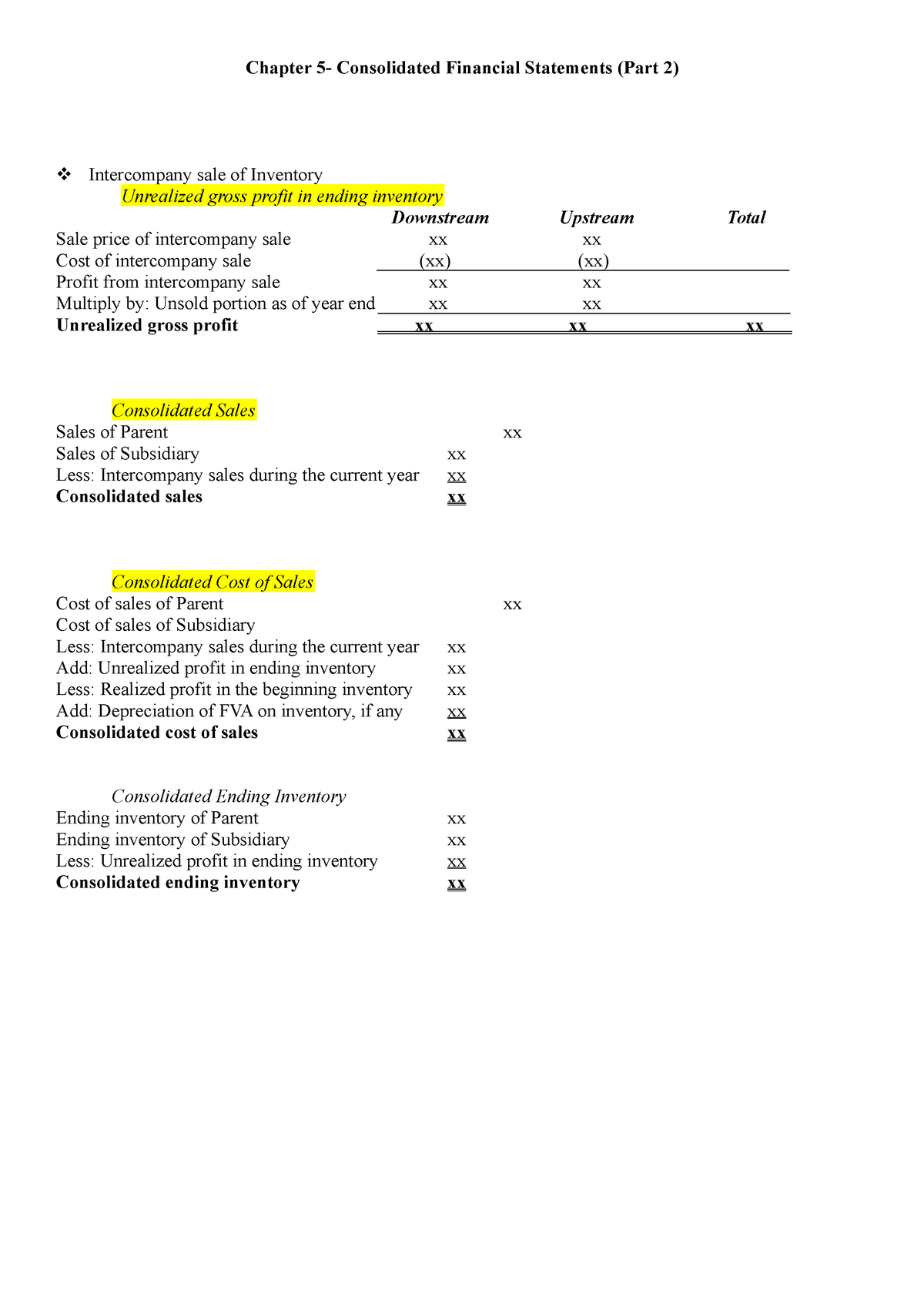

Intercompany accounting is based on the simple concept that transactions between group companies are irrelevant to the financial health of the consolidated. Gaap requires companies to eliminate intercompany transactions from their consolidated statements. Essentially, intercompany elimination ensures that there are only third.

What is the purpose of eliminating intercompany transactions in consolidated financial statements? Powered by ai and the linkedin community 1. Financial consolidation is the process by which businesses combine financial data from multiple entities within a corporate structure into a single, unified set of consolidated.

The financial consolidation process involves several steps, including: Intercompany transactions that were formerly eliminated in the parent entity consolidated financial statements generally would not be eliminated in the carve. Intercompany elimination is the process of eliminating transactions between companies in a group when preparing consolidated financial statements.

In order to avoid “double counting” them, they must. In consolidated income statements, discharge intercompany income and cost of sales resulting from the transaction. Intercompany inventory transactions | consolidations | accounting article shared by:

Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april.

.png)

![Excel for Consolidated Reporting [with Eliminations] Velixo](https://www.velixo.com/app/uploads/2022/09/Consolidated-PL.png)

+Example+8.5:+(Contd.).jpg)