Favorite Info About Expenses In Trial Balance

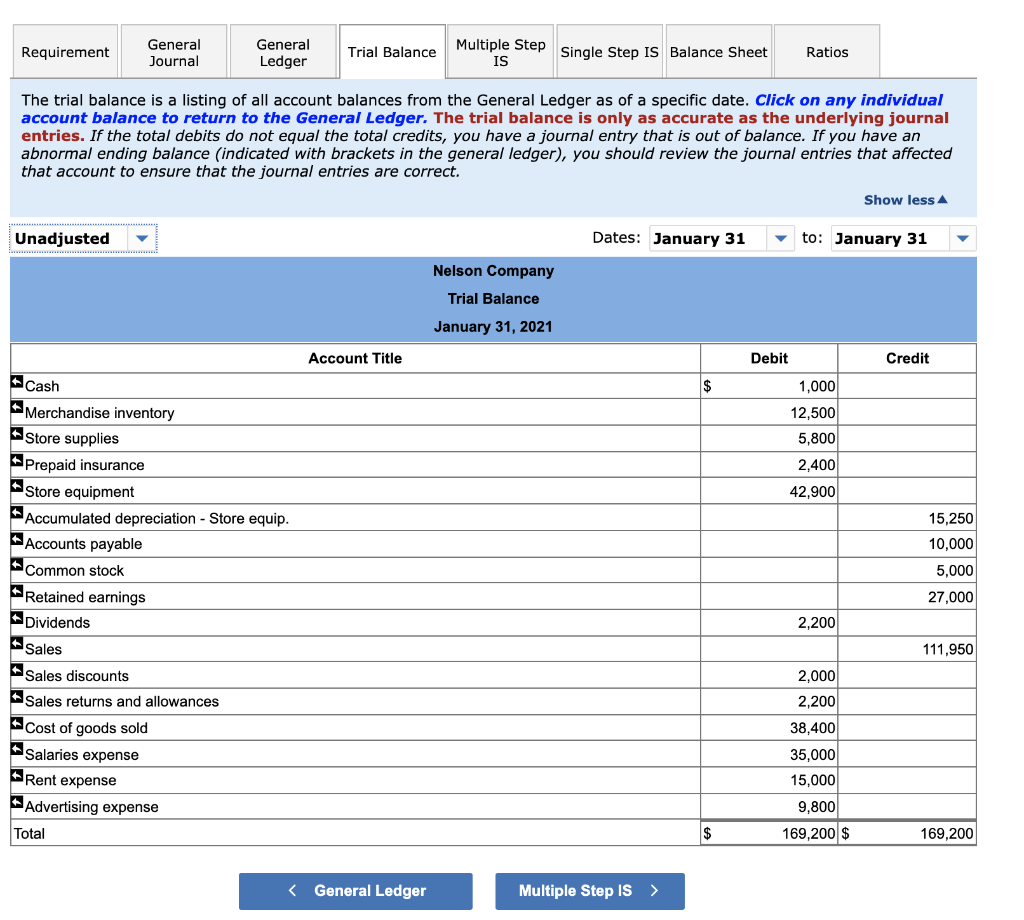

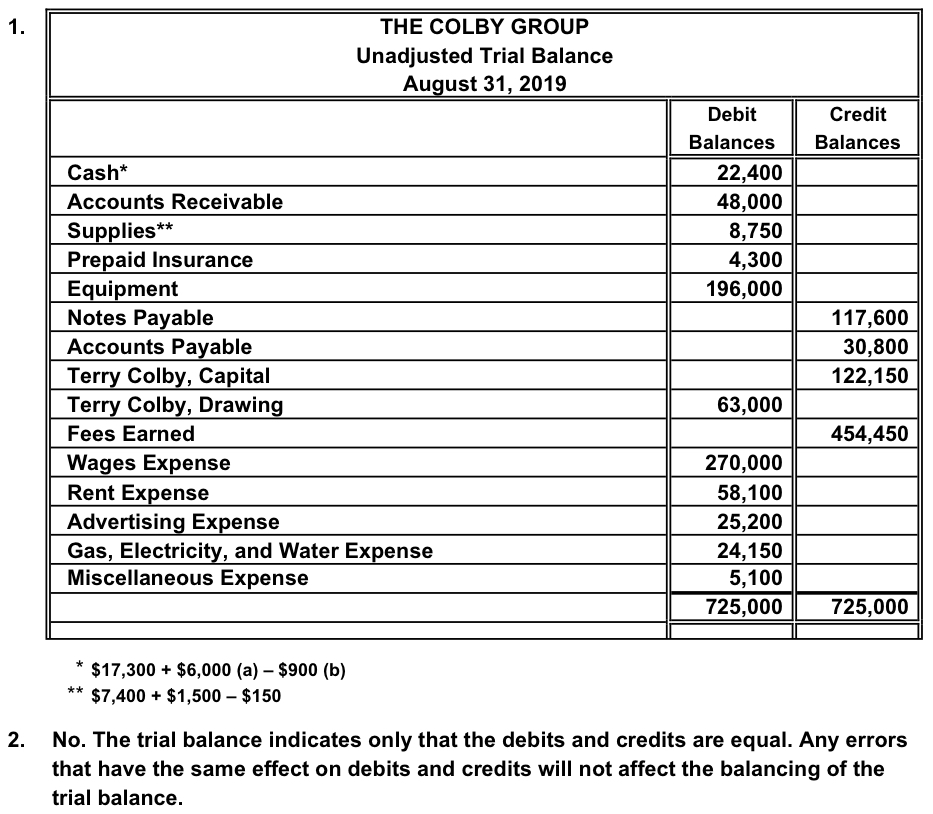

It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct.

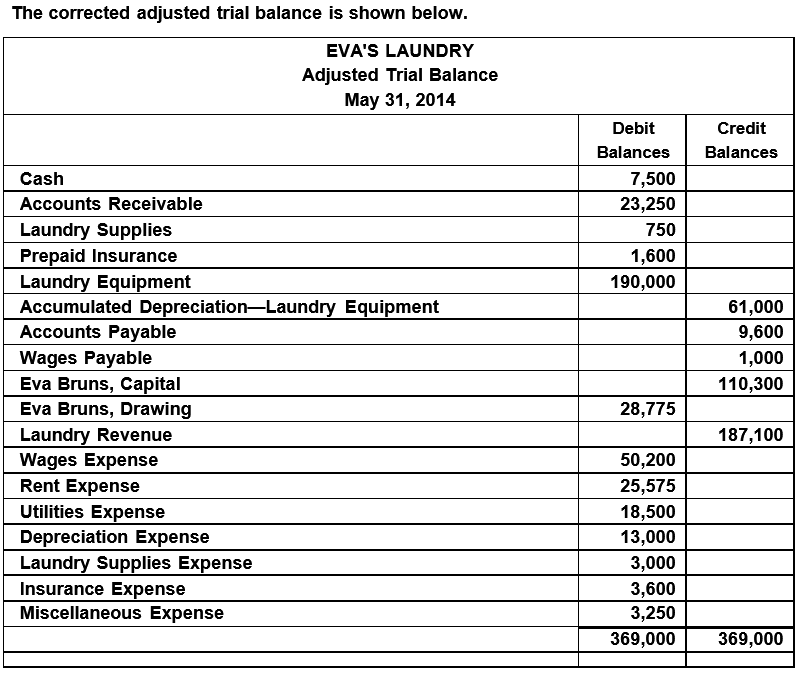

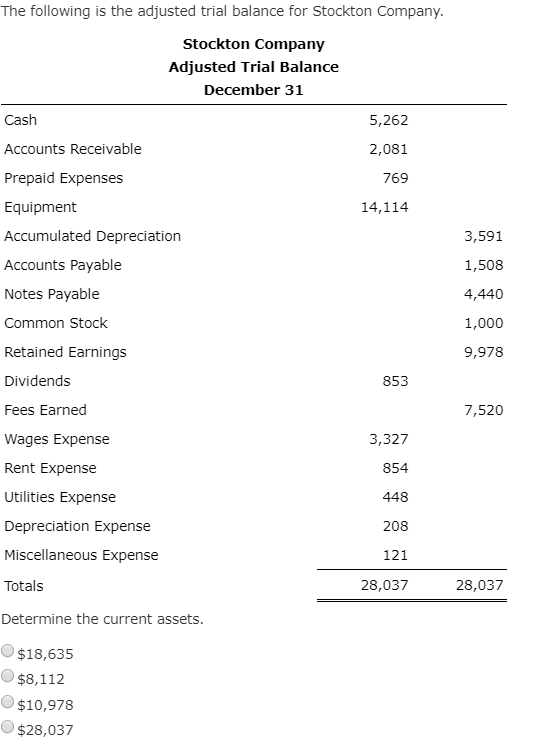

Expenses in trial balance. Total expenses are subtracted from total revenues to get a net income of $4,665. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Rules in drawing the trial balance:

Here are the rules of a trial balance. Expenses must be reflected on the debit side of the trial balance. The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally.

Expenses such as prepaid rent, insurance, etc. $10,000 (initial assets) + $3,000 (expenses) + $2,000 (software) = $15,000. His appearance was met with loud boos as well as.

Three different types of trial balance are: This information is then used to prepare financial statements. A trial balance is a summarization of all journal entries made, aggregated by account.

In the trial balance, revenue accounts (which have credit balances) are expected to have corresponding expense accounts (which have debit balances). Equity, dividends, revenues, and expenses. This is because revenues increase equity, and expenses decrease equity.

Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. Preparing and adjusting trial balances aid in the preparation of accurate financial statements. Some small businesses less efficiently use google sheets or excel worksheets or templates for preparing their trial balance documents.

Liabilities & incomes shall have a credit balance. Gains and income must be reflected on the credit side of a trial balance. The debits and credits include all business.

The trial balance is a list of all the accounts a company uses with the balances in debit and credit columns. All liabilities must be reflected on the credit side and assets reflected on the debit side. Accounting software and erp systems often generate trial balance reports.

January 7, 2024 what is a trial balance? A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements. Are shown in the trial balance on the debit side as they are initially an asset for the business, however, once the benefit is received, the value of the asset falls.

Here's what to know. Trial balance a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in creating financial statements. This is done to determine that debits equal credits in the recording process the trial balance is the first step toward recording and interesting your financial results.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)