Impressive Info About Need Of Cash Flow Statement

Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in.

Need of cash flow statement. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two. Objectives of cash flow statement. December 13, 2023 what is a statement of cash flows?

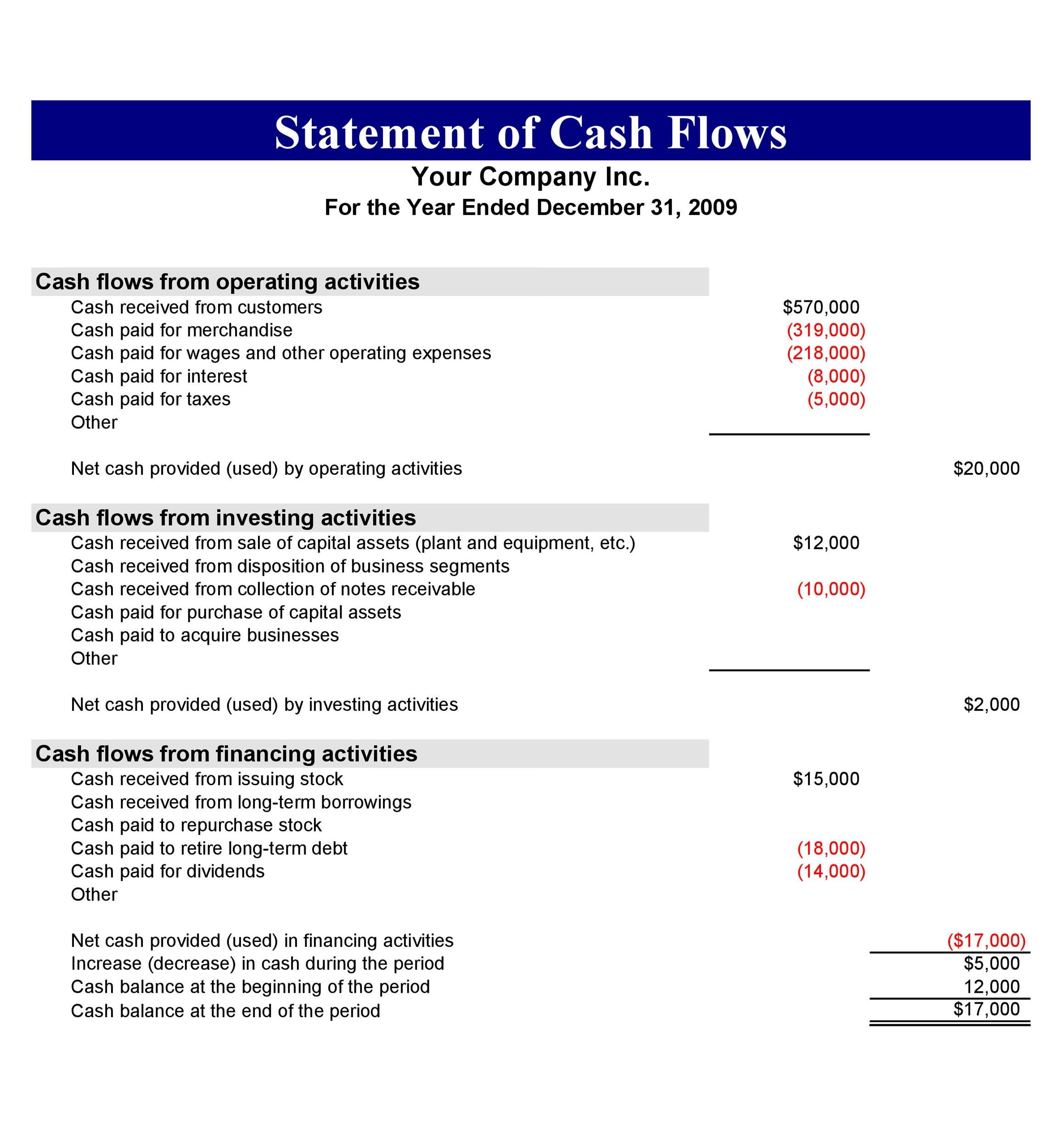

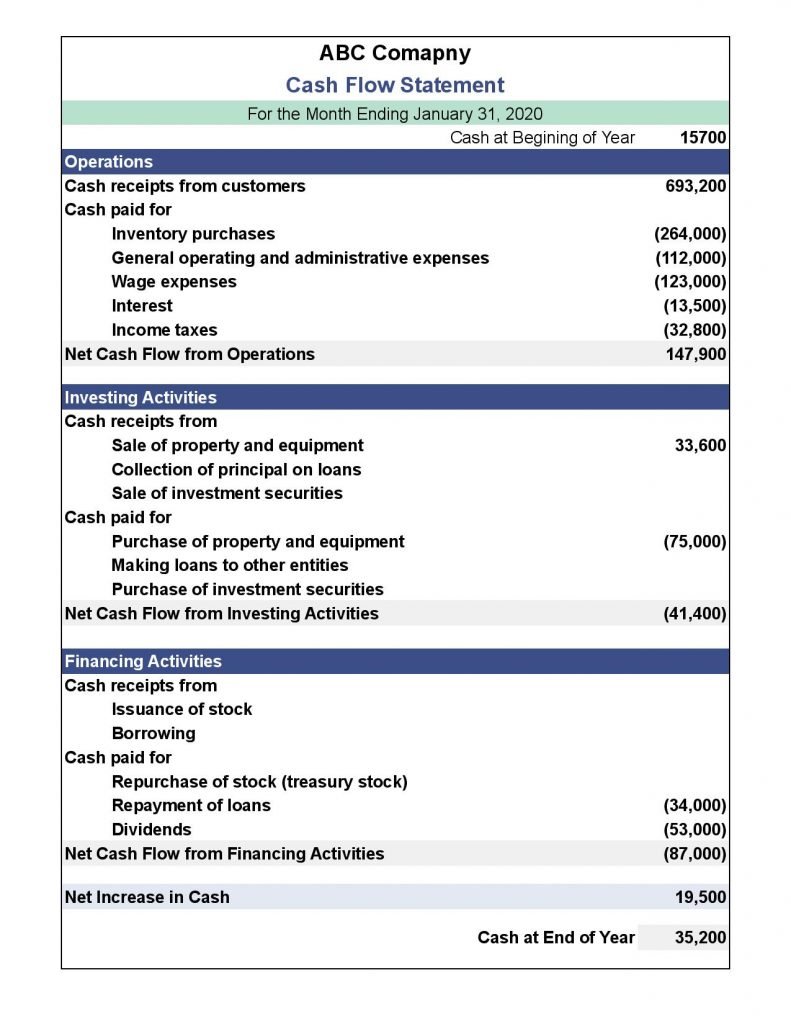

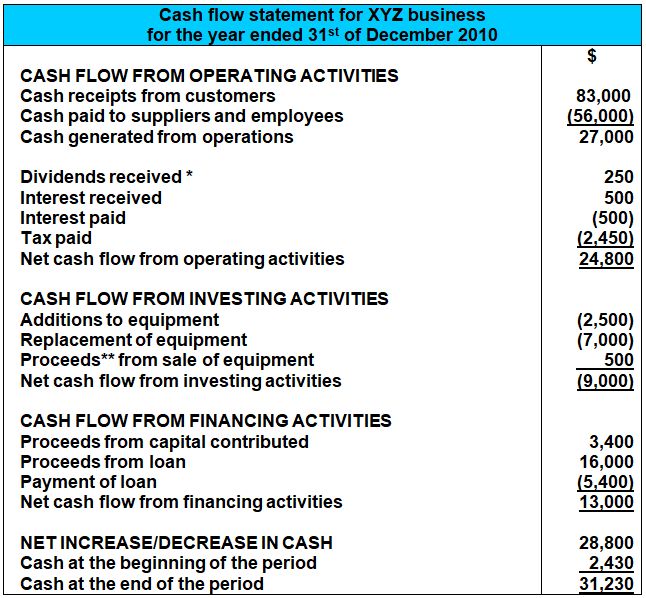

Why is cash flow statement important? Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Cash flow statements reveal a business’s liquidity, help evaluate changes in assets, liabilities and equity, and make it easier when analysing operating.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The cfs measures how well a. A cash flow statement, also known as the statement of cash flows, is a financial statement that shows the flow of cash into and out of your business during a specific period of time.

The cash flow statement is a financial statement. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. We will use these names interchangeably throughout our explanation, practice quiz, and other materials.

Example and template (2024) learn the basics of a cash flow statement, including the common elements and how to prepare one. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. It ascertains the closing balance of cash and cash equivalents at the end of the year.

It is an essential document for evaluating the sources and uses of cash for an organization. The cash flow statement is required for a complete set of financial statements. The cash flow statement is important because it is used to measure the cash position of the business, i.e., the inflow and outflow of cash and cash equivalents in the business for an accounting year, and it also helps the business to know the availability of cash in their business.

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. Therefore, the statement of cash flows is necessary to reconcile net income to adjust for factors that include the following: By kaleigh moore nov 28, 2023 on this page what is a cash flow statement?

It accounts for three major business activities in which cash is exchanged, i.e., operating, investing, and financing. Key takeaways cash flow is the movement of money in and out of a company. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less than 10 months, according to. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Cash received signifies inflows, and cash spent is outflows. Written by jeff schmidt what is the statement of cash flows? A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)