Outstanding Tips About General Expenses In Profit And Loss Account

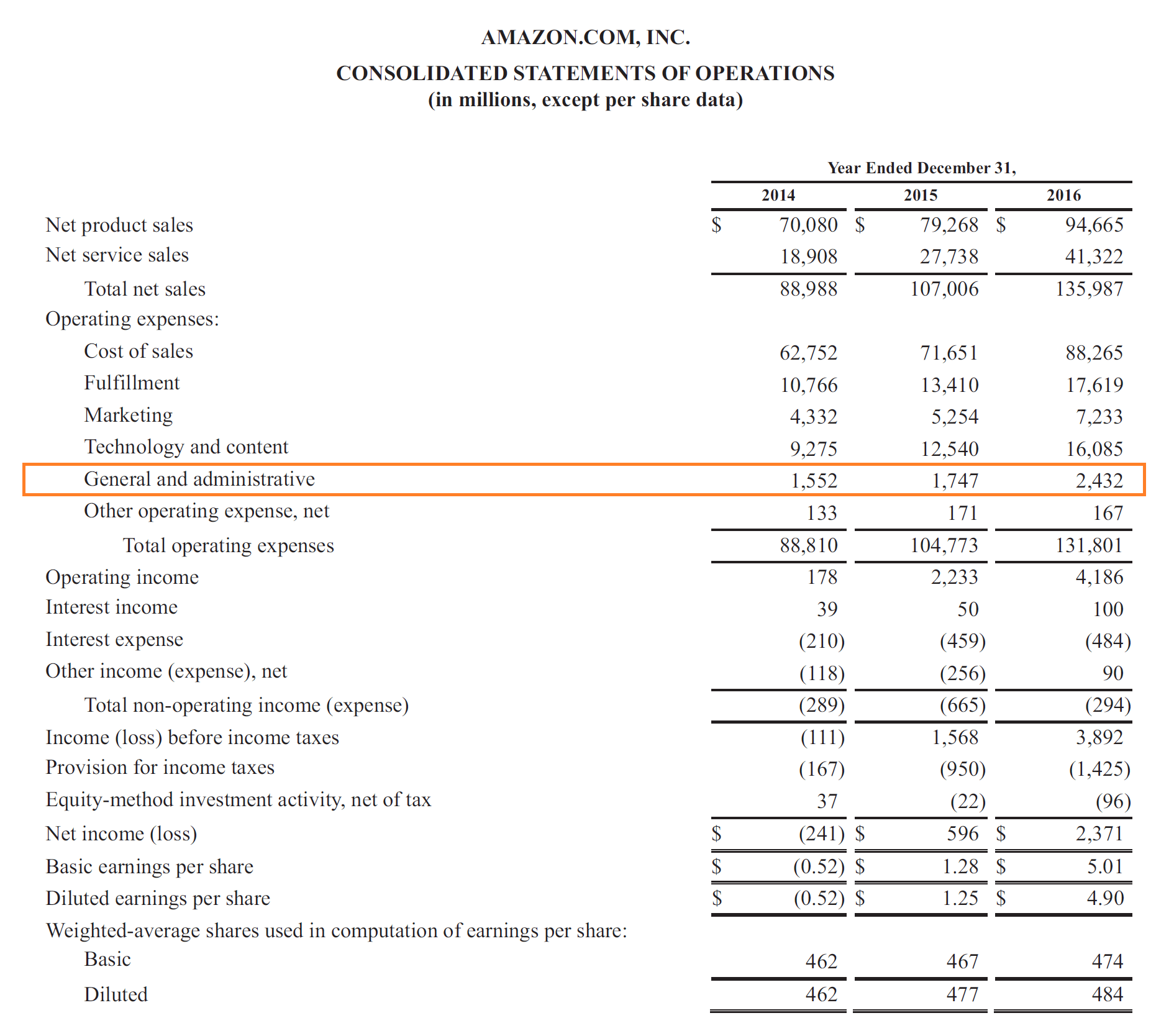

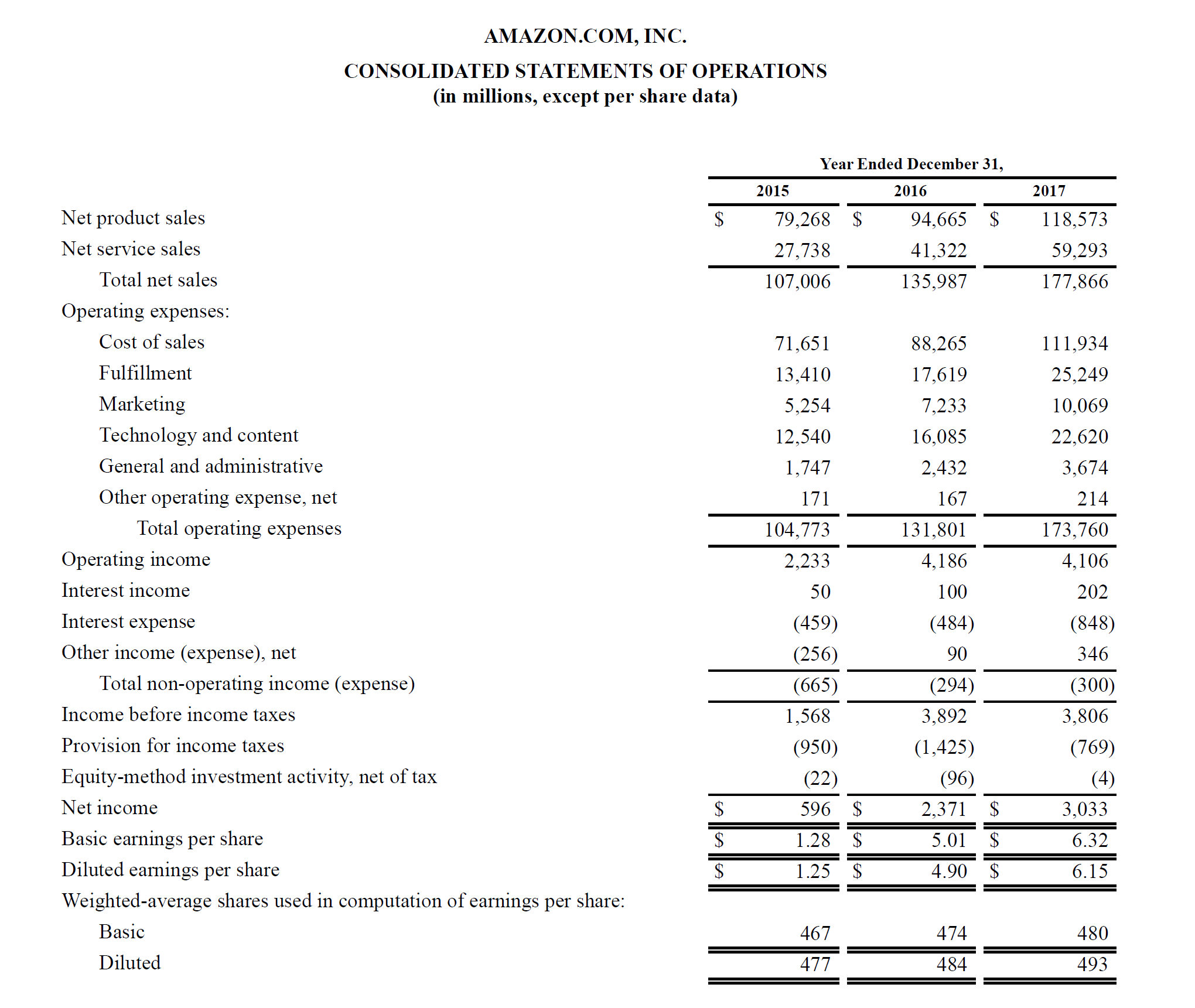

As seen before with best buy, macy's gross profit of $2.14 billion dramatically differs from its net income of $43 million, due to sg&a costs, interest expenses, impairment and restructuring costs.

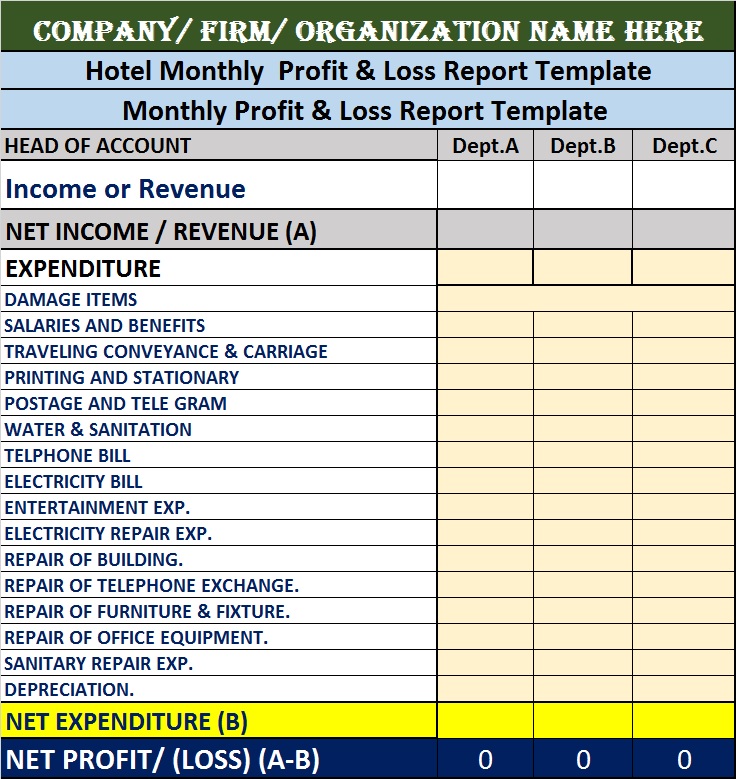

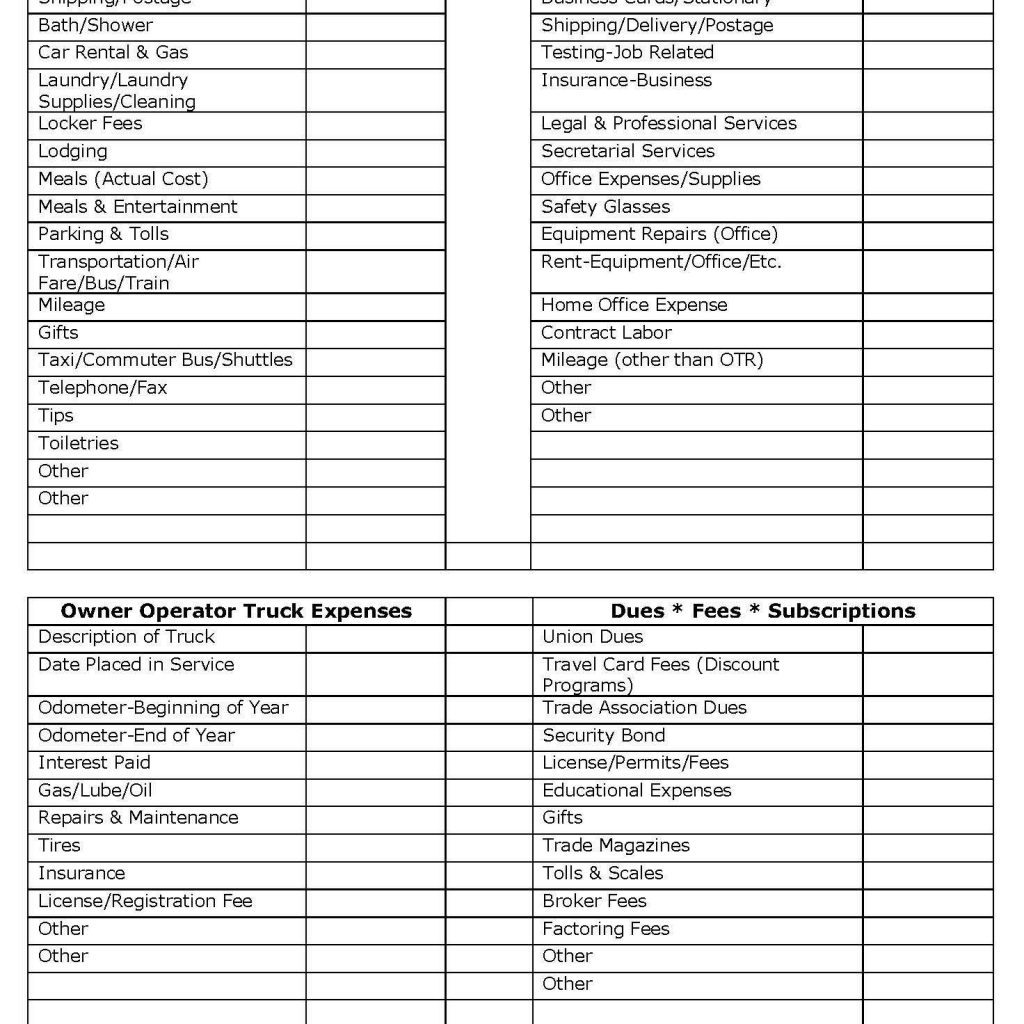

General expenses in profit and loss account. They’re the costs a company generates that don’t relate to the production of a product. It shows your revenue, minus expenses and losses. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

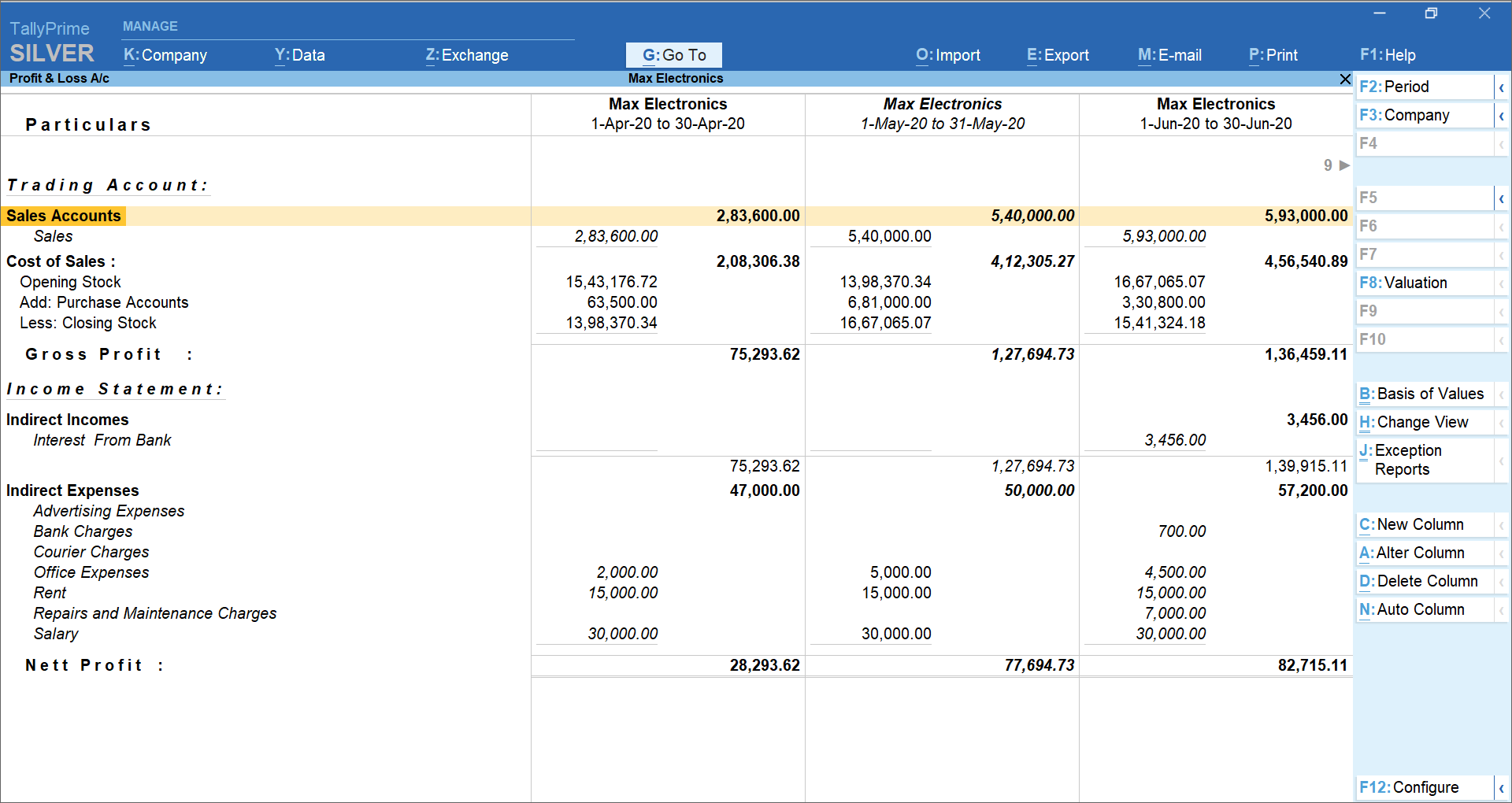

Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period. General and administrative expenses typically refer to expenses that are still incurred by a company, regardless of whether the company produces or sells anything. A profit and loss account (or statement or sheet) is, on a simple level, used to show you how much your company is making or how much it is losing.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Profit and loss account format items not shown in profit and loss account format The p&l statement is one of three financial.

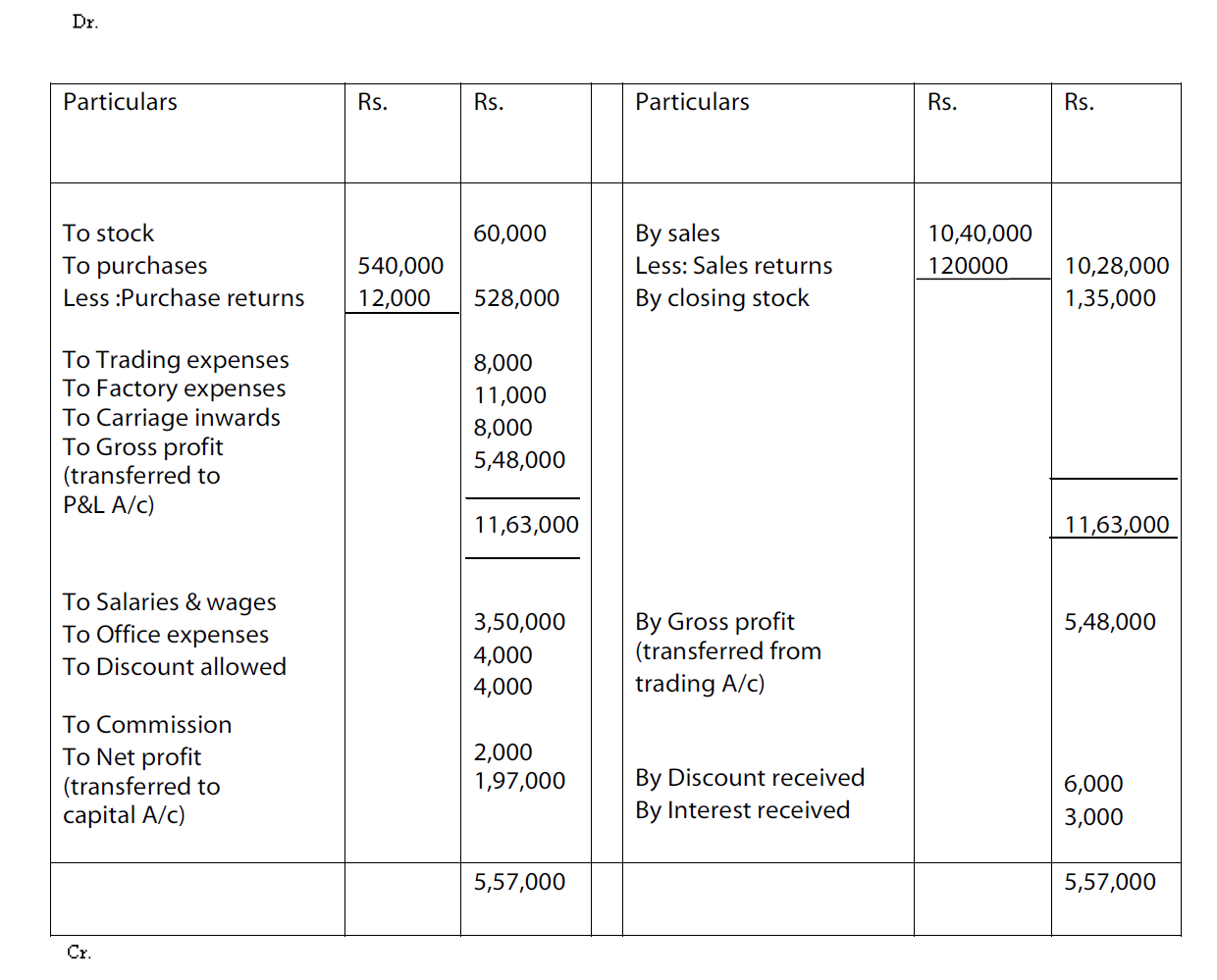

The net profit is calculated. Expenses included in the profit and loss account are selling and distribution expenses, freight & carriage on sales, sales tax, administrative expenses, financial expenses, maintenance, depreciation and provisions and more. Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business.

Operating expenses can really impact the profitability of a business. How to classify expenses in profit or loss? There are several different types of expenses that can be listed in a profit and loss account.

In other words, from what your goods cost you, take away what you managed to sell them for. In contrast, a balance sheet is a ‘snap shot’ of the assets and liabilities of the. Profit & loss account is also known as p&l a/c, profit & loss statement, income statement or income and expense statement.

To understand how, consider the basic formula of a company’s profit and loss statement: After making closing entries, the balances of these accounts disappear from the ledger.

As general expenses are part of the operating expenses of a business, they are deducted from the gross profit (revenues minus the cost of sales or cost of goods sold), to produce the operating profit or earnings before interest,. This is where the initial gross profit or gross loss is determined. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

The profit and loss account shows the net profit which is the determined by deducting the expenses of the business from the trading account gross profit and adding other income. The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

The segregated view of the financial inflows and outflows enables organizations to track their financial performance and implement ways to keep up the same or improve it. Annual net profit/annual net loss. In order to create a profit and loss account, the cost of sales method also requires that you start your calculations with sales revenue (by proceeding in the same manner as with the nature of expense method).