One Of The Best Info About T776 Rental Income

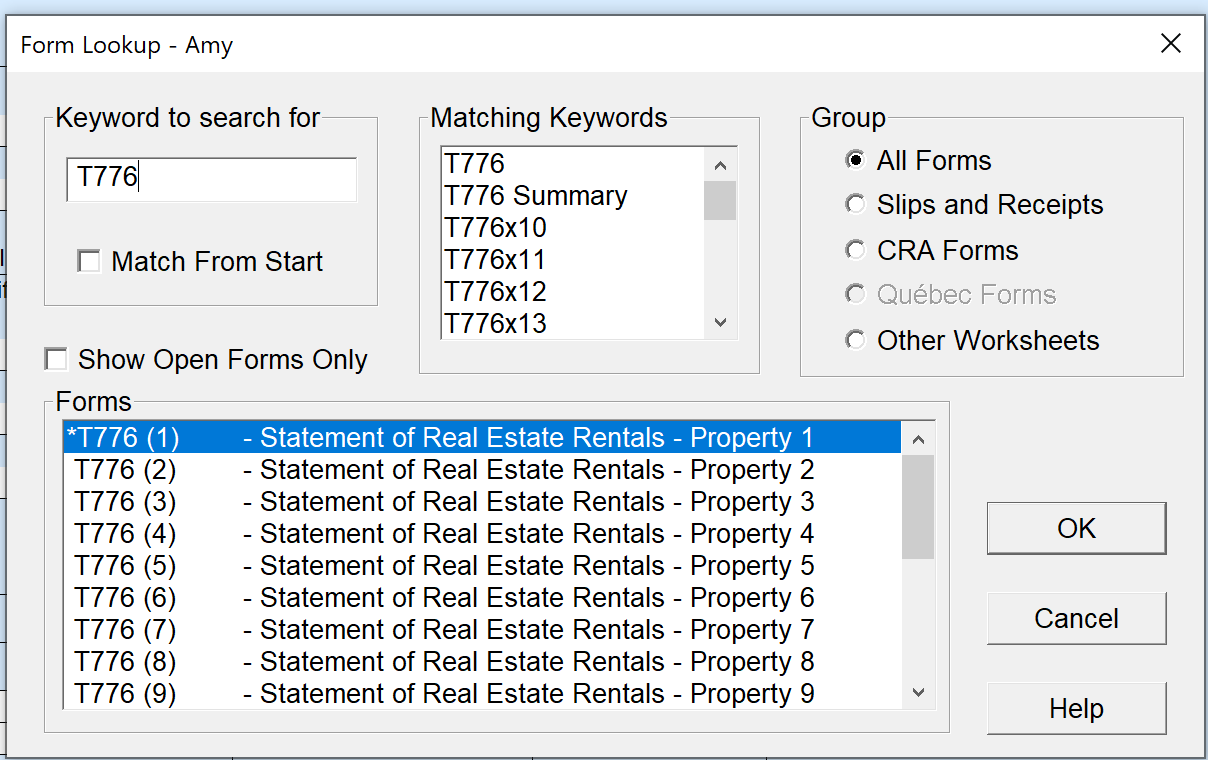

Learn how to:• create a t776 form set• when to group or separate properties• choose between a partner and a.

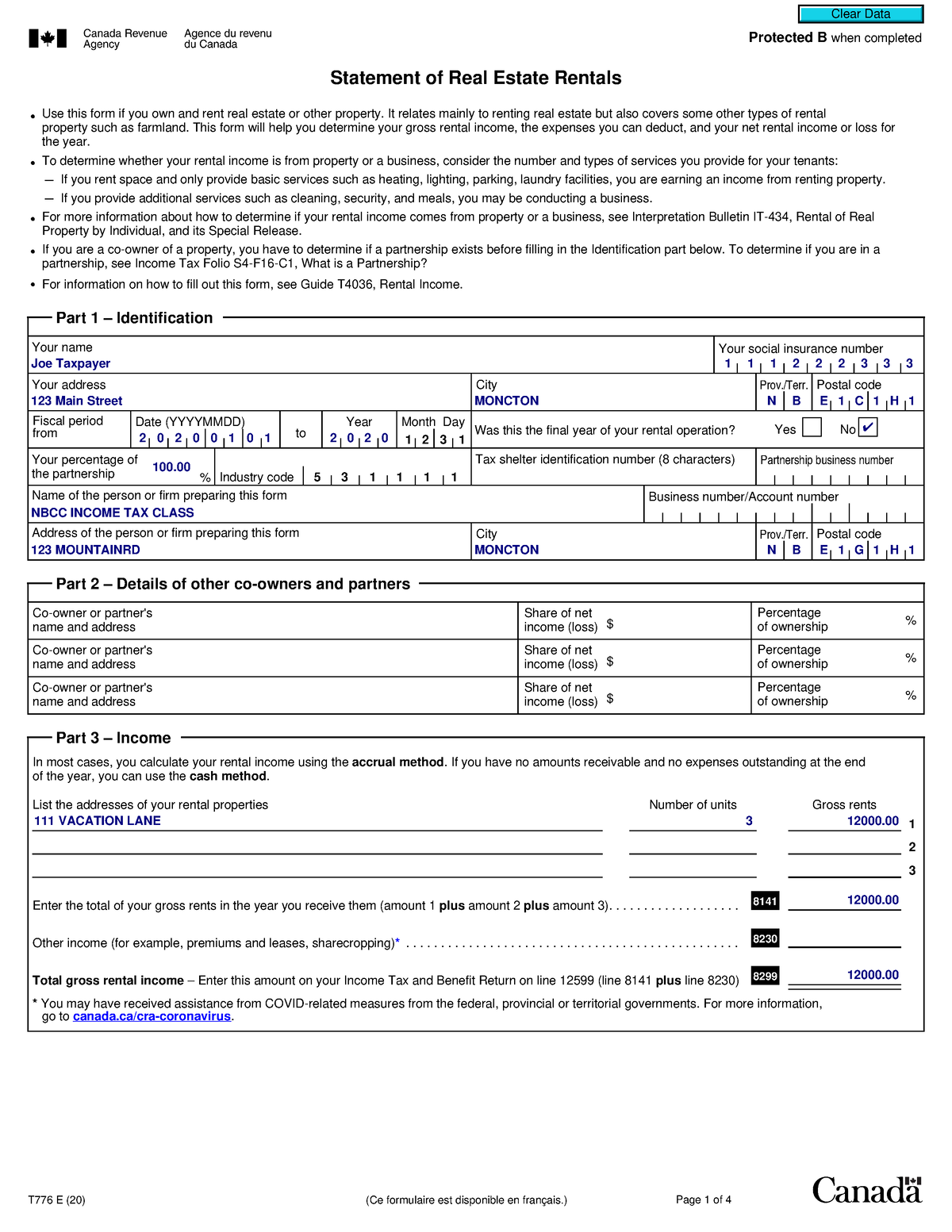

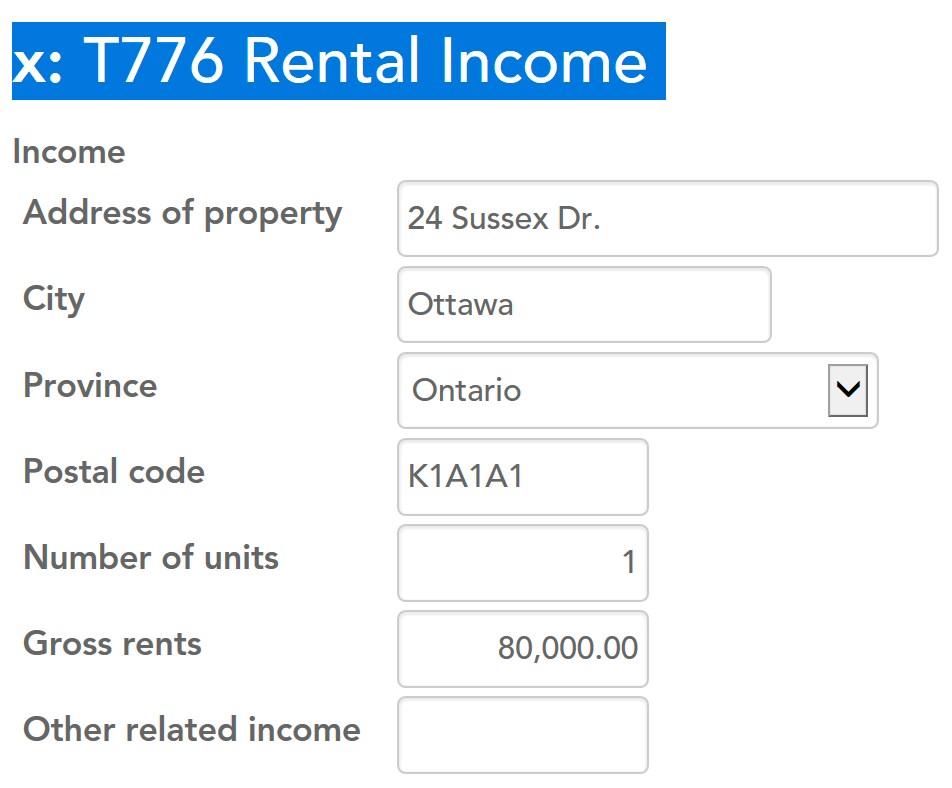

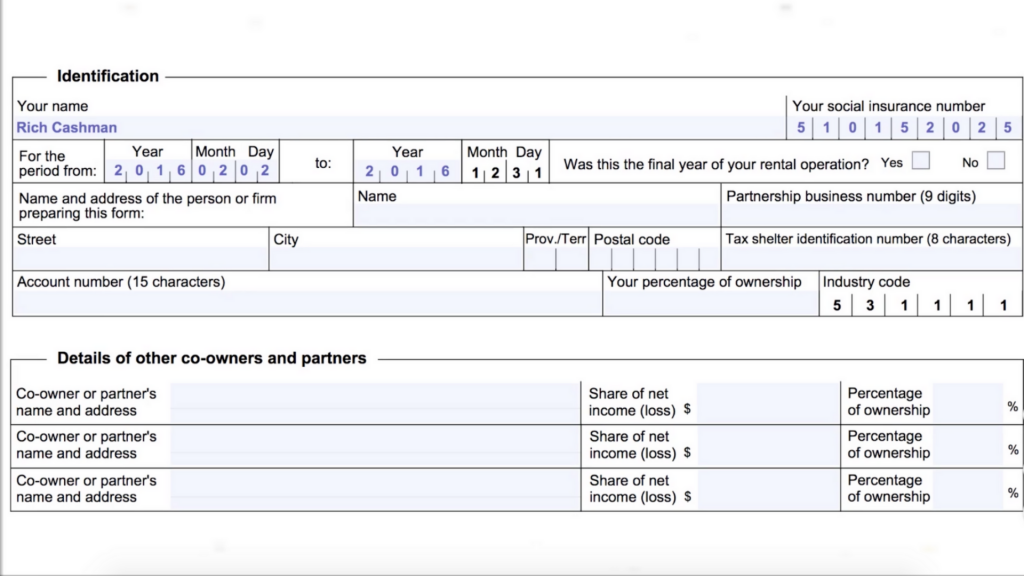

T776 rental income. Enter rental income and expenses in taxcycle t1. Form t776 is also called the statement of real estate rentals. This guide will help you determine your gross rental income, the expenses you can deduct, and your net rental income or loss for the year.

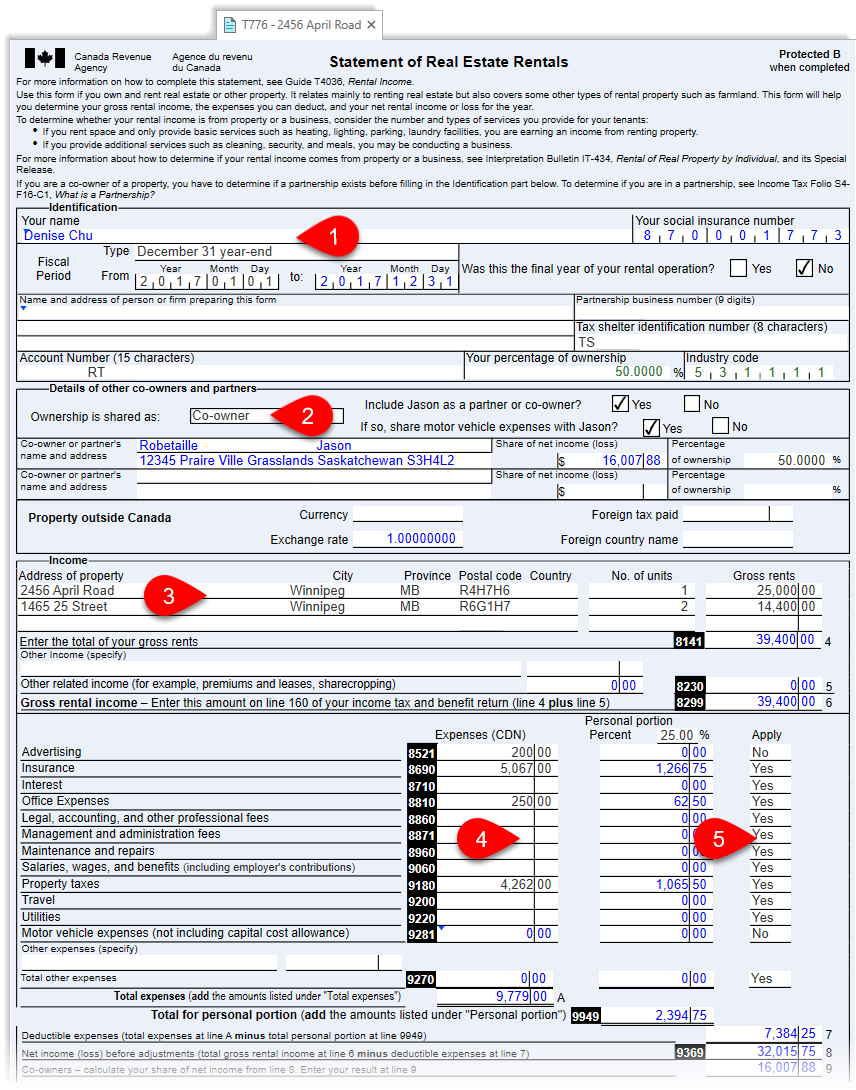

Statement of real estate rentals. Create a t776 form set. This guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the year.

The t776 form must be completed by any taxpayer who owns real estate property and generates rental income. If you had rental income in 2017 from renting out a property that you own (a house, an apartment, rooms, space in an office building, or. What is the t776?

Choose between a partner and a. This form, statement of real estate rentals, is where you can declare income and expenses related to rental income. It will also help you fill out form t776,.

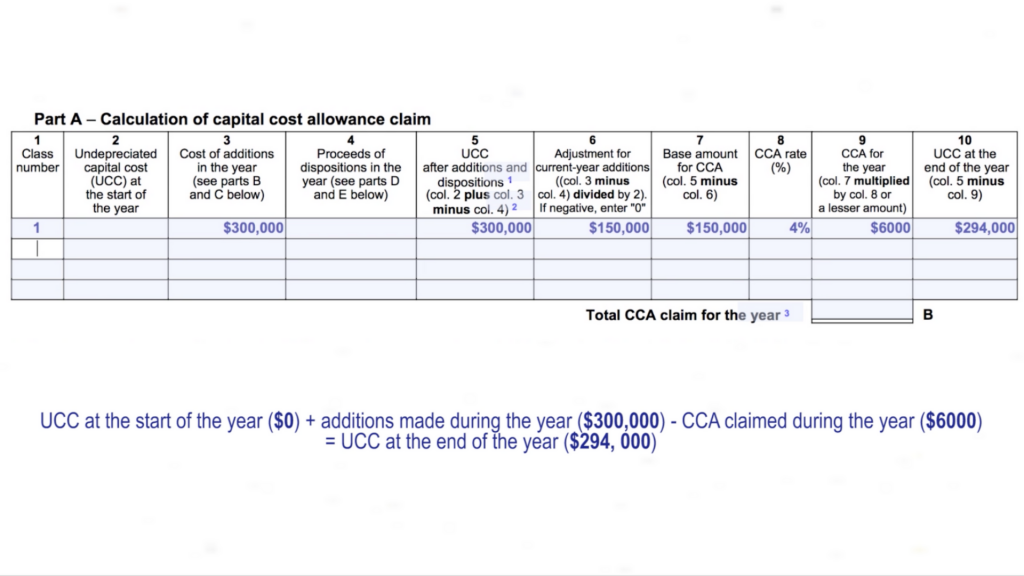

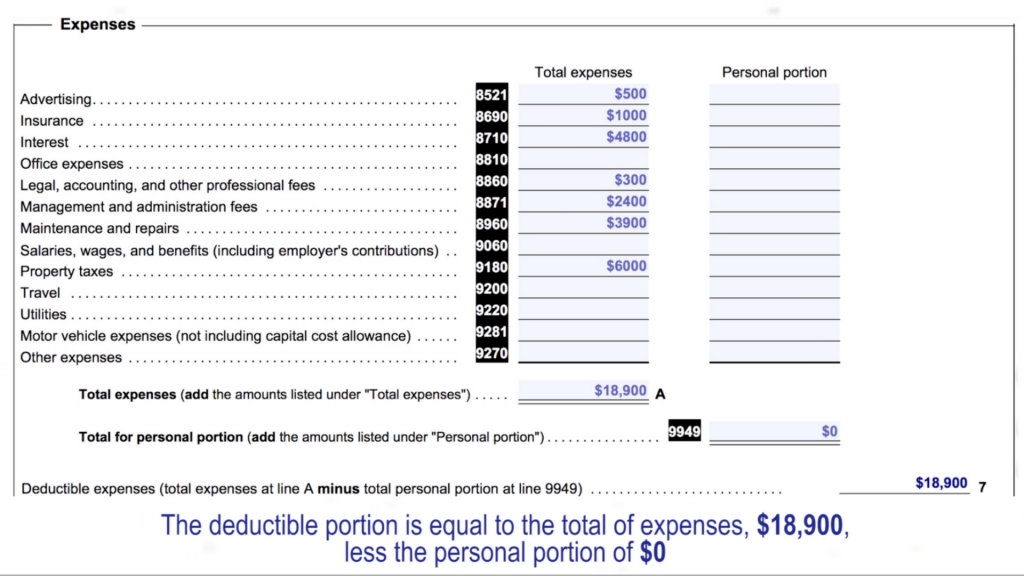

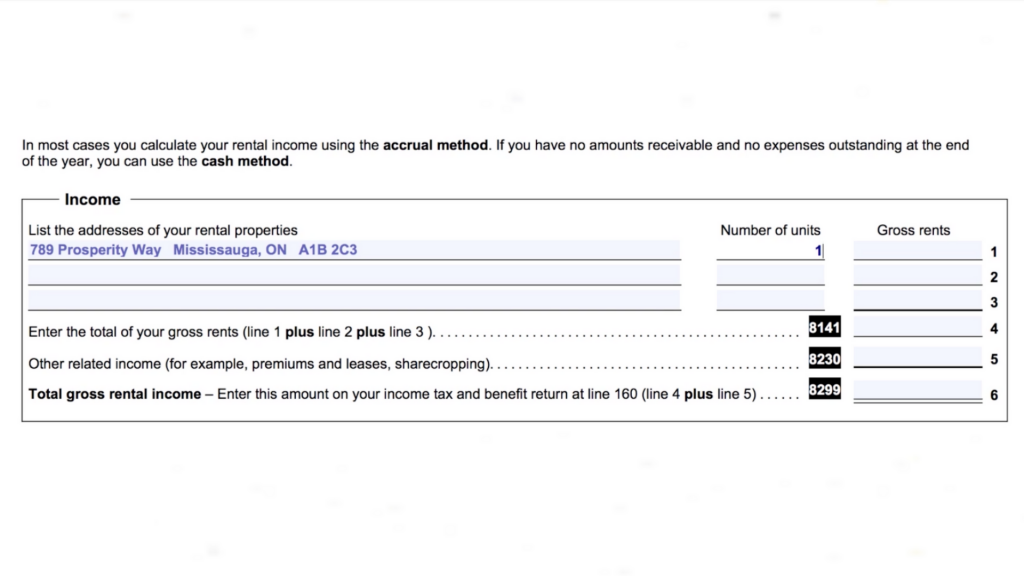

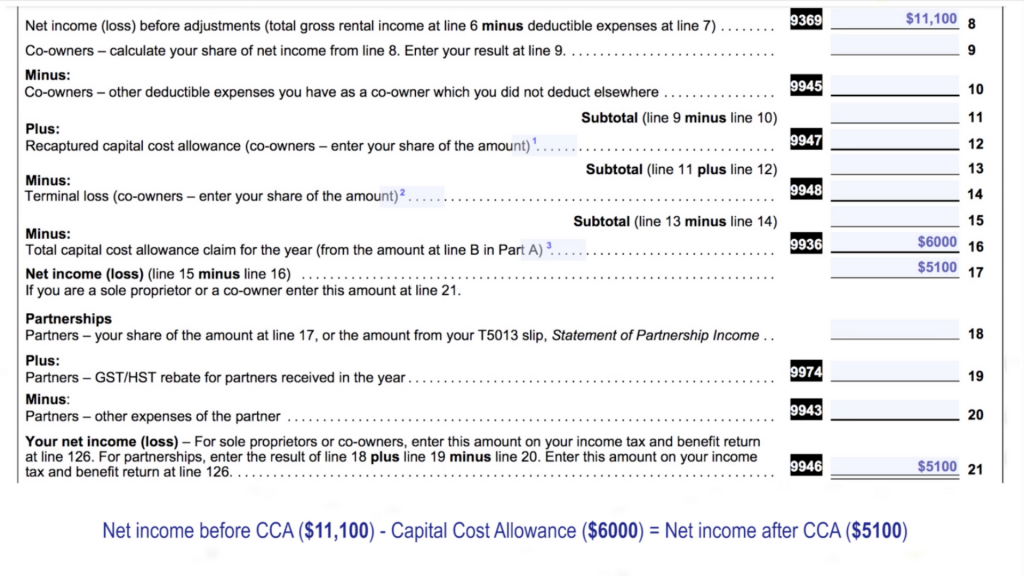

For more information on how to fill out. On line 1, part 4 enter the gross. To calculate your rental income or loss as well as your capital cost allowance (cca), complete the areas of the form that apply to you.

Who is the t776 tax form designed for? If you own and rent real estate, or other property. When to group or separate properties.

A couple of tax preparers have asked me to help. The statement of real estate rentals allows you to declare rental income and expenses. Follow these 4 steps to properly report rental income and expenses on form t776, statement of real estate rentals:

If you are using an accounting software your t776 will automatically help you calculating foreign tax credits. The canada revenue agency (cra) requires it be completed by those earning income from rental properties.