Beautiful Tips About Statement Of Recognised Income And Expense

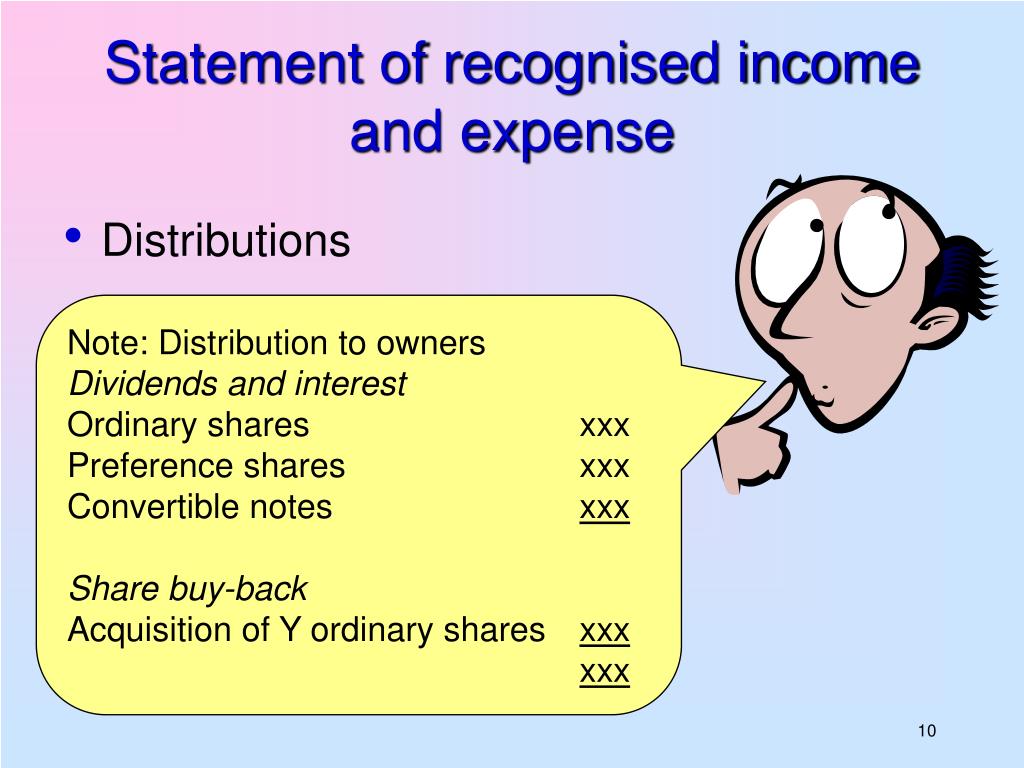

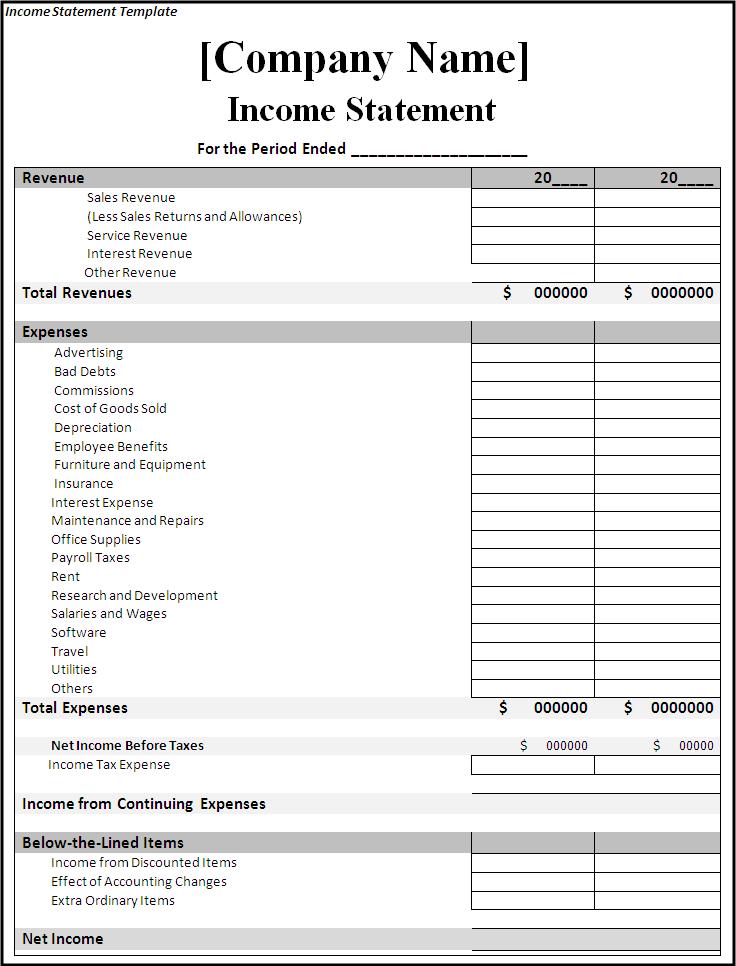

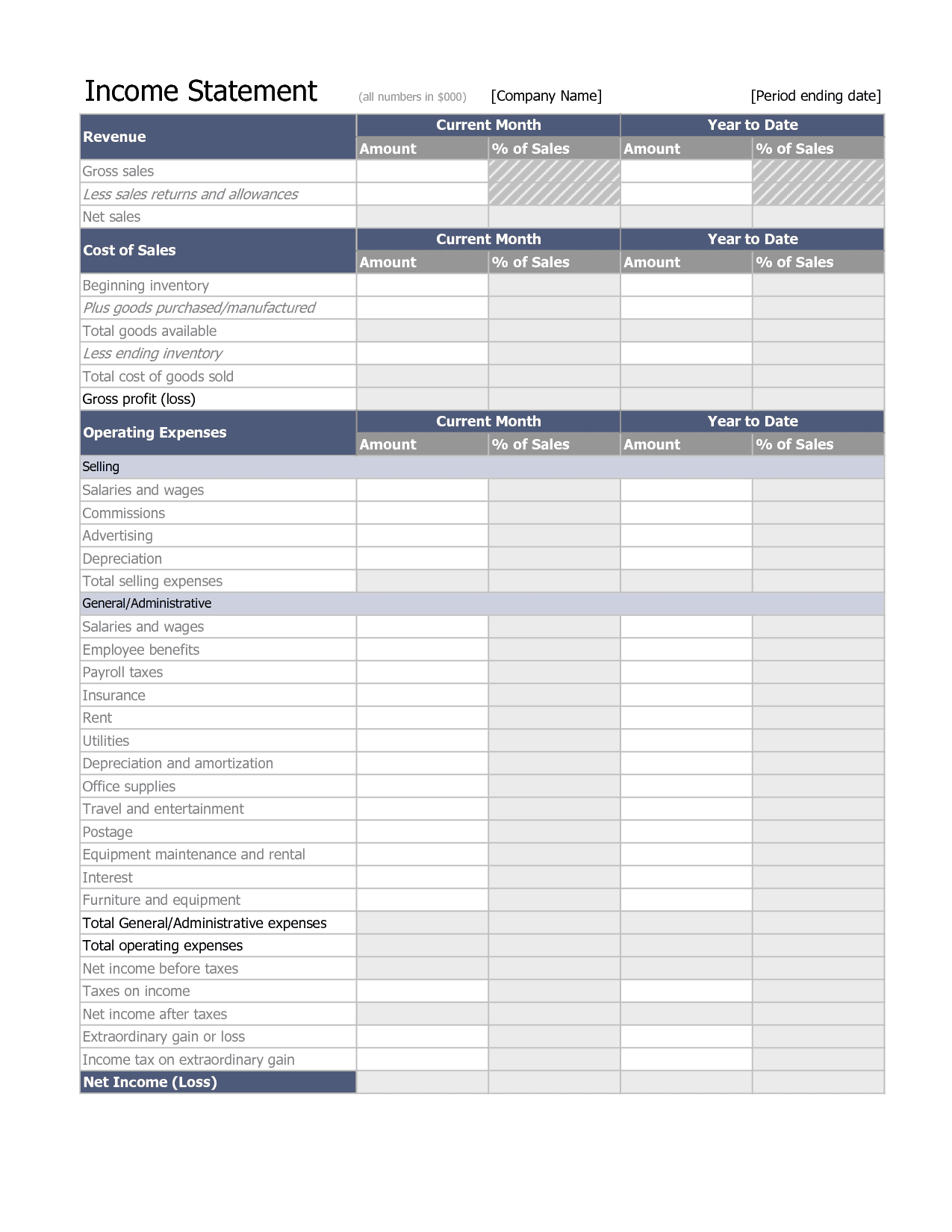

Notes to the statement of income.

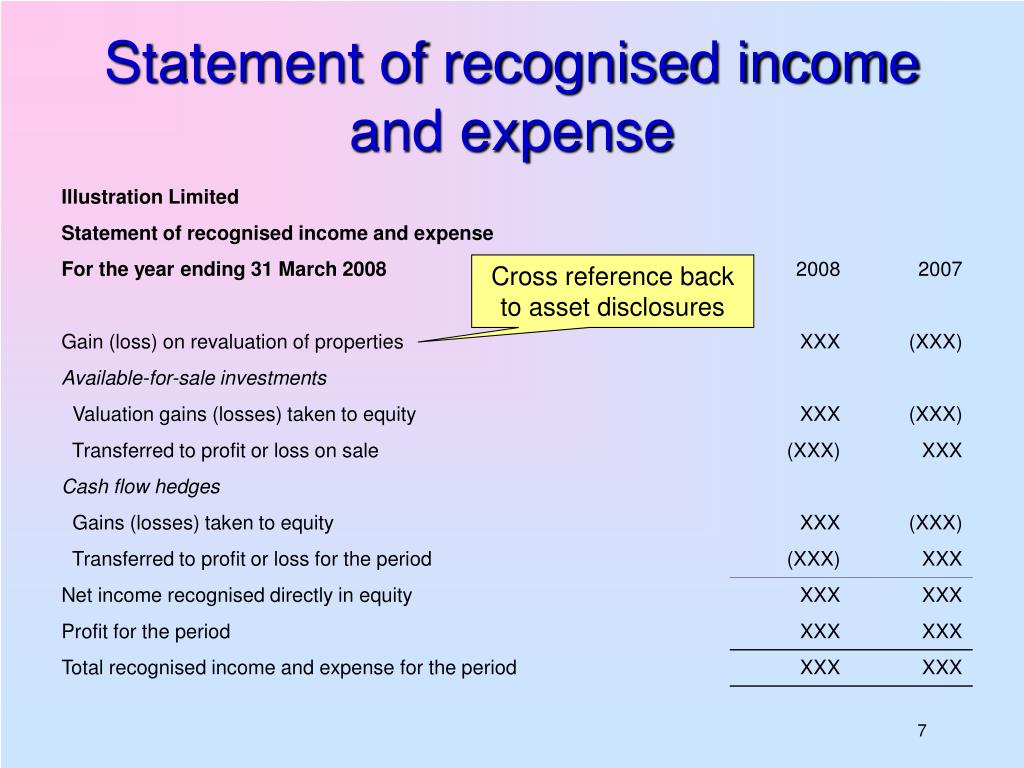

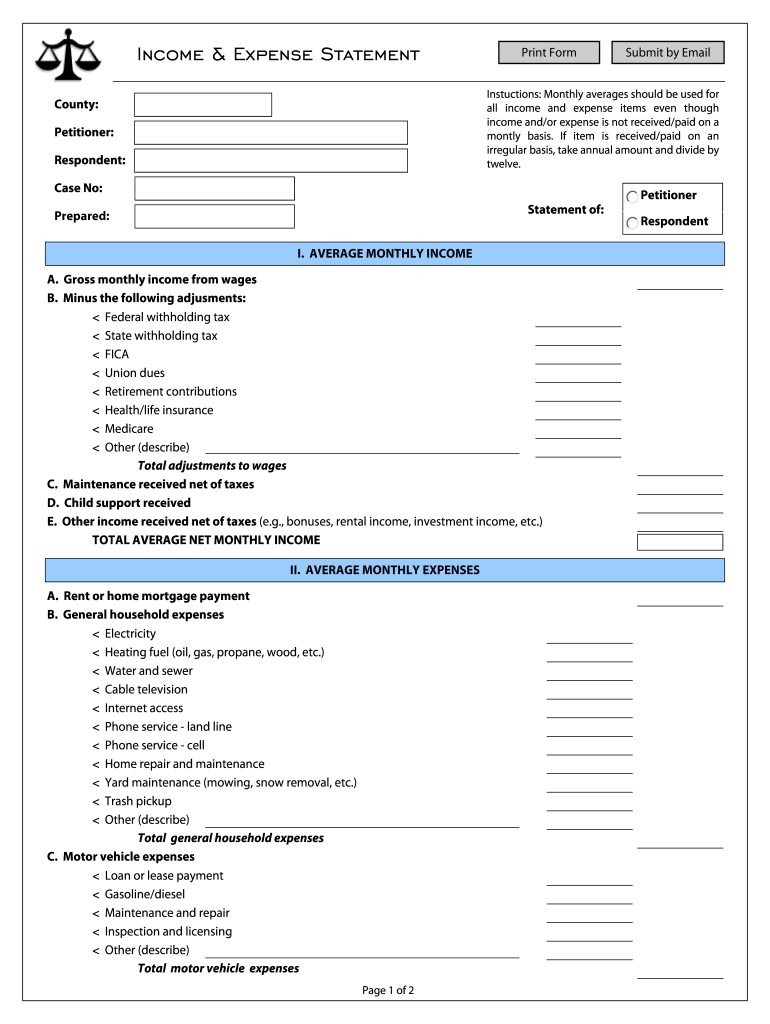

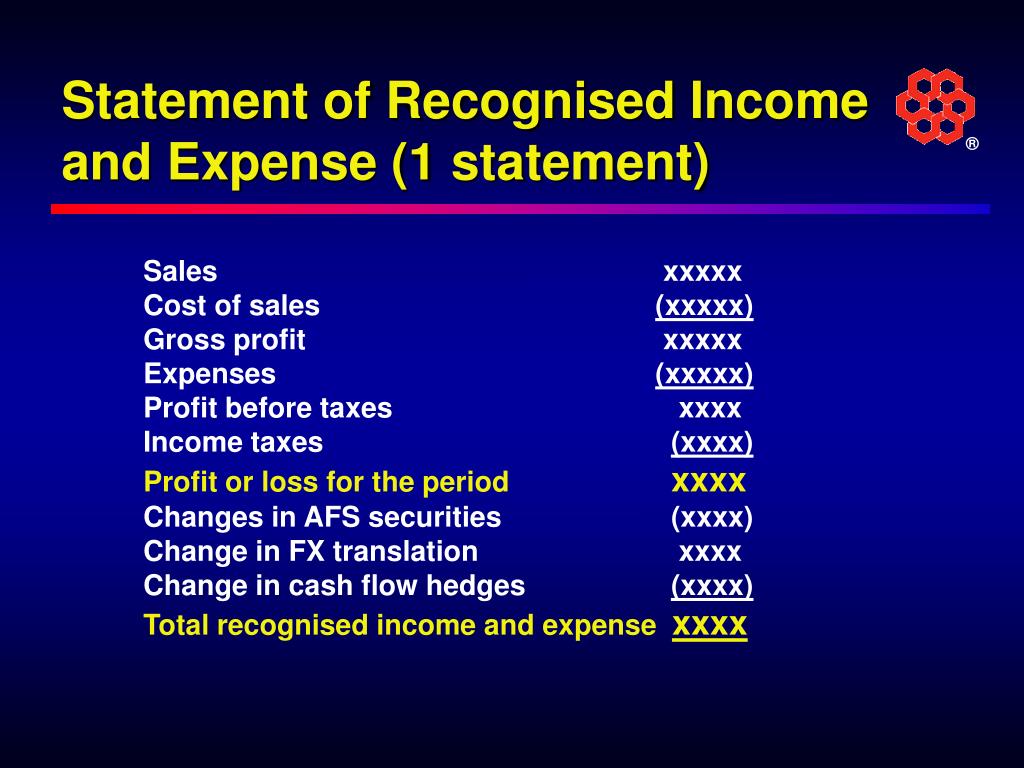

Statement of recognised income and expense. When and how to recognize an expense Other operating income and expenses. (a) in a single statement of recognised income and expense;

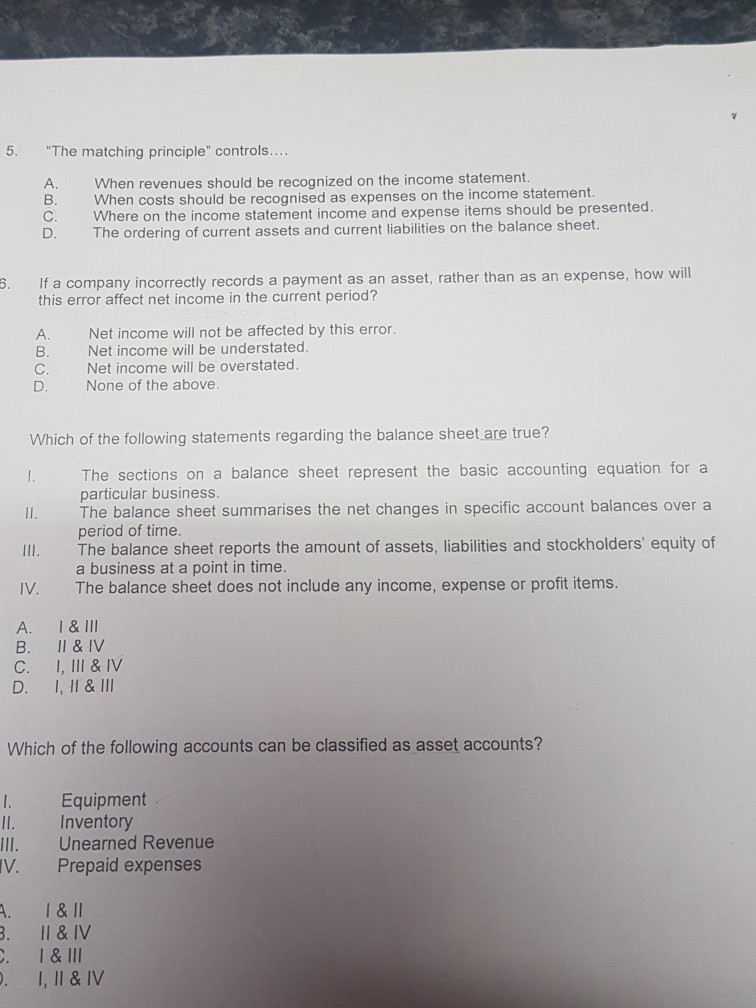

Paragraph 5.4(b) specifies three items of income and expenses that are recognised outside of profit or loss (ie in other comprehensive income). Recognition is the process of incorporating in the balance sheet or income statement an item that meets the definition of an element and satisfies the criteria for recognition set. What is the expense recognition principle?

Or (b) in two statements: An entity shall present all components of income and expense recognised in a period: Criteria for recognition of expenses an expense should be recognised in the operating statement, in the determination of the result for the reporting period, when and only.

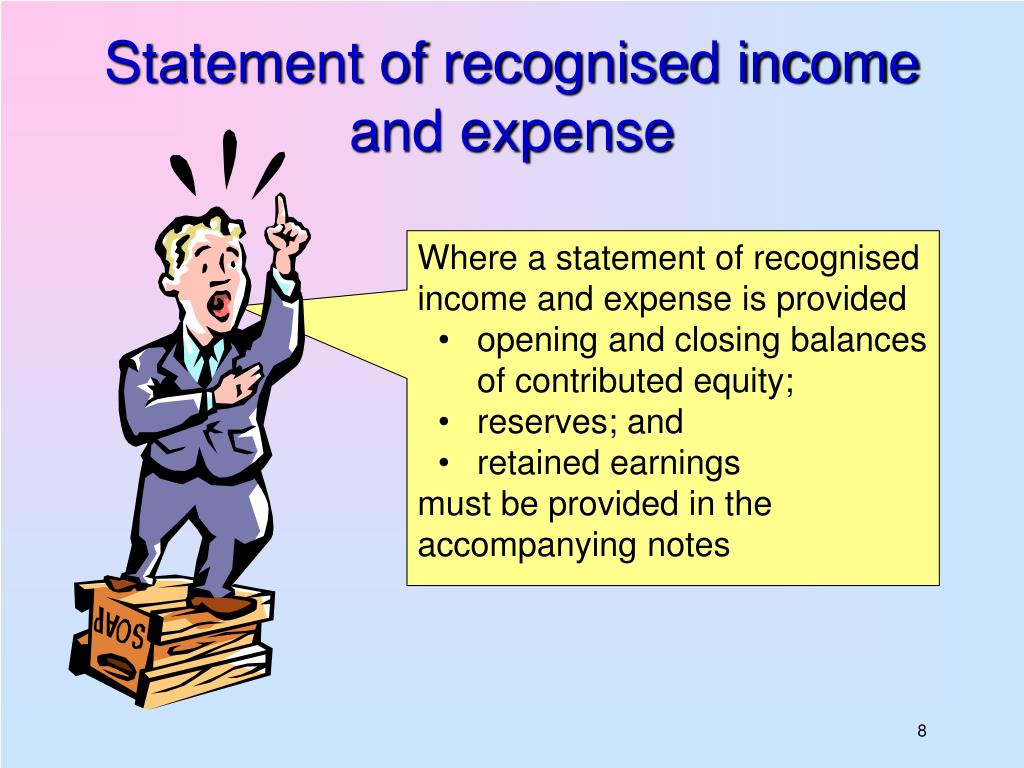

Statement of income and expense recognized in equity (xls:) download income before minority interests and statement of income and expense recognized directly in equity. Those statements and information about items that do not qualify for recognition in those statements. A statement of recognised income and expense, often known by its acronym a sorie, disclosing the information shown in a statement of changes in equity in the notes to its.

An entity should present a single statement of all recognised income and expense items as a component of a complete set of financial statements. Under ias 1, other comprehensive income (oci) includes items of income and expense (including reclassification adjustments) that are not recognised in profit or. Income includes both revenue and gains, which is recognised in the statement of profit or loss and other comprehensive income when an increase in future.

The usual international financial reporting standard term for a statement of total recognized gains and losses. Recognise revenue when each performance obligation is satisfied. Revenue recognition is an accounting principle under generally accepted accounting principles (gaap) that determines the specific conditions under which.

Other comprehensive income comprises items of income and expense. Ifrs 15 became mandatory for accounting periods beginning on or after 1 january 2018. Statement of recognized income and.

To recognize an expense means to report the proper amount of an expense on the income statement for the appropriate accounting period. The expense recognition principle states that expenses should be recognized in the same period as the revenues.

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/media/c50/c50cca1f-cfa5-4c81-a37f-2810754a3a83/phpTzrprB)

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)