Ace Tips About Gain Loss Account

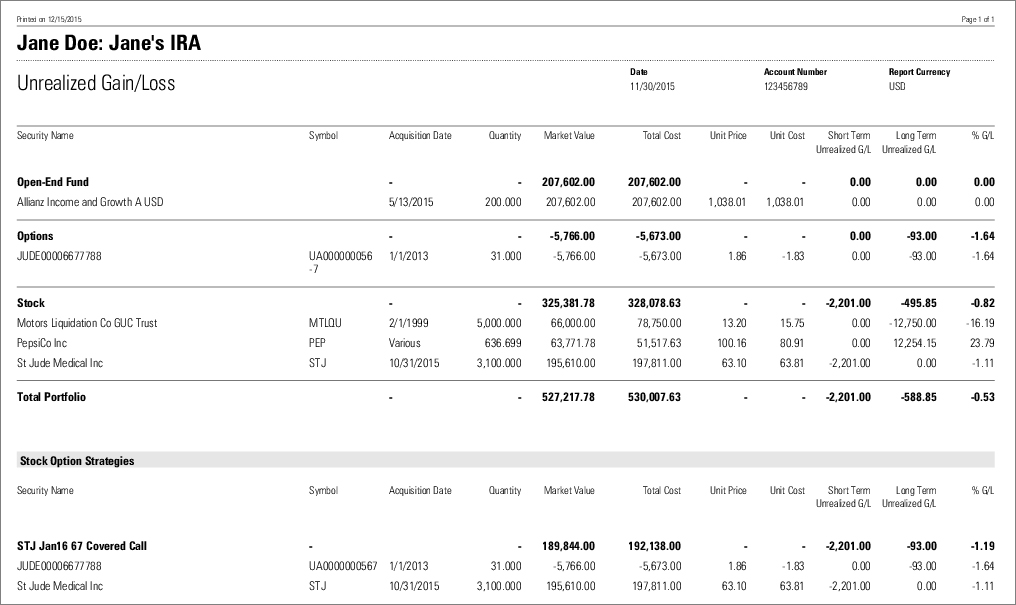

Debit off any liabilities (margin) due the position;

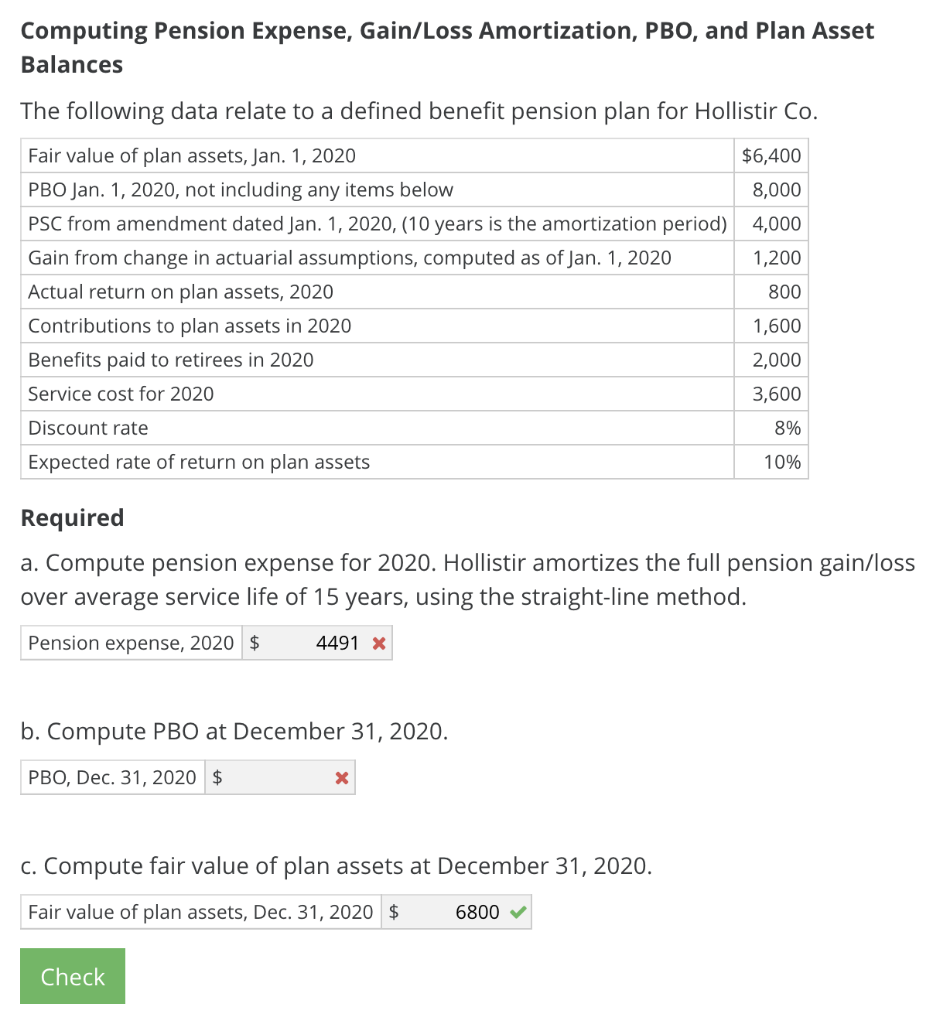

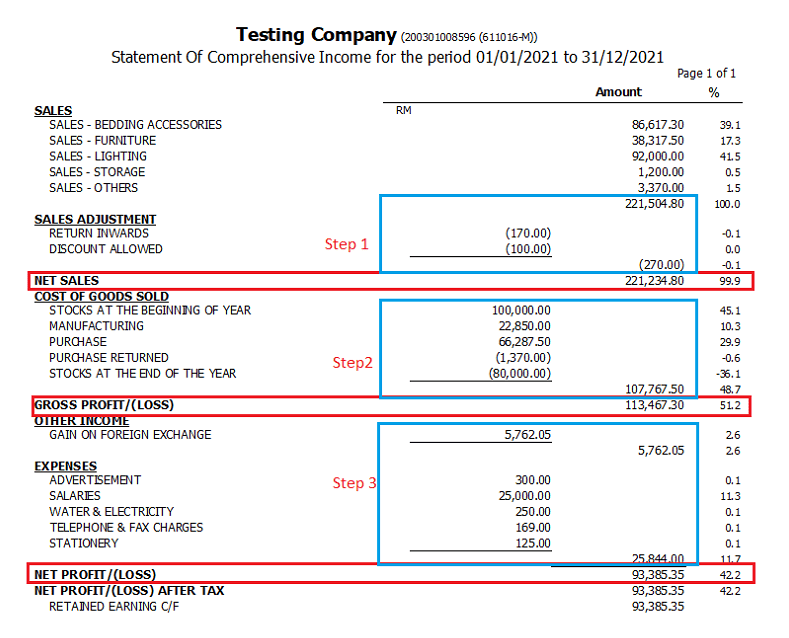

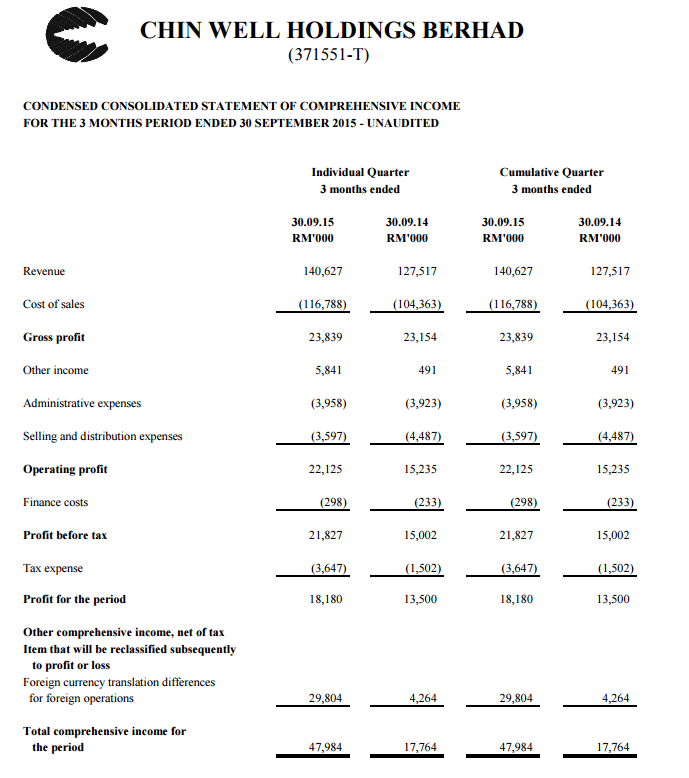

Gain loss account. It is the price difference. A realized foreign exchange gain or loss is ultimately recorded when the transaction is settled. The gain is unrealized until the.

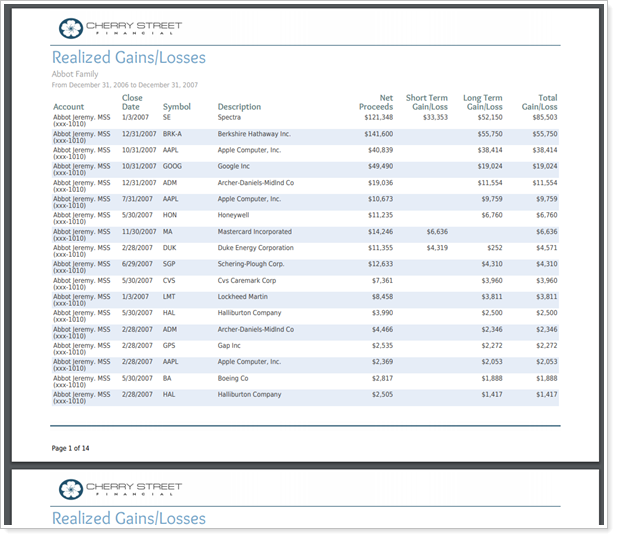

Debit cash in the amount. Gain or loss on investment is the profit or loss that investors receive from their investment such as shares, bonds, and other investments.

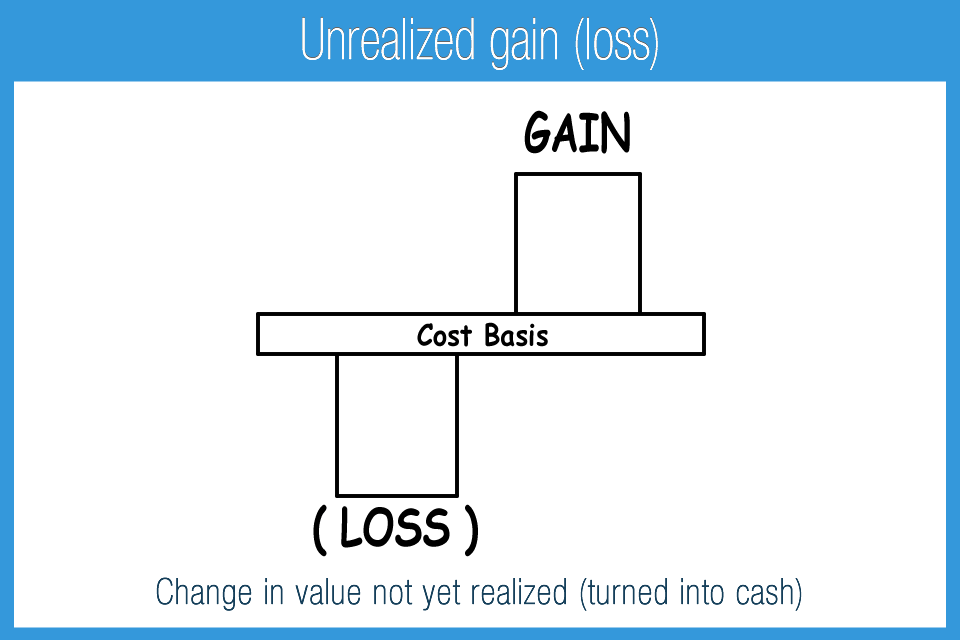

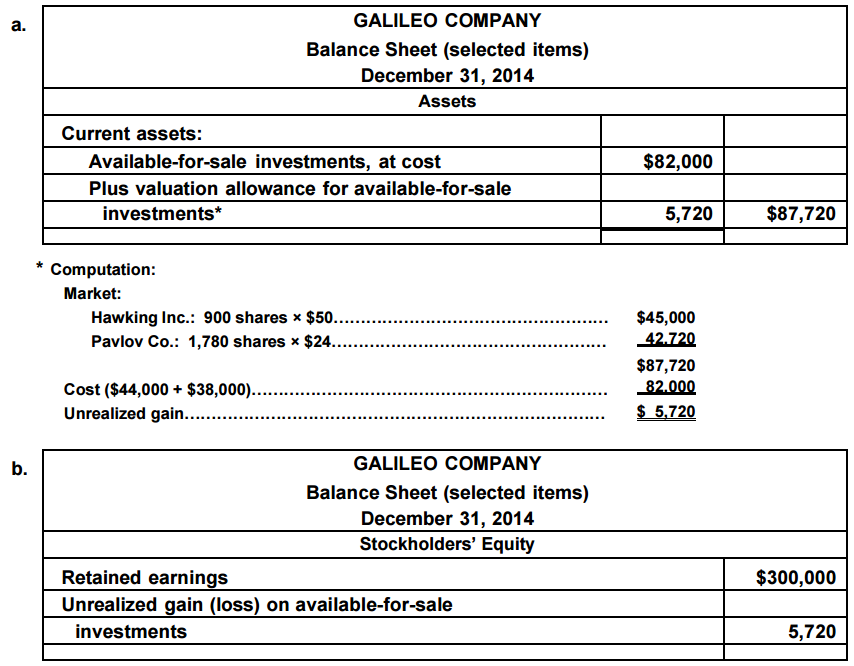

Once they are sold the gain or. Russia's position in the war is stronger than it was a year ago, and the country is in the process of seizing the initiative and gaining the upper hand militarily, the focus 2024. Unrealized gains or losses refer to the increase or decrease in the value of different company assets that have not been sold yet.

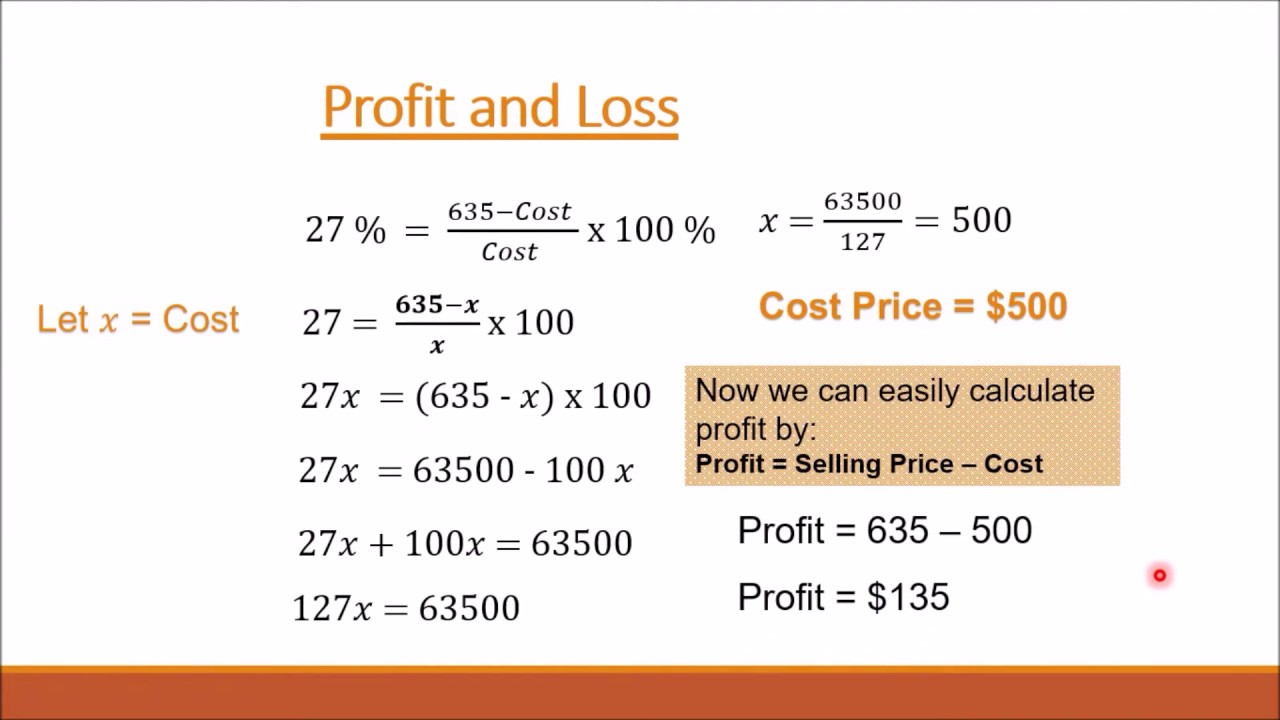

Unrealized gains and losses is the amount that the seller expects to earn when the invoice is settled, but the customer had failed to settle the amount by the close of the accounting. Amy schumer is sharing a health update to raise awareness and redirect rude commenters. The gain or loss is calculated as the net disposal proceeds, minus the asset’s carrying value.

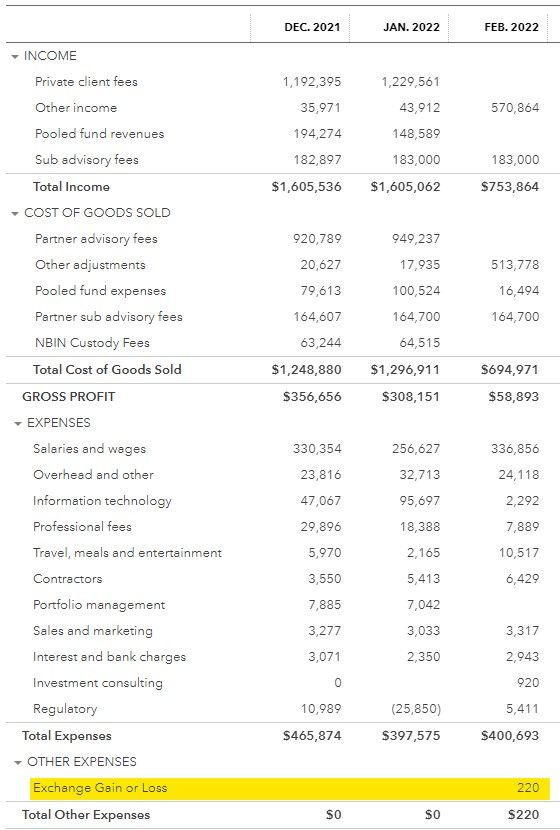

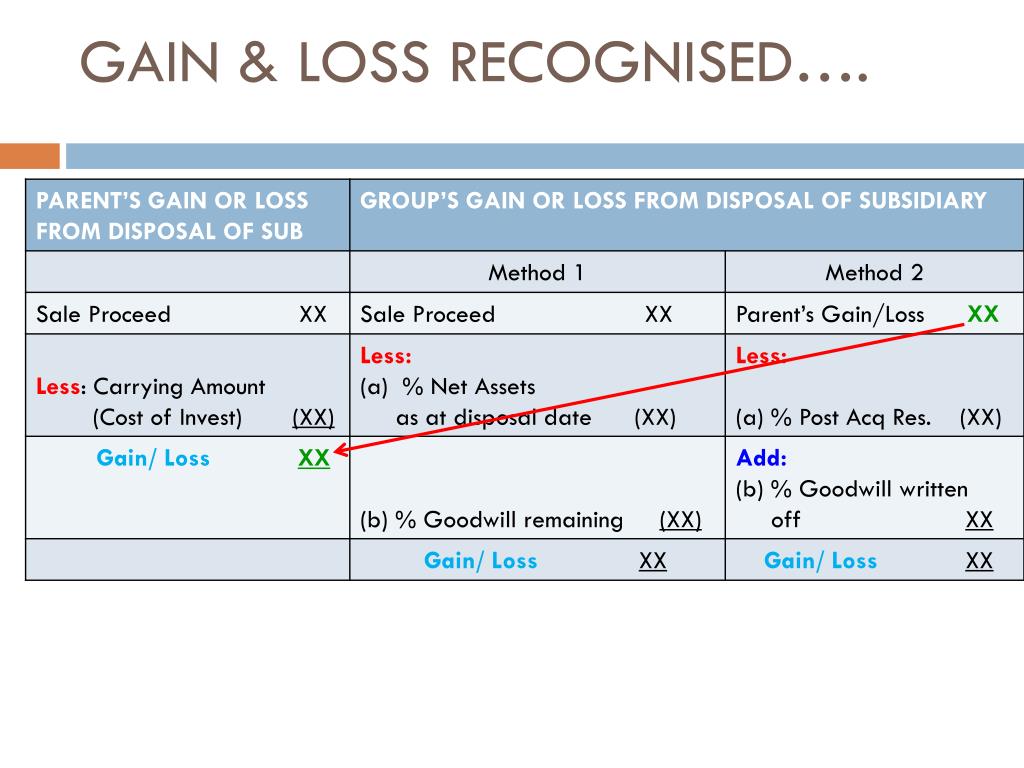

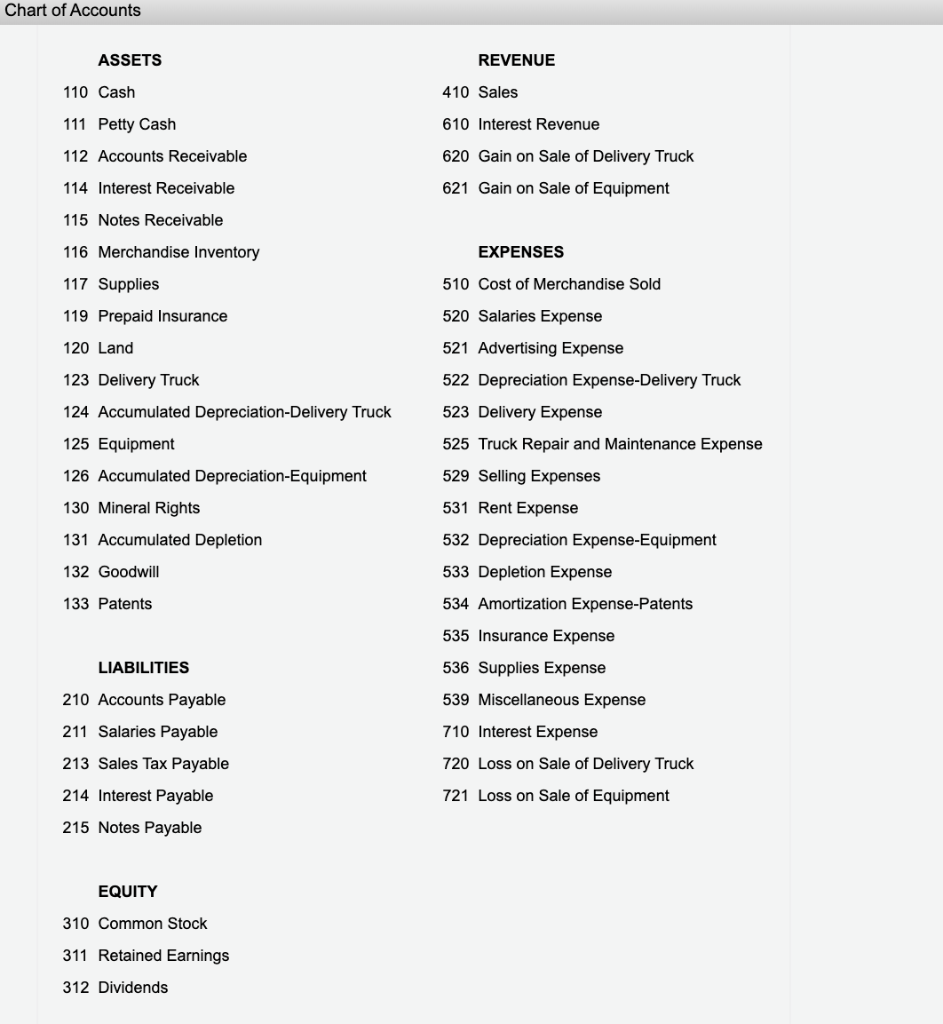

1 join the conversation best answers vpcontroller level 11 october 15, 2018 05:16 pm select chart of accounts for gain/loss on sales of asset as other. A disposal account is a gain or loss account that appears in the income statement, and in which is recorded the difference between the disposal proceeds and. Gain and loss accounts are used when we only want to show the net effects of a transaction instead of tracking the inflows and outflows separately.

The gain/loss account can be set in. Credit off the position (the initial cost & any accumulated recognized capital gains/losses) under assets; If the actual residual value upon disposal had been $1,000 and there had been a loss on disposal of asset of $1,000, then the journal entry would have included.

A former competitor on the biggest loser said she lost 150 pounds and kept it off for years, thanks to five simple weight loss tips.megan hoffman of california was. What are unrealized gains/losses? The options for accounting for the disposal of assets are noted.

You can select any account except for system accounts ,. The account called it “one of the broadest approved by the eu”. For example, if you receive cash for an account receivable, or pay.

Unrealized gains or losses are the gains or losses that the seller expects to earn when the invoice is settled, but the customer has failed to pay the invoice by the close of the. To calculate a gain or loss on the sale of an asset, compare the cash received to the carrying value of the asset. Yarilet perez gains & losses vs.

Gains and losses are reported on the income statement. We do this when the. The following steps provide more detail about.