Amazing Tips About Prepaid Income In Balance Sheet

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

Prepaid income is found on the balance sheet of.

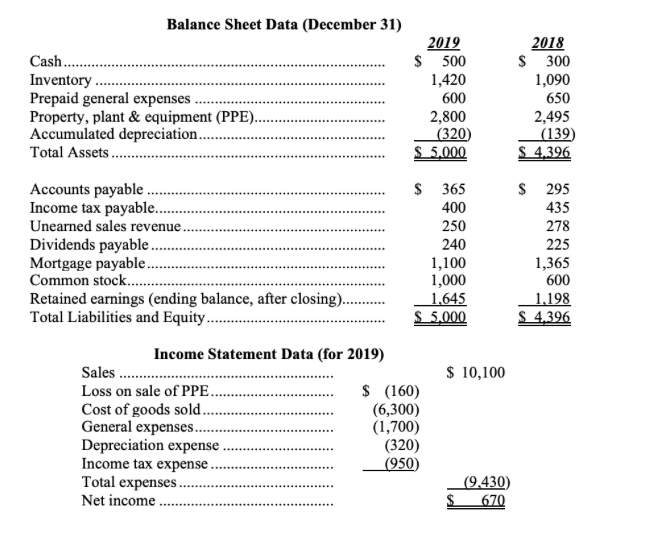

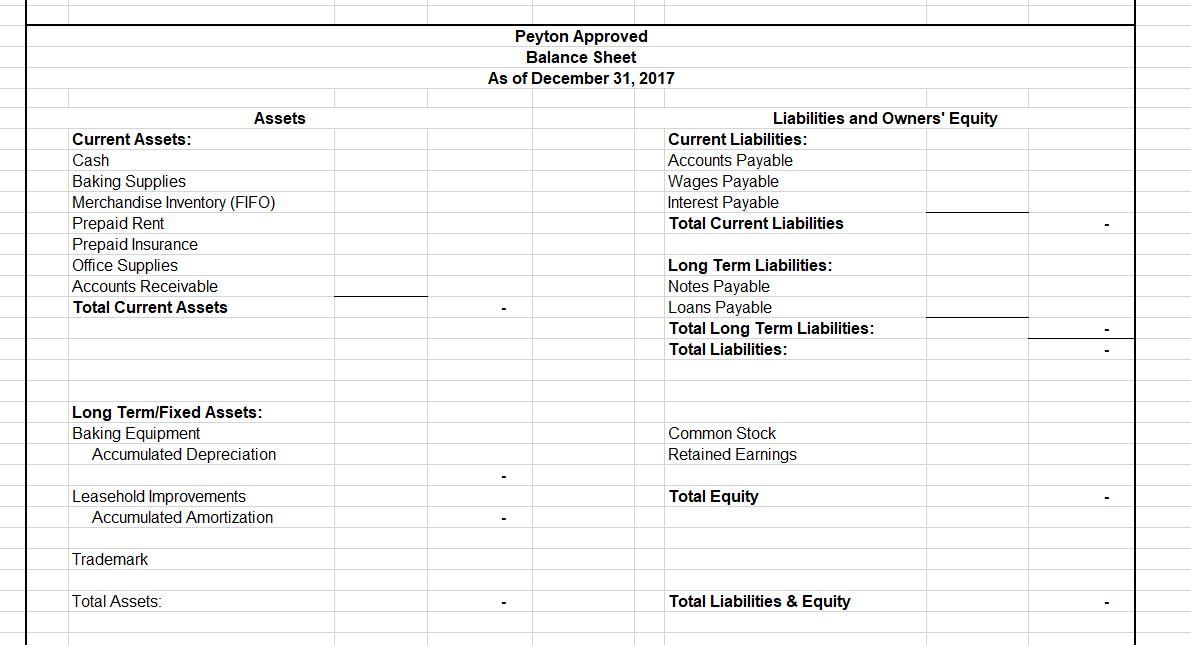

Prepaid income in balance sheet. The initial entry to record a prepaid expense only affects the balance sheet. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid rent will increase, while cash will.

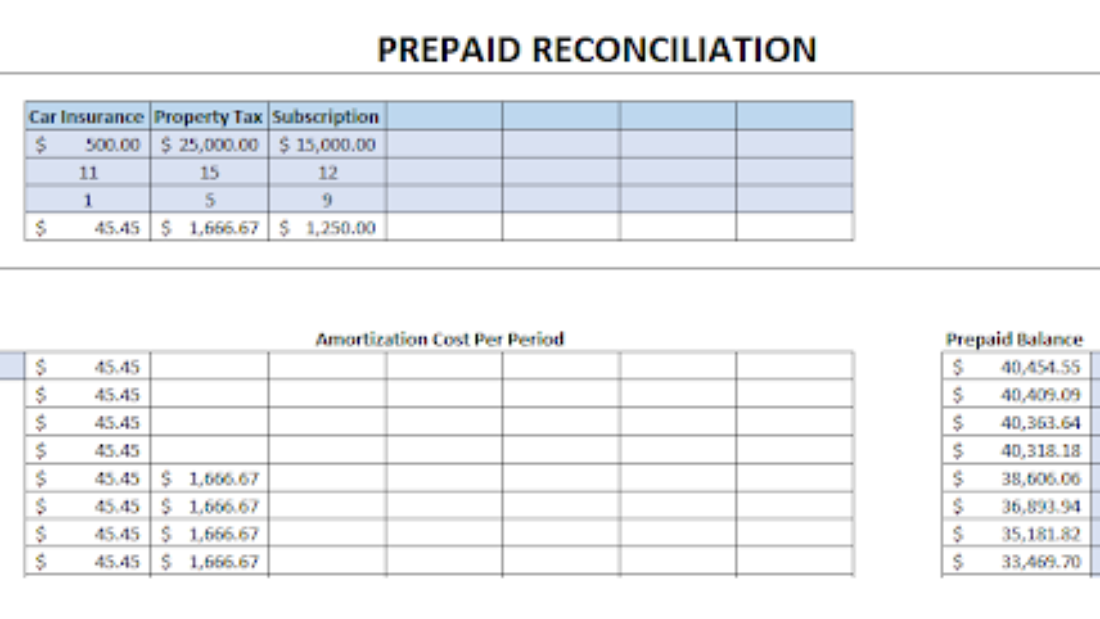

Following accounting entry is required to account for the prepaid income: You shift $2,400 out of cash on the balance sheet and report $2,400 as a prepaid expense instead. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within.

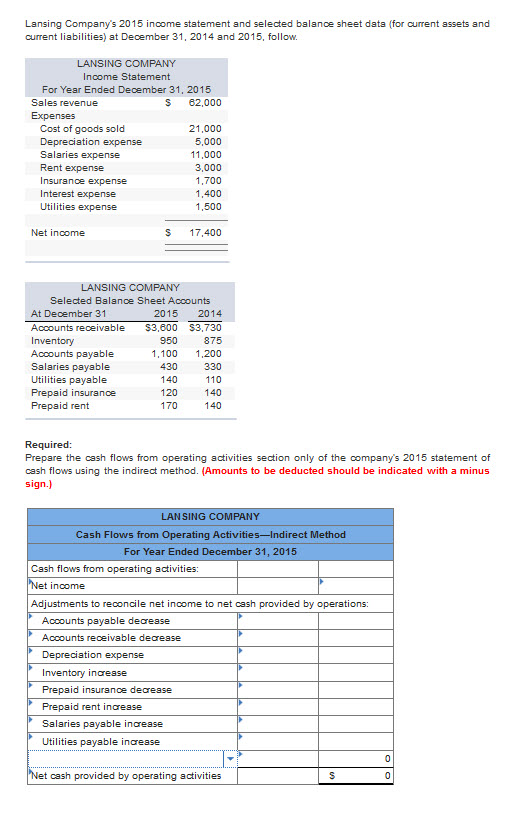

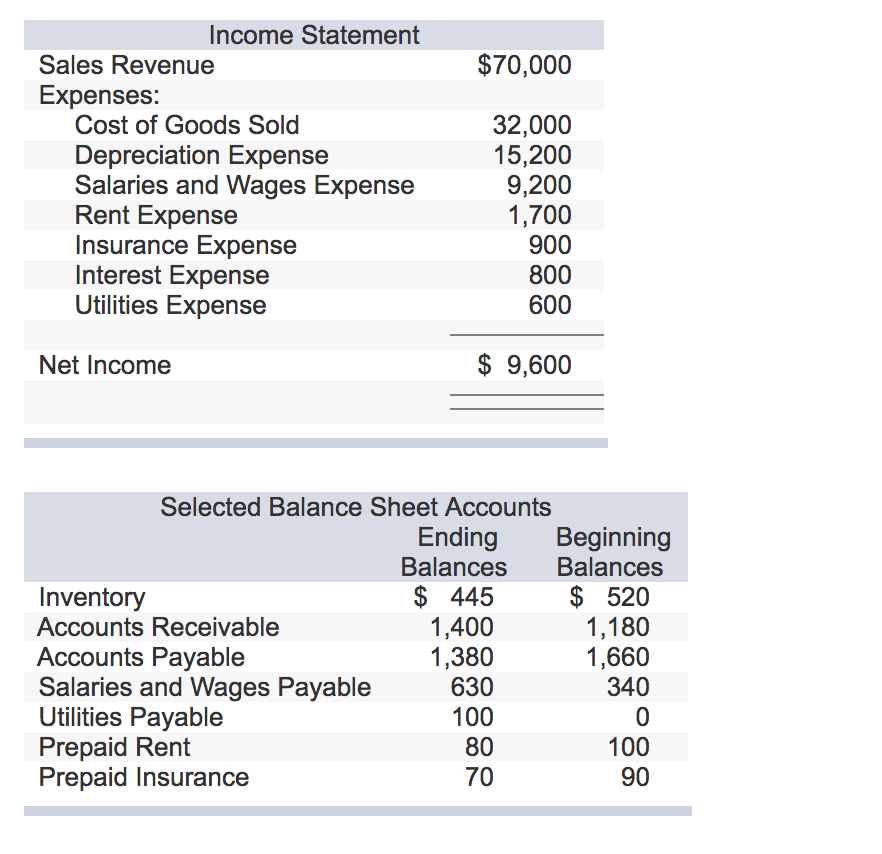

Effect of prepaid expenses on financial statements. Prepaid expenses can help small businesses. As each month passes, the prepaid expense account for rent on the balance sheet is decreased by the monthly rent amount, and the rent expense account.

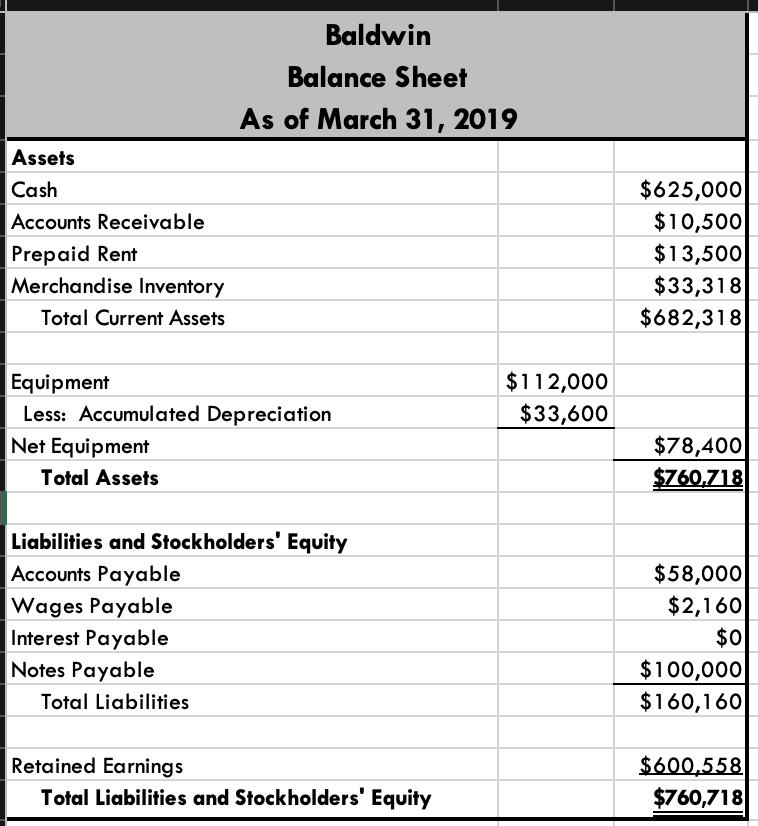

The balance sheet lists prepaid expenses under current assets, which are expected to be consumed or utilized within a year. The prepaid expense is shown on the assets side of the. Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet.

The prepaid portion of the expense (unexpired) is reduced from the total expense in the profit & loss account. Explore prepaid expenses in a balance sheet and see prepaid expenses. Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset.

Prepaid expenses can benefit businesses struggling to make ends meet. In the company’s balance sheet, the prepaid expenses are recorded as a current asset account. Initial journal entry for prepaid insurance:

How to find prepaid expenses on the balance sheet? The prepaid expense a/c appears on the assets side of the balance sheet. Every month, when you get the work you paid for, you reduce.

However, there are some pitfalls to be aware of. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular year. In short, these expenses are.

Prepaid expenses recorded as current assets. While preparing the trading and profit and loss a/c we need to deduct the amount of prepaid. A company prepaying for an expense is to be recorded as a prepaid asset on the balance sheet and is termed as ‘prepaid expense’.

Prepaid income is considered a liability, since the seller has not yet delivered, and so it appears on the balance sheet of the seller as a current liability.

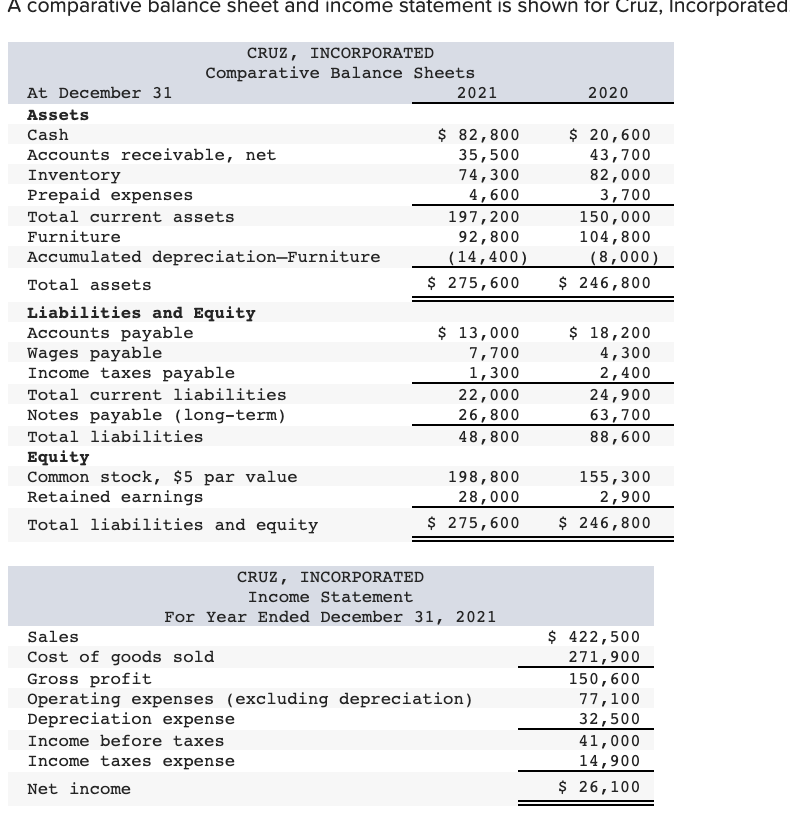

![[Solved] The classified balance sheet and selected SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2022/11/636a720c3544d_396636a720c25008.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)