Impressive Info About Capital Reserves Balance Sheet

Capital’ (herein defined as capital excluding revaluation.

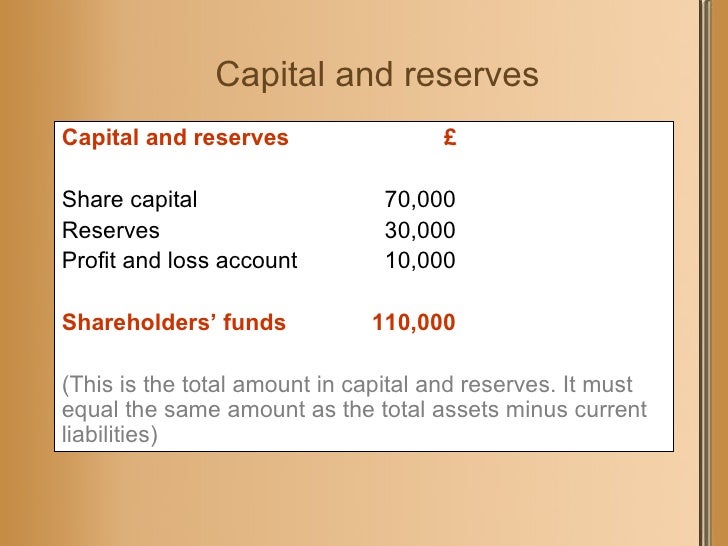

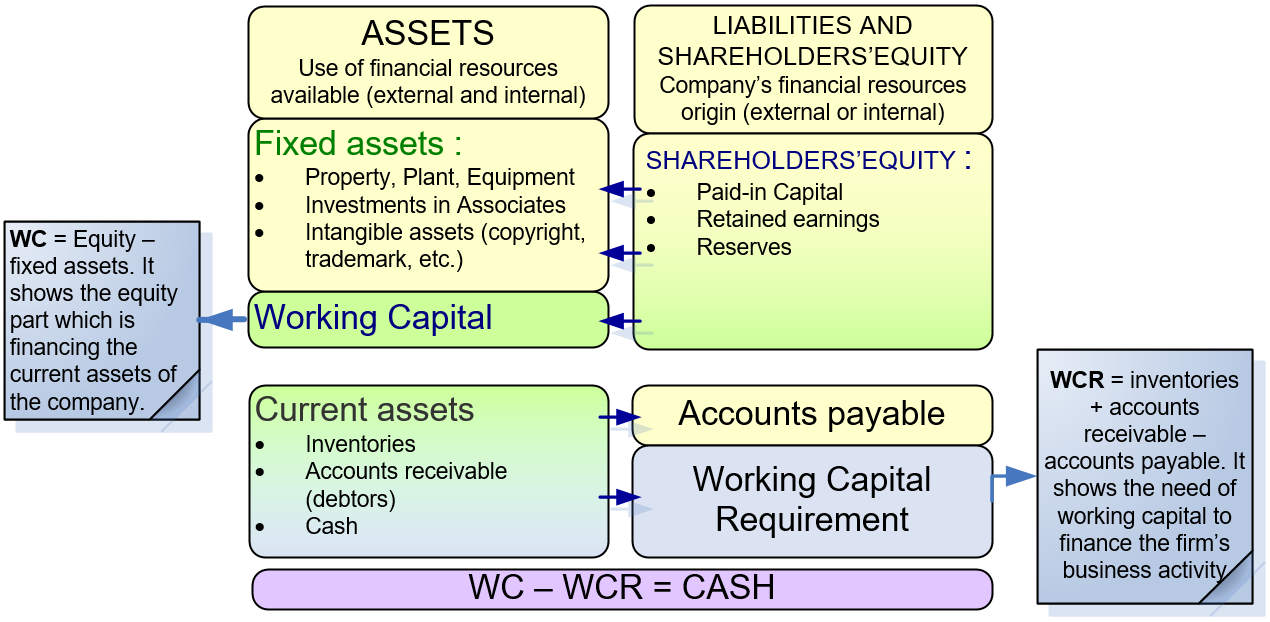

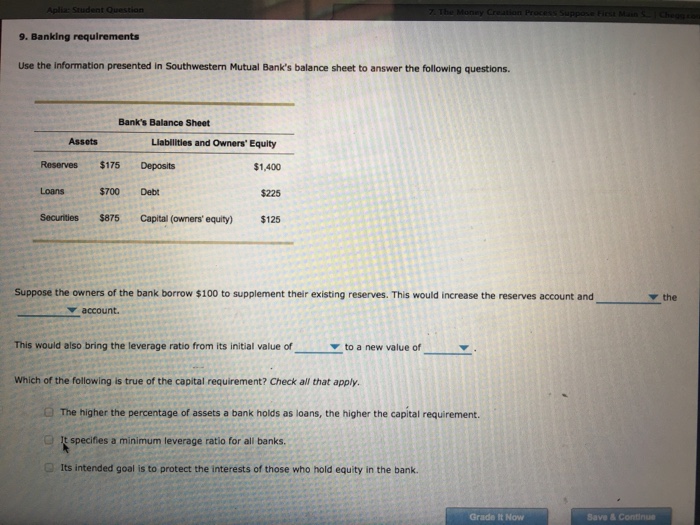

Capital reserves balance sheet. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks. In simple terms, the capital reserve is a surplus from different transactions and is most commonly acquired when you sell a capital asset. Company reserves are the profits that sit in the company’s accounts, ready for use later.

Capital on a balance sheet refers to any financial assets a company has. It is probable that more confusion exists with regard to reserves than any other. By michael s.

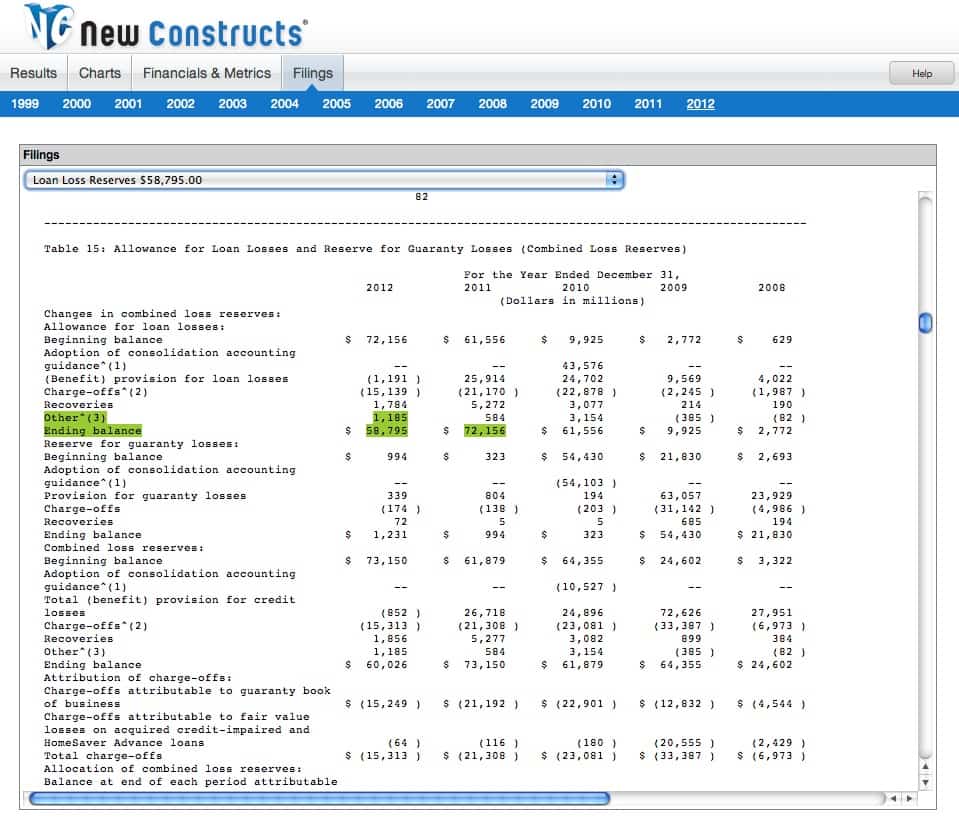

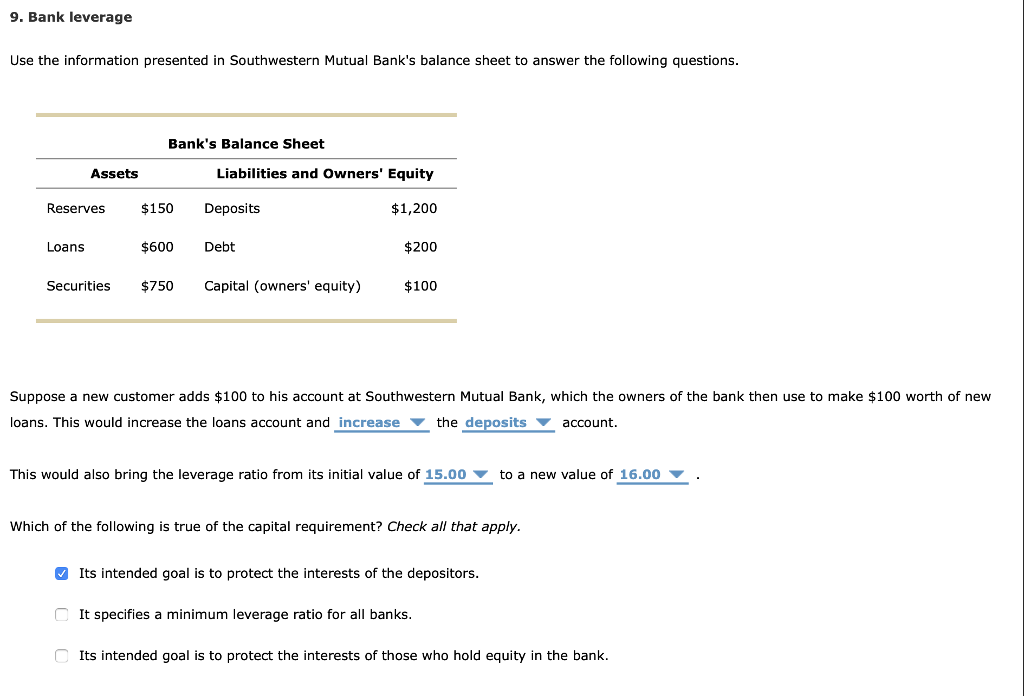

Total assets from q1 1984 to q3 2023 about assets and usa. Reserves should without exception be found upon the righthand side of the balance sheet. It is an account on a company's balance sheet put aside to settle financial emergencies or capital losses that the company might face.

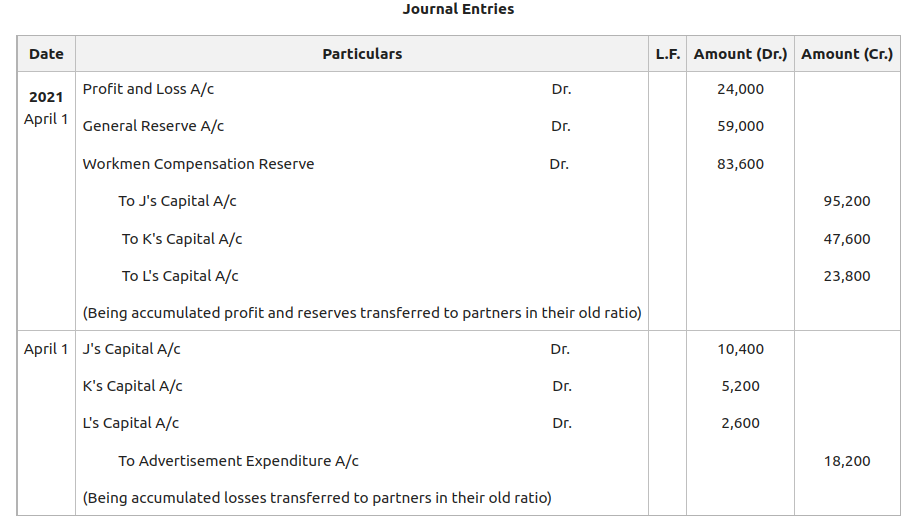

Reserves are shown on the liability side of a balance sheet under the head “reserves and surplus” along with capital. Capital reserve is the part of the profit or surplus, maintained as an account in the balance sheet that can be used only for special purposes. I’m quite confused on what capital and reserves are in the balance sheet.

I couldn’t find a clear, simple, easy to understand explanation anywhere. How to calculate capital on the balance sheet. It is made out of capital profits earned.

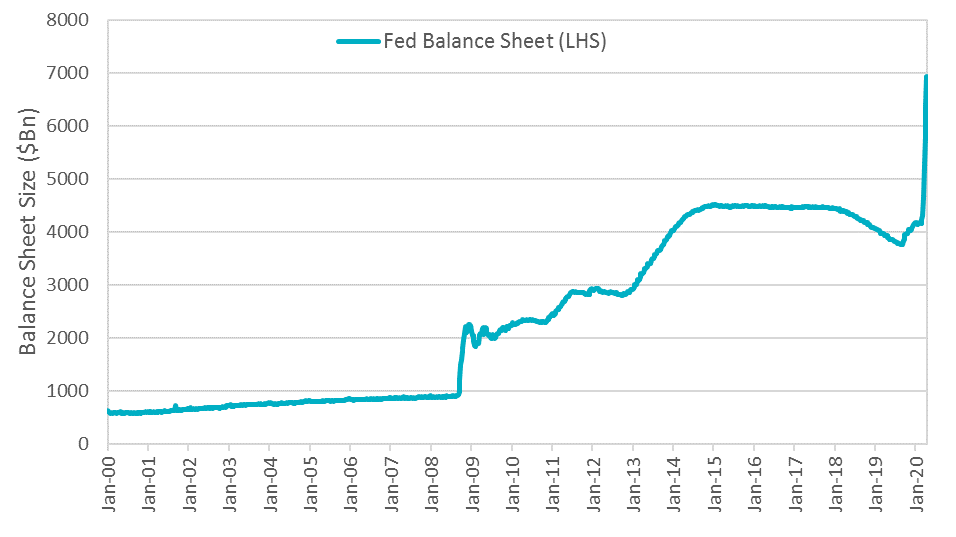

Graph and download economic data for balance sheet: The federal reserve’s internal debate over the fate of its balance sheet reduction effort is set to quicken at its march policy meeting, with policymakers first. If a company faces losses then it may not be created, at all.

Legal reserves rose by €70 million in 2020 and by €66 million in 2019 due to reclassifications from retained earnings. A capital reserve is set. In your balance sheet, capital will fall under the equity category and have the surplus and reserve classification.

To calculate capital on the balance sheet, you need to add up the value of all the components mentioned above. Other factors draining reserve balances: Balance sheet and in the notes is to segregate ‘statutory.

Reserve balances with federal reserve banks: The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near. Graph and download economic data for liabilities and capital:

The additional 24l over and above the share capital will now sit on the liabilities side of the balance sheet, under ‘reserves & surplus’, in a sub header called. This reserve refers to the cash on hand that companies can use to offset future. The company creates a revenue reserve so that the core of the business can get strengthened.

:max_bytes(150000):strip_icc()/capitalreserve.asp-final-4ee04af3045840f6970764ff1432151e.png)

:max_bytes(150000):strip_icc()/ExxonOilreservesPDF-f07628dcc0c04b21a67b1fe1f0d06a4f.jpg)

:max_bytes(150000):strip_icc()/Balance-Sheet-Reserves_Final_4201025-resized-b426e3a4e56040f29fba29b238f53ec3.jpg)