Simple Tips About Cash Flow In Financing Activities

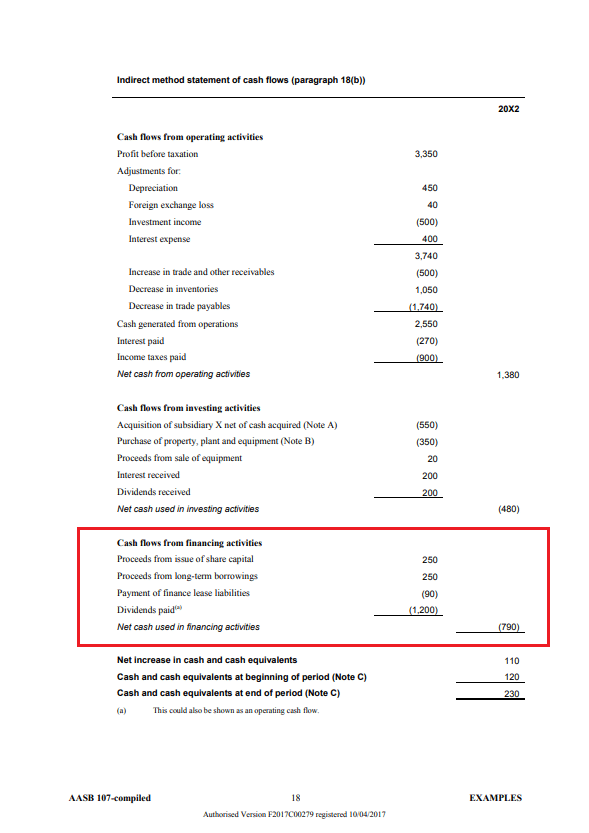

Cash flows from financing activities is a line item in the statement of cash flows.

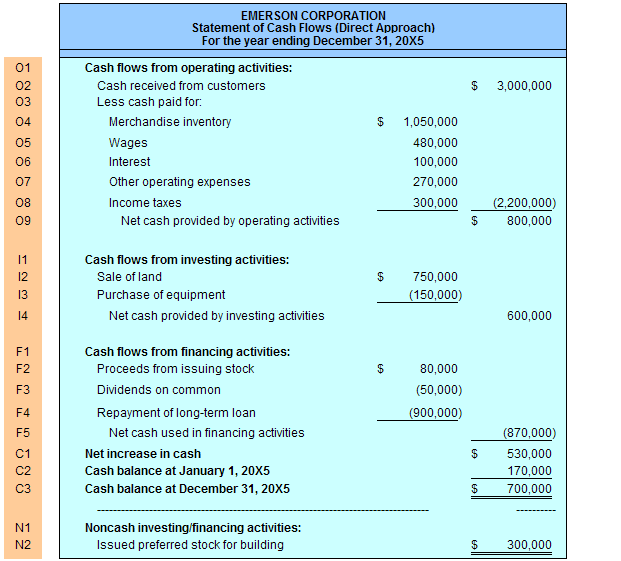

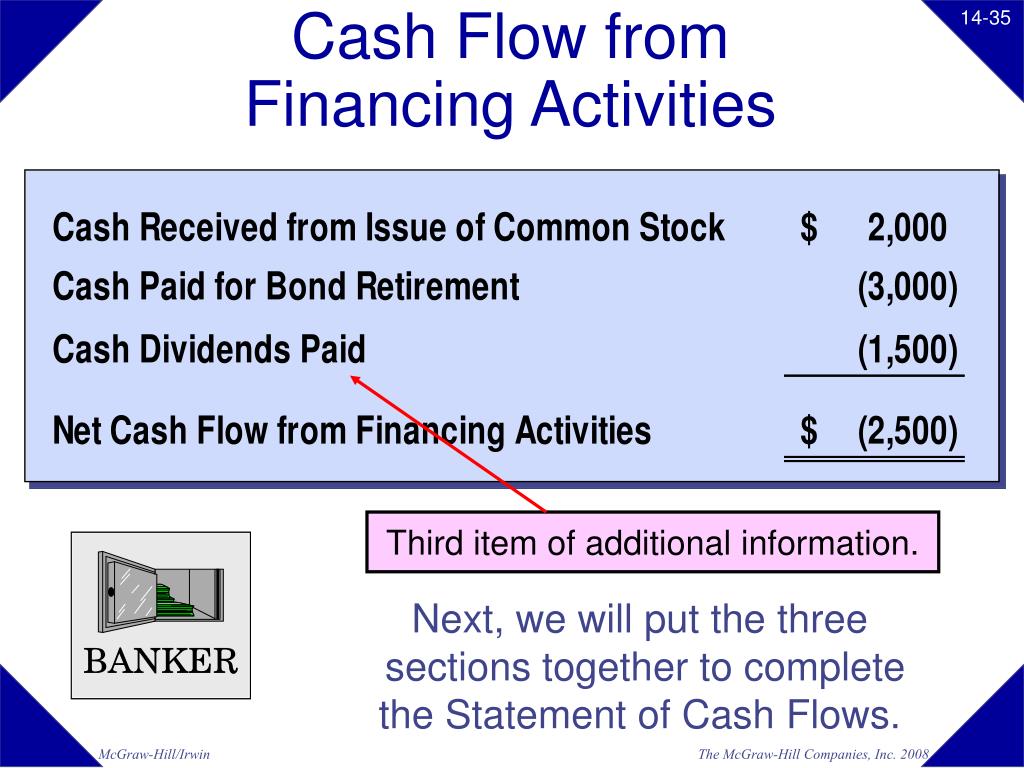

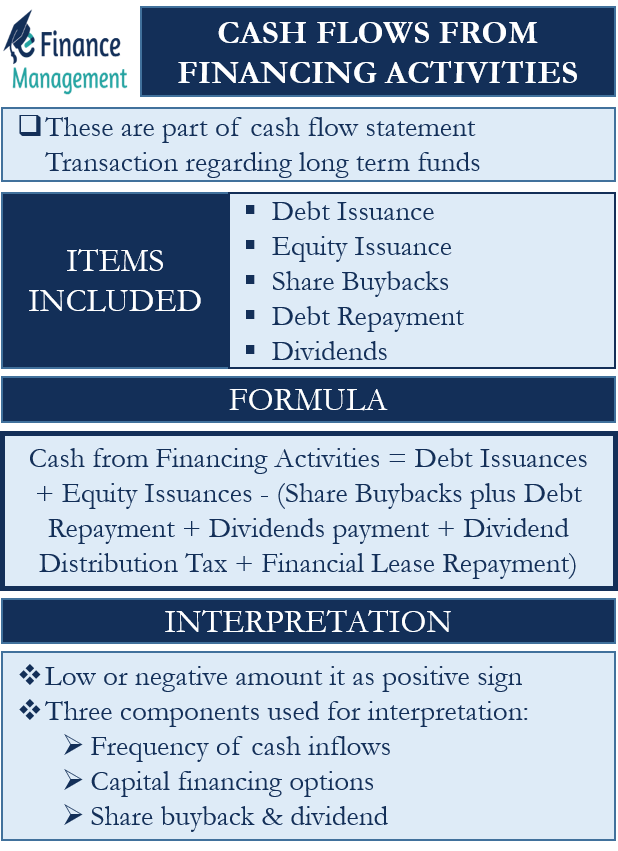

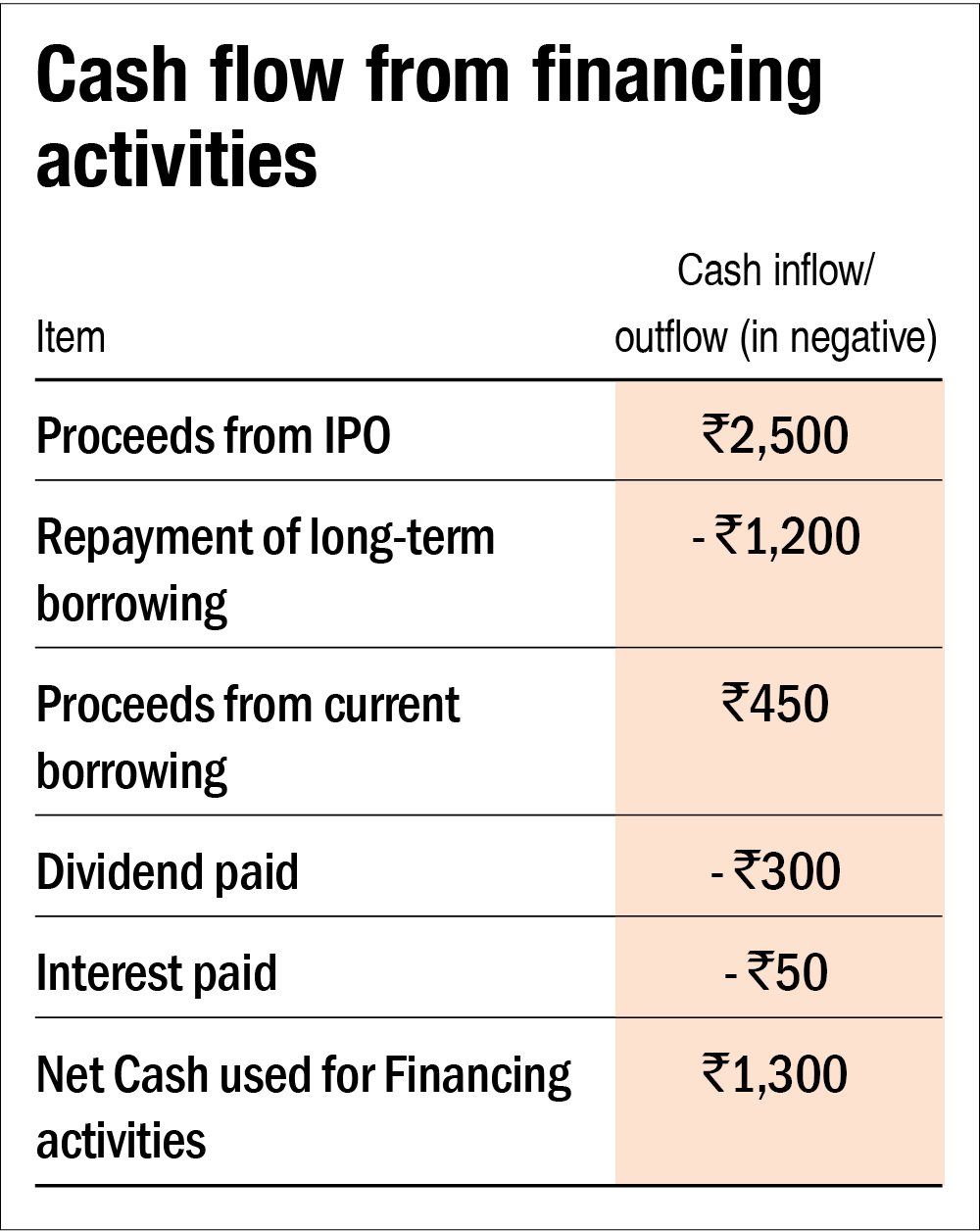

Cash flow in financing activities. Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a given period. Cash flow from financing activities refers to the inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of securities like equity shares, preference shares, issuing debt, debentures, and from the redemption of securities or repayment of a long term or short term debt, payment of divi. Common line items cash flow from financing.

This equity balance reflects the cost of repurchased shares. The respective financing activities include transactions that involve dividends, equity, and debt. Apparently, $100,000 was the cost of the.

Cash flow from financing activities 1. Think of it as the vital fluid that keeps your business’s heart pumping, allowing you to cover expenses, pay employees, and invest in growth. So what are financing activities?

Cash flow from financing activities helps the lenders of funds in estimating their claims on cash flows in the future. Cash flow from financing activities describes the incoming and outgoing capital that a business raises and repays, whether through debt financing, equity financing, or dividend payments. These transactions include adding or changing loans, issuing and selling more stock, paying cash dividends.

Principal repayments of capital lease obligations outflow: The main cash flow types are: Best for lower credit scores:

Net cash of €14 million as at december 31, 2022), as a result of a strong free cash flow generation, and including the dividend payment (of which €564 million to shareholders of the parent company on 2022 fiscal year. Cash flow can come from three sources: Cash flow from financing activities is the net increase or decrease in cash and cash equivalents resulting from sources of finance, such as issuing debt or equity, borrowing, repaying loans, etc.

It is calculated by analysing the change in equity and preference share capital, debentures, and other. Cash flow that arises from financing activities is known to provide the investors with an insight into the financial strength of the company along with how well the capital structure of the company is managed. February 19, 2020 the third section of a statement of cash flows is for financing activities.

What is cash flow from financing activities? Best for line of credit: It’s essential because it mirrors your financial health and is the lifeblood that sustains your operations.

Operating, investing, and financing activities. Essentially, your cash flow from financing activities boils down to how your company’s cash moves among its owners, investors, and creditors. Financing activities are those activities, which relate to changes in the size and composition of the contributed equity and borrowings of the entity.

This includes any cash used or provided by activities such as borrowing, lending, issuing and repurchasing. Cash flow from financing activities (cff) is the net cash flow used to raise capital for your business. Cash from financing activities represents the source or way a company raises capital and covers the return of the capital raised to the investors.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)