Fabulous Tips About Cash Flow Direct Method Format

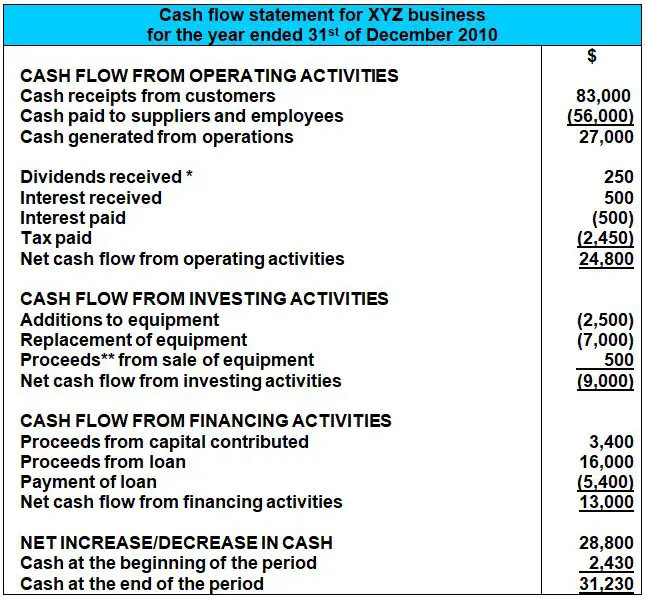

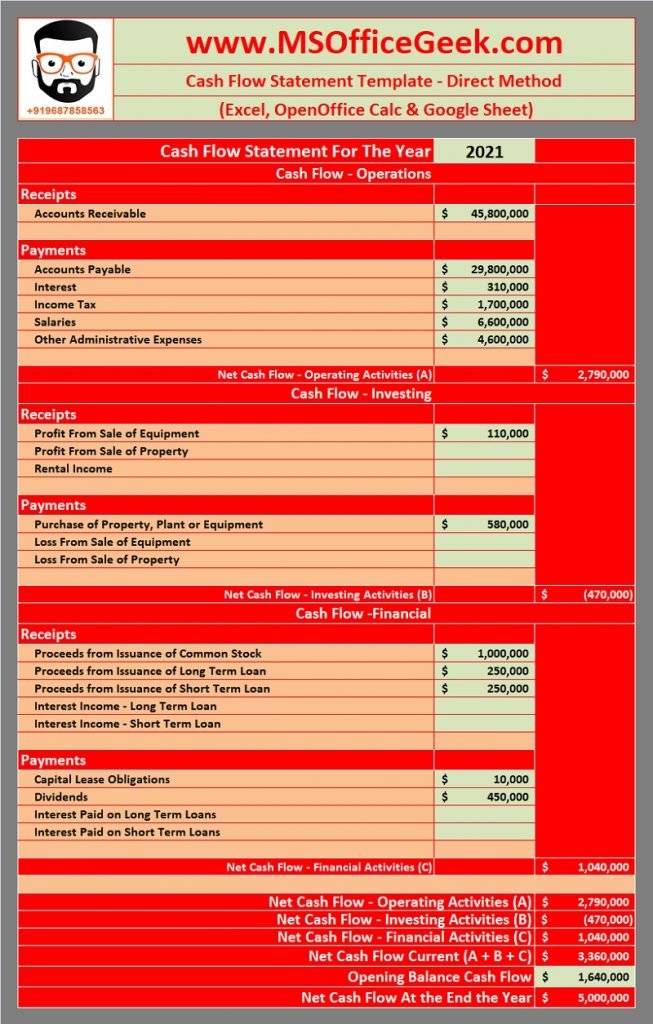

As you can see, all of the operating activities are clearly listed by their sources.

Cash flow direct method format. The operating cash flows section of the statement of cash flows under the direct method would appear something like this: Here’s an example of a cash flow statement prepared using the direct method. Do not include any sales made on credit.

List cash collected from customers. Cash flow statement classifies all the business activities into three main categories. Interest paid ( 270) income taxes paid ( 900) net cash from operating activities.

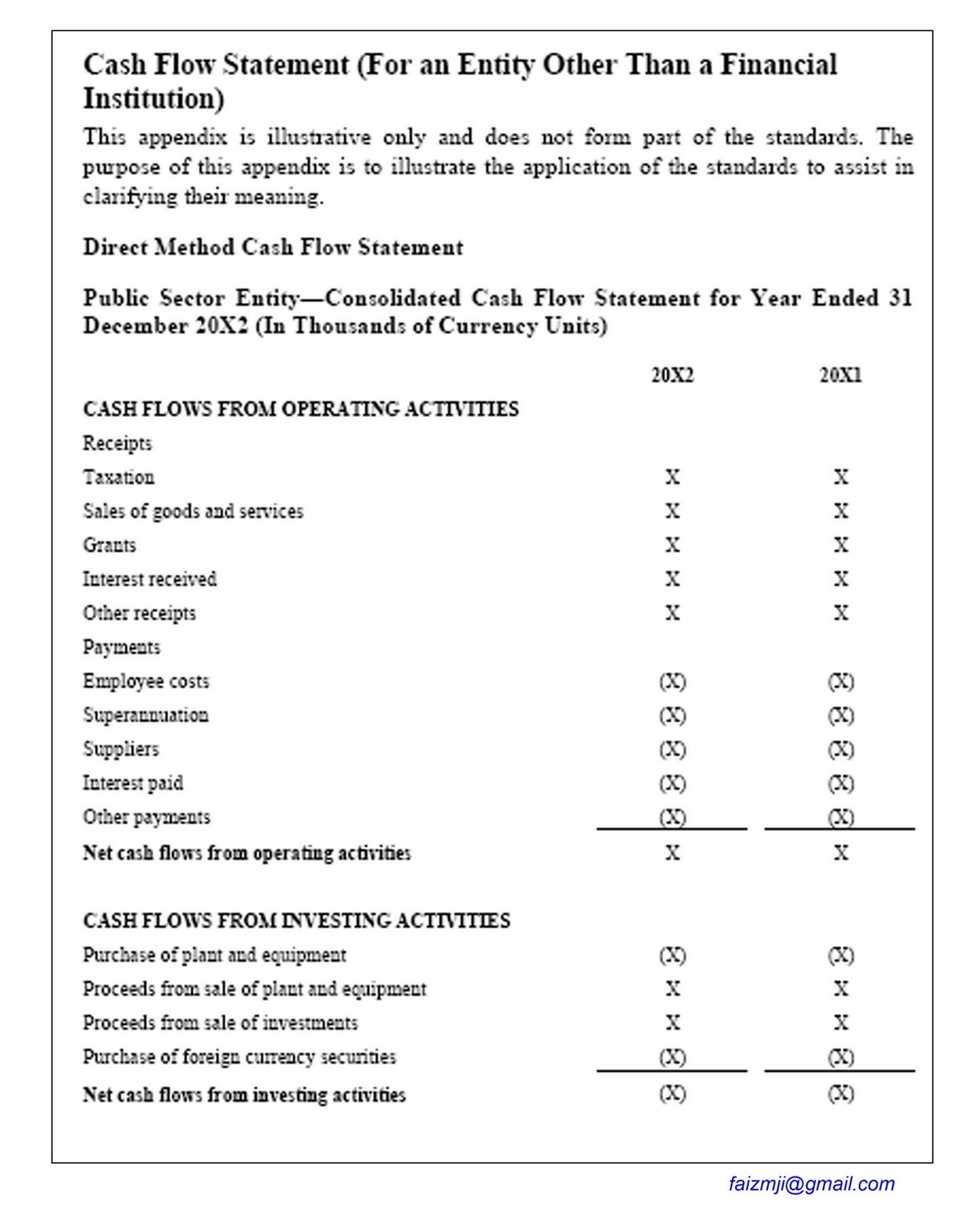

Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in october 1977). The direct method is one of two accounting treatments used to generate a cash flow statement. The direct method cash flow, where major classes of gross cash receipts and gross cash payments are disclosed.

This is a simple but rarely used method, as the indirect presentation is more common. The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. Items that typically do so include:

The direct method shows each major class of gross cash receipts and gross cash payments. The cash flow statement direct method format includes the following steps: Operating cash flows are presented as a reconciliation from profit to cash flow.

Cash paid to suppliers and employees ( 27,600) cash generated from operations. Include a list of all cash paid to employees. In many cases, some companies may have a salaries payable balance.

This categorization does make it useful to read, but the costs of producing it. Cash in from sales, cash out for operating expenses, etc. List any interest income or dividends that your company received.

Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Cash flows from operating activities. These categories are operating, investing and financing activities.

Cash flows from investing activities