Lessons I Learned From Info About Working Capital In Income Statement

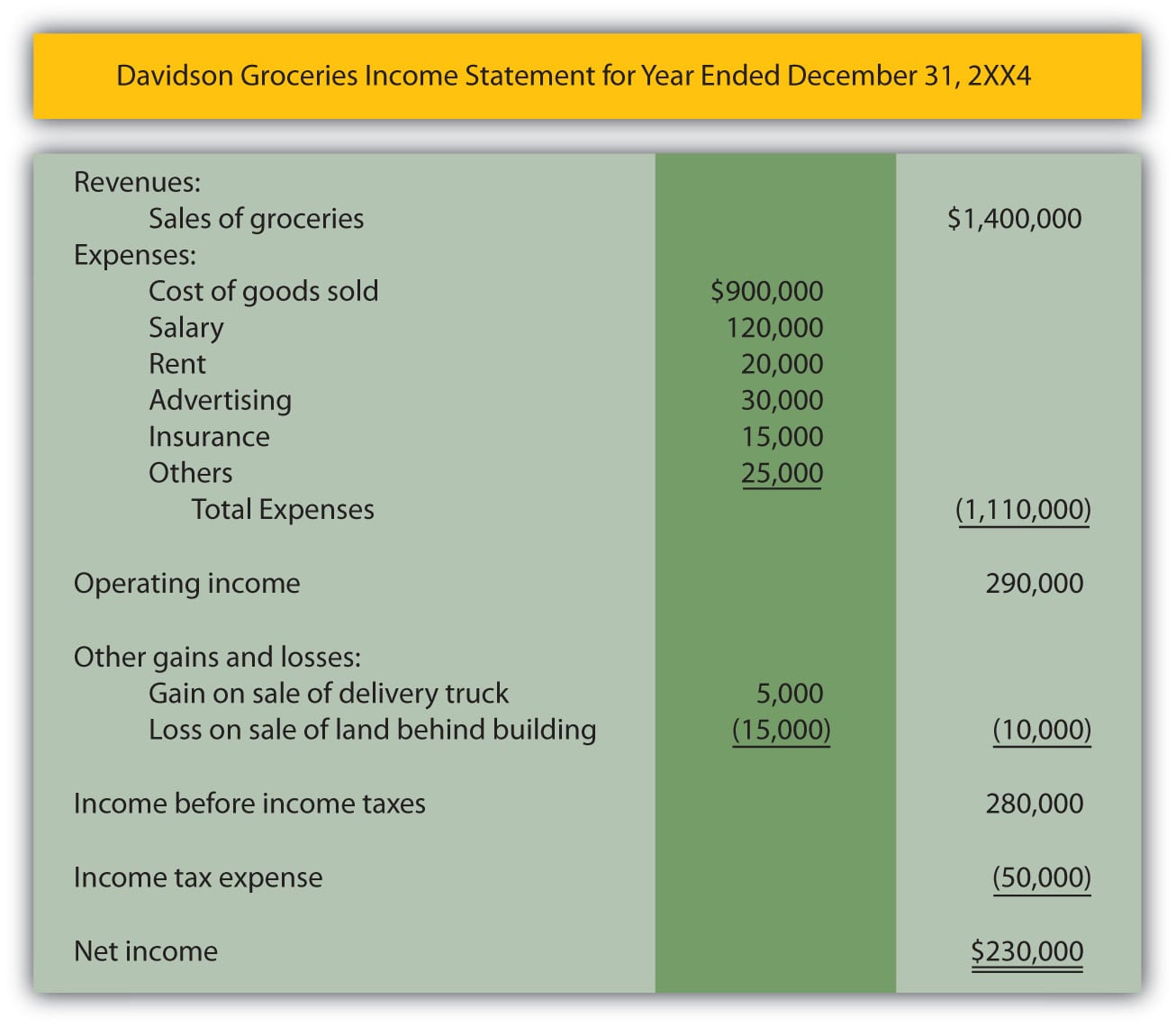

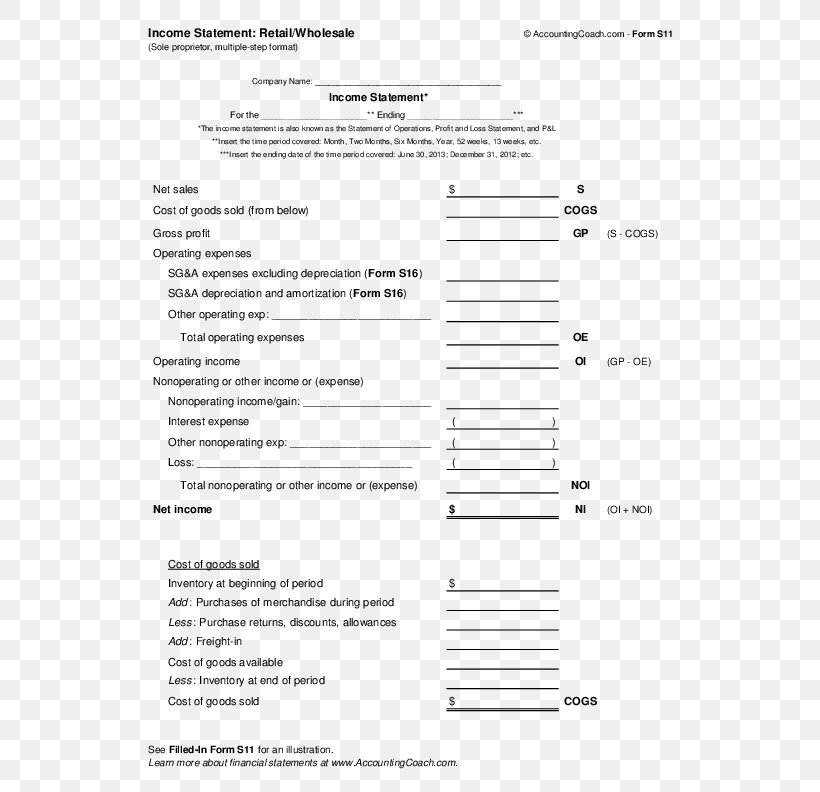

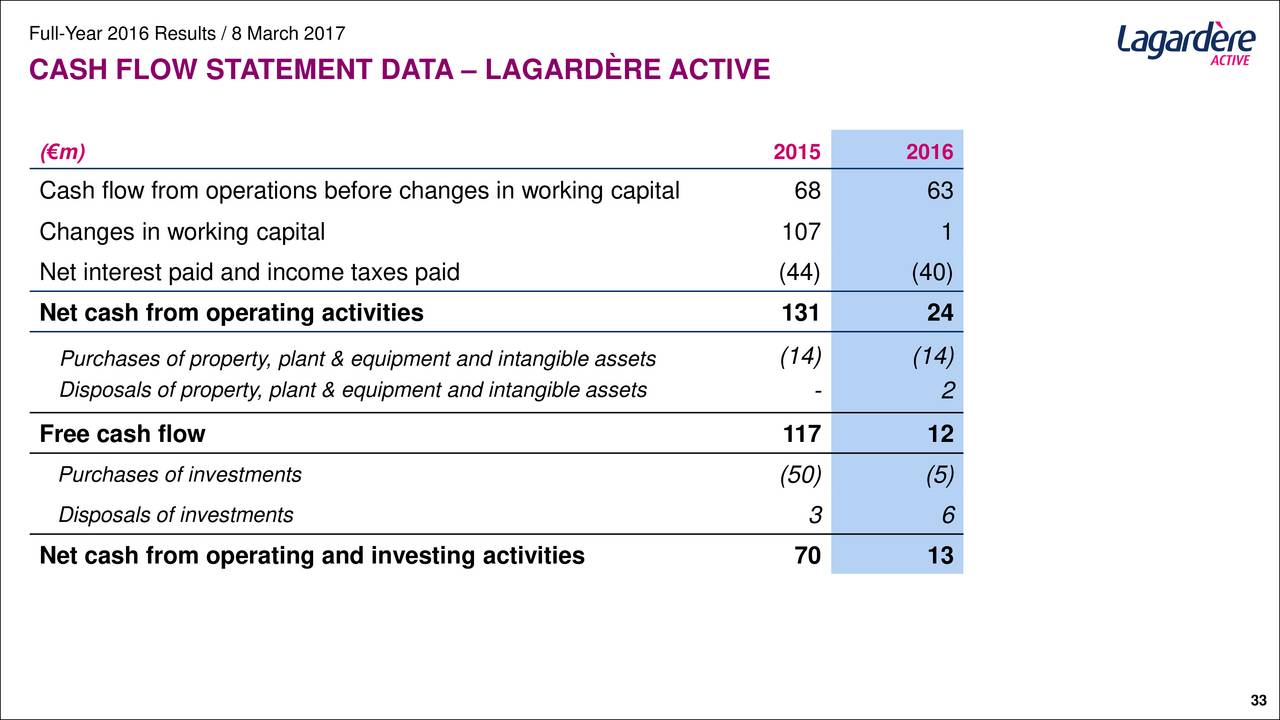

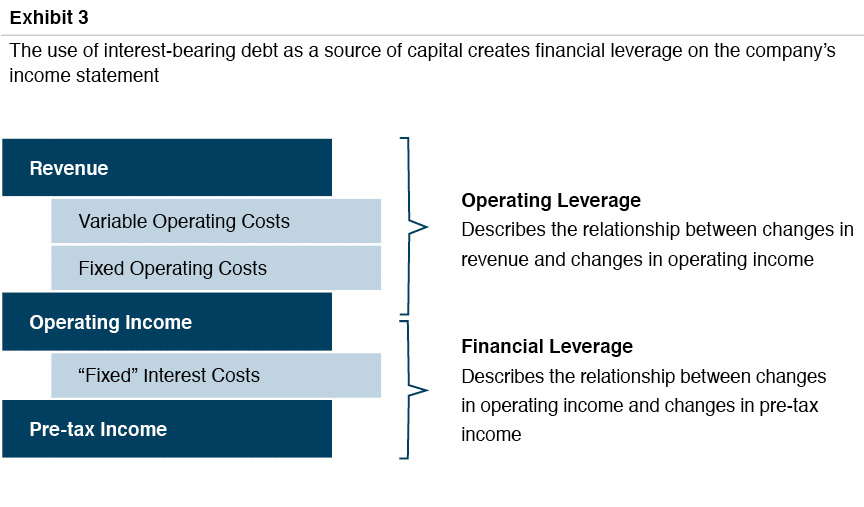

Working capital provided by operations is derived from the income statement by omitting certain items that do not affect working capital.

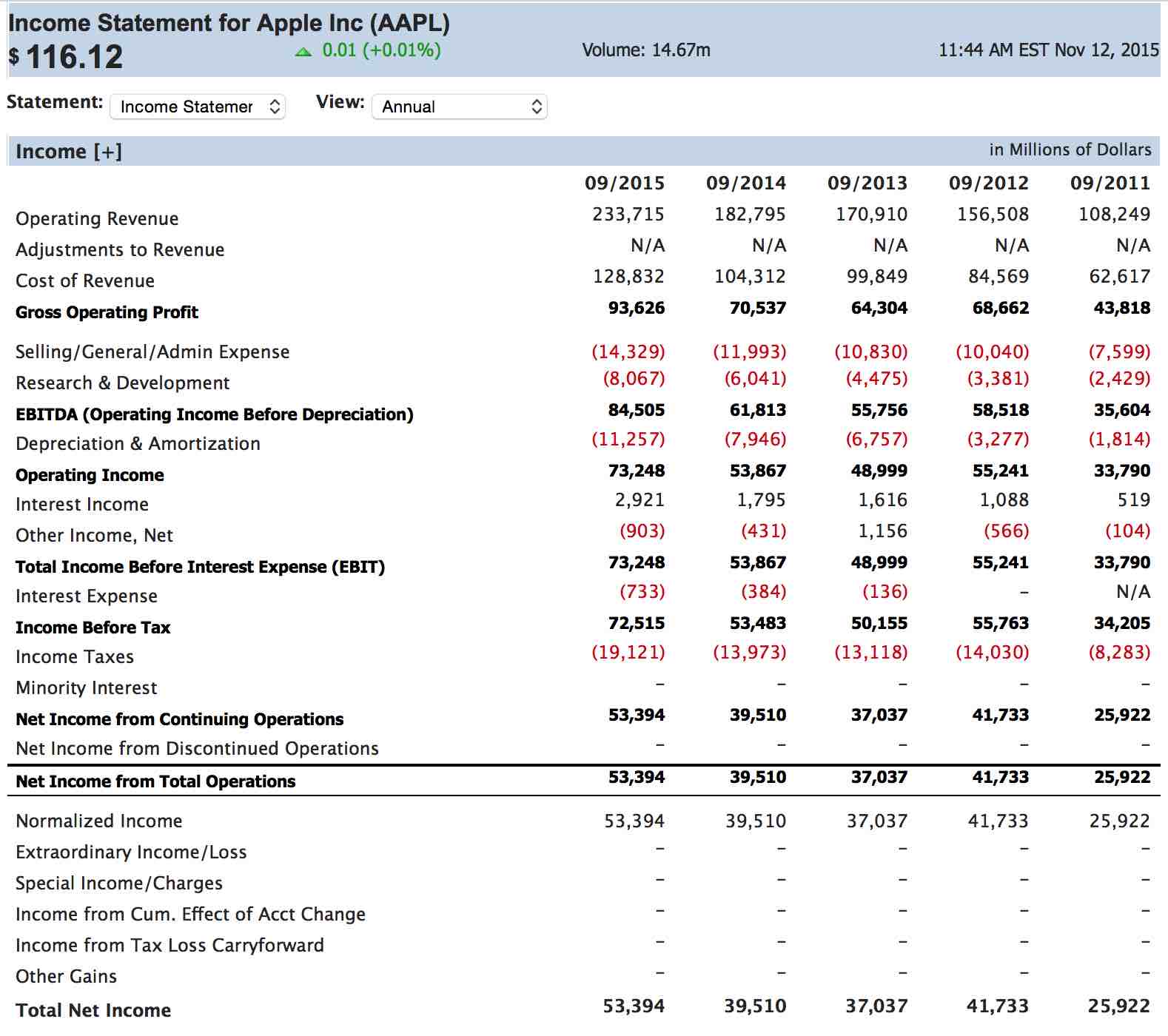

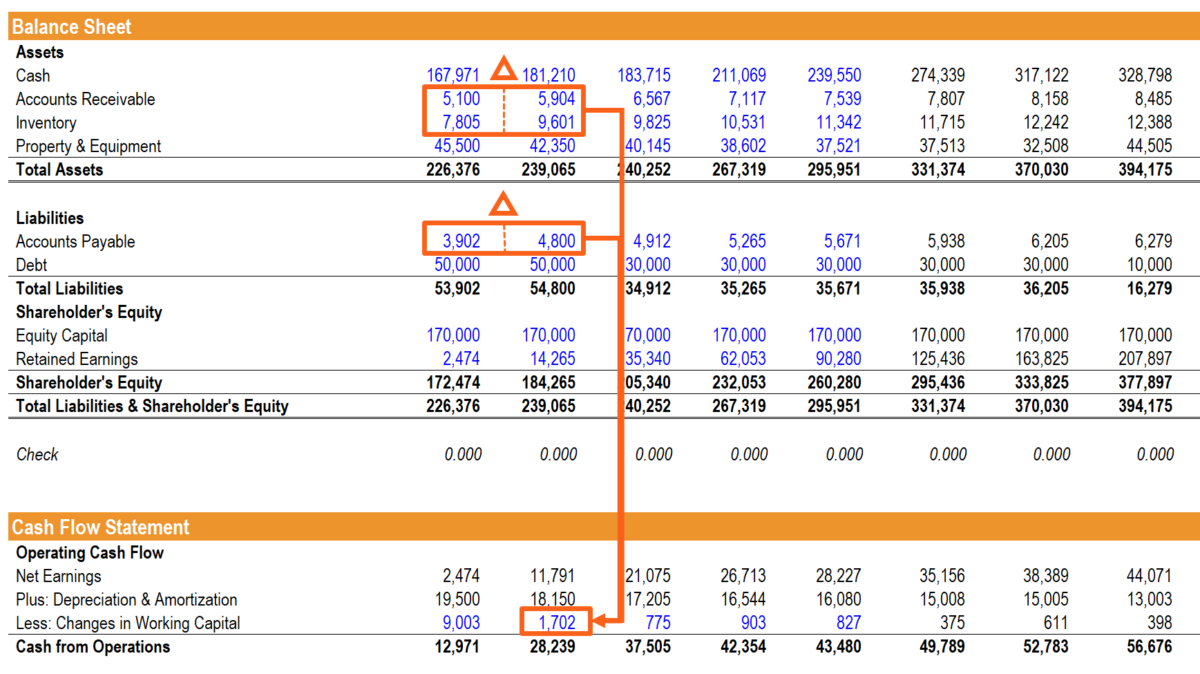

Working capital in income statement. For this reason, working capital. What is working capital in business? The balance sheet quantifies the working capital position, the income statement aids in optimizing profitability and managing expenses, and the cash flow.

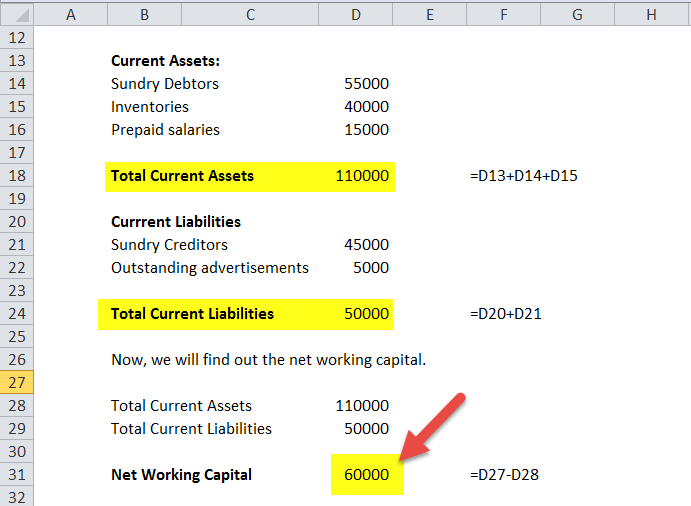

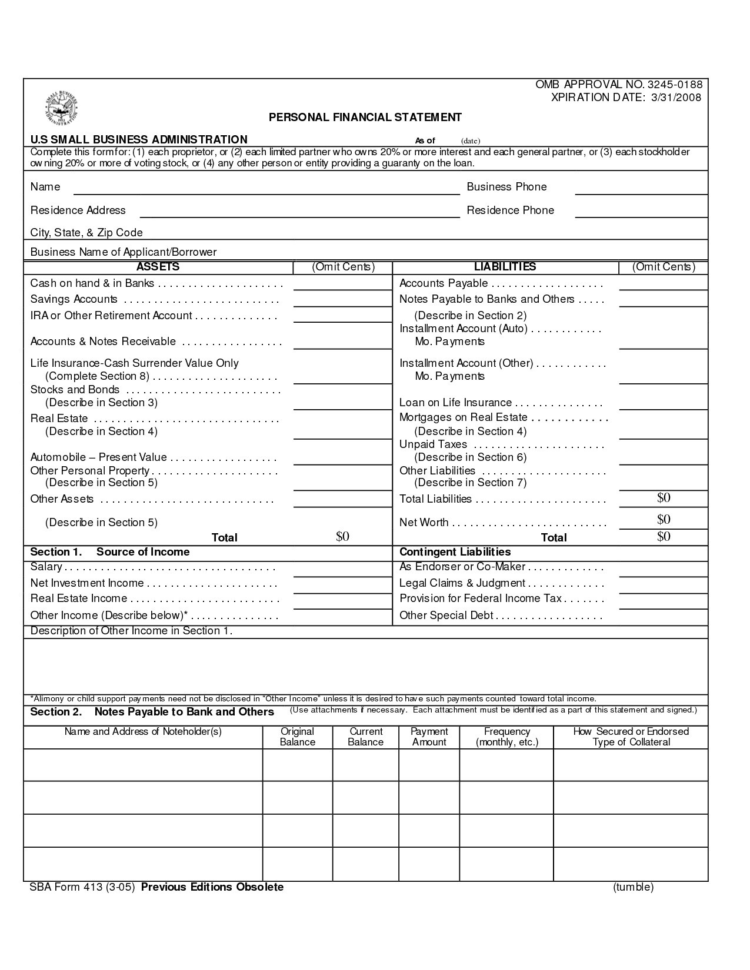

Working capital, also known as net working capital (nwc), is the difference between a company’s current assets—such as cash, accounts receivable/customers’ unpaid bills, and inventories of raw materials and finished goods—and its current liabilities, such as accounts payable. Working capital is the difference between a firm's current assets and current liabilities, represented on the balance sheet. After you have identified and calculated your four main components of working capital, use this formula:

Working capital represents the financial resources available to. A company's working capital is a. Working capital is the difference between a.

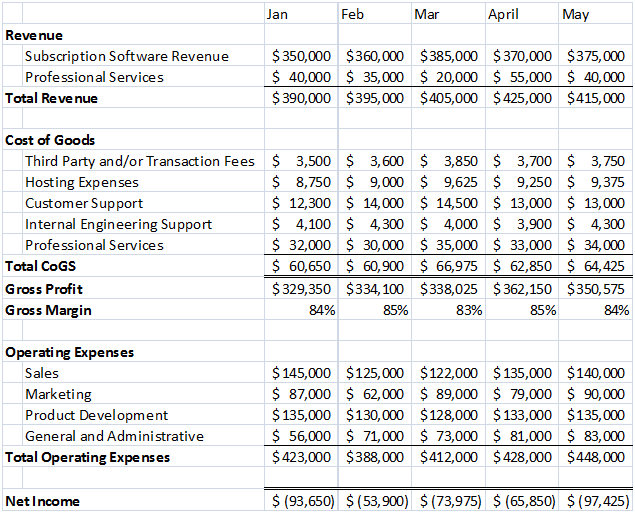

The net working capital (nwc) metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on. Read on to understand the relation between these terms. Step 1 at the very top of the working capital schedule, reference sales and cost of goods sold from the income statement for all relevant periods.

How to calculate working capital from cash flow statement & balance sheet the following formula is used to calculate working capital: Working capital represents the amount of. Working capital requirement is a concept that anyone starting a company has to know and understand.

Positive net working capital shows. How to calculate net working capital? Key takeaways net working capital measures capital tied up in business operations.

Working capital, often known as net working capital (nwc), is the difference between the current assets and current liabilities of a business. The working capital formula is: It's calculated as current assets minus current liabilities.

19.1 goal of working capital management the goal of working capital management is to maintain adequate working capital to meet the operational needs of the company;. Start free written by cfi team what is the working capital formula?

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)