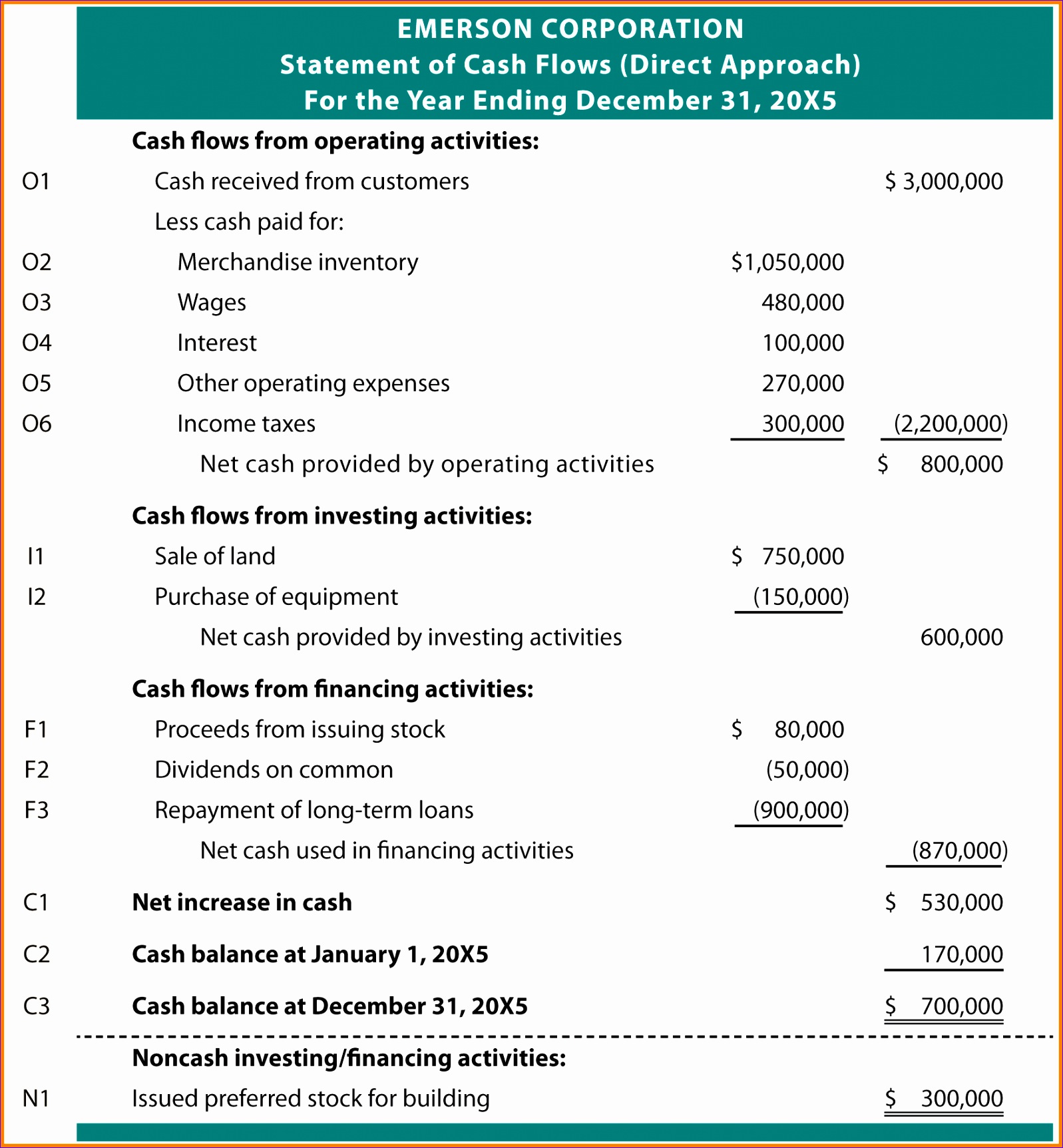

Supreme Info About Cash Flow Using Direct Method

The direct method of cash flow statement format presents a clear picture of a company’s cash flow.

Cash flow using direct method. Sum up all cash inflows from operating activities; The direct method (cash flow) is an accounting approach used in the preparation of a cash flow statement, which portrays the exact payments and receipts of cash by a company during a certain period. The direct method recap and final thoughts.

Viewing 1 post (of 1 total) author. Unlike the indirect method, it directly reports each major cash inflow and outflow, offering a detailed view of cash flows from. Items that typically do so include:

Cash collected from customers interest and dividends received cash paid to employees Advantages of the direct method cash flow. The investing and financing sections are prepared exactly the same way.

The direct method details where cash comes from and where it goes. The direct method cash flow differs from accrual accounting in that the direct method determines changes in cash receipts and payments as a result of the company's operations, whereas accrual. Generally, firms prefer the indirect method of preparing the cash flow statement;

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. In the direct method of cash flow statement, preparation time is less than in the indirect. The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source.

In contrast, the direct cash flow method only measures cash received. Learning outcomes calculate cash flows from operating activities by the direct method the direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally presented on a gross basis.

This method shows a company’s total operating, financing, and investing cash flow over a set period. The cash flow statement direct method shows all the cash transactions a business completes. The cash flow is calculated by netting the inflows and outflows.

It does so by grouping cash transactions into major classes of cash receipts and cash payments. The direct method of developing the cash flow statement lists operating cash receipts (e.g., receipt from customers) and cash payments (e.g., payments to employees, suppliers, operations, etc.) in the operating activities section. The direct method is one of the two methods used while preparing a cash flow statement.

This means it measures cash as its received or paid, rather than using the accrual accounting method. The direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. What is the statement of cash flows direct method?

Sum up all cash outflows from operating activities; Using the direct method only influences the way you report on the first section, which is operating activities, the. Disadvantages of the direct method.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)