Beautiful Tips About Balance Sheet Of Society

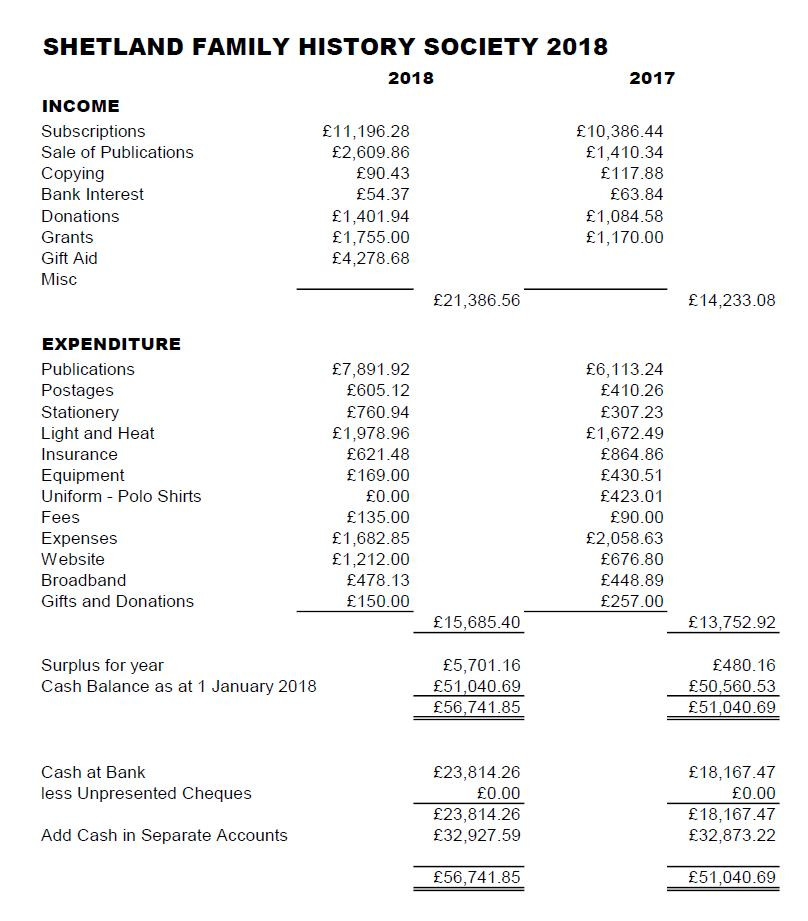

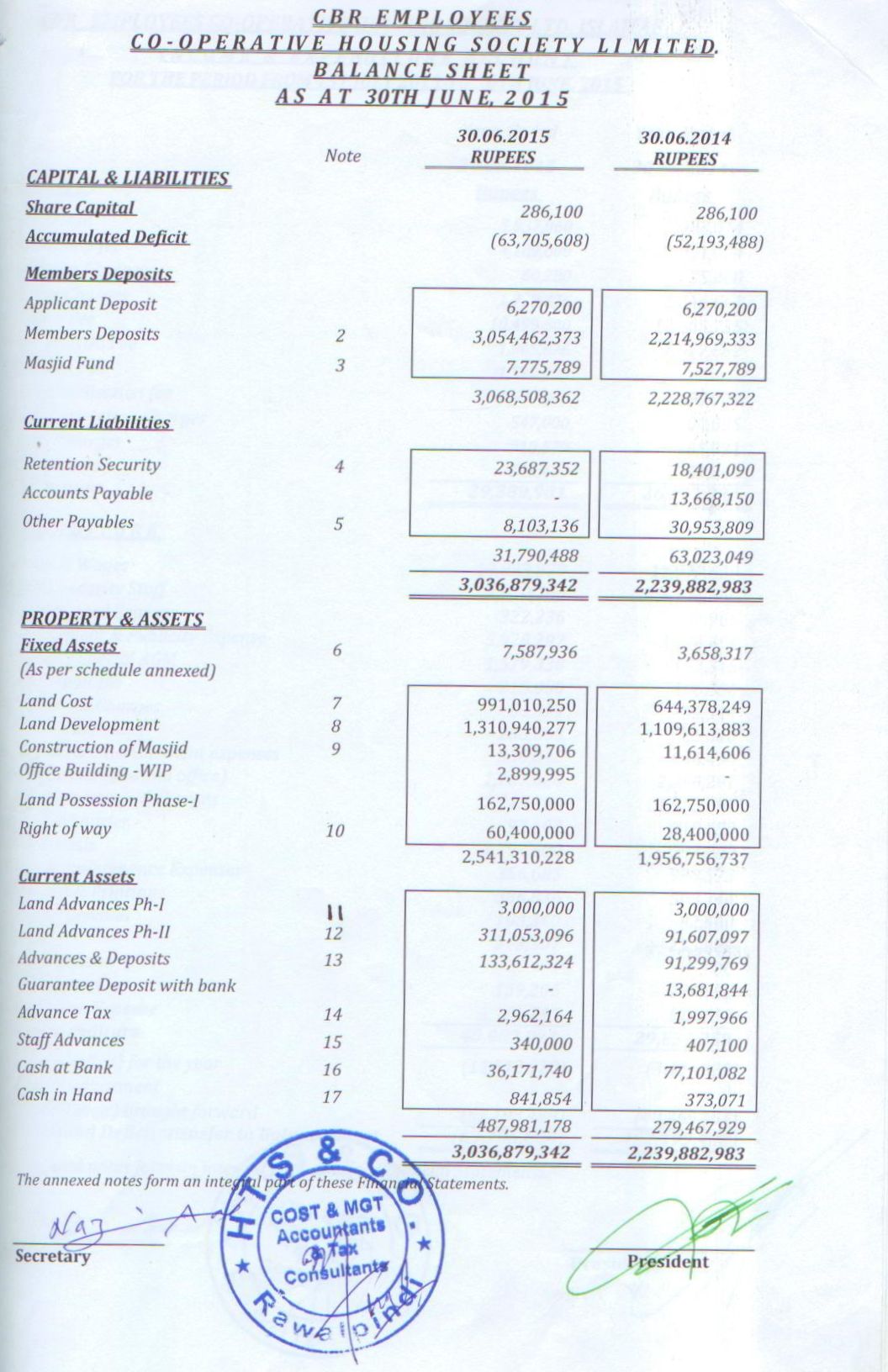

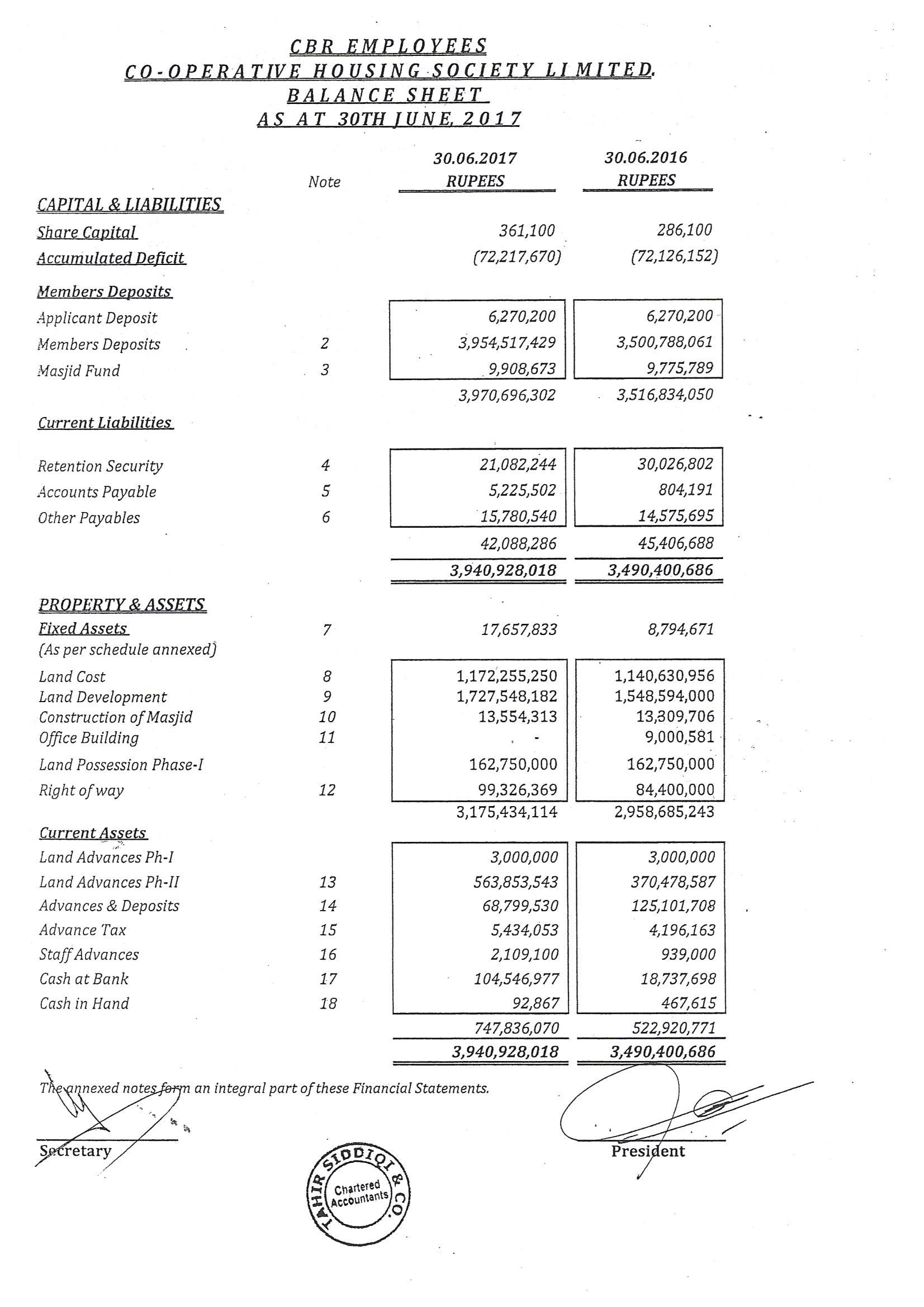

The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

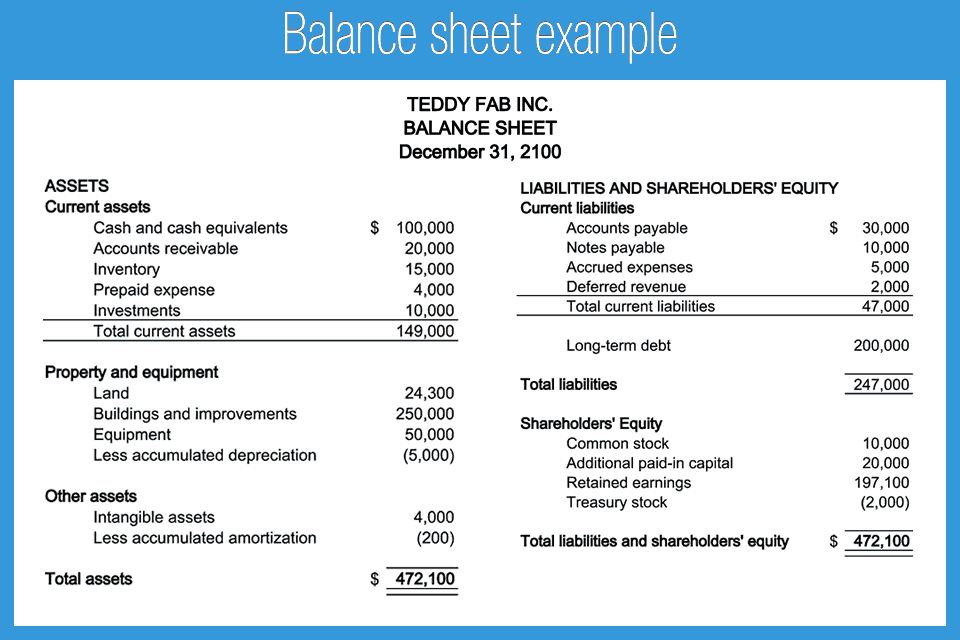

Balance sheet of society. The liabilities and assets are listed in the 1st and 3rd column of. For example, if you buy a car for $40,000 and expect it to last for five years, you. The debts to the shareholders.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. These societies account for around 95% of building society business. Add total liabilities to total shareholders’ equity and compare to assets.

The balance sheet total is the sum of all assets (as well as all liabilities). Once their data had been aggregated they were. A balance sheet has three primary components:

The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity. To do this, you’ll need to add liabilities and shareholders’ equity together. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle.

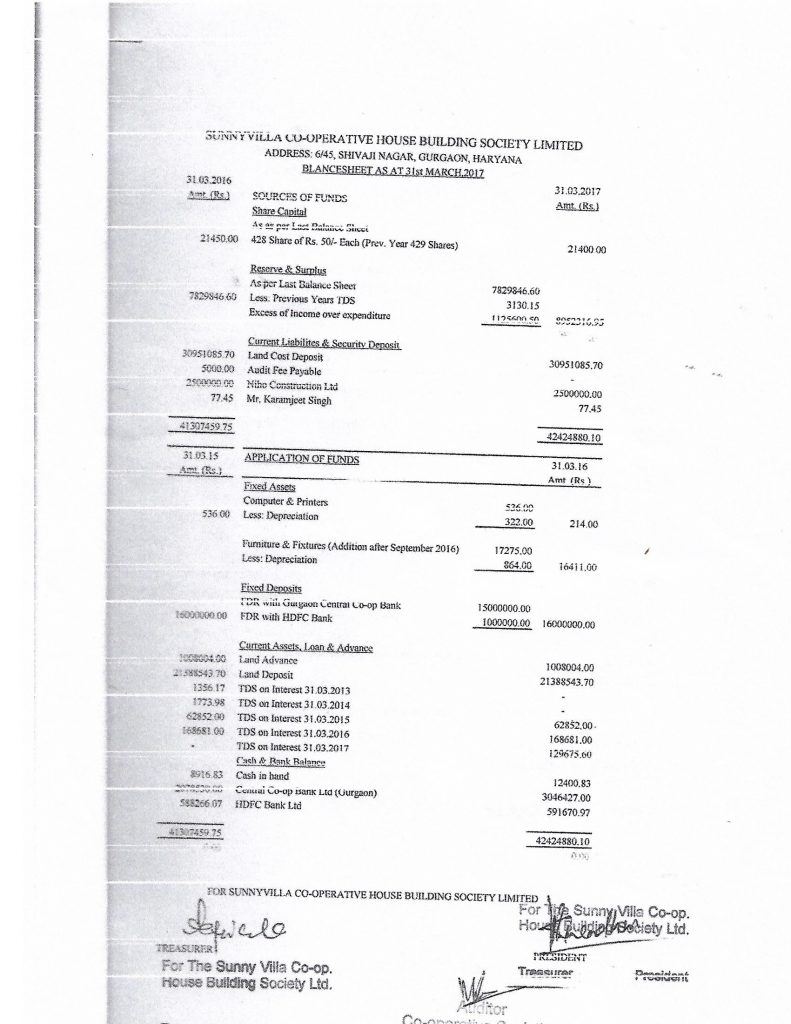

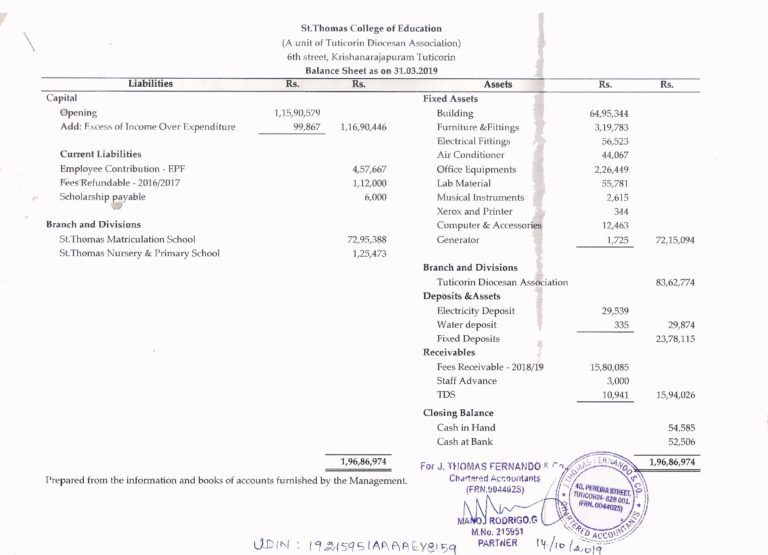

The imf public sector balance sheet database allows comparisons of changes in general government liabilities to be made for 46 states for which data are available; In principle the equity is money that a bank can dispose of immediately. The balance sheet is also called the financial statement of the cooperative society and provides a picture of our society’s financial status at the end of a particular financial year.

In a horizontal format, assets and liabilities are presented descriptively. This can be used to evaluate society’s financial health, find ways to improve it and make intelligent decisions about investments, operations, and other financial matters. It is an association of persons who voluntarily pool their resources for utilizing them for the mutual welfare of members itself.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. These can include cash, investments, and tangible objects. It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts.

Assets assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. For g7 countries, the increase was 159%. The balance sheet is a statement that shows the financial position of the business.

It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. Download the free balance sheet template.

(1) assets (2) debt assets belong things of financial value that a housing society owns, such as cash balance, bank balance, investments in fds, dues from members, fixes your of and society, and tds receivable for celebrations. A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. Assets = liabilities + owners’ equity