Wonderful Tips About 26as View Income Tax

Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly.

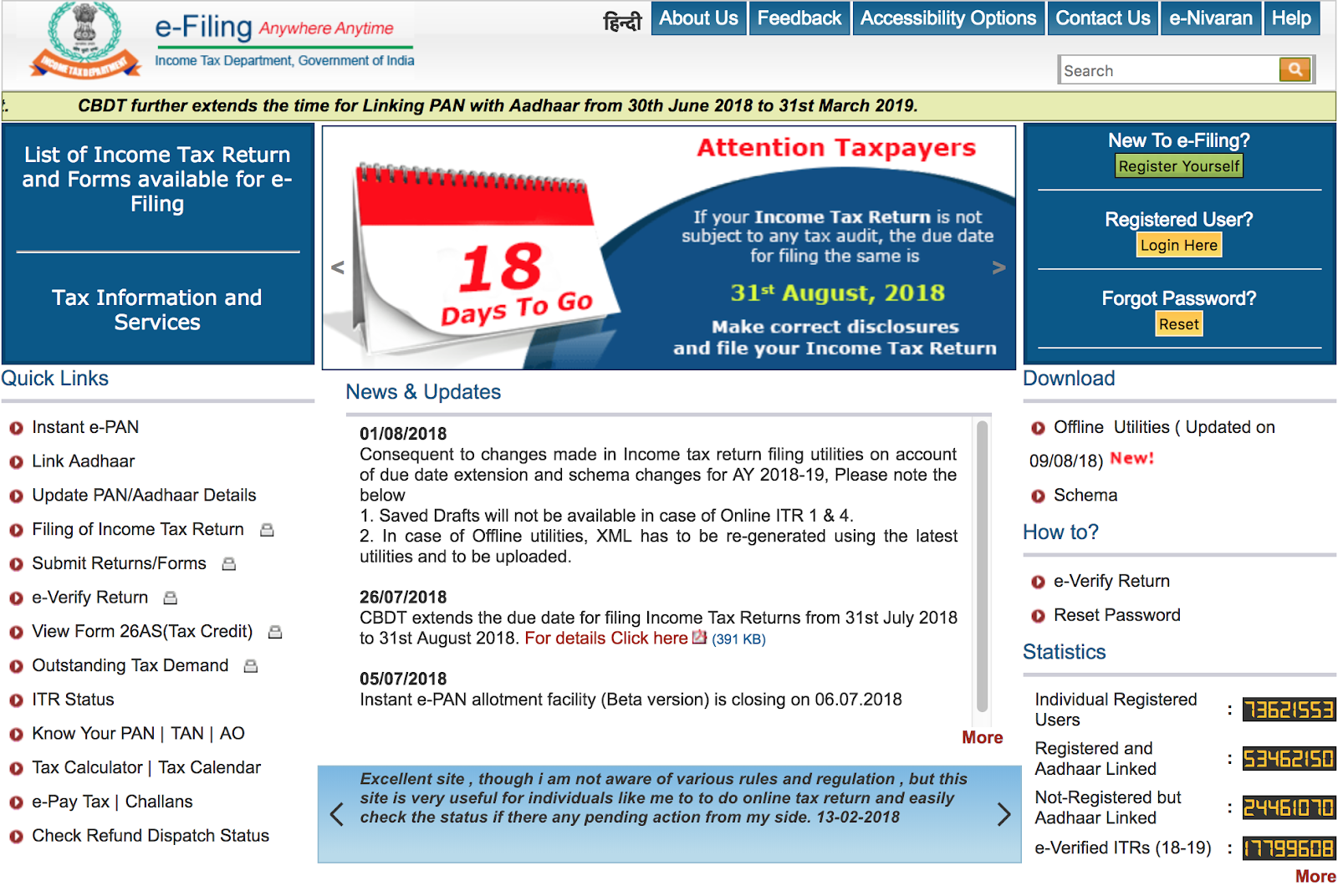

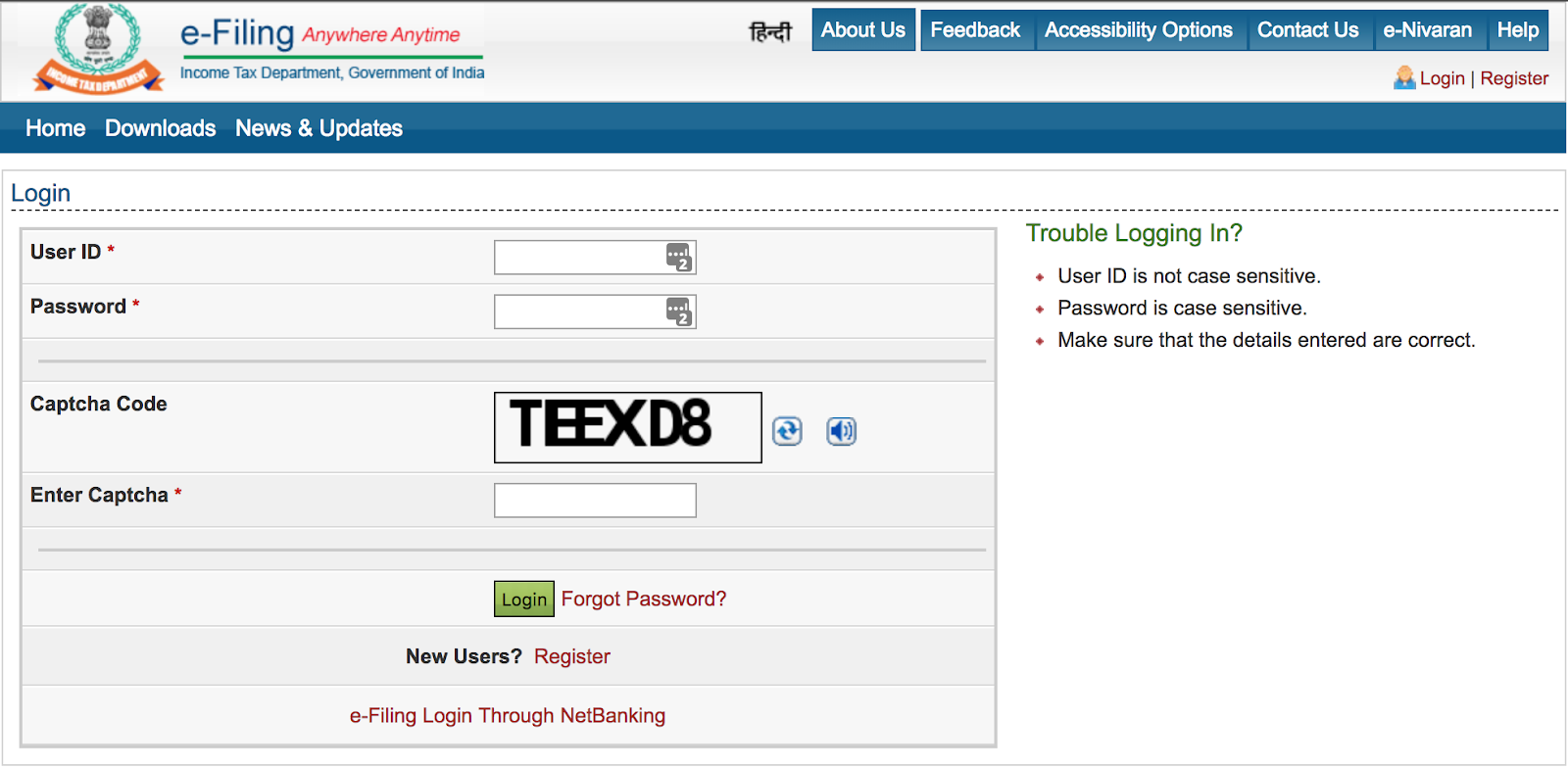

26as view income tax. Tax deducted at source, or. The website provides access to the. Read the disclaimer, click 'confirm' and the user.

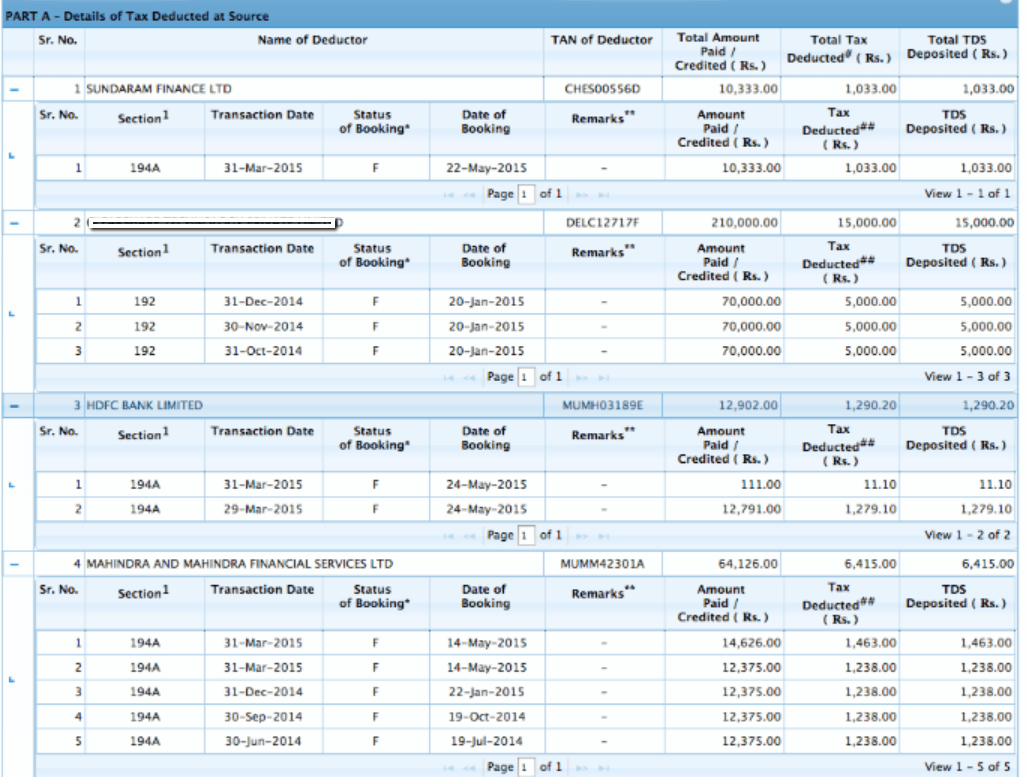

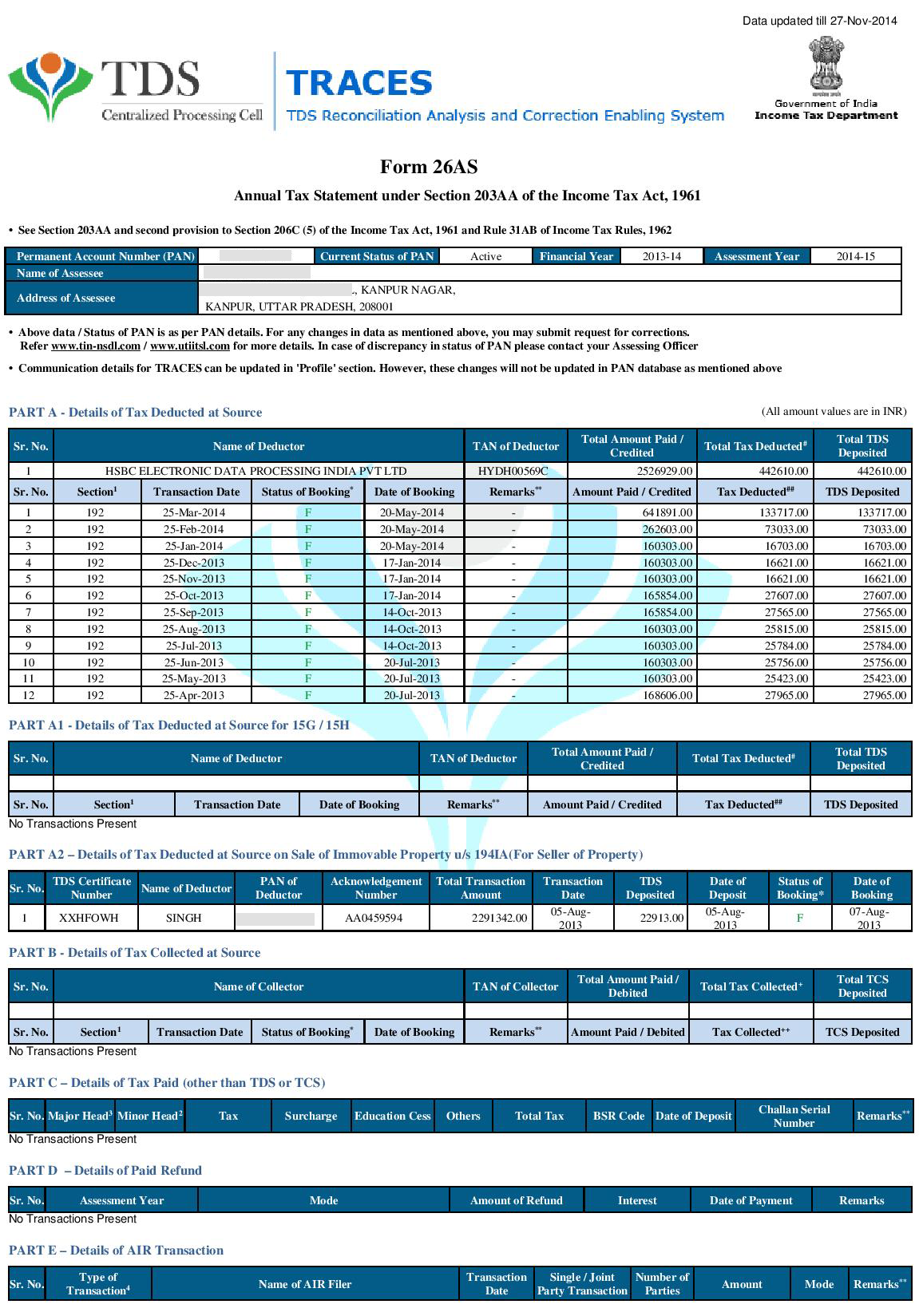

This article explores the evolving role of form 26as as a comprehensive tax credit statement. What is form 26as ? Tax deducted on income:

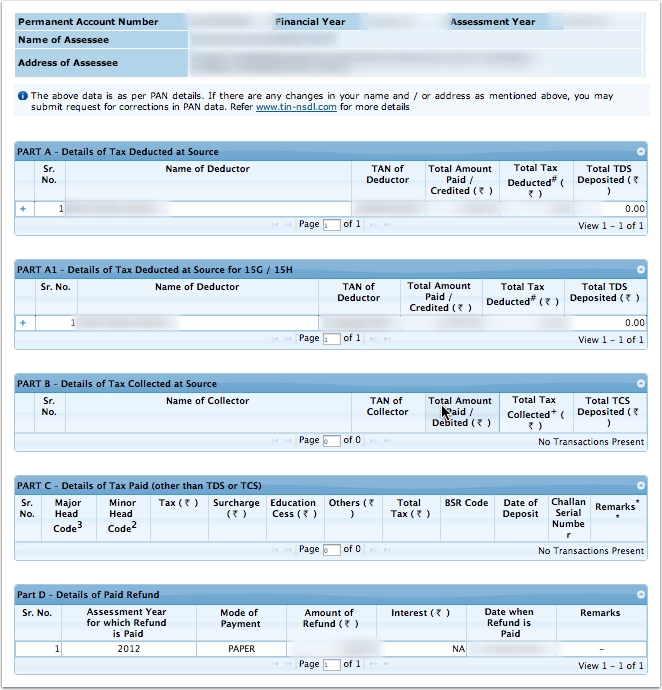

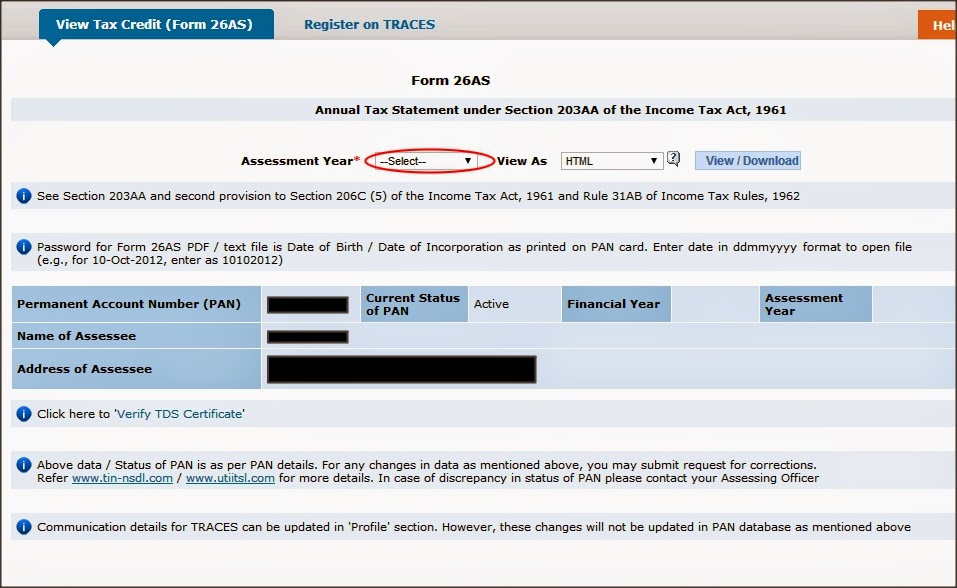

Upon being redirected, the individual needs to click on the “view tax credit (form 26as)” link. Form 26as provides the taxpayer with the relevant tax related information such as details of tds and tcs, details of taxes paid in the form of advance tax and. Here, the user is required to provide the assessment year and also the format in.

Go to new income tax portal www.incometax.gov.in and. The assessee’s submissions were that the services were rendered in a.y. Form 26as displays the amount of tax deducted at source (tds) from various sources of income, such as salary, interest, or dividends.

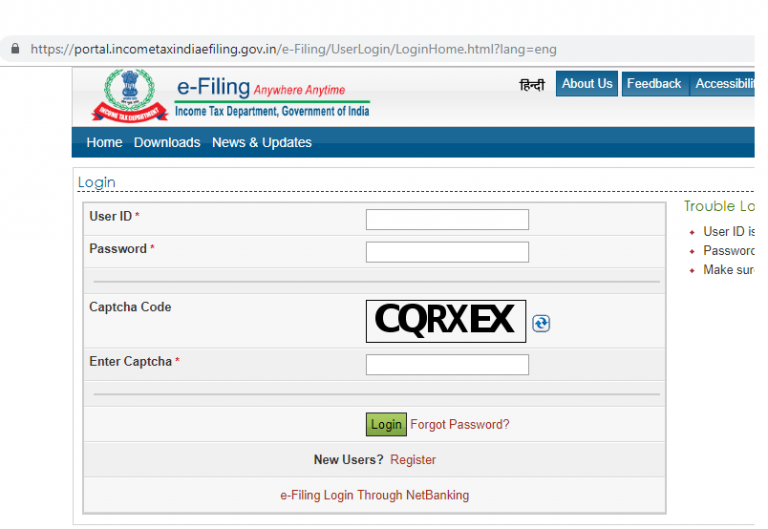

Input ‘view type’ and ‘assessment year’. To view your form 26as, click the link at the bottom of the page and then select view tax credit (form 26as). You are accessing traces from outside india and therefore, you will require a user id with password.

All the details of collected tax by the person who is collecting. Click ‘view form 26as’ and then select ‘confirm’. Tax collected at source, or.

Displays details of income tax directly paid by you (like advance tax, self assessment tax) and details of the challan through which you have deposited this tax in the bank. Form 26as includes the information on all the deducted tax on the income of deducted. The article details its expanded scope, covering diverse financial.

The income tax department’s website provides an option to view form 26as by logging in using one’s pan (permanent account number). Select the assessment year and the desired. Form 26as can be accessed by a taxpayer from the income tax portal using the pan.

Click ‘proceed’ on the next page followed by selecting ‘view tax credit’.