Spectacular Info About Calculate The Cash Flow From Operating Activities

Cash flows from (for) operating activities:

Calculate the cash flow from operating activities. Cash flow from operating activities = funds from operations + changes in working capital where, funds from operations = (net income + depreciation, depletion, & amortization + deferred taxes. First, they adjust the net income to account for the unpaid accounts receivable: This means that the company earns £3 from its operations for every £1 of liabilities.

Because the ancillary business endeavours aren't visible in the numbers in the calculation, a company's operating profit margin can confuse its financial partners. Cash flow is calculated using the direct (drawing on income statement data using cash receipts and disbursements from operating activities) or the indirect method (starts with net income,. Cash receipts from the sale of goods and rendering services.

Operating cash flow formula: The two methods of calculating cash flow are the direct method and. Cash flow from operations ratio = cash flow from operations / change in accounts payable = £60,000 / £20,000 = 3.

As such, you can calculate cash flow from operating activities using the following formula: The main components of the cfs are cash from three areas: Total revenue is the full amount of money an organization earns from sales during the accounting period

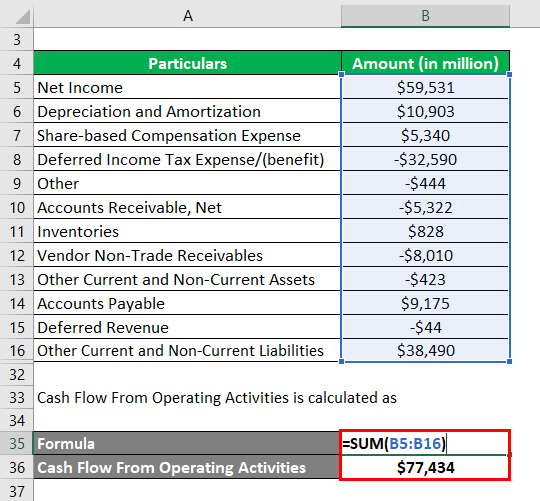

Using the indirect method, calculate net cash flow from operating activities (cfo) from the following information. Significance of net cash flow from operating activities in business evaluation Now you can calculate the cash flow from operations ratio:

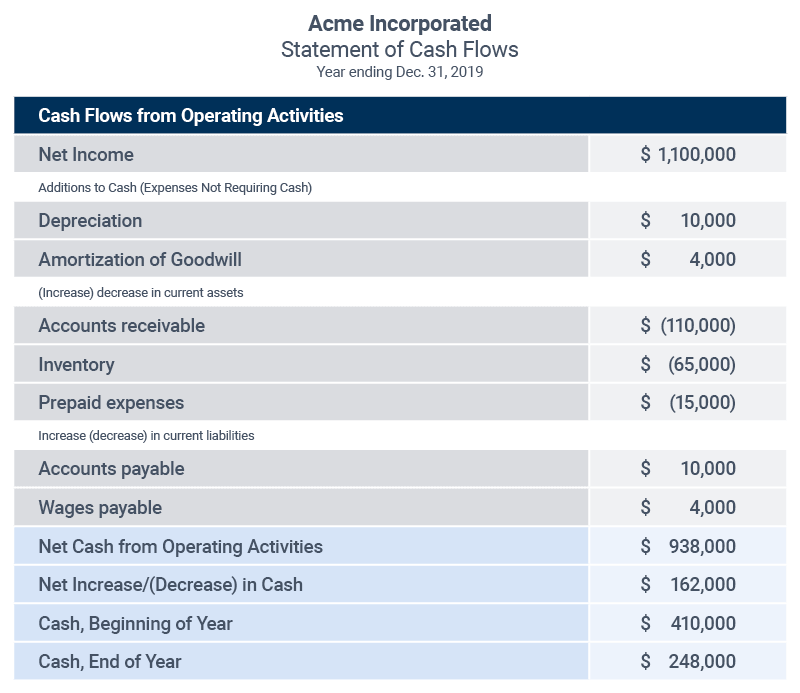

These are known as the direct method and the indirect method. Wants to calculate its cash flow from operating activities for the month of january. Begin with net income from the income statement.

Then, they use the formula: Some of the cash flows arising from operating activities are as follows: Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

If a business grows rapidly, so does the cost of its sales and revenues. Add back noncash expenses, such as depreciation, amortization, and depletion. Therefore, this value must be subtracted in the cash flow calculation.

Cash flow from operations example. The statement of cash flows operates on the principle of cash basis accounting, focusing on the actual movement of cash rather than accounting entries. Operating activities, investing activities, and financing activities.

The calculation for ocf using the indirect method uses the following formula: Each method arrives at the same place but highlight different details along the way. Cash flow from operations formula (indirect method) = $170,000 + $0 + 14,500 + $4000 = $188,500.

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)