Out Of This World Info About Gaap For Non Profit Organizations

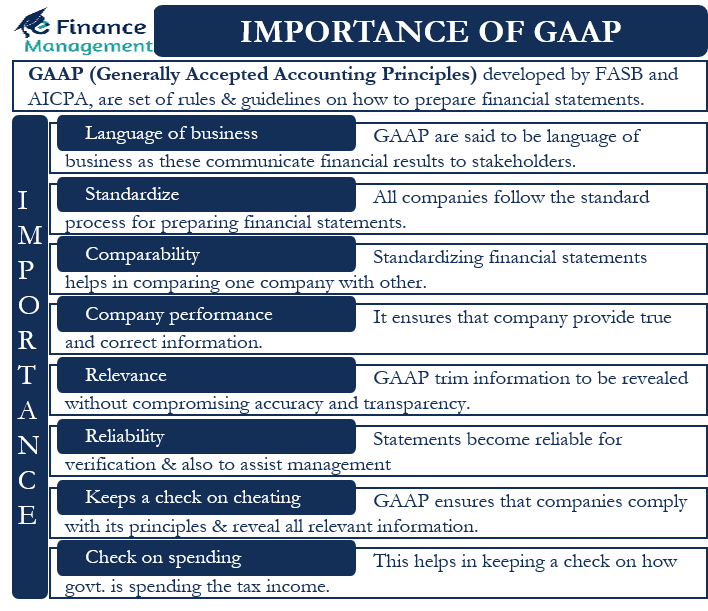

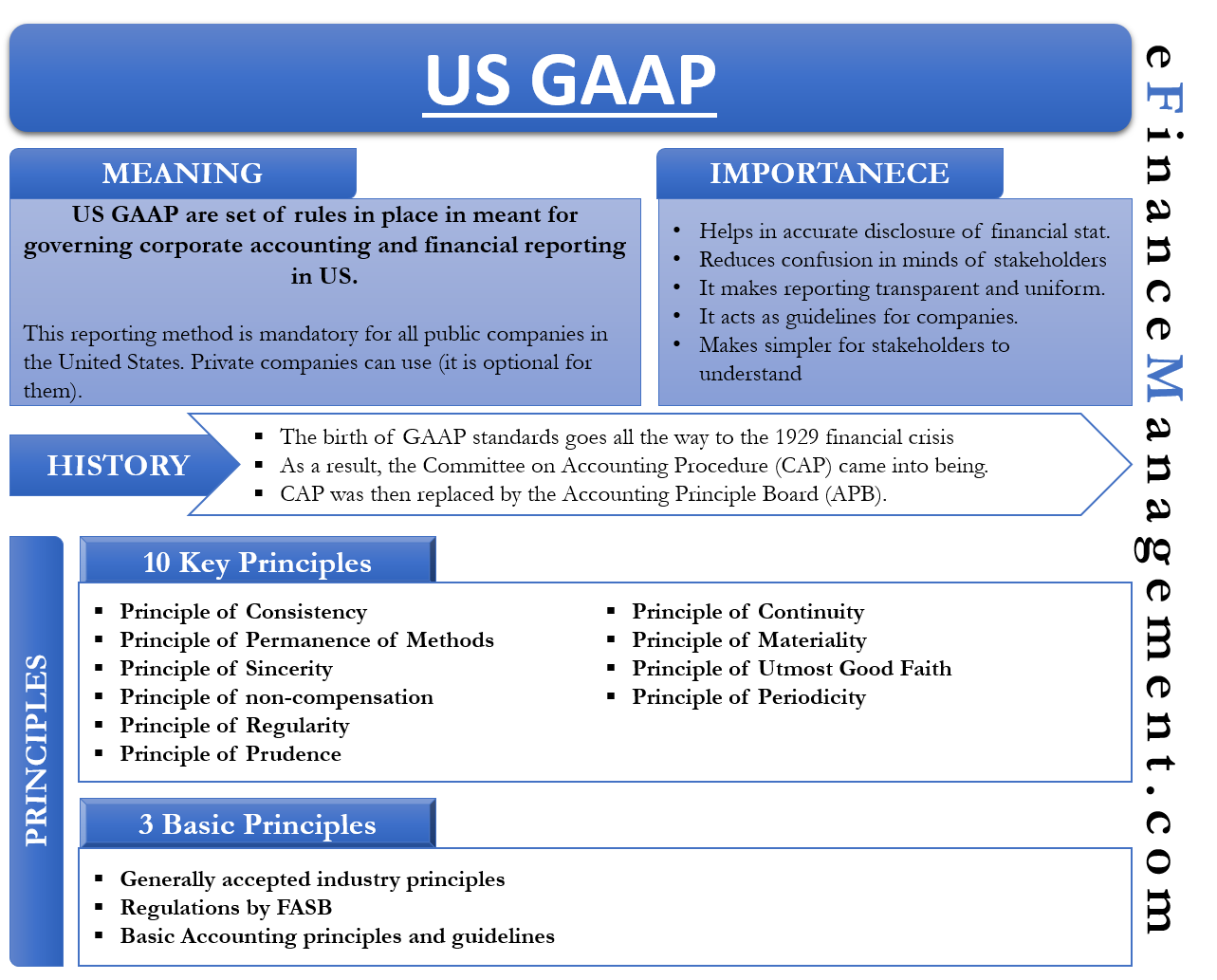

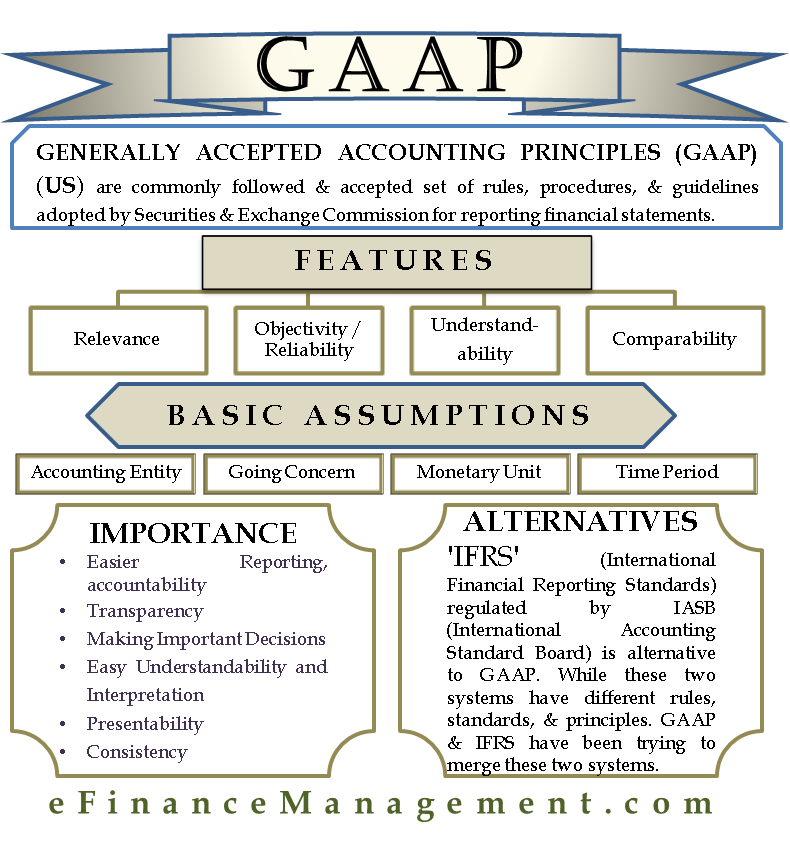

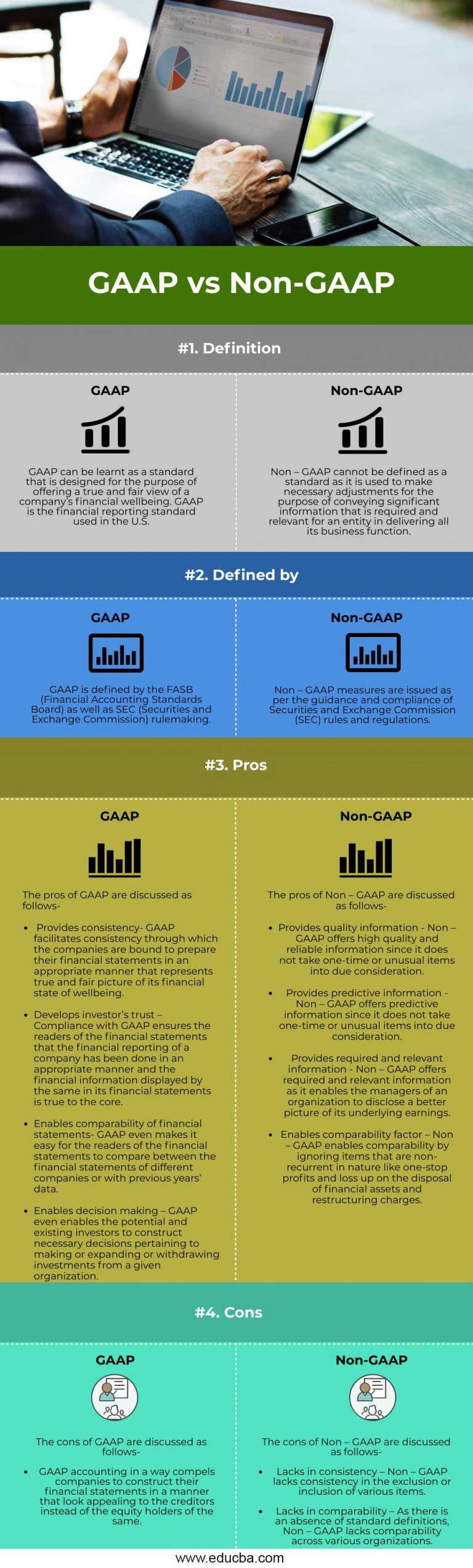

Generally accepted accounting principles, or gaap, are guidelines that make the financial reporting process transparent and are.

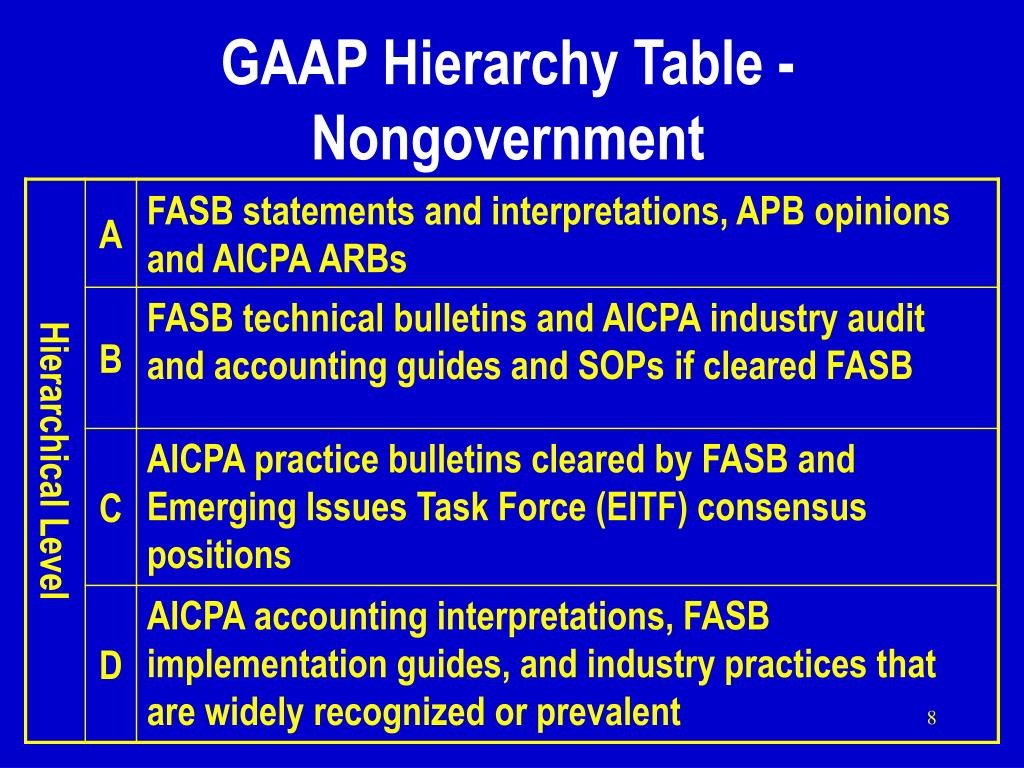

Gaap for non profit organizations. Tax benefit related to the irs audit: In certain respects, this guidance differs. Fasb accounting standards update (asu) no.

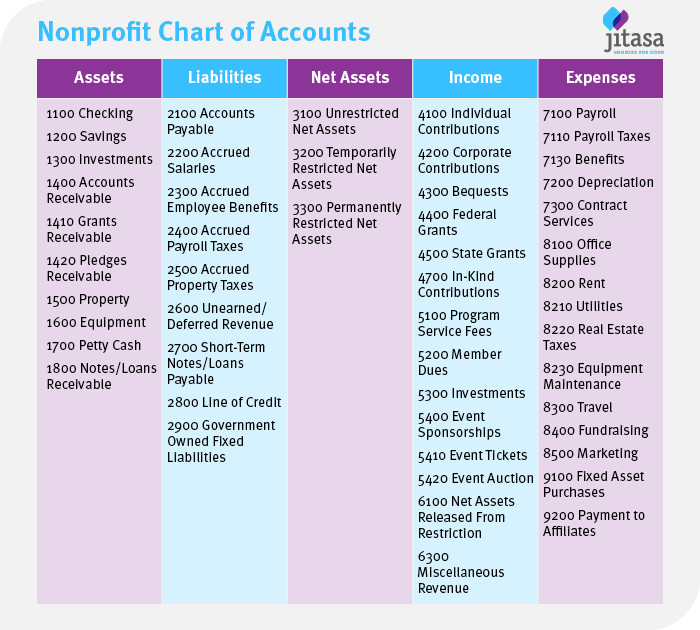

When it comes to asnpo, the search is over. What is gaap for nonprofits? Many of these volunteers serve as members of their organization’s board of.

Jan 26, 2023 · authored by adithi ramesh. Gaap stands for generally accepted accounting principles. In the united states, the rules, standards, and conventions that govern the preparation of financial statements are known as generally accepted accounting.

This chapter provides an overview of the accounting and. It provides accounting definitions for entities such as nonprofit. To evaluate the current not for profit reporting.

Best overall nonprofit accounting software: Us nfp guide a pdf version of this publication is attached here: 1, 2022 asc 842 lease standards went into effect for organizations.

(1) organic net sales, adjusted gross profit, adjusted gross profit margin, adjusted operating income, adjusted ebitda, adjusted eps, free cash flow, and free.