Underrated Ideas Of Tips About Non Cash Financing Activities

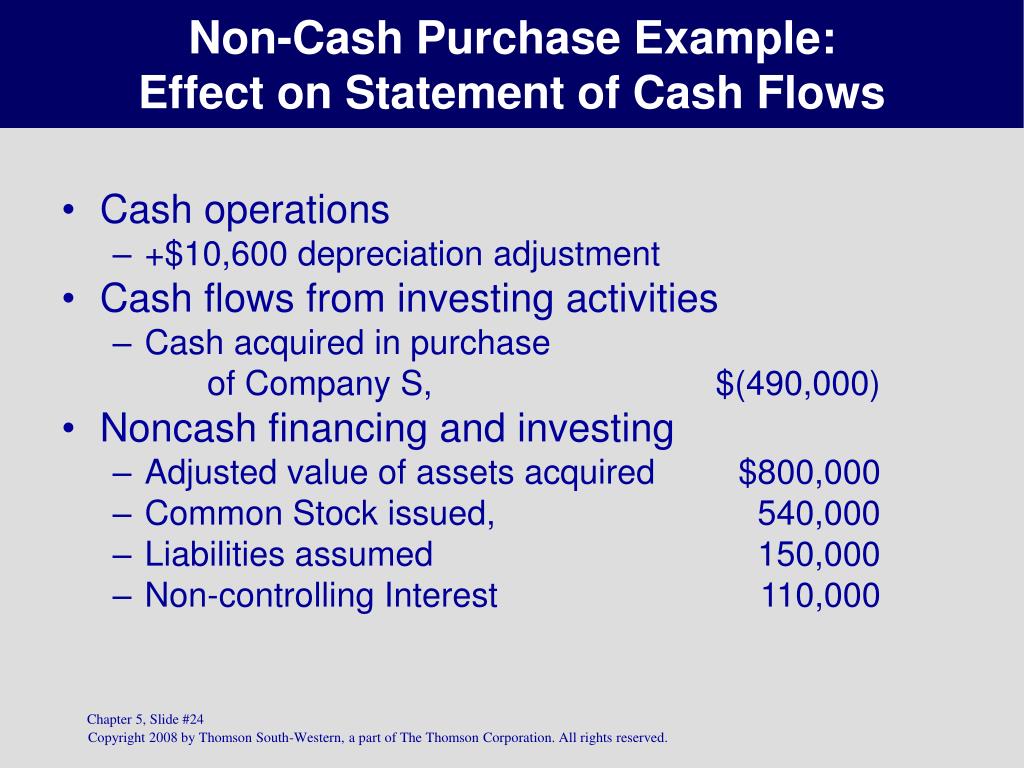

For example, a company may exchange common stock for land, or.

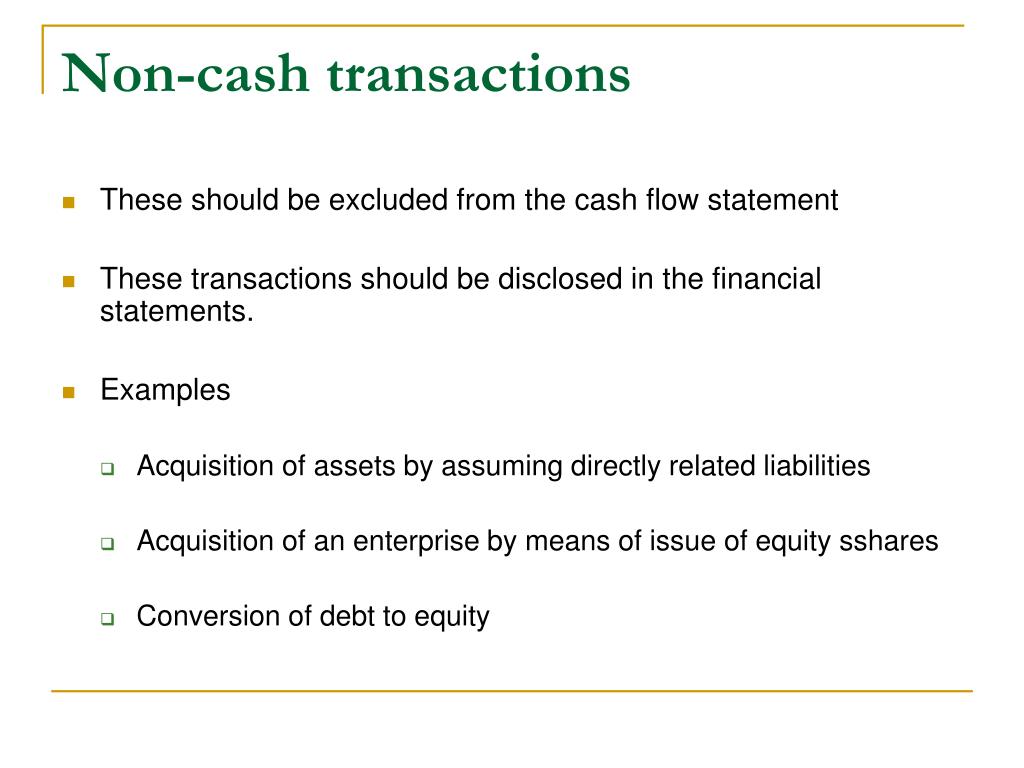

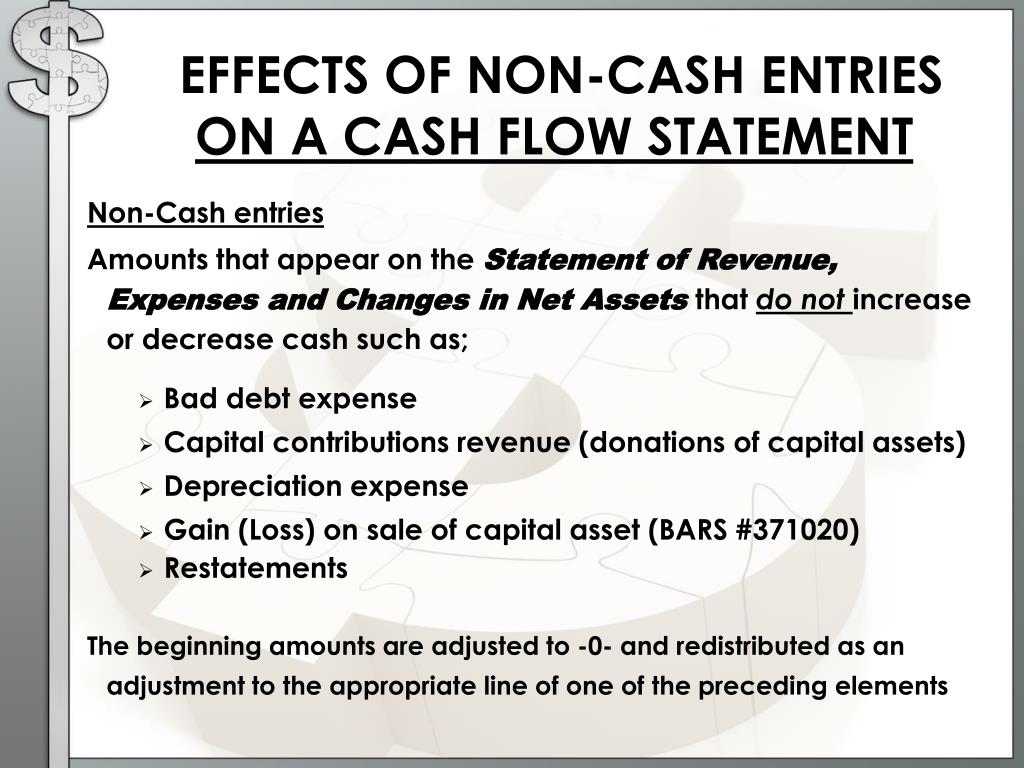

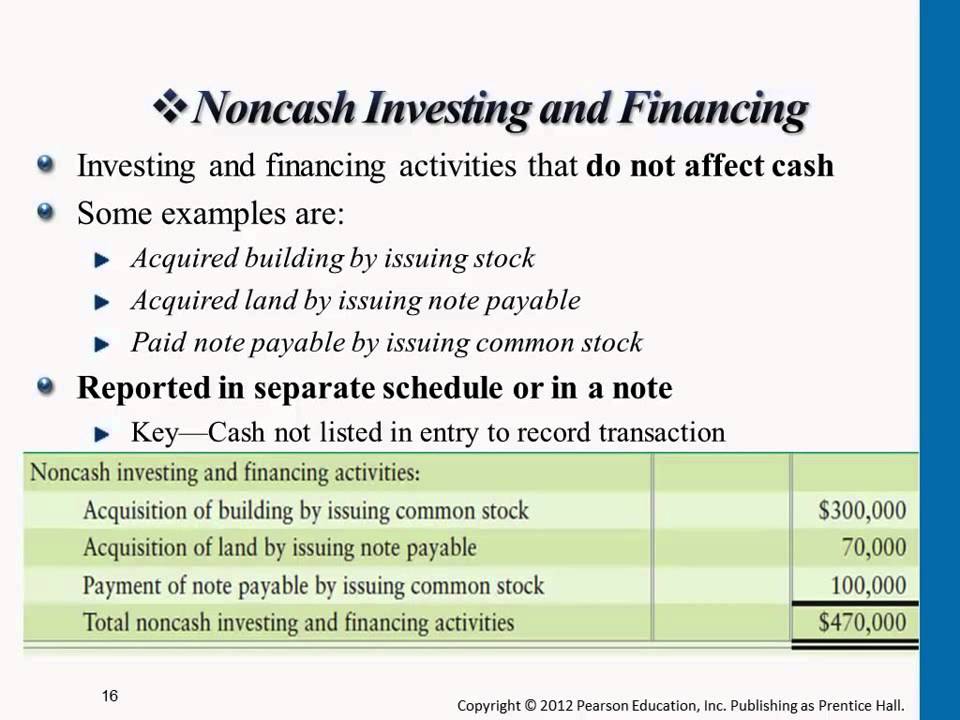

Non cash financing activities. A select set of important investing and financing activities occur without generating or consuming any cash. The company’s policy is to report noncash investing and financing activities in a separate statement, after the presentation of the statement of cash flows. Property, plant and equipment resides on the balance sheet.

Consumer bank capital one plans to acquire u.s. 6.8 noncash investing and financing activities. These activities might include the use of money.

Q4 net revenue of $3.1 billion with 22.4 million active customers wayfair inc. Separately, reporting entities may undertake transactions in which cash is received or disbursed on its behalf by another entity. These transactions are not reported in the cash flow statements, as there is no.

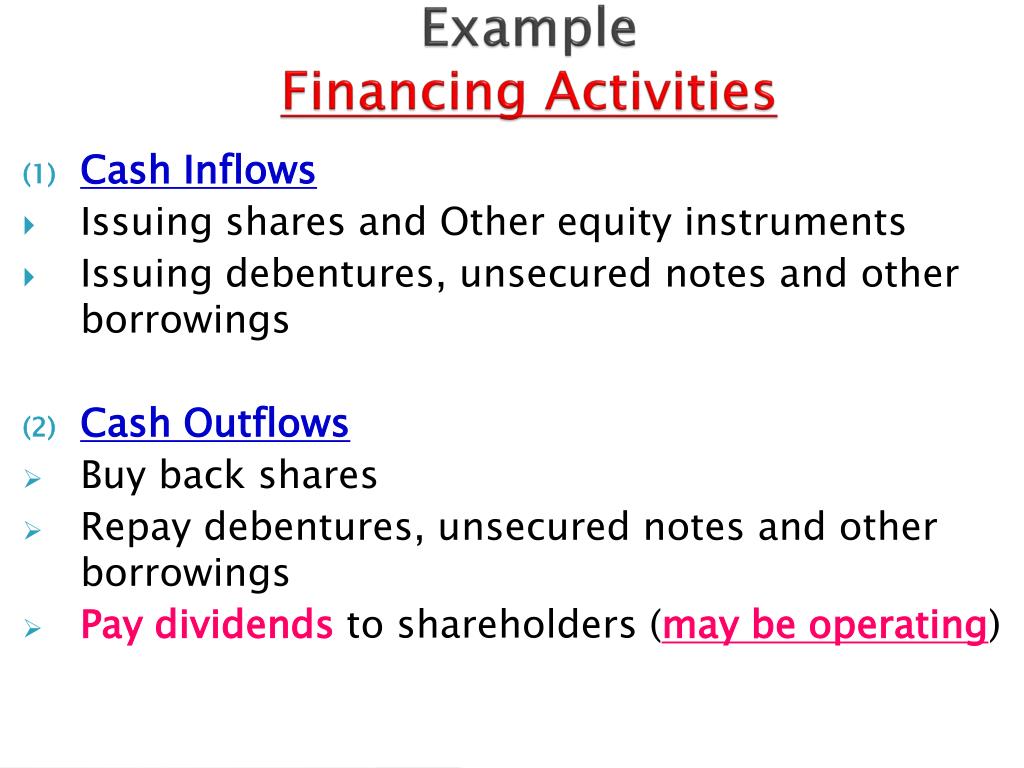

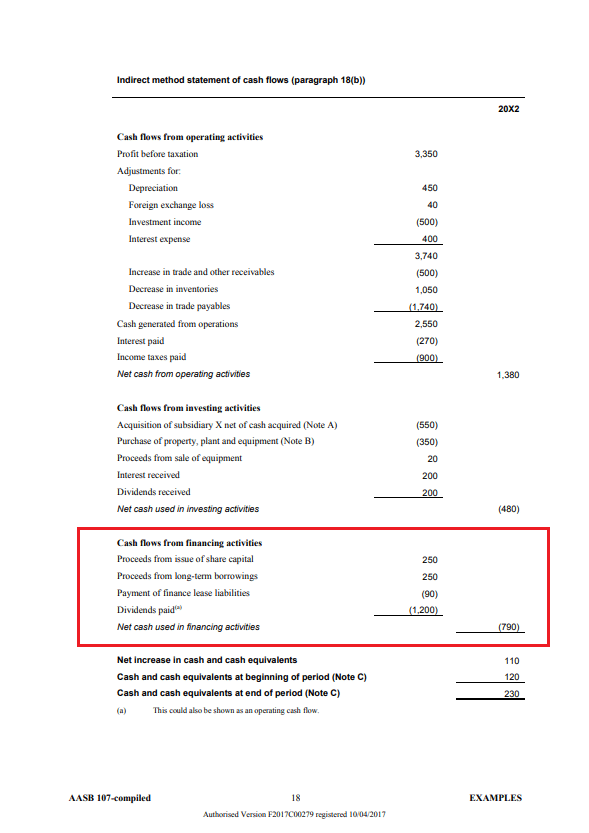

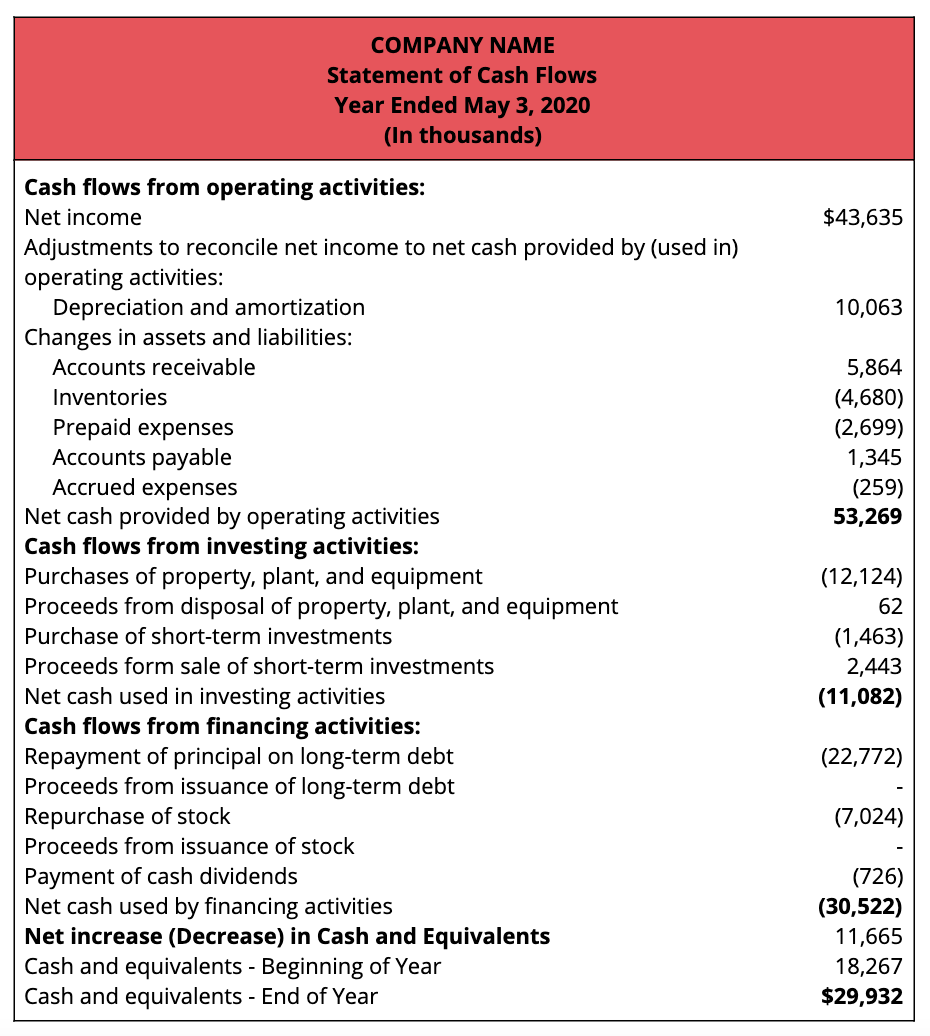

For example, capital items of property,. The ic observed that an entity applies judgement in determining the extent to which it disaggregates and explains the changes in liabilities arising from. Cash flow from financing (cff) activities is a category in a company’s cash flow statement that accounts for external.

Property, plant and equipment resides on the balance sheet. Cash flow from financing activities. W), one of the world's largest destinations for the.

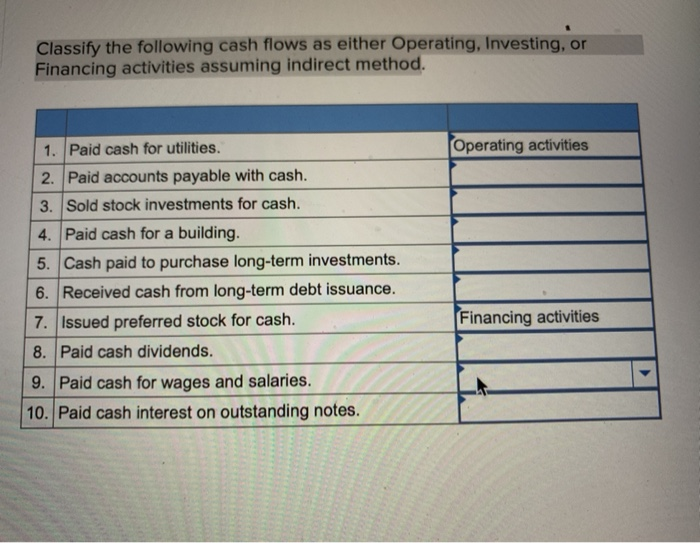

In this study, for a sample of 120 companies, we identify and recast the statement of cash flows for the implied cash effects of six general categories of non. This chapter focuses on two troublesome preparation and presentation issues, including statement classification and noncash activities. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through.

Cash flow from financing activities: Some examples of noncash investing and financing activities include: 5 previous topic learn significant noncash activities with.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/Term-Definitions_CFF-Final-V2-59b1197815114baf8e44d14286edbf6e.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)