Wonderful Tips About Typical Profit And Loss Statement

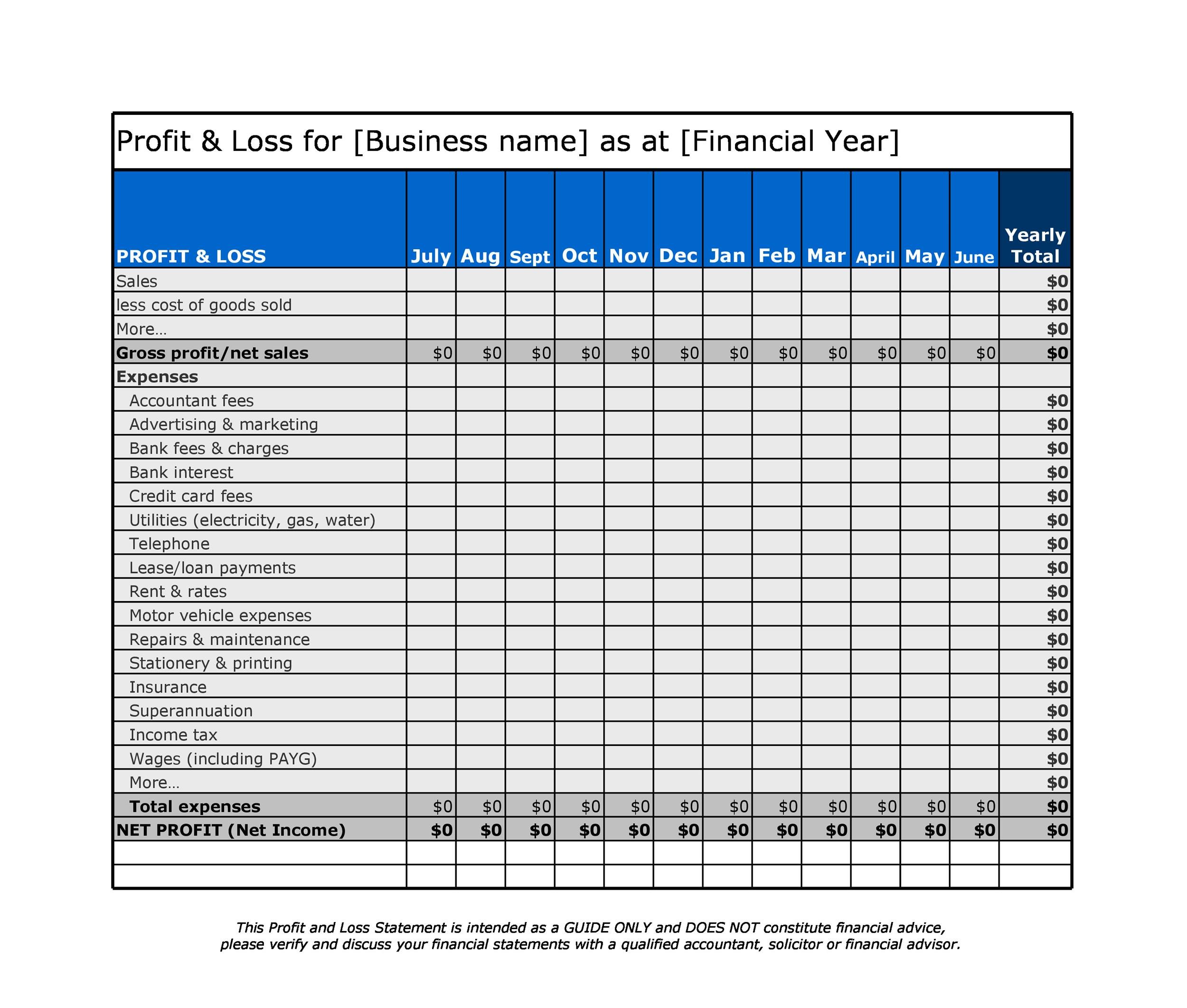

A p&l statement explains the income and expenses that lead to a company’s profits (or losses).

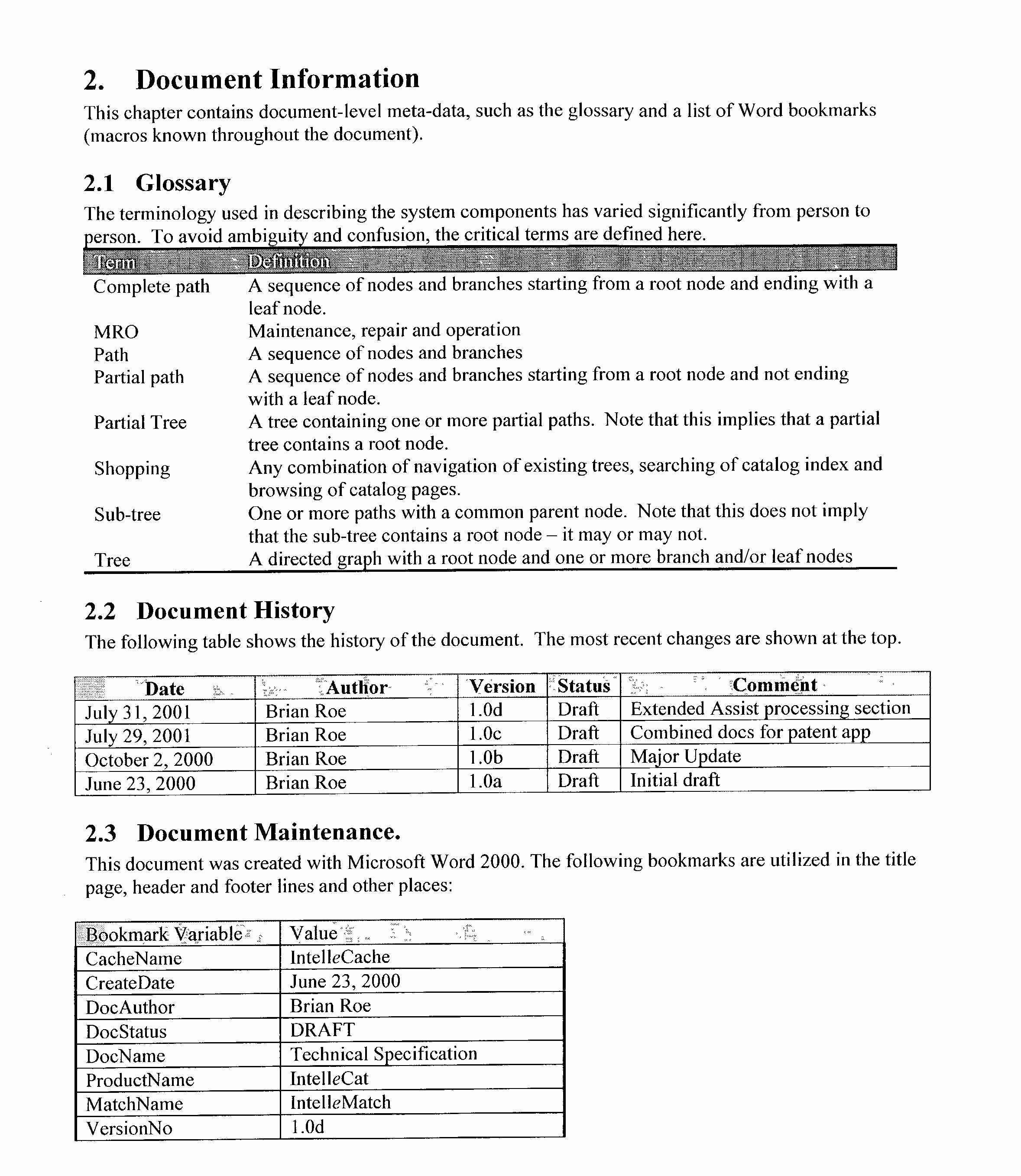

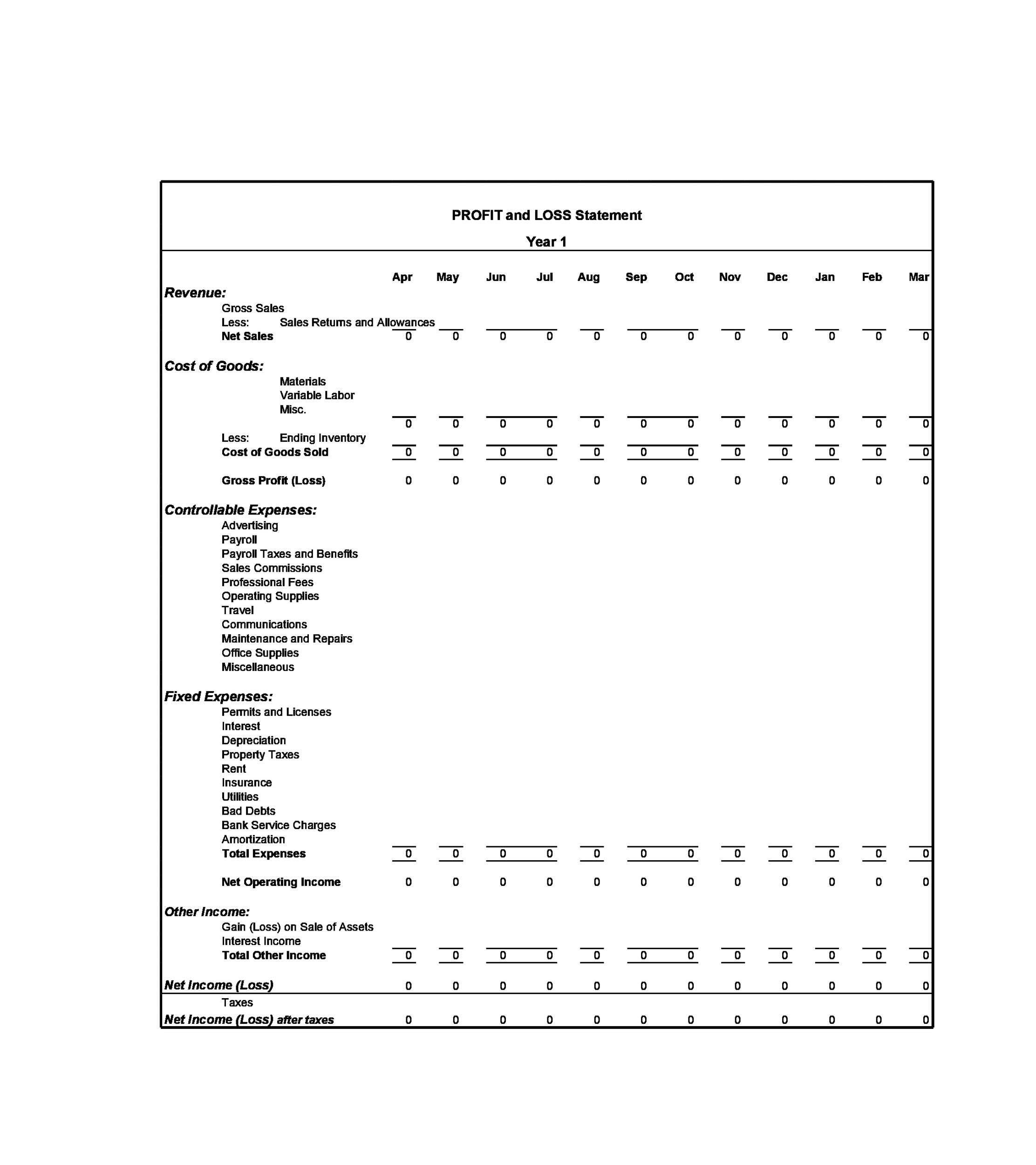

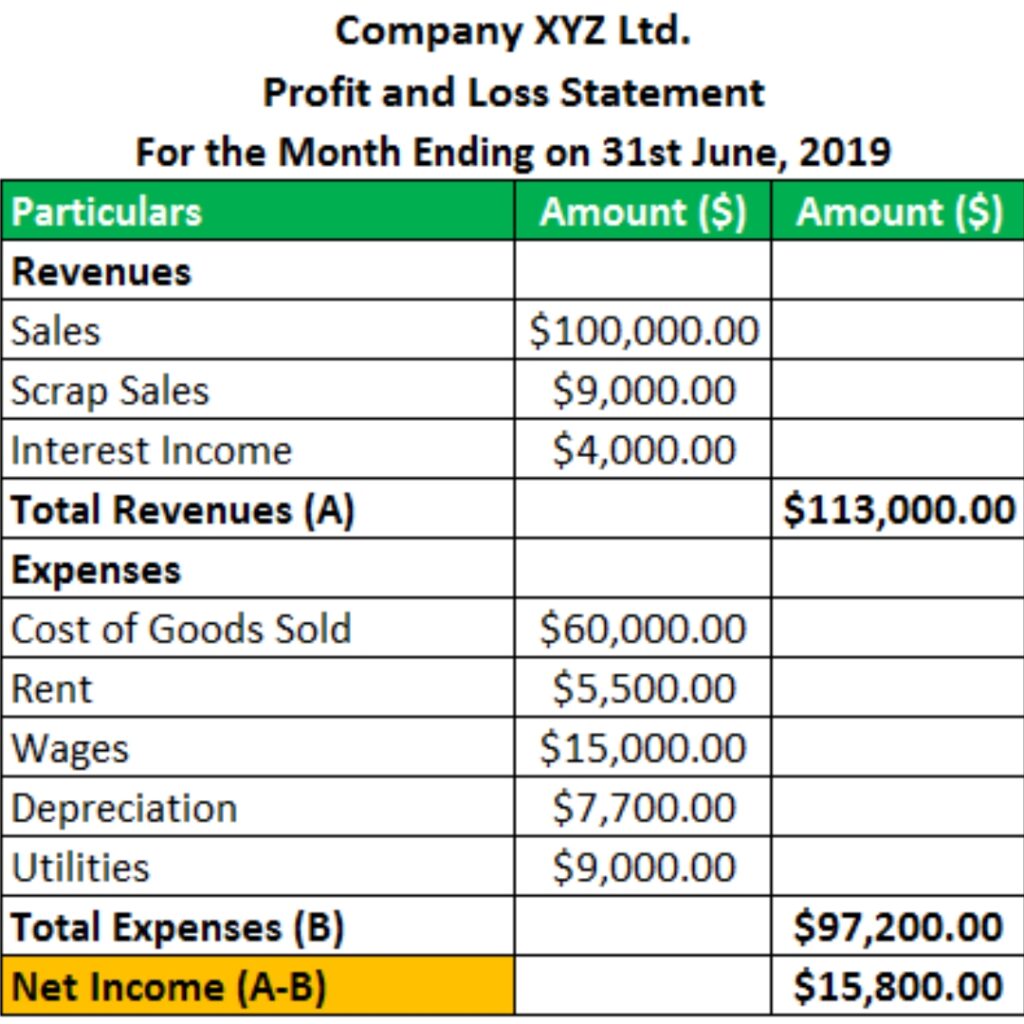

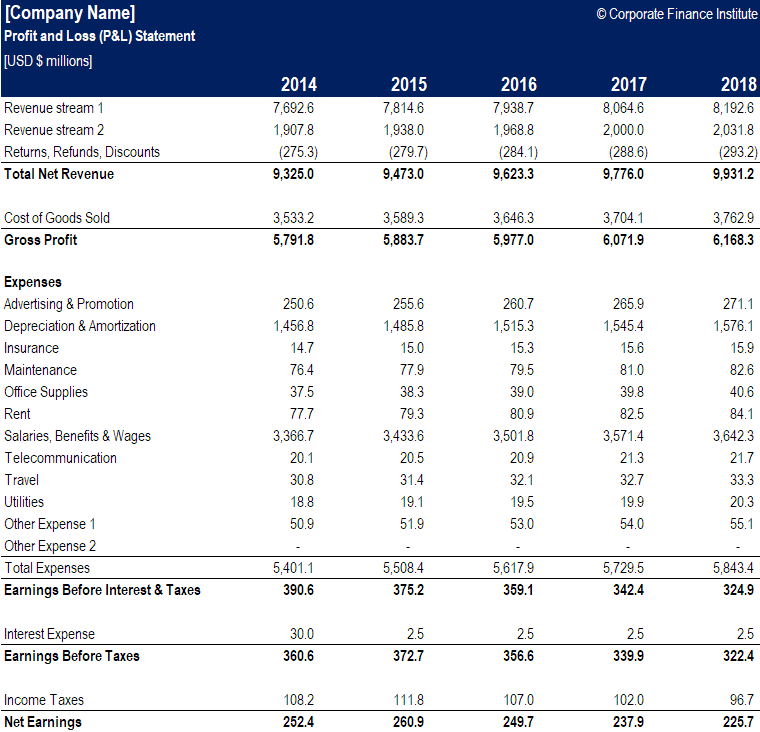

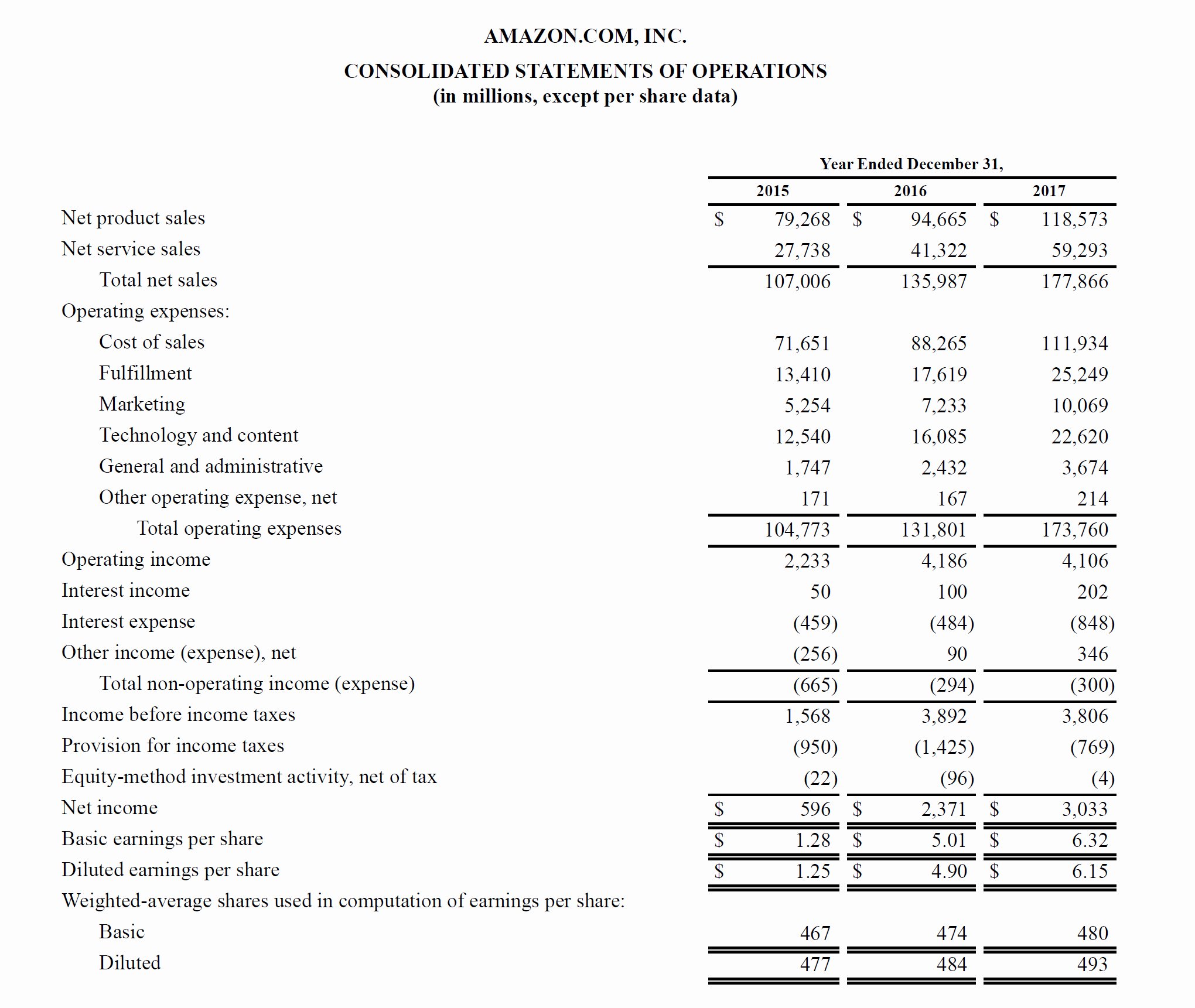

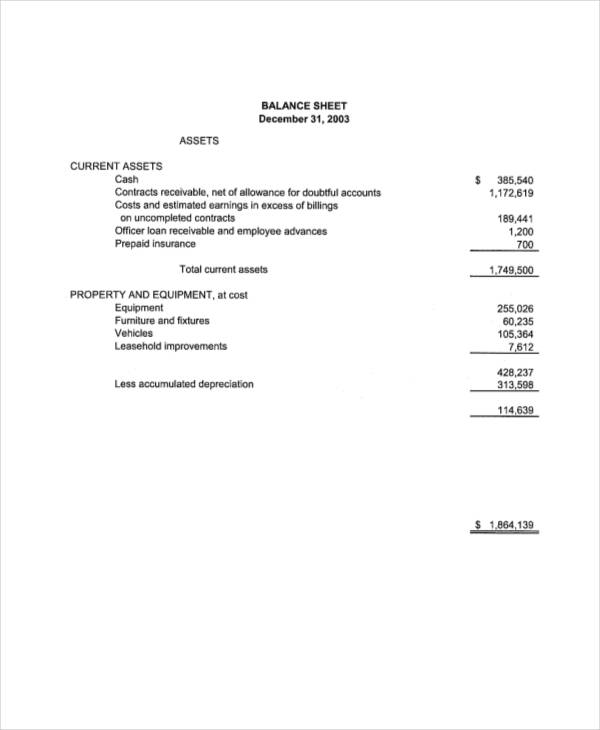

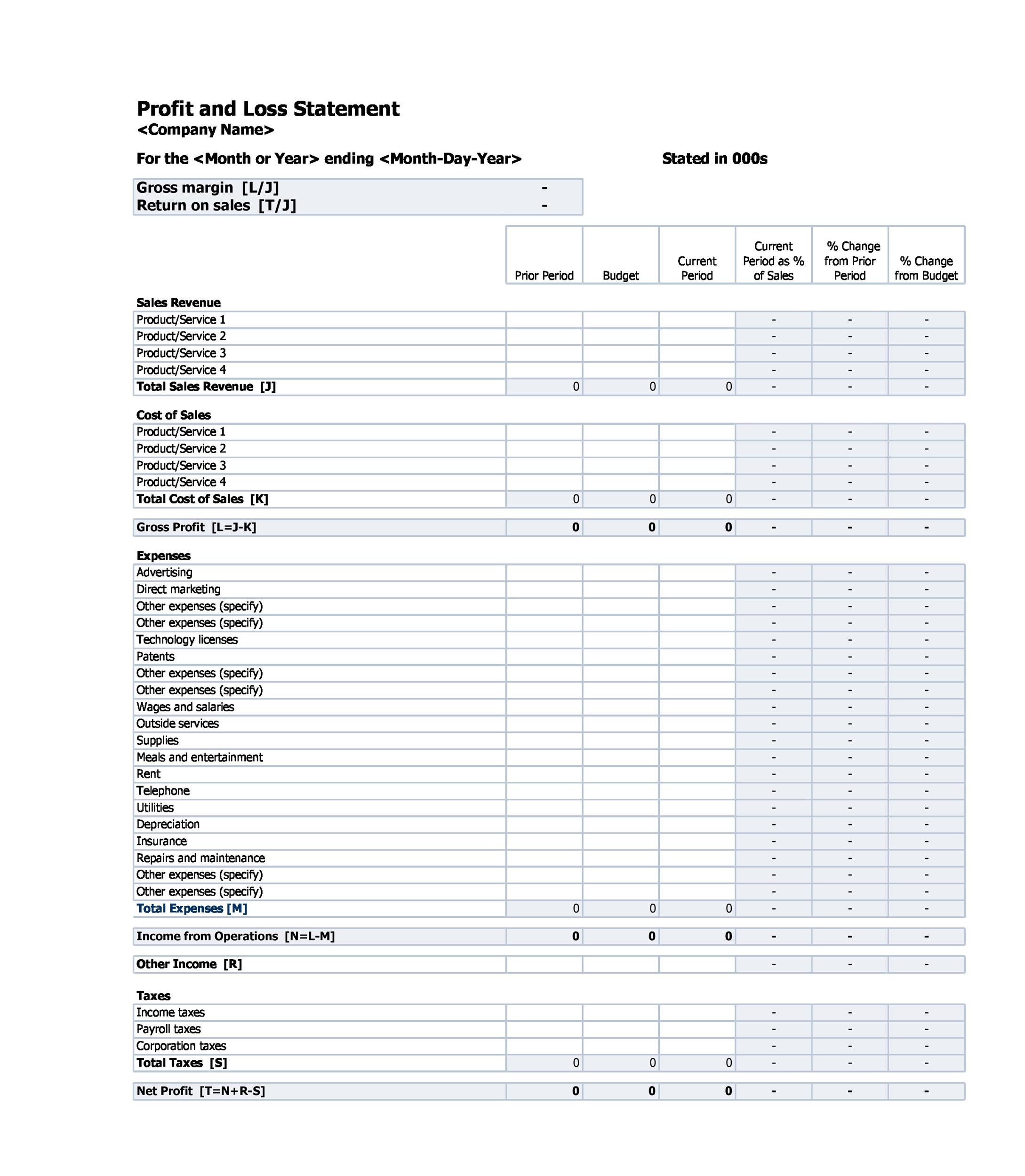

Typical profit and loss statement. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. In this article, we'll show you what a profit and loss statement looks like, unpack each component of a profit and loss statement and outline what profit and loss statements are used for. It’s ideal to review changes in p&l statements over multiple periods.

Moreover, a profit and loss statement usually consists of company revenues, costs, and expenses within a specific period, like a month, a quarter, a fiscal year — or even a week. The p&l statement is one of three. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

The result is either your final profit (if. It’s a financial document that includes the revenues and expenses of a company. Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or.

Components of a p&l statement The profit and loss statement format is also called the income statement and it is used to show the details of revenue earned and expenses incurred during an accounting period. A profit and loss statement contains three basic elements:

The p&l statement is a financial report containing a company’s costs, profits, and revenue. Prepare the profit and loss statement for the year ended december 31, 2018, for the shop. Based on this information, the profit or loss is calculated during year ending to understand the profitability of the company.

Your p&l statement shows your revenue, minus expenses and losses. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The report helps investors determine a company’s profitability.

Ultimately, it helps show whether a company is making a profit or losing money. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. A profit and loss (p&l) statement is a type of financial statement covering a specific period and revealing a company’s revenues, costs, and expenses.

Let’s look at each of the profit & loss/income statement types one by one. 03 sep 2020 | 5 min read. Profit and loss statement template (p&l) suppose we’re creating a simple profit and loss statement (p&l) for a company with the following financial data.

Interest expense = $5 million; Revenue, expenses, and net income. A profit and loss statement is a financial statement that typically covers the following items:

How profit and loss statements work It essentially provides a snapshot of your business's profitability during that time. You usually complete a profit and loss statement every month, quarter or year.

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-and-Loss-Statement-Overview.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Rental-Property-Profit-and-Loss-Statement-Template-TemplateLab.com_-scaled.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)