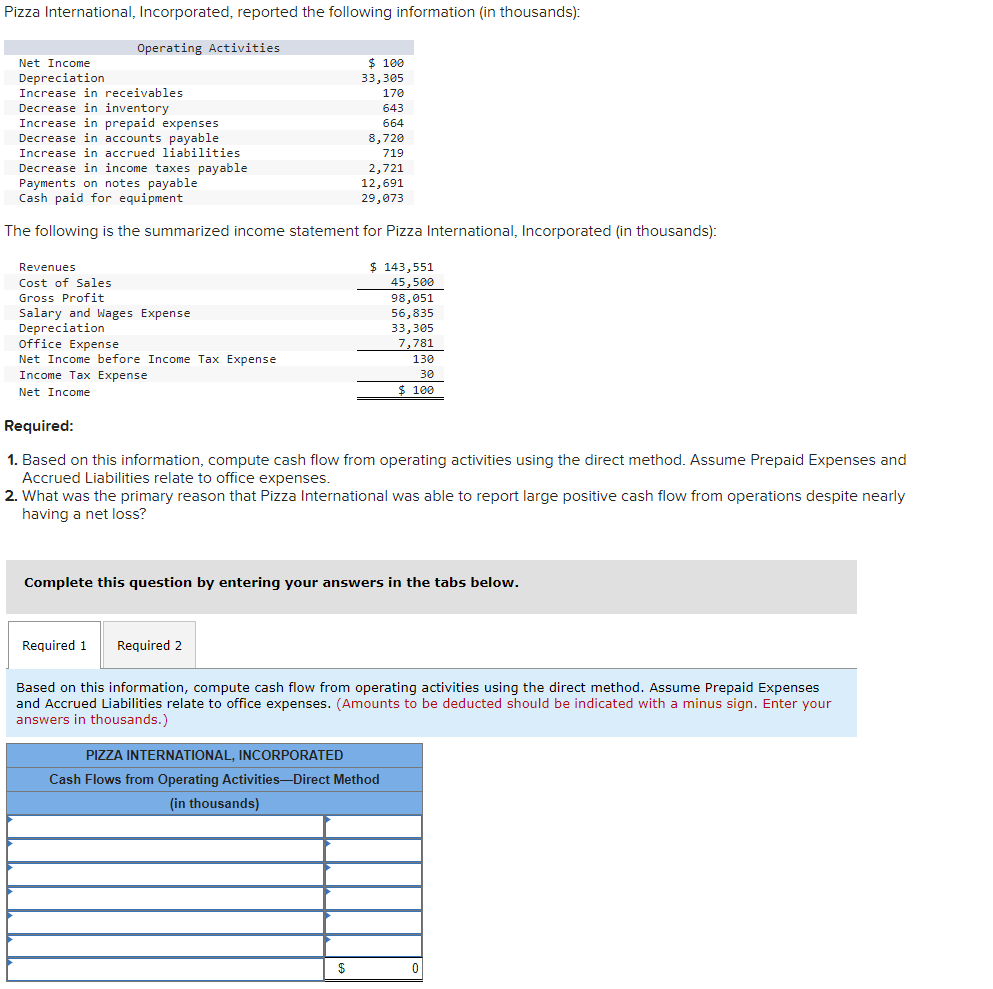

Brilliant Info About Decrease In Receivables Cash Flow

The increase in accounts receivables is deducted from net profit and the decrease in accounts receivables is added to net profit.

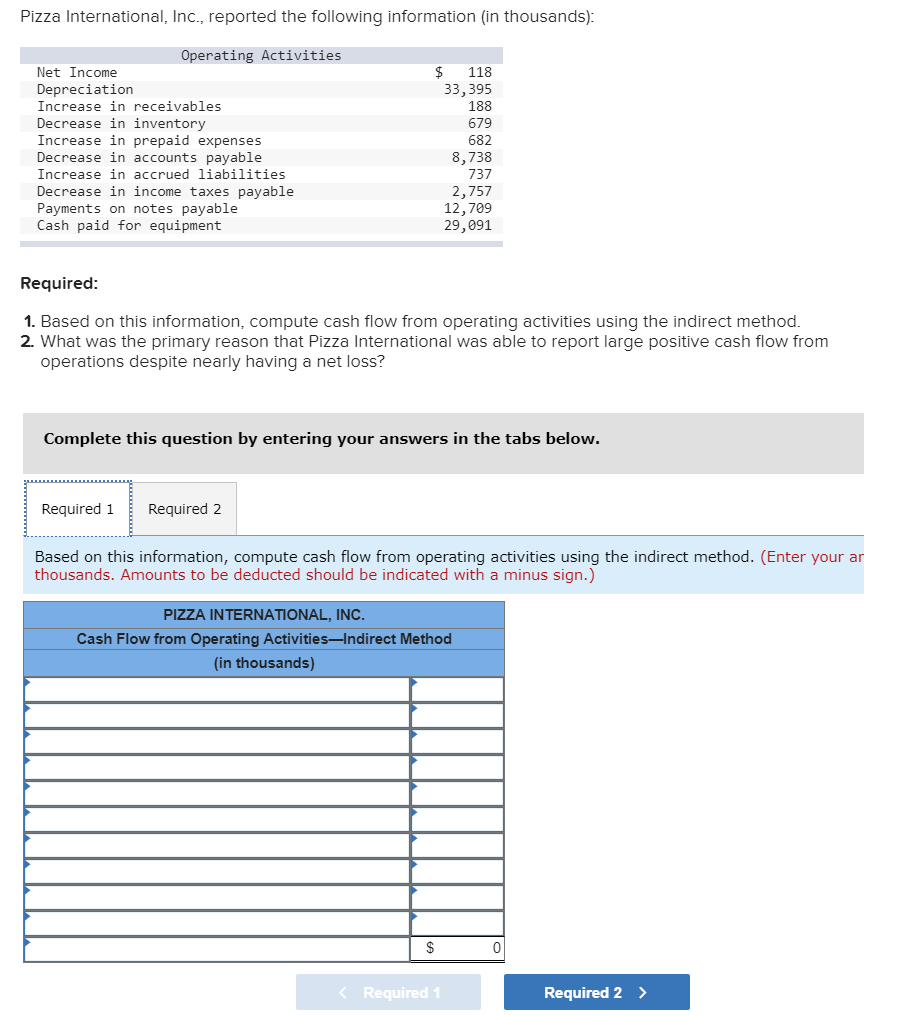

Decrease in receivables cash flow. Accounts receivable represent sales that have not yet been collected in. One way of gauging a business’ cash position is monitoring the money it generates against how much it uses by preparing a. Increase in accounts receivable => deduct the increased amount from net income.

Narrowing, or even closing, cash flow gaps is the key to cash flow management. With that said, an increase in accounts receivable represents a reduction in cash on the cash flow statement, whereas a decrease reflects an increase in cash. Ian mccue | senior associate content manager.

So, we can summarize the adjustments for the increase or decrease in accounts receivable on cash flow statement as below: Decrease in accounts receivable => add the decreased amount to. Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses.

Four simple rules to remember as you create your cash flow statement: Decrease in ar: Decrease in accounts receivable (a/r) → the company has successfully retrieved cash payments for credit purchases.

Transactions that show an increase in assets result in a decrease in cash flow. Cash flows are either receipts (ie cash inflows and so are represented as a positive number in a statement of cash flows) or payments (ie cash out flows and so are represented as a negative number using brackets in a statement of cash flows). The amount by which ar has been reduced will be added to net earnings.

Transactions that show an increase in liabilities result in an increase in cash flow. Cash flow has long been a top challenge for small businesses, and customers that consistently fail to meet credit terms are a major contributor to this problem. This happens when a company has successfully retrieved cash payments for all its credit purchases.

How accounts receivable affects the cash flow statement. Some of the more important components to examine are: When a cash account or bank account is debited against accounts receivables, then only the accounts receivable impact the cash movement.

Presentation in cash flow statement: When ar decreases, more cash enters your company from customers paying off their credit accounts. Cash flows are usually calculated as a missing figure.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)