Matchless Tips About Kpmg Financial Statements 2019

Kpmg’s audit division increased revenues 3.4 per cent to $11.9bn while the tax and legal operations boosted sales by 4.7 per.

Kpmg financial statements 2019. The board submits its report together with the audited consolidated financial statements of kpmg llp and its subsidiary undertakings (the group) for the year ended 30 september 2019. 2019 inspection kpmg llp (headquartered in new york, new york) december 17, 2020. You must bring a laptop with excel 2019 or above to the seminar.

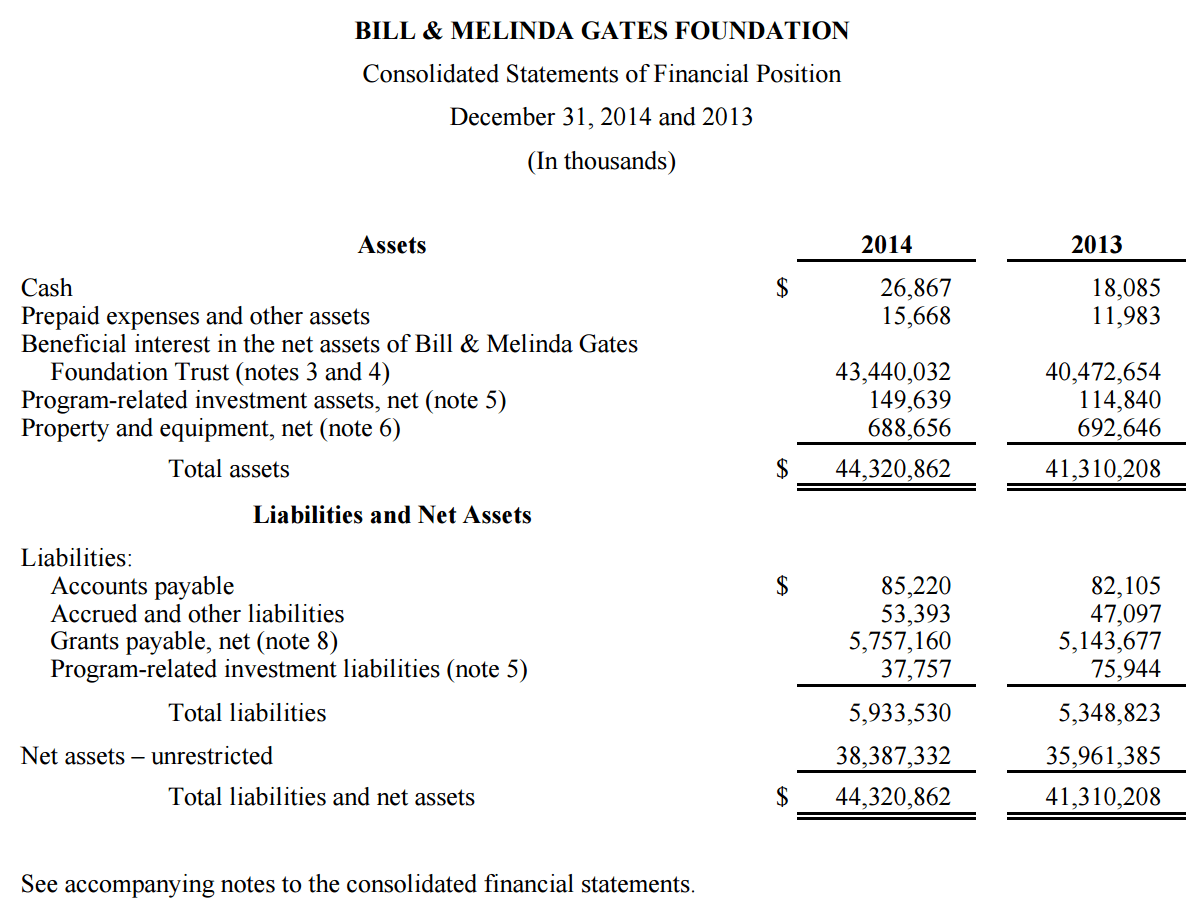

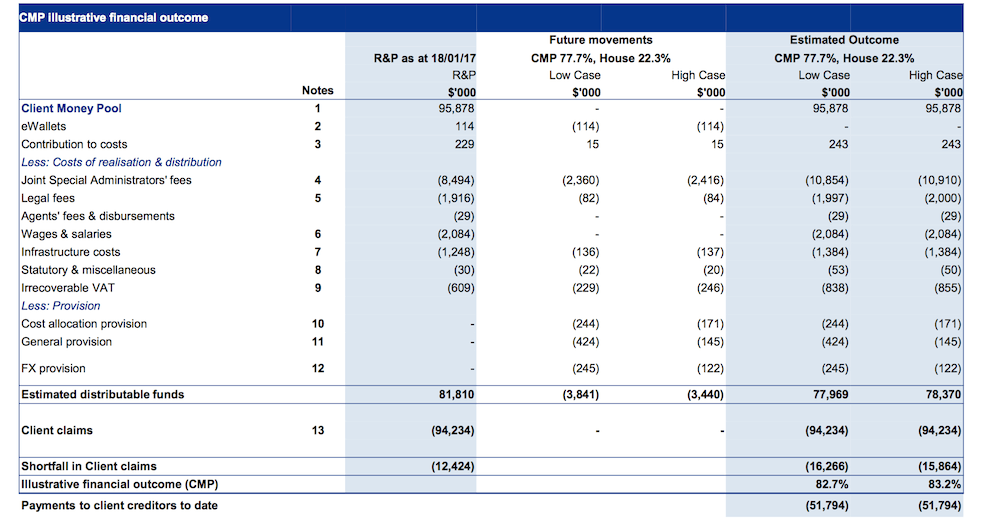

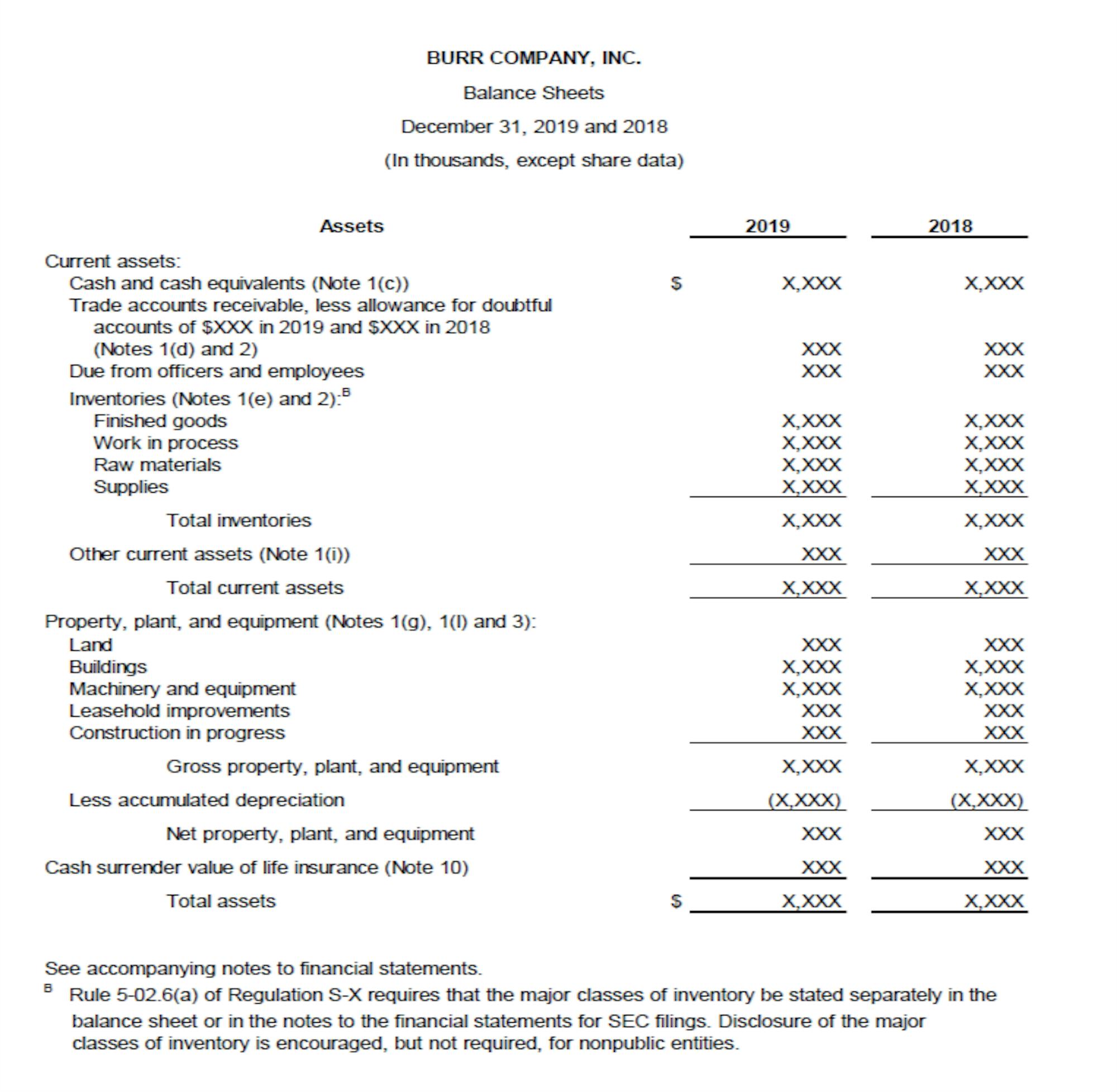

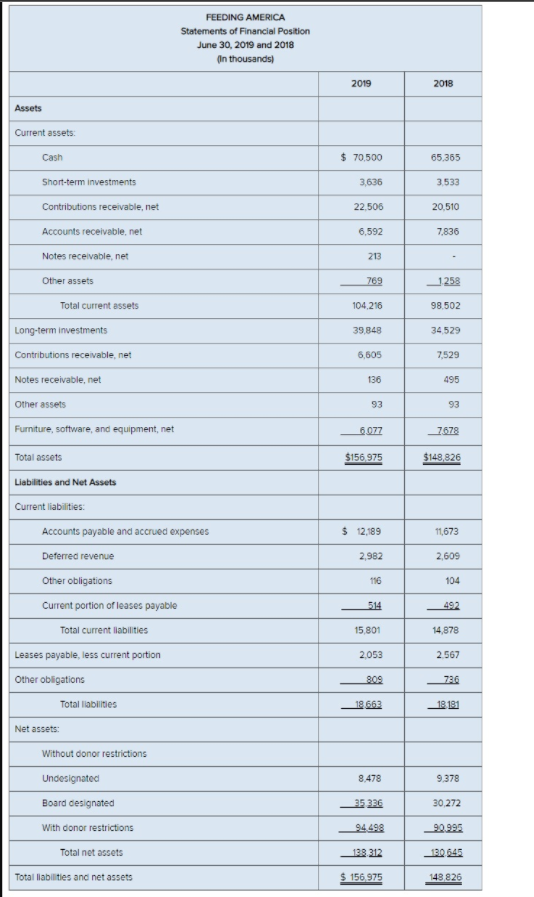

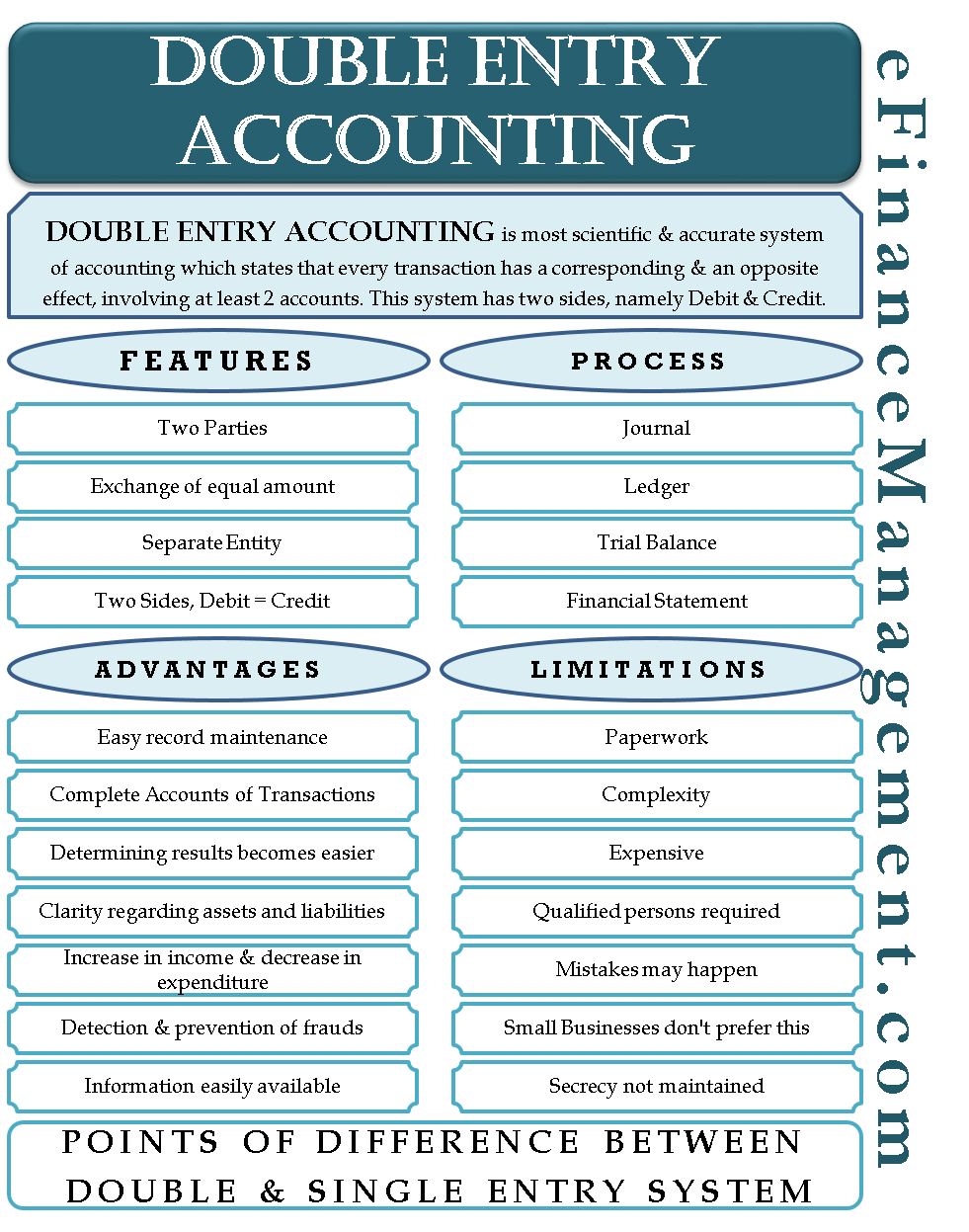

The financial information reported represents combined information of the independent kpmg member firms that perform professional services for clients, affiliated with kpmg international limited. To effectively review and assess financial statements, the audit committee needs to understand the context for financial reporting, considering inter alia the impact of relevant accounting standards, financial reporting developments and the overall requirement that the financial statements present a “true and fair view”. We have audited the consolidated financial statements of [name of the company] and its subsidiaries (the group), which comprise the consolidated statement of financial position as at 31 december 2020, and the consolidated statements of profit or.

We use excel 365 in the seminar. Working knowledge of indirect cash flows and taxes. Singapore illustrative financial statements year ended 31 december 2019 1 about singapore illustrative financial statements 2019 this publication is produced by kpmg in singapore, and the views expressed herein are those of kpmg in singapore.

Financial statements for 2019 the international executive director is pleased to present the annual management report and financial statements for the year ended 31 december 2019. 17 consolidated statement of comprehensive income 18 statements of financial position 19 statements of changes in equity 20 statements of cash flows 21 notes 22 appendix: Sharing our expertise and perspective.

2020 was a successful year for kpmg in denmark reaching a total revenue growth of 22% across audit, advisory and tax. Related parties under asc 850 and subsequent events under asc 855) and sec regulations. This publication illustrates best practices for financial statement disclosures that comply with the singapore companies act, singapore financial reporting standards (international) [sfrs (i)] and the singapore exchange limited listing manual for companies with a financial year ending 31 december 2020.

Opinions on the financial statements and/or icfr — does not necessarily mean that the issuer’s financial statements are materially misstated or that undisclosed material weaknesses in icfr exist. Delivering insights to financial reporting professionals. This desktop reference provides the financial statements of a newly acquired business required in a.

This includes, for example, the homogenisation of the system landscape or the standardisation. Your essential guides to financial statements. Asc 205 to asc 280), other broad topics (e.g.

Handbooks | february 2021. The purpose of this publication is to assist entities in malaysia which are currently preparing t heir financial statements in accordance with malaysian financial reporting standards (“mfrss”) issued by the malaysian accounting standards board (“masb”). Our guides to financial statements help you to prepare financial statements in accordance with ifrs ® accounting standards.

Ema = europe, middle east and africa, including india fy23: Wonderful malaysia berhad is kpmg plt’s illustrative financial statements for financial statements prepared in accordance with malaysia financial reporting standards (mfrs) and reflects the latest amendments to the disclosure requirements for annual financial statements at the end of each year. Our team at kpmg has the expertise to assist you.

Deloitte reported revenues of $59.3bn, while pwc generated $50.3bn. Your essential guides to disclosures for insurers. Kpmg teams up with latham & watkins to provide the guide to acquired business financial statements.