Ideal Info About Depreciation And Amortization On Cash Flow Statement

It has no effect on cash flows.

Depreciation and amortization on cash flow statement. Gross profit before depreciation and amortization 1: 14,293 = net income 10,080 = depreciation & amortization 761 = deferred income tax Not all captions are applicable to all reporting entities.

I wouldn’t worry about this for the cfa though. Fact checked by suzanne kvilhaug depreciation is a type of expense that is used to reduce the carrying value of an asset. In a nutshell, depreciation is an accounting measure and added back to revenue or net sales while calculating the company’s cash flow.

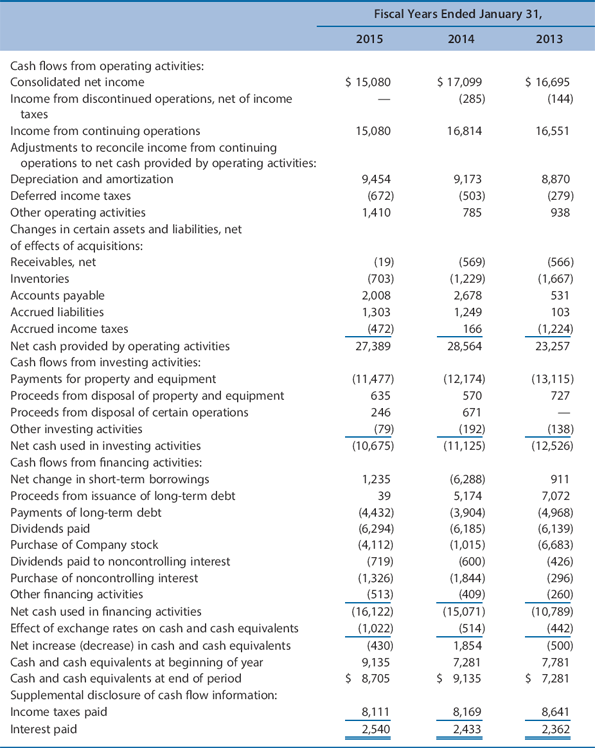

Depreciation and amortization expensing a truck leads to inconsistent performance depreciating the truck depreciation in cash flow amortization and depreciation economics > finance and capital markets > Depreciation and amortization is a noncash charge that companies subtract from earnings on their income statement. Consolidated statements of cash flows (in thousands, unaudited) year ended december 31, 2023 :

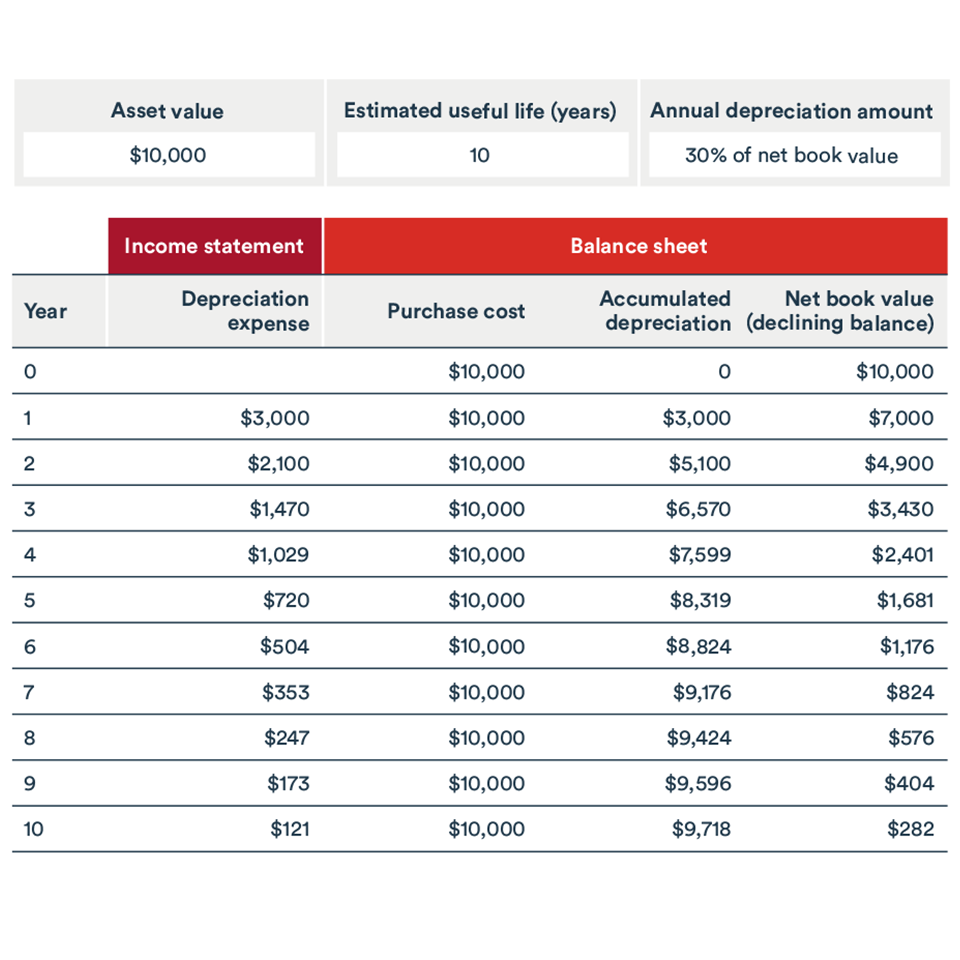

Amortization and cash flow. However, right now, i am looking at a 2017 cash flow statement from walmart , but depreciation is shown as a positive number. Depreciation expense and accumulated depreciation depreciation expense is an income statement item.

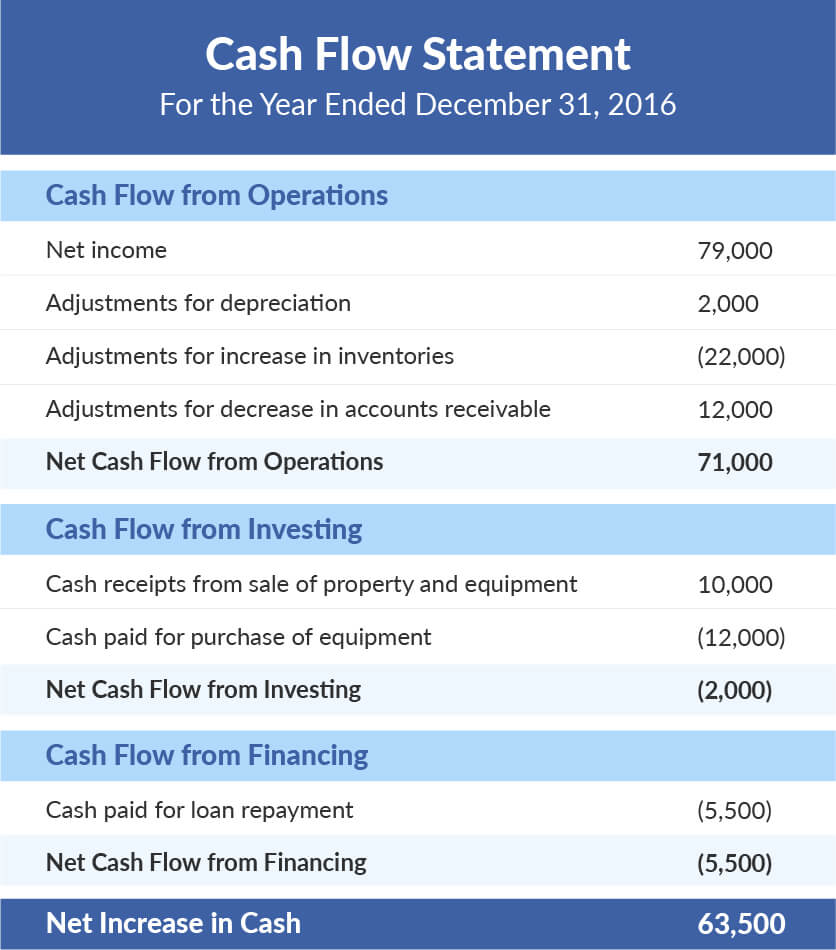

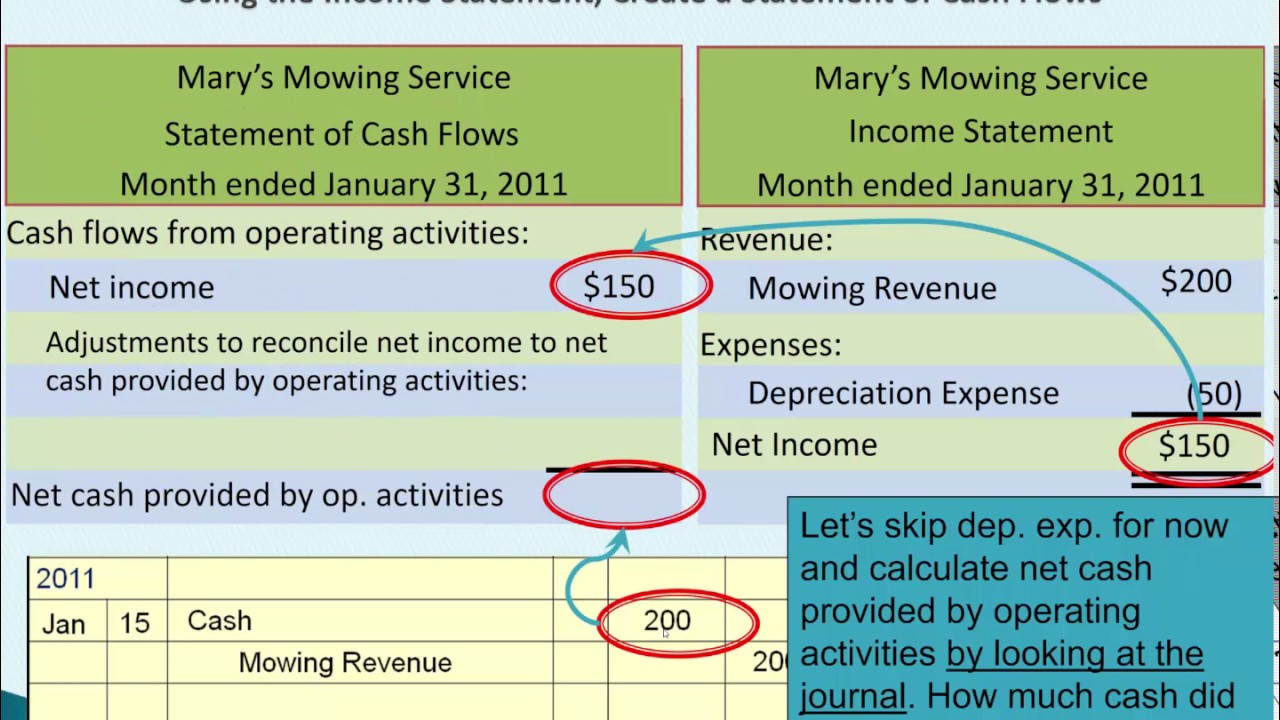

Depreciation can only be presented in cash flow statement when it is prepared using indirect. Cash flows from operating activities: The accounts involved in recording depreciation are depreciation expense and accumulated depreciation.

It is an estimated expense that is scheduled rather than an explicit. I would bet that the difference is because on the income statement, they only amortize pp&e, and on the cash flow statement, they are showing all amortization (buildings, movies, etc.) but the other numbers aren’t showing this (movie amort is about $27m so there has to be something else). How depreciation affects cash flow.

Key takeaways amortization and depreciation are two methods of calculating the value for business assets over time. Specifically, amortization occurs when the depreciation of an intangible asset is split up over time, and depreciation occurs when a fixed asset loses value over time. For example, if you calculate cash flow for 2019, make sure you use.

Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by (used in) operating activities: Financial metrics (cad$ in millions, except per share data) q4 2023:

Put simply, lower taxes lead to increased net income, and as net income is. Finance and capital markets > unit 5 lesson 3: Unaudited condensed consolidated statements of cash flows (1).

The income statement doesn’t represent actual cash paid or received in the company’s bank accounts. Revenue $ 4,108 $ 3,140: Think of it this way;

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)