Smart Tips About Free Cash Flow Examples

It provides your business with growth opportunities if you’re looking to expand operations or even invest in another business, free cash flow can help your business do that.

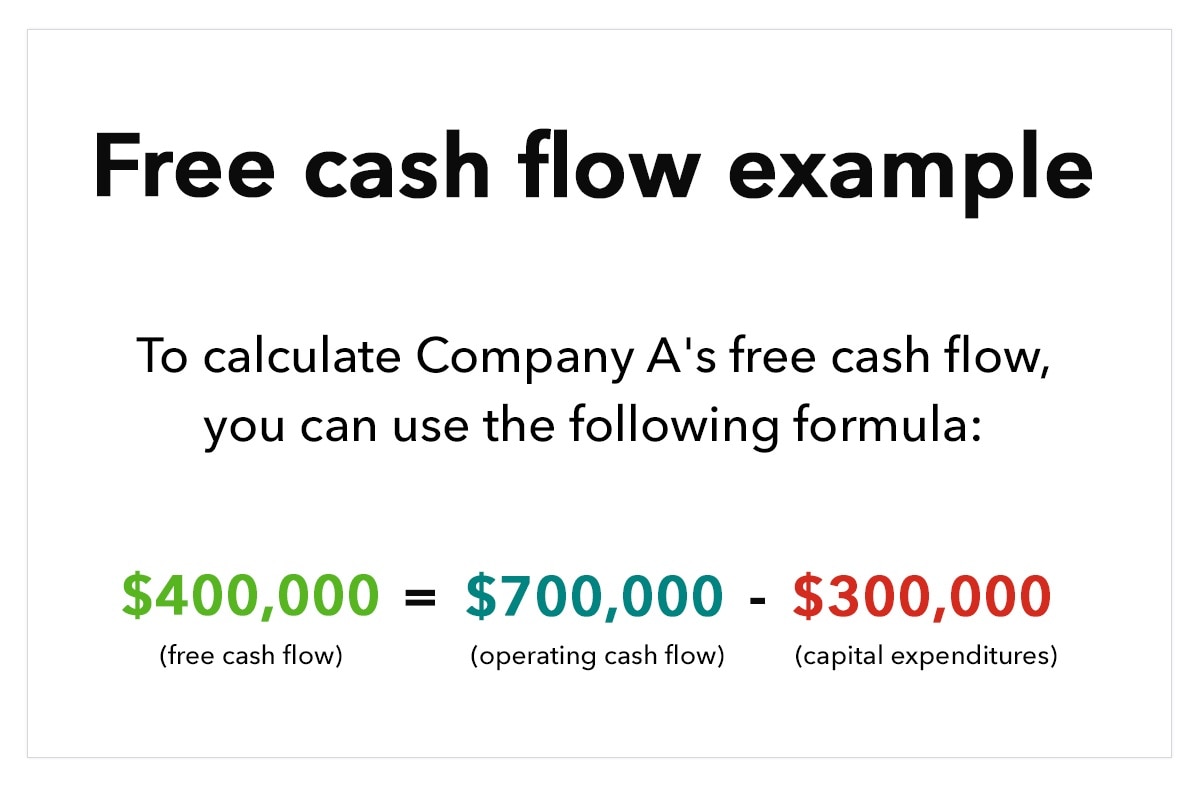

Free cash flow examples. To calculate company a’s free cash flow, you can use the following formula: ** shares in flsmidth fls rise around 4% after the danish engineering group posted strong free cash flow in the fourth quarter as it reported results in line with preliminary figures released last month. Example of a free cash flow calculation.

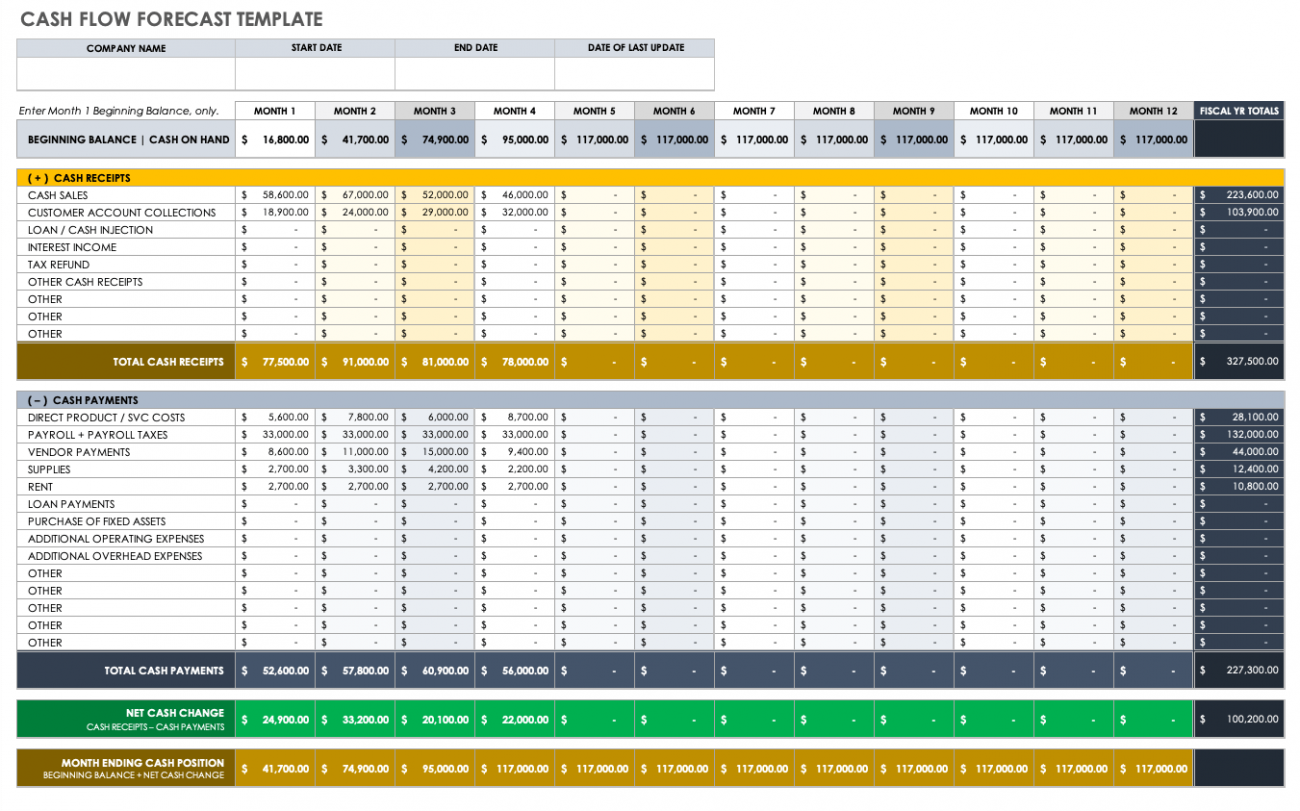

Example of how to calculate fcff. Download a free statement of cash flows template download cfi’s free excel template and start practicing today. Calculation of free cash flow.

Feb 22, 202401:16 pst. In order to gain an intuitive understand of free cash flow to firm (fcff), let us assume that there is a guy named peter who started his business with some initial equity capital (let us assume $500,000), and we also assume that he takes a bank loan of another $500,000 so that his overall finance capital stands.

Example of free cash flow calculation. Let us see an example to calculate free cash flow with another formula. Example tim’s tool shop is a small home improvement store that sells tools and other household goods.

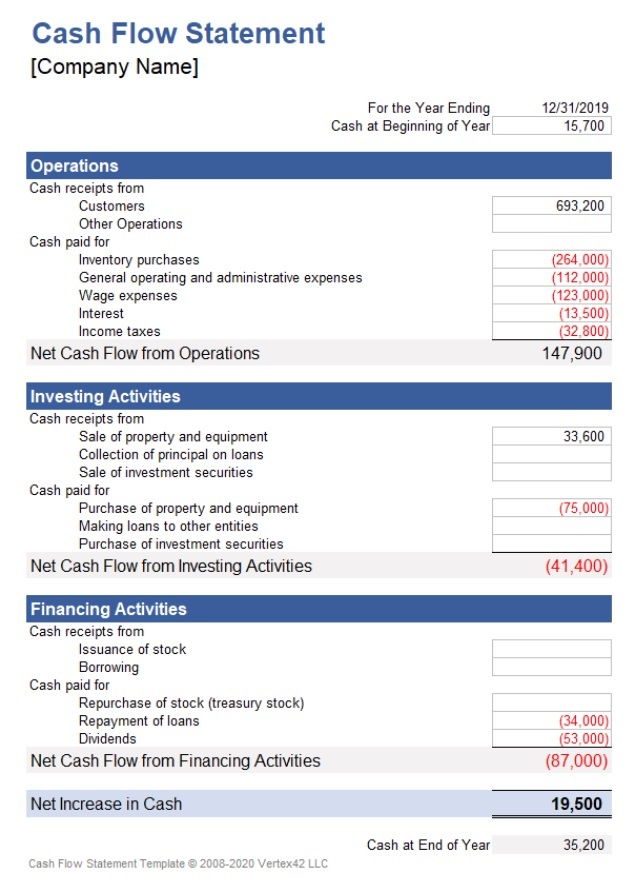

It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow. Docs free cash flow data by ycharts; At its core, free cash flow is one of the measures used to understand profitability and it is a type of formula that can be used to calculate profits.

** free cash flow of more than dkk 1.8 billion is 26 per cent below. Tim wants to expand into new territories, but he can’t do it on his own.

January 13, 2021 free cash flow (fcf) is a metric business owners and investors use to measure a company’s financial health. Feb 21, 202409:57 utc. Thus, he wants to bring on new investors.

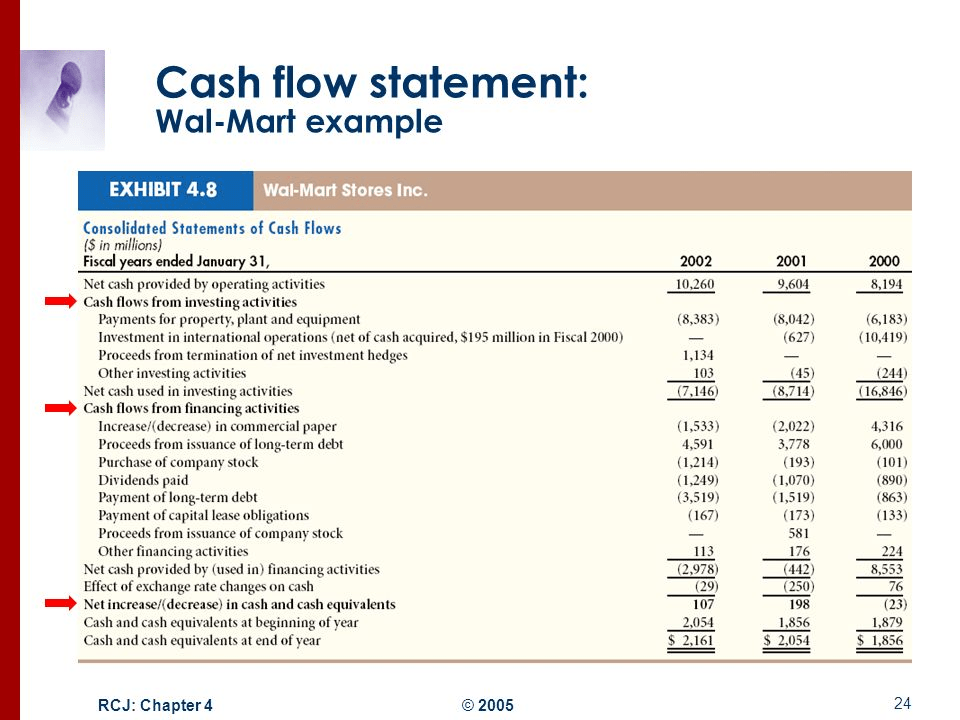

** shares in iss iss drop 9% as the danish services provider q4 print and 2024 free cash flow guidance fall short of market expectations, overshadowing the announcement of a one billion danish crowns billion share buyback. Why is the cash flow statement important? Reviewing a cash flow statement.

Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a simple reason: Free cash flow in financial forecasting. ** flsmidth has a very strong free cash flow in the fourth quarter due to a drop in working capital, sydbank.

For example, if a company's operating cash flow is $5 million and its capital expenditures are $3 million, then the company's free cash flow would be $2 million. Examples and formulas by adam hayes updated march 19, 2022 reviewed by julius mansa fact checked by timothy li what is free cash flow to the firm (fcff)?